States With The Lowest Taxes And The Highest Taxes

OVERVIEW

Where you live can help or hinder your ability to make ends meet. A myriad of taxesproperty, license, state and local sales, property, inheritance, estate and excise taxes on gasolineeat away at your disposable income. Weighing the tax landscape against your financial picture lets you stretch your dollars. Here’s a roundup of the highest and lowest taxes by state.

“Location, location, location” is a focus that applies to more than just housing. Where you live can help or hinder your ability to make ends meet.

A myriad of taxes such as property, license, state and local sales, inheritance, estate, and excise taxes can eat away at your income. Often, the biggest tax ticket citizens face after paying the Internal Revenue Service is the one their state presents. As a result, identifying the states with the lowest taxes might be a smart financial move to make.

Currently, 41 states and the District of Columbia levy a personal income tax. Weighing the tax landscape against your financial picture could help you stretch your dollars further.

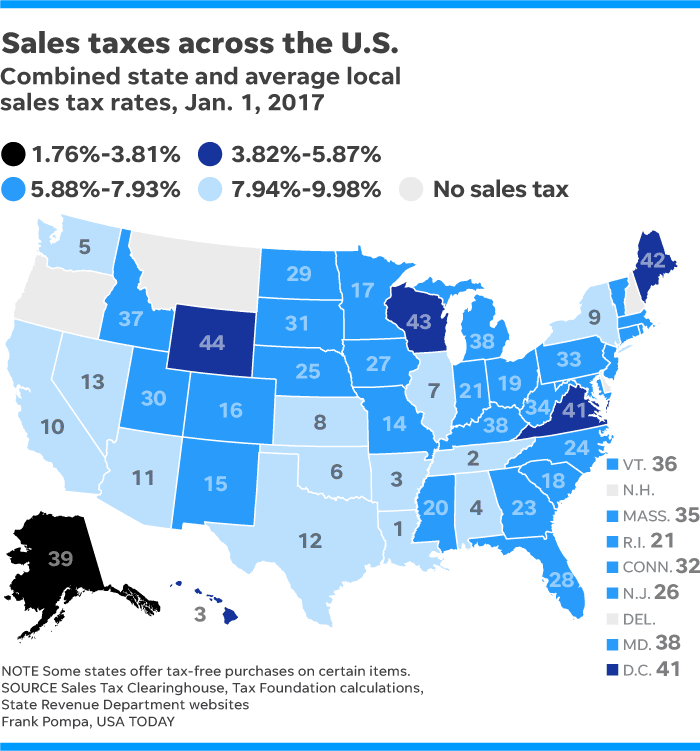

Which States Have The Highest Sales Tax Rates

So where are the highest state sales tax rates? Head West to California. California has the highest sales tax rate of any state at 7.25 percent. As weve already talked about, California also houses cities with high sales tax rates, making the combined sales tax rates in cities in the Golden State some of the highest in the nation.There are a few states that tie for the second highest sales tax rate at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee.

Wondering which states have the lowest sales tax rate? While there are four states that do not have sales tax, the state with the lowest rate that is not zero is Colorado at 2.9 percent. Following that, there are five states that have the next lowest rate of 4 percent: Alabama, Georgia, Hawaii, New York, and Wyoming. However, that likely means higher income and property taxes in these states. States use tax revenue to fund a variety of programs such as schools, infrastructure repairs, community outreach. In order for those essential programs to continue to operate, the state needs funding. So if you are lucky enough to have a low sales tax rate in your state, you probably have higher tax rates in other areas. Its all about balance!

States With The Highest Sales Taxes

At the other end of the spectrum are states with very high state sales tax rates. In some cases, these rates are high enough that shoppers drive across state lines to visit lower-tax or tax-free states when they want to make major purchases. This frequently occurs in areas of Massachusetts that aren’t too far from tax-free New Hampshire.

California has the dubious honor of having the highest statewide sales tax rate at 7.25%. It’s followed by:

- Indiana, Mississippi, Rhode Island, and Tennessee at 7%

- Minnesota at 6.875%

- Washington, Arkansas, and Kansas at 6.5%

Don’t Miss: Sales Tax And Use Texas

Total Tax Burden: 614%

With an estimated six people per square mile, Wyoming is the second least densely populated state, bested only by Alaska, which has roughly one human being for every square mile. Citizens pay no personal or corporate state income taxes, no retirement income taxes, and enjoy low sales tax rates. The total tax burdenincluding property, income, sales, and excise taxes as a percentage of personal incomeis 6.14%, ranking the state third lowest.

Like Alaska, Wyoming taxes natural resources, primarily oil, to make up for the lack of a personal income tax, according to reporting in the Cowboy State Daily. The state ranks an average 33rd in affordability and 35th on the U.S. News & World Report list of Best States to Live In.

In 2019, at $16,304 per pupil, Wyoming was one of the highest spenders on education in the western U.S., second only to Alaska. It also earned a grade of A for its school funding distribution in 2015, the best on this list.

Wyomings healthcare spending in 2014 was more moderate by comparison, at $8,320 per capita. Although Wyoming hasnt received an official letter grade for its infrastructure yet, the ASCE found that 6.9% of its bridges are structurally deficient and 99 of its dams have a high hazard potential.

So Why Are The Sales Taxes In These States So High

Tennessee and Arkansas both have no state income tax, while Arkansas and Louisiana have some of the lowest property taxes in the country. This means that these states, and their local governments, all have to depend on higher sales taxes to replace tax revenue not being brought in by income and property taxes.

This table ranks the states by average state + local sales taxes by default. Click the arrows in the column headers to change the sort order or column. You can view a list of the highest city sales taxes in the United States here.

Sales Tax Rates Database:Need an updated list of local sales tax rates for your business? Download our sales tax database!

| Rank |

|---|

Also Check: Pay Federal Estimated Tax Online

Which States Have The Lowest Sales Tax

The sales tax laws within the United States are not subject to federal regulation and each state has control over its base sales tax. Sales taxes are imposed on retail transactions and certain services.

Whether or not a state imposes a state sales tax, local municipalities and counties may impose excise or surtaxes. For example, the sales tax in New York state is 4%, but New York City has additional taxes, increasing the rate to 8.875%.

As of 2022, five states impose a 0.000% sales tax including Alaska, Delaware, Montana, New Hampshire, and Oregon. Each of these states, however, may have individual municipalities that impose excise taxes, income taxes, and taxes imposed on tourist locations.

Ology How We Determined The States With The Most Tax Burden

To find the states that tax their residents the most and least aggressively, we ranked the 50 states on three criteria:

-

Individual Income Tax

-

Total Sales Tax

Each of the above criteria was ranked based on the percent of income. Property tax and individual income were weighted together and makeup 70% of each states score. To put a dollar amount to income, we pulled from the median state income. To put a dollar amount to home value, each states percent of property tax was applied to the states median home price. The two numbers were added together and the total was applied to the median income to get a combined tax burden for property and income tax. Sales tax makes up the remaining 30% of the ranking.o local taxes or excise taxes were used in our rankings. However, these can vary dramatically from city to city.

We collected the above data from a combination of the Tax Foundation and scouring state tax documents. The median state income and home prices came from the Census most recent American Community Survey.

The full ranked list of states from the greatest to least tax burden is located at the bottom of the article.

You May Like: How To Read Tax Return

Which State Has No Property Tax In Usa

Unfortunately, there are no states that do not have a property tax. The majority of the states revenue comes from property taxes. The proceeds of a tax are used to pay for the operation and maintenance of essential government services, such as law enforcement, infrastructure, education, transportation, parks, water, and sewer service improvements.

The 10 Best States To Retire In The Us

Furthermore, each of these states has a low combined state and local tax burden, low income tax rates, and generous tax breaks for retirement income. Furthermore, they have strong economies with low unemployment rates and high incomes, in addition to low unemployment rates. If youre looking for a state to retire in, youve come to the right place.

Total Tax Burden: 823%

Nevada relies heavily on revenue from high sales taxes on everything from groceries to clothes, sin taxes on alcohol and gambling, and taxes on casinos and hotels. This results in a state-imposed total tax burden of 8.23% of personal income for Nevadans, the second-highest on this list. However, it still ranks a very respectable 22 out of 50 when compared with all states.

That said, the high costs of living and housing put Nevada near the bottom when it comes to affordability. The state ranks 37th on the U.S. News & World Report Best States to Live In list.

Nevadas spending on education in 2019 was $9,344 per pupil, the fourth-lowest in the western region of the U.S. One year earlier, in 2018, the ASCE gave Nevada a grade of C for its infrastructure.

In addition to receiving an F grade from the Education Law Center in 2015, Nevada was also the worst state overall in terms of the fairness of its state school funding distribution. Nevadas healthcare spending in 2014 was $6,714 per capita, the lowest on this list and the fourth-lowest nationally.

Read Also: 1 Year Tax Return Mortgage

Total Tax Burden: 684%

New Hampshire does not tax earned income but does tax dividends and interest. New Hampshires Senate passed legislation to phase out the investment income tax by 1% per year over five years, with full implementation by 2027. The state has no state sales tax but does levy excise taxes, including taxes on alcohol, and its average property tax rate of 1.86% of property values is the third highest in the country.

Even so, New Hampshires total tax burden is just 6.84%, according to WalletHub, ranking the state fifth in the nation. The state ranks fourth on the U.S. News & World Report list of Best States to Live In and 38th in the nation for affordability.

Although New Hampshire spent more on education than any other state on this list at $17,462 per pupil in 2019, its outlay was among the lowest in the northeastern region of the U.S. Additionally, in 2015 it earned a grade of D from the Education Law Center for its school funding distribution.

New Hampshire received a marginally better grade of C- for its infrastructure in 2017. At $9,589 per capita in 2014, its healthcare spending is the ninth highest in the nation.

The States With The Highest Sales Tax

The states with the highest sales tax are Tennessee , Arkansas , Louisiana , Alabama , and Washington . In Tennessee, the use and sales tax rate for items is at 7%. However, a lower rate tax of 5.25% is levied on food apart from supplements, ready-made food, and candy which attracts a 7% tax rate. It is the local sales taxes that tips the scale to at least 9%, as municipal jurisdictions are allowed to collect at a range rate of 1.5% to 2.75%. The gross use and sales tax rate of Arkansas was raised in July 2013 from 6% to 6.5%. This state also taxes towing and wrecker services such as body piercings, electrolysis, tattooing, boat storage, pet grooming, and pest control. Besides the state sales tax, Arkansas has at least 300 local taxes that are levied on different goods and services. Although the state of Louisiana has a lower sales tax rate of 4%, it is its allowance of municipalities to tax as much as 7% locally that put the local sales tax rate at 4.89%.

The states that charge higher sales tax do so to compensate other taxes that are excepted. For example, Tennessee does not levy a tax on earned income while the state of Louisiana has relatively lower income taxes. Also, state sales tax rates depend on the amount of revenue collected from a tax and the effect it has on the economy.

Recommended Reading: Amend My 2020 Tax Return

Summary On States With The Highest Tax Burdens

Tax is a complicated issue, with different tax breaks and brackets based on income and household size. However, some states quite simply tax more than others. Between property taxes, sales tax, and personal income there are a variety of ways for states to get revenue and often a low tax in one area means a higher rate in another.

When contemplating an interstate job move, savvy job hunters know that the salary is just one component to investigate, as higher taxes can take a deep chunk of that anticipated pay raise. Which states offer job seekers the least tax obligations?

States With The Lowest Tax Burdens

Sales Tax Takers And Leavers

If you’re a consumer, you’ll want to consider that all but four states Oregon, New Hampshire, Montana and Delaware rely on sales tax for revenue.

Of these, Alaska also has no income tax, thanks to the severance tax it levies on oil and natural gas production. 37 states, including Alaska and Montana, allow local municipalities to impose a sales tax, which can add up. Lake Providence, Louisiana has the dubious distinction of most expensive sales tax city in the country in 2021, with a combined state and city rate of 11.45%.

Factoring the combination of state and average local sales tax, the top five highest total sales tax states as ranked by the Tax Foundation for 2021 are:

- Tennessee 9.55%

Residents of these states pay the least in sales taxes overall:

- New Hampshire 0%

You May Like: Haven T Received Tax Return

What Cities Have The Highest Sales Tax

While the highest state-level sales tax in the USA is 7%, thousands of municipal governments charge an additional local-option sales tax on top of the state rate. This means that some cities have tax rates that can be significantly higher than their state’s sales tax rate.

This table lists cities and towns with the highest sales tax rates in the United States. Arkansas accounts for the majority of the top-ten highest taxed cities in the USA, with many cities collecting combined state and local sales taxes of 11% or more. Other states with cities in the top-50 include Louisiana, Colorado, Arizona, and Oklahoma.

Sales Tax Rates Database:Need an updated list of local sales tax rates for your business? Download our sales tax database!

| Rank |

|---|

Paying Your Florida Real Estate Taxes

Real estate taxes are due on November 1 of each year in Florida, and you have 60 days after receiving the original tax notice to pay them. If you do not pay the tax by March 31, it will become delinquent the next day, April 1. You may be able to negotiate a payment plan with the tax collector if you are late on your taxes.

Also Check: Penalty For Filing Taxes Late If I Owe Nothing

How To Avoid Paying More Taxes Than You Need To

Moving to a state with a lower tax burden isnt an option for many of us. So, if thats you, there are some ways to lower your sales tax.

One silver lining with a sales tax is that you can avoid paying it by not buying stuff. Hey, we all have needs and wants , but money you dont spend is not subject to sales tax. On the other hand, you cant avoid income taxes. Well, you can . . . but you can also be charged with tax evasion.

If you create a budget and spend less on your needs and wants, youll automatically pay less for sales tax. Sometimes saving money on groceries is as simple as redefining a meal or two each week.

But with the U.S. experiencing inflation at levels it hasnt seen in 40 years, cutting your spending might be easier said than done. But dont lose hope. The extra time and effort it takes to create a budget that works for you will be worth it in the long run.

Total Tax Burden: 574%

Before 2016, Tennessee taxed income from investments, including most interest and dividends but not wages. Legislation passed in 2016 included a plan to lower taxes on unearned income by 1% per year until the tax was eliminated at the start of 2021. To make up for the shortfall, Tennessee levies high sales taxes and the highest beer tax of any state in the union at $1.29 per gallon.

With full implementation of the new legislation, Tennessee expects to attract retirees who depend heavily on investment income. The states total tax burden is 5.74%, the second-lowest in the nation. In the affordability category, Tennessee ranks 17th overall, and on the U.S. News& World Report Best States to Live In list, it ranks 29th.

In 2019, at $9,868 per pupil, Tennessee ranked just above Texas in terms of education spending in the southern U.S. It also did a better job of fairly distributing its school funding than the Lone Star State did, earning the Equality State a C in 2015.

At $7,372 per capita, Tennessee ranked 39th in terms of healthcare spending in 2014. The state hasnt received an official letter grade for its infrastructure yet, although the ASCE did note that 4.4% of its bridges are structurally deficient and 276 of its dams have a high hazard potential.

Read Also: Tax Short Term Capital Gains

Combined State And Local Sales Tax Rates

Five states do not have statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. Of these, Alaska allows localities to charge local sales taxes.

The five states with the highest average combined state and local sales tax rates are Tennessee , Louisiana , Arkansas , Washington , and Alabama . The five states with the lowest average combined rates are Alaska , Hawaii , Wyoming , Wisconsin , and Maine .