Is A Pay Stub The Same As A Paycheck

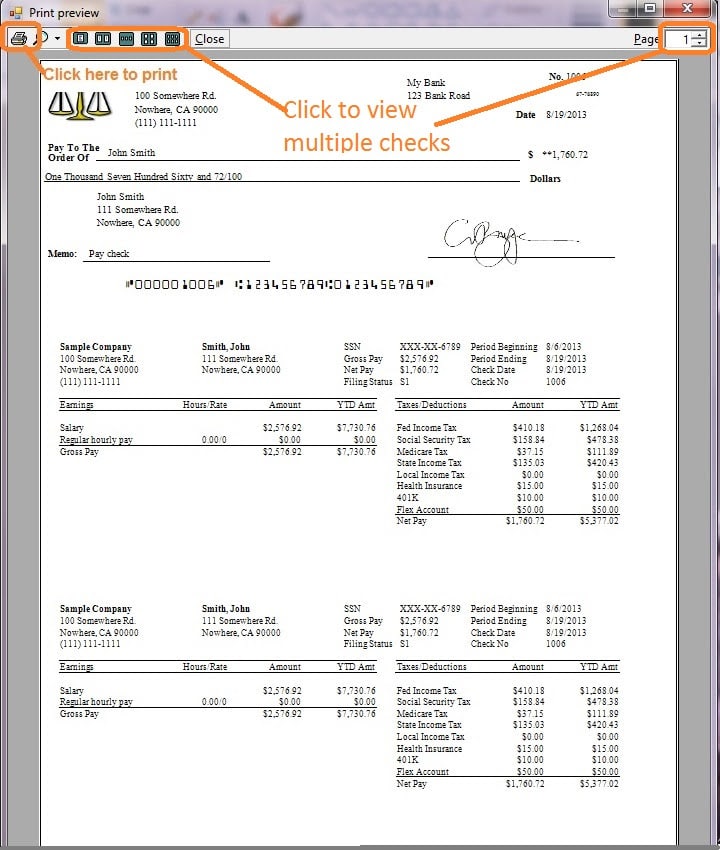

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employeeâs wages.

Do any of your employees make over $147,700? If so, the rules are a little different, and they may owe additional Medicare tax. Read more at the IRS.gov website.

Wisconsin Median Household Income

| 2010 | $49,001 |

Previously, Wisconsin had some of the highest state income and property taxes nationwide. Beginning in 2013 and 2014, the state made significant tax cuts that have reduced, and will continue to reduce, rates. These cuts have had the most significant effect on the lowest of the four income brackets. The top state income tax bracket stayed the same, though.

As a single earner or head of household in Wisconsin, you’ll be taxed at a rate of 3.54% if you make up to $12,120 in taxable income per year. Singles and heads of household making $266,930 or more in taxable income are subject to the highest tax rate of 7.65%. The tax rates are the same across all filing brackets, but the income levels change based on filing status. There are no additional local income taxes anywhere in the Badger State.

If youre thinking about buying a home in the state, or if youre looking to refinance a property, you might want to check out our Wisconsin mortgage guide to make sure youre familiar with the rates and details of getting a mortgage there.

Recommended Reading: Do Retirees Need To File Taxes

State And Local Taxes

Some states have no state income taxes, so you may be off the hook. But if youre required to pay state taxes , youll want to make sure your calculations are done right.

Different states apply payroll taxes in different ways, but once you know how to calculate the FIT and FICA taxes, calculating state taxes is a similar exercise.

Also, be sure to check whether your state imposes local taxes that are paid on top of federal and state taxes.

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Don’t Miss: Is Hazard Insurance Tax Deductible

Federal Payroll Tax Rates

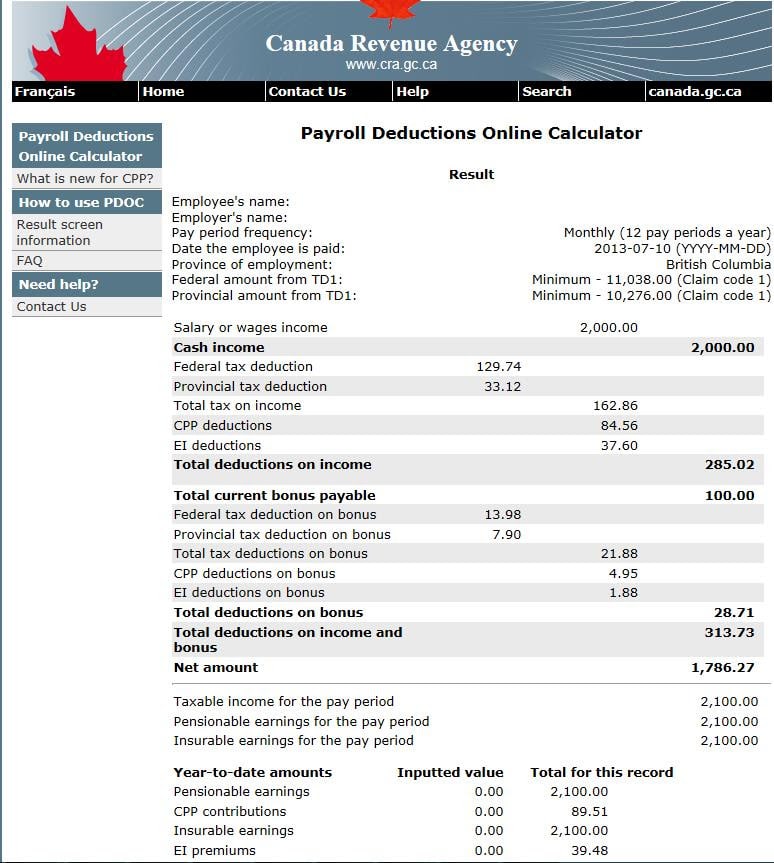

The steps our calculator uses to figure out each employees paycheck are pretty simple, but there are a lot of them. Heres how it works, and what tax rates youll need to apply.

How Much Is The Standard Deduction

Next, subtract your standard deduction. For taxpayers who are single or married filing separately, the standard deduction is $12,950 in 2022. For those who are married and filing jointly, the standard deduction is $25,900 in 2022. Heads of households have a standard deduction of $19,400 in 2022.

The standard deduction is higher for taxpayers who are age 65 or older, or who are blind.

The resulting number should be very close to your taxable income. This is the total that will be used to determine your federal and state tax brackets.

You May Like: What Is An Able Account For Taxes

Don’t Miss: Sale Of Second Home Tax Treatment

Income Tax Calculator For Salaried Persons

How does the calculator function?

To obtain the results, you must simply provide the following values:

Number of the Basic Pay Scale

gross monthly salary

How much house rent allowance do you receive? Just a yes or a no

Findings from the Calculator

You will obtain the following results after providing the aforementioned information:

Income Taxable Each Year

recurring tax

gross income

Gross salary is the term used to refer to the total amount of pay and benefits, which typically includes the Basic Salary, House Rent Allowance, Conveyance Allowance, Medical Allowance, Ardali Allowance, Adhoc Allowances, Special Allowances, Disparity Reduction Allowance, and any other type of pay or benefit.

Gross Salary is not the amount that remains after GP Fund, Advances, Group Insurance, or Benevolent Fund have been subtracted. Its known as net salary.

Difference in House Rent Allowance

67 5 67 5

There could be some variations in how the House Rent Allowance is calculated. The same is true in that certain cities have higher HRA rates than other ones.

Changes To Irs Form W

Prior to the enactment in 2017 of the federal Tax Cuts and Jobs Act , most withholding allowances were based on personal exemptions, including those for the employee, spouse and any dependents. The TCJA made significant changes to tax rates, deductions, tax credits and withholding calculations, and changed the value of personal exemptions to zero.

As of January 1, 2020, IRS Form W-4 has been revised to reflect changes resulting from the TCJA where the withholding calculation is no longer tied to the number of personal exemptions claimed.

The TCJA did not impact Massachusetts laws regarding exemptions. To accurately determine the correct amount of Massachusetts withholding, employers will rely on Massachusetts Form M-4.

New employees are expected to complete both Form W-4 and Form M-4 for employers. It is not necessary for current employees to resubmit the federal Form W-4 unless they choose to adjust their withholding amounts. Employees who choose to make adjustments will submit both Form W-4 and Form M-4 to the employer.

Recommended Reading: What Percent Of Your Check Goes To Taxes

How You Can Affect Your Missouri Paycheck

If you always find yourself facing a big bill during tax season, one option is to have your employer withhold a dollar amount from each of your paychecks. Simply decide on an amount, such as $50, and write that amount on a new W-4. It might not sound enticing to get smaller paychecks all year, but youll be happy you did when you dont have to pay a big bill in April.

If you are comfortable with receiving a smaller paycheck throughout the year, you may want to contribute more of your money to retirement accounts or medical spending accounts. For example, you can increase contributions to a 401 or 403 account if your employer offers them. And if you do contribute to one of these accounts, try to put in enough to at least get any employer matches. In addition to saving money for the future, putting money into these tax-advantaged accounts will actually help you save on taxes. Money you put into these retirement accounts is deducted from your paycheck prior to taxes, so you are actually lowering your taxable income by stashing money there. Furthermore, your money grows tax-free in a 401 until you withdraw it in retirement.

Any contributions you make to a health savings account or flexible spending account are also pre-tax. Just keep in mind that only $500 will roll over in an FSA from one year to the next. If you have more than $500 left in your FSA at the end of the year, you will lose it.

Texas Median Household Income

| 2010 | $48,615 |

Payroll taxes in Texas are relatively simple because there are no state or local income taxes. Texas is a good place to be self-employed or own a business because the tax withholding won’t as much of a headache. And if you live in a state with an income tax but you work in Texas, you’ll be sitting pretty compared to your neighbors who work in a state where their wages are taxed at the state level. If you’re considering moving to the Lone Star State, our Texas mortgage guide has information about rates, getting a mortgage in Texas and details about each county.

Be aware, though, that payroll taxes arent the only relevant taxes in a household budget. In part to make up for its lack of a state or local income tax, sales and property taxes in Texas tend to be high. So your big Texas paycheck may take a hit when your property taxes come due.

Also Check: Are Real Estate Taxes The Same As Property Taxes

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

Also Check: Do You Pay Sales Tax On Out Of State Purchases

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAssets tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Read Also: How To Read Tax Return

Calculating Taxable Income Using Exemptions And Deductions

Of course, calculating how much you owe in taxes is not quite that simple. For starters, federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The tax plan signed in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

Why Is It Important To Have Accurate Paychecks

Having accurate paychecks isnt just important for employees. Its an essential part of operating your business legally. Fail to pay employees fairly under federal, state, or local laws, and you may find yourself facing thousands of dollars in fines. Underpaying employee overtime is one of the most common labor law violations businesses commit. If you live in California, New York, or Texas, where local laws go beyond federal requirements, youll want to be especially diligent.

You May Like: Nys Dtf Pit Tax Paymnt

How You Can Affect Your California Paycheck

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you choose to save more of each paycheck for retirement, for example, your take-home pay will go down. Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise, so they dont experience a smaller paycheck and get discouraged from saving.

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your companys insurance offerings.

If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of your paychecks. If you take more allowances, you might get a smaller refund but you should get bigger paychecks. Conversely, if you always owe tax money come April, you may want to claim fewer allowances so that more money is withheld throughout the year.

What Is The Difference Between Payroll Tax And Income Tax

Payroll taxes have flat rates and are sent directly to the program for which they are intended, e.g., Medicare, Social Security, etc. Income taxes, on the other hand, have progressive rates that vary with total income and go to the U.S. Department of the Treasury, where they may be used to fund various government initiatives. In addition, some payroll taxes have a wage base limit, after which the tax is no longer deducted from the employees wages for the remainder of the year. Income taxes have no such cap.

Get 3 months free* when you sign up for payroll processing today.

* See the Terms & Conditions

Read Also: How Is Property Tax Paid

What Is The Federal Insurance Contributions Act

The Federal Insurance Contributions Act is a U.S. law establishing payroll taxes to fund the Social Security and Medicare programs. Taxes under the Federal Insurance Contributions Act are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes The taxes are calculated as a percentage of the employees subject wages. FICA mandates employers to withhold the correct dollar amount from every paycheck and forward it to the government. Failure to comply can result in significant penalties.

Go deeper

History Of Withholding Taxes

Tax withholding first occurred in the United States in 1862 at the order of President Abraham Lincoln to help finance the Civil War. The federal government also implemented excise taxes for the same purpose. Tax withholding and income tax were abolished after the Civil War in 1872.

The current system was accompanied by a large tax hike when it was implemented in 1943. At the time, it was thought that it would be difficult to collect taxes without getting them from the source. Most employees are subject to withholding taxes when they are hired and fill out a W-4 Form. The form estimates the amount of taxes that will be due.

The withholding tax is one of two types of payroll taxes. The other type is paid to the government by the employer and is based on an individual employees wages. It contributes to funding for Social Security and federal unemployment programs as well as Medicare .

Recommended Reading: Morgan Stanley Tax Documents 2021