Q& a: How Do I Print A Copy Of A Return I Prepared

If you previously used E-file.com to prepare a tax return which was transmitted and accepted by the IRS, we should have a copy of this return available for you to print from your account. You can print a PDF of a return you prepared by clicking Prior Year on the my account page within your account.

If your return is not accessible within your E-file.com account, you may need to use the IRS transcript service in order to obtain a copy of this return. You can access the online transcript program here –

How Do I File Back Taxes

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

There’s a way you may be able to make more money while in quarantine. By filing old federal income tax returns, you may be able to claim tax refunds you didn’t know that you are entitled to.

Written byAttorney John Coble.

The COVID-19 pandemic may have left you with extra time on your hands due to unemployment or fewer hours than youâre usually scheduled at work. Stimulus payments and higher unemployment checks than usual may have helped you survive. There’s a way you may be able to make more money while in quarantine. By filing old federal income tax returns, you may be able to claim tax refunds you didn’t know that you are entitled to.

Or, by filing old tax returns, you may be able to settle with the Internal Revenue Service for less than the full amount of any overdue taxes that you owe the government. When your financial situation is at its worst, you can usually settle with the IRS for a smaller amount than you would ordinarily owe. This article goes into detail about why you should file old federal tax returns, how to prepare and file these returns, and how to resolve any tax debts from previous years.

What If I Cant Afford To Pay Back Taxes

The IRS offers several options to assist taxpayers who cannot pay their tax liability. However, if you owe back taxes, its up to you to contact the IRS for assistance. If you do nothing, the IRS will continue to charge interest on your unpaid taxes.

Some options for individuals who cant afford tax payments include:

- Request to delay collections

- Apply for penalty abatement relief

- Request an installment agreement

In some cases, you may need professional help preparing an offer in compromise or other solution for your unpaid tax liability. Try to avoid tax settlement firms that claim to offer an easy solution to reduce your debt. These companies often charge high fees and make promises that are nearly impossible to keep.

Taxpayers in this situation should contact a qualified tax attorney who can evaluate their situation and provide a recommendation. The key is to get help as soon as possible to limit penalty charges and accruing interest. Ideally, this is before you receive notice from the IRS. The IRS has a directory of approved federal tax preparers that includes attorneys. It also offers Low-Income Taxpayer Clinics to help in this situation.

Also Check: How Does Tax Write Off Work

Child And Dependent Care Credit

The Child and Dependent Care Credit is a federal tax benefit that can help you pay expenses for child or adult care that is needed to work or to look for work. The 2021 American Rescue Plan temporarily expands the credit for tax year 2021 , making it fully refundable. This means the credit can provide money back even if you dont owe taxes. It is worth up to $4,000 for one dependent or up to $8,000 for two or more dependents. Learn more here.

Understand Everything Before You File

When you fill out unemployment forms, make sure you understand the implications so youre not surprised during tax time. Unemployment benefits are taxable income at the federal level, though not all states will require you to pay taxes on them. It pays to understand how unemployment benefits are taxed and what you need to do to file your taxes.

More on Taxes

Don’t Miss: Do I Have To Claim Unemployment On My Taxes

Got A Question Ask Away

Does an extension give me more time to pay my taxes?

No. An extension doesn’t delay your payment deadline if you owe money. If you haven’t paid your estimated balance due by May 17, you should do so as soon as possible to minimize penalties and interest.

What happens if you file your taxes late?

There is no penalty for filing your taxes late if you are due a tax refund. But if you owe taxes, you may be subject to penalties and interest from the IRS.

The late filing penalty is 5% of the unpaid taxes with a minimum penalty of $435, or 100% of the unpaid taxes if less, when the return is filed more than 60 days after May 17 . The penalty increases 5% a month until the taxes are paid or the penalty reaches 25% of the unpaid taxes.

What are the IRS penalties for paying late?

While penalties and interest may depend on your unique situation, generally the IRS charges the following:

- 0.5% interest for every month

- Maximum penalty for late payment is 25% of the total amount owed

- Don’t forget: The IRS compounds interest daily and penalty assessment monthly

The IRS combines the late filing and late penalty payments each month you are subject to both. The maximum penalty per month is 4.5% late filing plus .5% late payment for a total of 5% per month. Generally the maximum penalty is 25%.

The IRS will assess penalties and interest on the outstanding taxes until they are paid in full. Consider an IRS Installment Agreement for payment if you owe and can’t pay all of your taxes at once.

How Do I File For A Pandemic Unemployment

How do I file for a pandemic unemployment? How Do I Apply?

Hereof, Will my boss know if I file for unemployment?

Can the boss find out that you have been collecting unemployment? The short answer is sort of, but they wont get that information from the government. Theres no secret file out there with your name on it containing your entire work history and its ups and downsat least, not one that employers can access.

Similarly Is it too late to apply for Pua? Answer: No, not for backdated benefits for claimants who qualify for Pandemic Unemployment Assistance after being denied standard Unemployment Insurance, according to the state Department of Labor and Industrial Relations. PUA will continue accepting applications from people in your situation until Oct.

You May Like: How To Read Tax Return

Tax Impact Of Benefits

Unemployment benefits are included along with your other income such as wages, salaries, and bank interest . The total amount of income you receive, including your unemployment benefits, and your filing status determines if you need to file a tax return.

TurboTax Tip: Use the TurboTax Unemployment Center to learn more about unemployment benefits, insurance, and eligibility.

Donât Miss: Unemployment 1099 G Form Nj

Why You Should File Back Taxes

Filing back tax returns could help you do one or more of the following:

1. Claim a refund

One practical reason to file a back tax return is to see if the IRS owes you a tax refund. While many have federal income taxes withheld from their paychecks, sometimes too much money is withheld. In these cases, filing a tax return could result in a tax refund that puts money in your bank account.

2. Stop late filing and payment penalties and interest

Filing a tax return on time is important to avoid or minimize penalties, even if you can’t pay the balance you owe. If you don’t file your return, you may have to pay an additional 5% of the unpaid tax you were required to report for each month your tax return is late, up to five months. Minimum penalty limits can also apply.

The IRS assesses another penalty for a failure to pay your taxes owed. If you do file on time, but you can’t pay what you owe in full by the due date, you’ll be charged an additional 0.5% of the amount of the tax not paid on time for each month or part of a month you are late. These fees will accrue until your balance is paid in full or the penalty reaches 25% of your tax, whichever comes first.

The IRS also charges interest on overdue taxes. Unlike penalties, interest does not stop accruing like the failure to file and failure to pay penalties.

3. Have tax returns for loan applications

4. Pay Social Security taxes to qualify for benefits

Read Also: Sales And Use Tax In Texas

Who Qualifies For The Fresh Start Program

There are a variety of limitations on who can qualify for the IRS Fresh Start initiative. Furthermore, some of the most common limitations include:

- A self-employed taxpayer must show proof of a 25 percent drop in their net income.

- Taxpayers must not earn more than $200,000 a year if theyre married. Additionally, single filers should not make more than $100,000 a year.

- The total tax debt balance for the taxpayer must be lower than $50,000.

It can be confusing to understand whether or not you qualify for the IRS Fresh Start program. For that reason, it can be helpful to work with a tax resolution professional. Our team can help you negotiate a tax settlement with the IRS so you dont have to deal with them directly.

What If I Owe More Than I Can Pay

If youre facing a tax bill you cant afford to pay in full right away, you may have payment options.

- Consider paying the IRS with a credit card or personal loan. Using credit to pay your tax debt likely means youll pay interest to the lender. But those costs may be less than the penalties and interest you might face if you fail to pay the IRS on time and in full.

- If you owe $50,000 or less, you can request an online payment agreement from the IRS. Short-term installment agreements give you 120 days or less to pay. A long-term agreement can give you up to 72 months to pay what you owe in monthly payments.

- If you meet certain criteria, you may be able to ask the IRS for an offer in compromise, which could allow you to settle your tax debt for less than what you owe.

- In dire cases when paying anything might prevent you from covering your basic life expenses, the IRS may agree to temporarily delay collection of your past-due tax debt.

Recommended Reading: What Does It Mean To Write Off Taxes

How Do I File Returns For Back Taxes

OVERVIEW

When would someone file back taxes, and what does this process typically look like?

Should you file back taxes? It may not be too late to file a previous year’s tax return to pay what you owe or claim your refund. Learn more about why one may choose to file back taxes and how to start this process.

An Offer In Compromise

An offer in compromise is a bit more complex. It involves reaching an agreement with the IRS to pay less than your full balance due. An offer in compromise is typically only approved if youre unable to pay through an installment plan and comes with an application fee. Youll probably need the help of a professional for this option.

You must establish that you cannot pay your balance through an installment agreement or by any other means. All your past due tax returns must be filed before the IRS can grant you this relief, and you must have made some payment toward taxes in the current year, either through withholding from your paychecks or by sending in quarterly estimated payments, even though you havent filed a tax return for the year yet.

You May Like: Will Property Taxes Go Up In 2022

What Should You Do If You Havent Filed Taxes In Years

What happens if you havent filed taxes in years? How many years can you go without filing taxes? Sometimes, life happens, and you cant pay your taxes on time or collect all the information you need before the filing deadline. Whatever your reason for not filing, the Internal Revenue Service takes not filing quite seriously.

Fortunately, if you are behind on taxes, you can get back in good standing. You can work with a tax professional who can investigate which tax returns need to be filed and help you collect the information you need, research your account, and file your returns.

What Questions Should You Ask A Tax Professional

When you choose to work with a tax professional, there may be a few questions you want to ask, such as:

- What licenses do you have?

- What is the price for your services?

- How many unfiled tax returns do I need to file?

- Should I hand-deliver or mail in my tax returns?

- Do you have a project plan for my tax situation?

- What is your preferred method of communication?

- How will I receive a refund if I am owed one from the IRS?

- Who will I be working with from start to finish on my tax situation?

You May Like: Federal Capital Gains Tax Rates

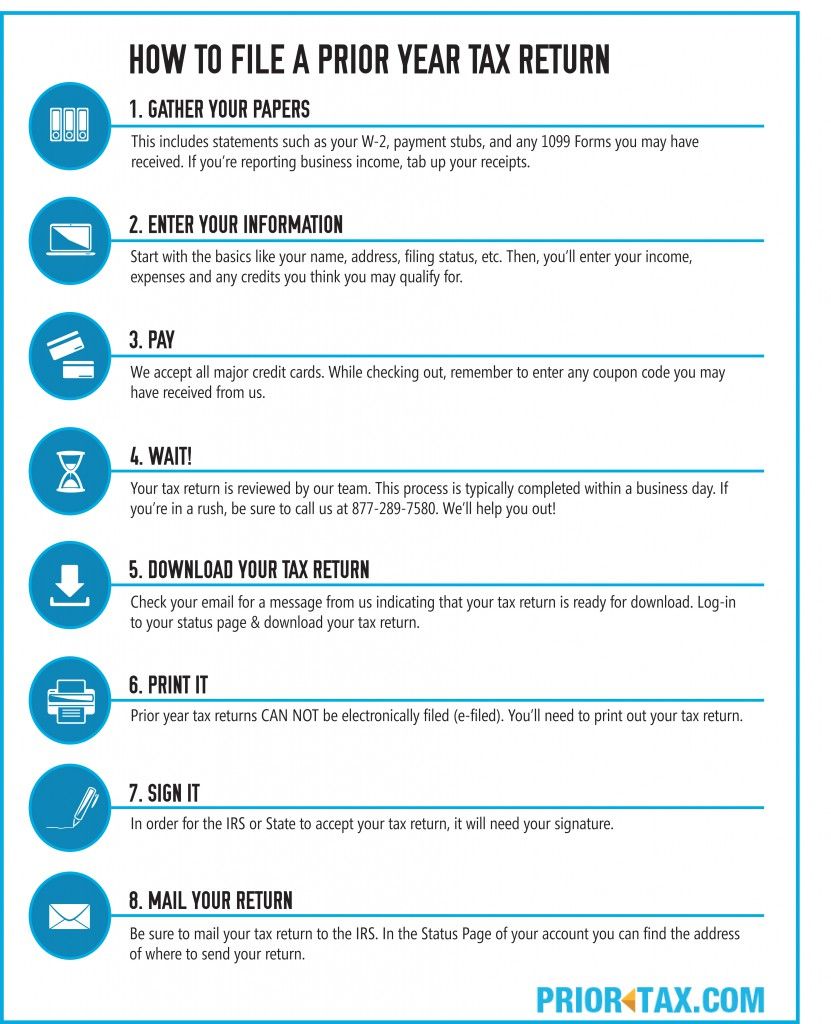

Complete And Mail The Forms And Pay Anything You Owe

You may be able to use an online tax preparation service to complete the forms, but you wont be able to e-file your back tax return. Youll need to print out and mail the forms to the address listed in the 1040 instructions for the tax year youre filing. If youre unsure how to proceed, a tax professional can help. You may also be able to get free assistance from the Volunteer Income Tax Assistance or Tax Counseling for the Elderly programs.

And if you have a tax liability back taxes, penalties and interest youll need to pay it or request a payment plan.

Deadlines For Letters You May Receive

If you havent filed a tax return in a few years, the IRS will pull your tax documents from those years and use them to calculate your tax. They will then mail you a letter known as an assessment letter that details how much tax you owe.

When this situation occurs, you can either file an original tax return or petition the Tax Court within 90 days after the date of the notice of deficiency. If you do not respond to the letter in a timely manner, you will receive a second letter known as the Statutory Notice of Deficiency.

- Assessment letter: Upon getting a letter in the mail, you may find that the IRS prepared a substitute tax return for you. In this letter, the IRS proposes to assess your tax based on the information the IRS has. This information typically consists of tax documents on file, such as W-2 forms and 1099 forms. In this letter, the IRS summarizes the sources of income that they used to calculate your tax.

- Statutory Notice of Deficiency: This 90-day letter will be mailed to notify you that the IRS is prepared to start collecting unpaid tax, interest and penalties. The letter will advise you on your right to dispute this assessment in Tax Court, and you may file either an original tax return or a Consent to Assessment and Collection, which is to agree that the IRSs calculations are correct.

You May Like: How Much Is Taxes In Florida

What Are Back Taxes

Back taxes refer to an outstanding federal or state tax liability from a prior year. Federal income tax returns are typically due each year on April 15 for the prior year. You may request an extension to file your taxes, which gives you another six months to file your return. However, even if your extension is approved, you must still pay your tax bill by the required due date. This is generally on April 15 for most individual tax filers.

How Long Can The Irs Collect Back Taxes

There is a 10-year statute of limitations on the IRS for collecting taxes. This means that the IRS has 10 years after assessment to collect any taxes you owe. This is a general rule, however, and the collection period can be suspended for various reasons, thus extending how long the IRS has to collect your debt.

There is no time limit, though, on how long the IRS has to pursue taxes that you owe if you never filed a return. The statute of limitations applies only to returns that have been filed.

There is also no statute of limitations for the IRS to collect back taxes if your return is part of a case that involves civil or criminal fraud.

Don’t Miss: Sales Tax In Nj Calculator

What If I Dont Pay My Taxes

A few things can happen if you dont pay the taxes you owe. None of these are pleasant, so we urge you to pay back your taxes as soon as possible.

- File a substitute return on your behalf. No, this doesnt mean you are off the hook for filing your taxes. Because the IRS doesnt have the information to determine if you are entitled to these or not, you will likely not receive the correct deductions and exemptions. Its much better to file your tax returns yourself.

- Place a levy on you. Once the IRS has created your substitute return, it sends you a tax bill. If this goes unpaid, the IRS can place a levy on your wages or bank account. Basically, the IRS seizes your paycheck or bank account for as long as it takes to pay your bill.