What Changes For 2020 Taxes Do I Need To Know About

For tax year 2020, the IRS has changed individual income tax brackets, adjusting them for inflation. There are also new temporary regulations created by last years CARES Act around charitable deductions, IRA and 401 plans and student loans that may affect how you prepare your taxes. The major changes include:

CNET has rounded up all of the changes to the tax rules this year, and there are even more details on the IRS website. And there are plenty of companies that would love to help you prepare your taxes for a fee, of course. CNET Money has prepared a wealth of tax resources to help you, including a series of articles covering the 2020 tax season from every angle.

Tax filings needed to be postmarked by May 17.

Also Check: How Can I Make Payments For My Taxes

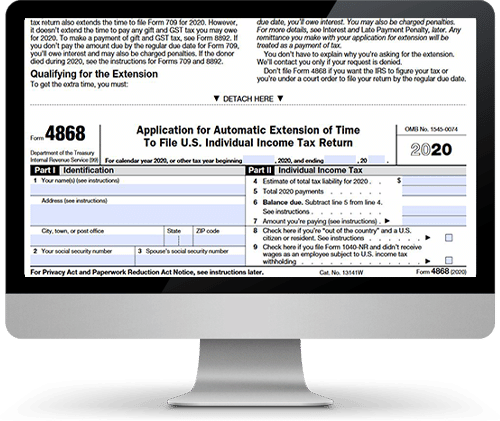

Heres How Taxpayers Can File An Extension For More Time To File Their Federal Taxes

IRS Tax Tip 2019-41, April 15, 2019

Taxpayers needing more time to file their taxes can get an automatic six-month extension from the IRS. For most taxpayers, this years tax-filing deadline is today, April 15. Taxpayers who live in Maine or Massachusetts have until April 17, 2019 to file their returns. This is because of the Patriots Day holiday on April 15 in those two states, and also because the Emancipation Day holiday on April 16 in the District of Columbia.

There are a few different ways taxpayers can file for an extension.

Here are a couple things for people filing an extension to remember:

- More time to file is not more time to pay. An extension to file gives taxpayers more time to file their return, but not more time to pay their taxes. Taxpayers should estimate and pay any owed taxes by the April deadline to help avoid possible penalties.

- The IRS can help. The IRS offers payment options for taxpayers who cant pay all the tax they owe. In most cases, they can apply for an installment agreement with the Online Payment Agreement application on IRS.gov. They may also file Form 9465, Installment Agreement Request. The IRS will work with taxpayers who cant make payments because of financial hardship.

Penalty And Interest Charges

If you do not respond to the first notice, you will receive an assessment notice that will include substantial penalty and interest charges. Under Maryland law, the assessment notice is presumed correct, and you would be required to file an appeal and request a hearing within 30 days of the assessment in order to dispute the amount due. Collection procedures will begin after the expiration of the 30-day period to appeal the assessment.

Your assessment will depend on the amount of taxes that we believe you owe. Interest will be calculated from the date the return was originally due. Penalty charges for late payments can be up to 25 percent of the amount of tax you owe.

If you do not settle your account promptly after you receive an assessment notice, legal action will begin that may include filing a property lien or attaching your bank accounts and salary, or referring your account to an outside collection agency.

You can file an appeal within 30 days of an assessment.

For assistance in calculating interest for unpaid taxes, .

Recommended Reading: Do I Need To Report Cryptocurrency On My Taxes

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Cant file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

Where Can I Get Tax Forms And What Tax Forms Do I Need

If youre choosing to prepare your taxes yourself, you can get the IRS tax forms you need on the IRS website at irs.gov. If youre filing just personal taxes, Form 1040 is the first one to grab, though depending on how you make your money, you might need a Schedule A , Schedule B and Schedule D .

If you own or operate a business, youll also file Form 1120 handling your companys tax info for the year. According to the IRSs calendar, the 1120 due date depends on when the companys fiscal year ends.

It notes, This form is due on the 15th day of the 4th month after the end of the corporations tax year. However, a corporation with a fiscal tax year ending June 30 must file by the 15th day of the 3rd month after the end of its tax year. A corporation with a short tax year ending anytime in June will be treated as if the short year ended on June 30, and must file by the 15th day of the 3rd month after the end of its tax year.

If youre using tax preparation software, like TurboTax for instance, these programs guide you through tax filing and actually fill out the forms on your behalf. That means you won’t need to spend time finding and downloading these forms.

More information here:

Don’t Miss: When Can You File Your Taxes

What Happens If You File Taxes Late Here Is The Good News And Bad

Just do it already. Reset your view on taxes if you think not filing a return is the best course of action for you. Why do you ask? If you file your taxes late, what will happen?

Well, Id love to keep it pithy and say, You dont want to know, but you might care to learn what happens if you file your taxes late, regardless. Why else would you be here with this question in mind?

I should be more realistic as this is a question many people ask themselvesbut should be afraid to find out.

The reality is, filing taxes late can have serious consequences, and what happens if you file taxes late largely depends on whether or not you owe the IRS moneyor youre even required to file .

If you owe them money, then what will happen is that the IRS will send you a notice asking for payment and detail the penalties and interest you owe with an explanation of what those fees are.

However, if theres no money due on your tax return, then it becomes less complicated.

The IRS has various options available to collect what theyre owed, such as levying wages or seizing property, and in some cases, interest rates can be up to 30%. Youll want to avoid all this by filing your taxes on time .

Back to the question What happens if you file your taxes late? A lot. Lets dive in and find out.

Read Also: Does The Irs Forgive Tax Debt

Important Tax Dates In 2023

With 2023 just around the corner, it is time to start thinking about the important tax dates coming up in the new year. Here are some of the important dates to remember:

– 4th-quarter 2021 estimated tax payments are due

If you are self-employed or have other 4th-quarter income that requires you to pay quarterly estimated taxes, make sure to get them postmarked by this day.

Tax Return Deadline & 1st-quarter 2022 estimated tax payments due

One of the most important tax dates of the year, this is the due date for filing tax returns and making tax payments. Make sure you have either applied for an extension, e-filed, or postmarked your individual tax returns by midnight. The Individual Tax Return Extension Form for Tax Year 2022 is also due on this day.

Also

If you are self-employed or have other income that requires you to pay quarterly estimated taxes, be sure to get your 1040-ES Form postmarked by this date.

Individual tax returns due for the tax year 2021

If you are self-employed or have other income that requires you to pay quarterly estimated taxes, make sure your payment is postmarked by this date.

– 3rd-quarter 2023 estimated tax payments due

If you are self-employed or have other income that requires you to pay quarterly estimated taxes, make sure your third-quarter payment is postmarked by September 15, 2023.

– Extended individual tax returns due

– 4th-quarter 2022 estimated tax payment due

Read Also: Are Real Estate Taxes The Same As Property Taxes

How Do I File Online My 2023 Taxes Before The Tax Filing Deadline

Filing your taxes doesnt have to be a chore. Let PriorTax take care of everything for you. Well tailor the filing process to your specific needs and make sure everything is done before the deadline. Plus, our support team is always here to help you out should you need it. So get started today and make tax season a breeze.

This entry was postedon Monday, November 14th, 2022 at 8:00 amand is filed under Tax Deadlines, Tax for Business, Tax News, Taxes for Prior Years.You can follow any responses to this entry through the RSS 2.0 feed.You can leave a response, or trackback from your own site.

Extensions Of Time To File

This is NOT an extension of time to pay your taxes it is an extension to file your return.

You get an automatic extension of up to six months to file your return. You do not need to file an extension form, but we will assess penalties if you have not met the prepayment requirements .

See instructions for line 41. All extension returns must be filed by Oct. 17, 2022.

Read Also: H& r Block Tax Refund Calculator

The Tax Preparation Process

If you are filing your federal income tax return or filing an extension for the first time, you will need to gather various documents to ensure that your return is accurate. Having all of your tax information in one place can help you avoid making rookie mistakes and can lead to lower tax preparation fees. Heres a list of things you need to know and do during your tax preparation process:

The IRS also encourages you to file your taxes as early as possible to avoid penalties. Most people must file their taxes by May 1. You can also file early for an extension if youve already made a payment.

Read Also: Irs Tax Extension 2021 Form

Is There A Penalty For Filing For A Tax Extension

No, filing for an extension does not incur a penalty. In most cases, what leads to penalties is not paying on time, not paying at all, or not paying enough. If you fail to pay everything you owe, the IRS will charge you interest on the amount outstanding until your bill is fully settled. If that happens to be less than 90% of the total, you might also be hit with a late payment penalty.

Also Check: Tax Refund When To Expect

Can I File My State Taxes Online

Many states have their own online tax platforms, which are usually free to use. TurboTax, H& R Block and other online tax tools can also help you file your state return and can import most of the information from a federal return theyve already prepared, though they usually charge a fee. Check out CNETs comparison of tax software and services to see which is best for you.

Also Check: How Can I Make Payments For My Taxes

Why Might A Tax Extension Request Be Rejected

Nine times out of 10, if you file on time and fill out the form correctly, you should have no issue getting an extension.

In most cases, applications are rejected for minor problems that can easily be fixed. If it comes down to a misspelling or providing information that doesnt align with IRS records, the tax authority will usually give you a few days to sort out those errors and file the form againthis time accurately.

The IRS tends to take less kindly to unrealistic tax liability estimates. If it disagrees with your figures, your application for an extension may be denied and you could even be hit with a penalty.

Read Also: State Income Tax In Kentucky

Also Check: States With No Retirement Income Tax

You Can File Later But You Must Pay Now

According to the IRS, filing for an extension on your federal income taxes isnt a way to avoid paying back money owed to the government. To avoid any interest or late penalties, taxpayers should pay their estimated owed federal income tax by May 17, 2021.

If taxpayers fail to pay what they owe, interest will be charged from the regular due date until the tax is paid.

WCNC Charlotte is always asking wheres the money? If you need help, reach out to the Defenders team by emailing .

Dependent Care And Child Tax Credits

If you have children, you may qualify for the child tax credit, which is $2,000 per qualifying child. And if your child tax credit amount exceeds your tax obligation for the year, you may be able to claim the Additional Child Tax Credit of $1,400 per qualifying child.

If you had to pay someone to watch your child or other dependent while you looked for work, you may also be able to claim the nonrefundable child and dependent care tax credit. For 2019 taxes, the amount of credit is between 20% and 35% of allowable expenses, which maxes out at $3,000 for one qualifying person or dependent, or $6,000 for two or more qualifying persons or dependents.

The percentage is based on your adjusted gross income, and you must have earned income in order to claim the credit. This means that if your only source of income in a year was unearned from unemployment benefits, for example you would not be eligible to claim this credit.

You May Like: How Long Receive Tax Refund

When Should I File My Taxes

Though the deadline for personal income taxes is April 15, you can file as soon as you have everything ready. If youre owed a refund, the advantage of filing early is obvious. The official word from the agencys site is, The IRS issues most refunds in fewer than 21 days for taxpayers who file electronically and choose direct deposit. However, some returns have errors or need more review and may take longer to process. The IRS works hard to get refunds to taxpayers quickly, but taxpayers shouldn’t rely on getting a refund by a certain date.

If youre delayed because youre missing a W-2, the IRS has a list of steps to take, starting with contacting the employer in question to try to track it down.

Apply For An Extension Of Time To File An Income Tax Return

If you cannot file on time, you can request an automatic extension of time to file the following forms:

- Form IT-201, Resident Income Tax Return

- Form IT-203, Nonresident and Part-Year Resident Income Tax Return

- Form IT-203-GR, Group Return for Nonresident Partners Note: Group agents must enter the special identification number assigned to the partnership in the Full Social Security number field.

- Form IT-204, Partnership Return

- Form IT-205, Fiduciary Income Tax Return

You May Like: Are Lawyer Fees Tax Deductible

Tax Preparation Programs Can Help

Most individual taxpayers will file their returns electronically this year. The figure has topped 80% in recent years, as the IRS has made it easier to do, and the use of tax preparation software has become even more widespread.

The IRS doesnt charge for e-filing, but some firms that prepare returns for submitting electronically do. There are free and low-cost options available.

As we mentioned above, if your business uses bookkeeping or accounting software, it is very easy to export all the pertinent information into most well-known tax preparation programs. The programs will walk you through a series of questions to figure out what deductions youre eligible for, and prepare the tax return for you. You can then e-file directly from the program.

There are several reputable software programs you can use to prepare and file your taxes. Three of the better-known programs are TurboTax, TaxACT, and H& R Block. Each has different versions of its software available, from free to deluxe, depending on your needs and how complicated your finances are. There are different products available from each of the major companies for sole proprietors, independent contractors, corporations, partnerships, and LLCs.

Each of these tax filing programs use a guided interview format that progresses through dozens of screens. You answer the questions, and the software does the calculations and fills them into the correct fields on the appropriate IRS forms and schedules.

How To File For Tax Extension

The best way to get an IRS tax extension is to file Form 4868. This form is available online and can be submitted electronically or by mail. When you file IRS form 4868, you will need to provide personal information such as your name, address, social security number, and an estimate of your tax liability for the tax year. You will also need to include the payment for any taxes due. Additionally, you can specify a future date when the IRS should expect your income tax return instead of the usual April 15 deadline.

Also Check: How Do I File Back Taxes

Don’t Miss: How Much Property Tax In California

Do I Need To File An Extension For My Personal State Taxes

Each state has its own rules regarding extensions. If you want more time to file your state taxes, select your state for applicable information:

In Arizona, you can file an extension in one of three ways: file a federal extension, make an extension payment at AZTaxes.gov, or print and mail Form 204. This extends your filing deadline to October 15, but if you owe, submit payment by to avoid penalties and interest.

To file an Arkansas extension, print and mail Form AR1055-IT by . A federal extension will also extend your Arkansas filing deadline. This extends your filing deadline to October 15, but if you owe, submit payment by to avoid penalties and interest.

Filing an extension gives you until October 15 to file but doesn’t give you until then to pay. To file an extension, either fill out Form D-410 and mail it in, or submit an online extension, by .

A taxpayer who is granted an automatic extension to file a federal income tax return will be granted an automatic extension to file the corresponding North Carolina income tax return. In order to receive an automatic State extension, the taxpayer must certify on the North Carolina tax return that the person was granted an automatic federal extension, by filling in the Federal Extension circle on page 1, Form D-400.

Michigan Department of Treasury

PO Box 30774

Lansing, MI 48909-8274

If you owe, submit payment by to avoid penalties and interest.