Filing Your Taxes Can Be Tricky When You’re Self

Theres no avoiding giving Uncle Sam his due, and if you want to avoid an audit, its important to do it right the first time. Unlike W-2 employees, self-employed individuals do not have taxes automatically deducted from their paychecks. Its up to them to keep track of what they owe and pay it on time.

Because taxes arent automatically deducted, take-home pay for the self-employed tends to be higher than it is for wage earners. However, unless you want the IRS to come knocking, its wise to set aside a chunk of those funds to cover your tax obligations.

Business owners, whether they are self-employed freelancers or corporation owners, are responsible for complying with tax law with respect to their business, said Shoshana Deutschkron, vice president of communications and brand at Upwork. Financial literacy is a critical skill, that literacy includes an understanding of taxation.

You need to hold on to some of your money, added Lise Greene-Lewis, CPA and tax expert for TurboTax. You should pretend you dont have that much money because your income varies so often. You have to think about paying your taxes.

Not only are government forms daunting, but learning the ropes of taxation can be truly complicated. If youre filing as self-employed with the IRS, here are the basics of filing, paying and saving for taxes.

When Do I Pay Income Tax On My Self

You pay tax on your self-employed profits at the same time as you pay tax on all of your other income for a tax year under Self Assessment. Remember you pay Class 4 National Insurance contributions at the same time as your income tax.

From here on, we will refer to income tax, but that should be taken to include Class 4 NIC. For information on when you pay your Class 2 NIC see our section How and when do I pay my Class 2 and Class 4 NIC?.

Generally speaking, you pay your income tax for a tax year in three instalments as follows:

|

Date |

|

|

31 January during the tax year |

50% of prior year income tax liability |

|

31 July following the tax year |

50% of prior year income tax liability |

|

31 January following the tax year |

balance of any income tax due PLUS first payment on account for next tax year |

Note: Class 2 NIC, Capital Gains Tax, and/or student loan repayments due are always paid as part of the balancing payment and are not included in payments on account.

Example: Marcus

His payments for 2021/22 are as follows:

|

31 January 2022 |

|

£2,908.60 which is £1,000 PLUS £1,750 PLUS £158.60 |

You will see that in this case for Marcus there are two amounts being paid on 31 January the balance due for one year and a payment on account for the following year.

Dont Miss: Do You Pay Taxes On Stocks

Tax Deductions And Tax Credits

When youre looking for ways to save on your taxes, you might automatically jump to tax deductions and tax credits. But do you know the difference between the two? According to H& R Block, tax credits directly decrease the amount of taxes you owe, while tax deductions lower the overall amount of your taxable income.

Since deductions lower your taxable income, they also lower the amount of taxes you owe by decreasing your tax bracket, not by lowering your actual taxes. There are standard deductions and itemized deductions:

- Almost everyone qualifies for the standard tax deduction the deduction amount varies based on your filing status , but everyone with the same filing status receives the same standard deduction amount.

- There are many possible itemized deductions, and the deduction amounts vary by individual. These are some of the most common itemized deductions:

- Certain medical and dental expenses above 7.5% of your adjusted gross income

- State income taxes

- State sales and local tax

- Mortgage interest

- Student loan interest

There is a catch when it comes to itemized deductions, however. Each taxpayer is only permitted to take either their standard or itemized deductions, whichever is higher, but not both.

When it comes to tax credits, there are two types refundable or non-refundable:

Which is better? If you had to choose, youd probably prefer to receive a tax credit. Here is a list of possible tax credits:

- Earned income credit

- Premium tax credit

- Health coverage tax credit

Also Check: How Much Will I Get Paid After Taxes

How To Calculate And Pay Self

You’re considered to be self-employed if you own a business that isn’t a corporation. You must pay self-employment taxes based on the net income of your business.

Self-employment taxes are paid to the Social Security Administration for Social Security and Medicare eligibility. If this tax sounds familiar, it’s because it’s essentially the same as Social Security and Medicare taxes for employees, just with a different name.

You pay these taxes on your personal tax return, along with the income tax liability for your business. Self-employment taxes are not withheld from your income as a business owner. You must figure the amount of the tax and keep track during the year.

You may also need to pay estimated taxes to cover the amount of business income tax and self-employment tax you’ll need to pay with your tax return.

Gig Economy Income Is Taxable

You must report income earned from the gig economy on a tax return, even if the income is:

- From part-time, temporary or side work

- Not reported on an information return formlike a Form 1099-K, 1099-MISC, W-2 or other income statement

- Paid in any form, including cash, property, goods, or virtual currency

Recommended Reading: Look Up State Tax Id Number

Who Has To Pay Self

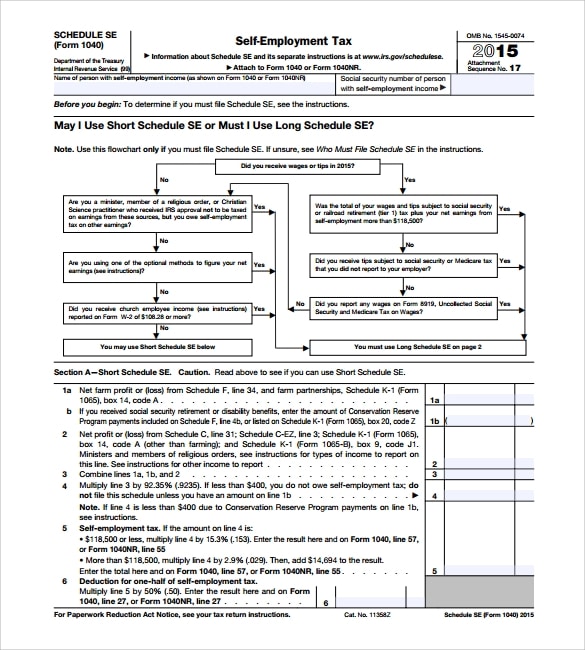

The IRS indicates that sole proprietors or independent contractors must pay self-employment tax and file Schedule SE if either of these apply2:

- Your net earnings from self-employment were $400 or more

- You had church employee income of $108.28 or more

These rules apply regardless of taxpayer age even if you’re already receiving Social Security or Medicare. IRS Schedule C is used to calculate your net earnings while IRS Schedule SE is used to calculate how much self-employment tax you owe. Not sure if you’re self-employed? According to the IRS, if you received a 1099 form instead of a W2, you are considered self-employed.

Being Taxed Like A Sole Proprietor

Your LLC partnership may be taxed just like a sole proprietor, where the income is passed through to the members own tax returns, and the business doesnt pay taxes itself on that income. An LLC will only receive a Form 1099 if it is taxed this way. If it is taxed as an S corporation, it will not receive Form 1099.

Don’t Miss: Where To Put 1098 T On Tax Return

Employee Taxes Vs Self

- Income reported on a Form W-2.

- Taxes withheld on Form W-4.

- Extra taxes might be paid with a tax return and Form 1040.

You are considered a business owner if you:

- File an 1120 business tax return based on your Schedule K-1.

- You are a member of a business partnership.

- You are a sole proprietor.

- You are in business for yourself either full-time or part-time.

Examples of independent contractors include:

- Dentists and doctors

- Web designers and graphic artists

When Do I Have To Pay Self

Your federal income tax return for any year is generally due on April 15 of the following tax year. However, because youre self-employed, you may need to make quarterly estimated tax payments to cover both your income tax and your self-employment tax obligations.

If you must make estimated quarterly payments, theyre due on April 15, June 15, Sept. 15 and Jan. 15 of the following year. Those due dates shift to the following business day if the 15th falls on a weekend or holiday. And special rules may apply if youre not a fiscal year taxpayer whose tax year doesnt begin on January 1, or if youre a farmer or fisherman.

If this is your first time dealing with self-employment taxes, knowing how much you should pay can be confusing.

The IRS provides a worksheet on Page 7 of Form 1040-ES to help you calculate your estimated self-employment tax, as well as your deduction for half of your self-employment taxes. You can use this worksheet and the worksheet on Page 8 of Form 1040-ES to calculate both your estimated self-employment tax and estimated income tax for the year. Divide them by four, then pay them in four equal installments by the due dates mentioned above, using the vouchers included in Form 1040-ES.

Don’t Miss: File Income Tax Return India

Do I Need To Include Coronavirus Business Support Grants On My Tax Return

You may have received financial support for your business during the Coronavirus pandemic. These grants may have come from your local authority , government departments or from HMRC grants).

Many of these grants are taxable and will need to be included on your tax return. See our page on Coronavirus payments for more information.

For each grant you have received you should check the conditions to see if it is taxable income and then if so, you need to work out which tax year it is taxable in, so that you know which tax return it needs to be included on. If the grants are taxable income, with the exception of the SEISS grants , factors such as when you received the support grant, your basis period and whether you prepare your accounts using the cash basis or the accruals basis will affect in which tax year they are taxable, and so which tax return they should be included on.

The 2021/22 tax return has a box on page 1 of the self-employment pages for Coronavirus business support income. For the SEISS grants, we have separate detailed guidance on our page: SEISS: where do I include the grants on my tax return?

Why Is Partnership Not Taxed

A Partnership Is Not Taxed as a Business Entity A partnership is not considered as a separate entity from the actual individual partners by the IRS for tax purposes. … This means that each partner is responsible for paying taxes according to their individual share of profits or losses on their individual tax returns.

Also Check: What Are State Income Taxes

What Are Net Earnings

The 15.3% tax seems high, but the good news is that you only pay self-employment tax on net earnings. This means that you can first subtract any deductions, such as business expenses, from your gross earnings.

One available deduction is half of the Social Security and Medicare taxes. Thats right, the IRS considers the employer portion of the self-employment tax as a deductible expense. Only 92.35% of your net earnings are subject to self-employment tax. There are a number of other tax deductions that self-employed individuals can claim to reduce their taxable earnings, like if you use your home for business.

Lets say you earn $1,500 from a freelance job and claim $500 in deductions. You would then multiply the net $1,000 by 92.35% to determine your taxable earnings. In this example, only $923.50 is subject to self-employment tax.

Common Pitfalls Of Llc Partnerships And Form 1099

Its easy to make mistakes when running an LLC partnership. Tax law can be overly complicated, and there are a lot of due dates and responsibilities to keep track of. Knowing some common pitfalls and their solutions can help you stay on track all year:

Putting best practices in place and watching out for these pitfalls can help ensure youre following all IRS guidelines as an LLC partnership. Pay close attention to every notice or document you receive from the IRS, as well, and make sure to respond in a timely manner.

Also Check: How To Pay My Tax Online

Why Do Partnerships Fail

Partnerships fail because:They don’t develop effective decision-making processes. This is problematic because assertive partners will do what they think needs to be done and the less assertive will resent those decisions and actions because they weren’t consulted. … As a consequence, other partners feel marginalized.

Dues And Publications Deduction

The cost of specialized magazines, journals, and books directly related to your business is tax deductible as supplies and materials, as are dues or fees for certain professional membership organizations.

A daily newspaper, for example, would not be specific enough to be considered a business expense. On the other hand, a subscription to Nations Restaurant News would be tax deductible if you are a restaurant owner, and Nathan Myhrvolds several-hundred-dollar Modernist Cuisine boxed set would be a legitimate book purchase for a self-employed, high-end personal chef.

As for membership dues or fees, you cant deduct them for belonging to clubs organized for business, pleasure, recreation, or any other social purpose. Examples include country clubs, golf and athletic clubs, hotel clubs, sporting clubs, airline clubs, and clubs operated to provide meals under circumstances generally considered to be conducive to business discussions. However, the IRS does make exceptions for groups that it considers do not exist for entertainment purposes. These are:

- Boards of trade

- Civic or public service organizations

- Professional organizations such as bar associations and medical associations

- Real estate boards

- Trade associations

You May Like: Your Tax Return Is Still Being Processed 2021

Affordable Care Act Tax Provisions

Additional Medicare Tax

The Additional Medicare Tax went into effect on January 1, 2013. The 0.9% Additional Medicare Tax applies to an individuals wages, Railroad Retirement Tax Act compensation and self-employment income that exceeds a threshold amount based on the individuals filing status. The threshold amounts are $250,000 for married taxpayers who file jointly, $125,000 for married taxpayers who file separately and $200,000 for all other taxpayers. An employer is responsible for withholding the Additional Medicare Tax from wages or compensation it pays to an employee in excess of $200,000 in a calendar year. For more information see Tax Topic 560, Additional Medicare Tax and our questions and answers.

Expatriate Health Plans

On June 10, 2016, the Treasury Department and Internal Revenue Service, the Department of Health and Human Services, and the Department of Labor issued proposed regulationsPDF that implement the Expatriate Health Coverage Clarification Act of 2014 . The EHCCA generally provides that most ACA provisions do not apply to expatriate health plans covering individuals traveling to or from the United States. More specifically, the EHCCA provides that the requirements of the ACA do not apply to expatriate health plans, expatriate health insurance issuers for coverage under expatriate health plans, and employers in their capacity as plan sponsors of expatriate health plans, except that:

Health Coverage for Older Children

Net Investment Income Tax

How Taxes Work In Germany For The Self

In Germany, you are taxed between 14% and 45% of your income, depending on which income bracket you belong to. These are the income tax percentage rates:

- Up to 9,744 per year: You are not required to pay income tax

- 9,745 57,918 per year: 14% to 42%

- 57,919 274,612 per year: 42%

- Over 274,613 per year: 45%

You may also be required to pay VAT or Umsatzsteuer in German. Freelancers offering goods and services must pay VAT. You must charge VAT to your customers and report this sum to your local Finanzamt. You wont need to pay VAT if, in the first year of business activity, you make less than 22,000 and in the second year less than 50,000.

Read Also: How Much Does Unemployment Take Out For Taxes

Also Check: What Is Mass Sales Tax

Figure Out How Much You Earned

This is the starting point for all taxes: you need to know how much you received in income before anything else can be relevant. If you donât have a good set of records to rely on, the year-end tax forms you receive will be key.

If you earned more than $600 from a single client or work platform they will likely send you a 1099-NEC by January 31st. You might also receive a 1099-K, reflecting payments you received through a third-party payment processor like PayPal or Stripe. You can use these statements to recreate your income for the year. I also highly recommend sifting through your bank statements for any income that might have been missed, or that falls under the $600 reporting threshold.

The Basics For Filing Self

Before you can determine your tax obligations, know your tax rate and consider whether your region requires separate city taxes. To figure out your rate, first calculate your net profit or net loss from your business. You can calculate this by subtracting business expenses from your business income. If your expenses are less than your income, the difference is net profit and is part of your income. If your expenses are more than your income, the difference is your net loss.

To prepare to file your taxes, you must first understand your tax rate, as well as any state and local taxes that might apply to you. To determine your tax rate, you must first figure out your net profit or loss during the taxable period.

Next, if your earnings from self-employment exceed $400, you must file a Schedule C . Even if your net earnings from self-employment were less than $400, you still have to file a return if you meet any of the other requirements listed in Form 1040.

According to the IRS, self-employed taxpayers who expect to owe more than $1,000 in self-employment tax must make estimated tax payments four times during the year. You will need to use IRS Form 1040 to file these quarterly taxes.

You can estimate your expected self-employment tax using free tools like this one from TaxAct.

Read Also: Mortgage Calculator Taxes And Insurance