Who Does Not Have To Pay Estimated Tax

If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4 with your employer. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold.

If you receive a paycheck, the Tax Withholding Estimator will help you make sure you have the right amount of tax withheld from your paycheck.

You dont have to pay estimated tax for the current year if you meet all three of the following conditions.

- You had no tax liability for the prior year

- You were a U.S. citizen or resident alien for the whole year

- Your prior tax year covered a 12-month period

You had no tax liability for the prior year if your total tax was zero or you didnt have to file an income tax return. For additional information on how to figure your estimated tax, refer to Publication 505, Tax Withholding and Estimated Tax.

What Are Some Tax Benefits For Teens

As we said before, filing a tax return could mean getting a tax refund of any excess taxes that were withheld from your paycheck. So even if you made less than the standard deduction in 2022, its still a good idea to file!

Many tax breaks depend on your dependency status. If you rely on your parents or guardian for more than half of your financial support, you could be considered a dependent if you are under age 19 or under age 24 if you are a full-time student.

If you can be claimed as a dependent on someone elses tax return, certain tax credits you might qualify for could instead be passed on to whoever is claiming you as a dependent.

One potential tax break for teen students is the student loan interest deduction. If you took out student loans for yourself, you could take a deduction for the interest you paid on those loan up to $2,500 per year. You can take this deduction even if you dont itemize your deductions.

How To Dispute Insufficient Interest Paid

If you think we underpaid interest owed to you on refunds or credits you’re eligible for, you can file an informal claim or complete and send Form 843PDF for us to consider allowing additional overpayment interest. Make sure to include your own computation and reason for making the request for additional interest on Line 7 .

Your request must be received within six years of the date of the scheduled overpayment.

Also Check: How To File Taxes Free

How To Pay Taxes As An Independent Contractor

In the U.S., federal income taxes operate on a pay-as-you-go system, meaning you generally cant wait until the end of the year to calculate your taxes and pay what you owe. Instead, the IRS requires you to estimate your tax liability and pay it throughout the year as you earn income.

Employees satisfy this requirement by having their employers withhold taxes from their paychecks. But independent contractors must make estimated quarterly payments on their ownif they expect to owe taxes of $1,000 or more when they file their tax returns.

Estimated tax payments are due on April 15, June 15, Sept. 15 and Jan. 15 . If any of those dates falls on a weekend or holiday, the due date shifts to the next business day.

Credit And Debit Cards

You can use your debit or credit card to pay your tax bill online or over the phone. The IRS doesn’t charge a fee for this service, but the service providers charge a fee for processing the payment. The three providers PayUSAtax, Pay1040, and ACI Payments, Inc. charge a fee. Debit card transactions are often between $2 and $4. For credit transactions, the fee is based upon a percentage of the payment amount. For instance, for a credit transaction of $1,000, the taxpayer may be charged a fee of $19.90 while a credit transaction of $10,000 would cost the taxpayer a fee of $199. The IRS accepts Visa, Discover, American Express, Mastercard, STAR, Pulse, NYCE, Accel, PayPal, and PayNearMe

Read Also: What Is Fica Ee Tax

What Is The Tax Rate For A Teenager

The rate you are taxed depends on how much money you earn throughout the year. Your annual income determines which income tax bracket you are in. Here are the tax brackets for 2022:

| Tax rate | |

| $323,926 or more | $539,901 or more |

For example, lets say you earned $15,000 as a single filer in 2022. The first $10,275 you made would be taxed at 10 percent, and the remaining $4,725 would be taxed at 12 percent.

Before You Start Tax Preparation

If you use a program such as Quicken® to keep track of your finances, print a report of your transactions for the tax year . This will make your tax preparation much easier, and helps you clearly see where your money goes each year.

- Having this information in a report is much easier than going through your checks and bank statements for the entire year.

- As you review the report, highlight information you will need to prepare your tax return or make notes to remind yourself of something later.

Recommended Reading: New York State Income Tax Rates

How To Pay Quarterly Taxes: 2022 Tax Guide

From flexible work hours to not reporting to a boss, being self-employed comes with a lot of perks. However, with the freedom of working for yourself also comes responsibilities such as paying quarterly taxes. Heres a checklist and basic steps to pay quarterly taxes in 2022. If you need more help with taxes, consider working with a financial advisor.

How Does Having A Roth Ira Affect Your Tax Return

There is usually no tax effect if you withdraw money from your Roth IRA because you already paid the taxes. However, you must meet certain qualifications to make a tax-free withdrawal. If you are under age 59½ or you havent waited at least five years to make your first withdrawal, you may have to pay an additional 10% penalty.

When you make a Roth IRA withdrawal, youll receive a Form 1099-R from your brokerage firm showing the amount of the withdrawal, any tax you withheld, and whether the distribution is taxable. Give this form to your tax preparer to include in your tax return.

You May Like: What Happens If I Don’t Pay My Taxes On Time

Why The Government Requires Quarterly Estimated Tax Payments

Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed individuals with quarterly tax payments. If you work for yourself as an independent contractor or freelancer, your taxes typically are not automatically taken from your paychecks. Therefore, the IRS collects income taxes with quarterly tax payments.

To determine if a taxpayer must make quarterly tax payments, they follow several guidelines.

- You anticipate owing more than $1,000 when filing your return for 2022

- You anticipate the withholding and tax credits will be less than 90% of your estimated tax liability for 2022 or 100% of your 2021 year tax liability .

If your adjusted gross income exceeds $150,000 $75,000 if youre married and file separately the requirement is 110%. Farmers and fishermen are an exception to this requirement. If youre in either of these professions and earn at least 66.6% of your income from the trades, you only need to pay a corresponding amount of the tax liability.

While paying your quarterly tax estimates seems like a pain, it can help you avoid a big tax bill during tax time. In addition, paying quarterly taxes makes your tax payment more manageable throughout the year.

Calculating Your Income Taxes As An Independent Contractor

Well continue with the same scenario to estimate your federal income taxes. And lets assume youre single, have no other income and claim the standard deduction. For simplicity, we will ignore certain tax credits and deductions, such as the Qualified Business Income deduction.

Start by calculating your taxable income after deductions. Take your $100,000 in earnings and subtract $7,065 . Then, subtract $12,950 . That leaves you with $79,985 of taxable income.

What kind of income tax hit will you take? The 2022 IRS tax tables indicate that if your taxable income is $79,985, youll owe income taxes of $13,212 for 2022.

Add your estimated self-employment taxes and your estimated federal income taxes , and you get an estimated federal tax liability of $27,342. Divide that number by four to determine the amount of your estimated quarterly payments.

If you make those payments on time, then you shouldnt have to worry about a hefty tax bill when you file your federal return.

Just keep in mind that you may need to make estimated state income tax payments, and those rates and deadlines vary by state.

If you need help calculating your estimated payments, use IRS Form 1040-ES, try our income tax calculator or speak with a tax professional to get a more dialed-in estimate of what you might owe.

Don’t Miss: Can I File Taxes Now

Easy Ways To Pay Taxes

IRS Tax Tip 2018-87, June 6, 2018

The IRS offers several payment options where taxpayers can pay immediately or arrange to pay in installments. Taxpayers should not ignore a bill from the IRS because as more time passes, interest and penalties accumulate.

Here are some ways to make payments:

- Direct Pay. Taxpayers can pay tax bills directly from a checking or savings account free with IRS Direct Pay. Taxpayers receive instant confirmation once theyve made a payment. With Direct Pay, taxpayers can schedule payments up to 30 days in advance. They can change or cancel a payment two business days before the scheduled payment date.

- Taxpayers can also pay their taxes by debit or credit card online, by phone or with a mobile device. The IRS does not charge a fee, but convenience fees apply and vary depending on the card used.

- Installment agreement. Taxpayers who are unable to pay their tax debt immediately may be able to make monthly payments. Before applying for any payment agreement, taxpayers must file all required tax returns. They can apply for an installment agreement with the Online Payment Agreement tool, which also has more information about whos eligible to apply for a monthly installment agreement.

Does Robinhood Report To Irs

Yes, Robinhood Report to the IRS. The dividends you receive from your Robinhood shares or any profits you earn through selling stocks via the app must be included on your tax return. If you profit from selling securities and pay tax on it, the rate will be based on the length of time you owned the stock.

Don’t Miss: United Way Free Tax Preparation

Do You Have To Pay Taxes If You Don’t Withdraw Stocks

If you sold stocks at a loss, you might get to write off up to $3,000 of those losses. And if you earned dividends or interest, you will have to report those on your tax return as well. However, if you bought securities but did not actually sell anything in 2020, you will not have to pay any “stock taxes.”

Taxes On Roth Ira Withdrawals

You arent required to take withdrawals from your Roth IRA at any time during your lifetime. That means you dont have to take a required minimum distribution from your Roth account at age 72 .

Withdrawals from a Roth IRA are usually tax-free because you paid the taxes when you made the contributions to the plan. But Roth distributions must meet certain qualifications to avoid paying taxes and penalties on the distribution amount.

To avoid penalties, distributions must be made:

- Five years or more after your first tax year of having the account

- On or after you reach age 59½

If you take a distribution before age 59½, you may have to pay an additional 10% tax on these early distributions.

There are, however, some exceptions to these requirements:

Don’t Miss: Best States For Income Tax

How Do I Calculate My Estimated Taxes

There are a few ways to calculate your quarterly tax payments depending on your business model and annual earnings.

- If you earn a steady income, estimate the tax you’ll owe for the year and send one-fourth to the IRS each quarter. For instance, let’s say you’ll earn $80,000, which places you in the 22% marginal tax bracket. You’ll owe $17,600 in federal taxes or $4,400 each quarter in 2022.

- If your income varies throughout the year, you can estimate your tax burden based on your income and deductions in the previous quarter. The IRS Estimated Tax Worksheet can help you do the math.

If you’ve overestimated your earnings at the end of the year, you can complete a 1040-ES form to receive a refund or apply your overpayment to future quarterly taxes. If you underpaid, the form can help you calculate what you still owe.

How To Figure Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax. Nonresident aliens use Form 1040-ES to figure estimated tax.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Use your prior year’s federal tax return as a guide. You can use the worksheet in Form 1040-ES to figure your estimated tax. You need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as accurately as you can to avoid penalties.

You must make adjustments both for changes in your own situation and for recent changes in the tax law.

Corporations generally use Form 1120-W, to figure estimated tax.

Recommended Reading: What Are State Income Taxes

How To Pay Taxes: 10 Ways To Pay Your Tax Bill

OVERVIEW

You know you owe taxes, but you may not be aware of all the available options for getting that money to the IRS.

|

Key Takeaways If you have a bank account, you can pay your tax bill by check or you can pay from your checking or savings account using an electronic bill paying service known as direct pay. If you e-file your taxes using a tax preparation software, a tax professional, or IRS Free File, you can pay your tax bill via direct debit using Electronic Funds Withdrawal . You can use your debit or credit card to pay your tax bill online or over the phone, using one of three providers: PayUSAtax, Pay1040, and ACI Payments, Inc. You can pay your tax bill with cash at certain participating retail stores or at IRS Taxpayer Assistance Centers . |

No one wants to end up with a tax bill. But if you do owe money for taxes, you’ll want to know what your payment options are. Here’s how to pay taxes and how to decide which option is right for you.

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Read Also: Are 2022 Tax Forms Available

Temporarily Delay The Collection Process

You may need this type of agreement in the event that you can’t pay your full tax liability in the foreseeable future . If you can’t pay any of your tax debt, then your account could be classified as “currently not collectible.” The IRS could then approve and temporarily delay collection until your financial condition improves.

Being currently not collectible doesn’t mean the debt goes away it means the IRS has determined you can’t afford to pay the debt at this time. Prior to approving your request to delay collection, you may be asked to complete a Collection Information Statement and provide proof of your financial status, including information about your assets, monthly income, and expenses.

What Are Quarterly Taxes

Quarterly taxes, also referred to as estimated taxes, are a type of taxation you must pay in advance of the annual tax return. They work on a pay-as-you-go basis, meaning you pay them throughout the year. During each quarter, applicable taxpayers pay a portion of their expected annual income tax. As a result, these payments are estimations.

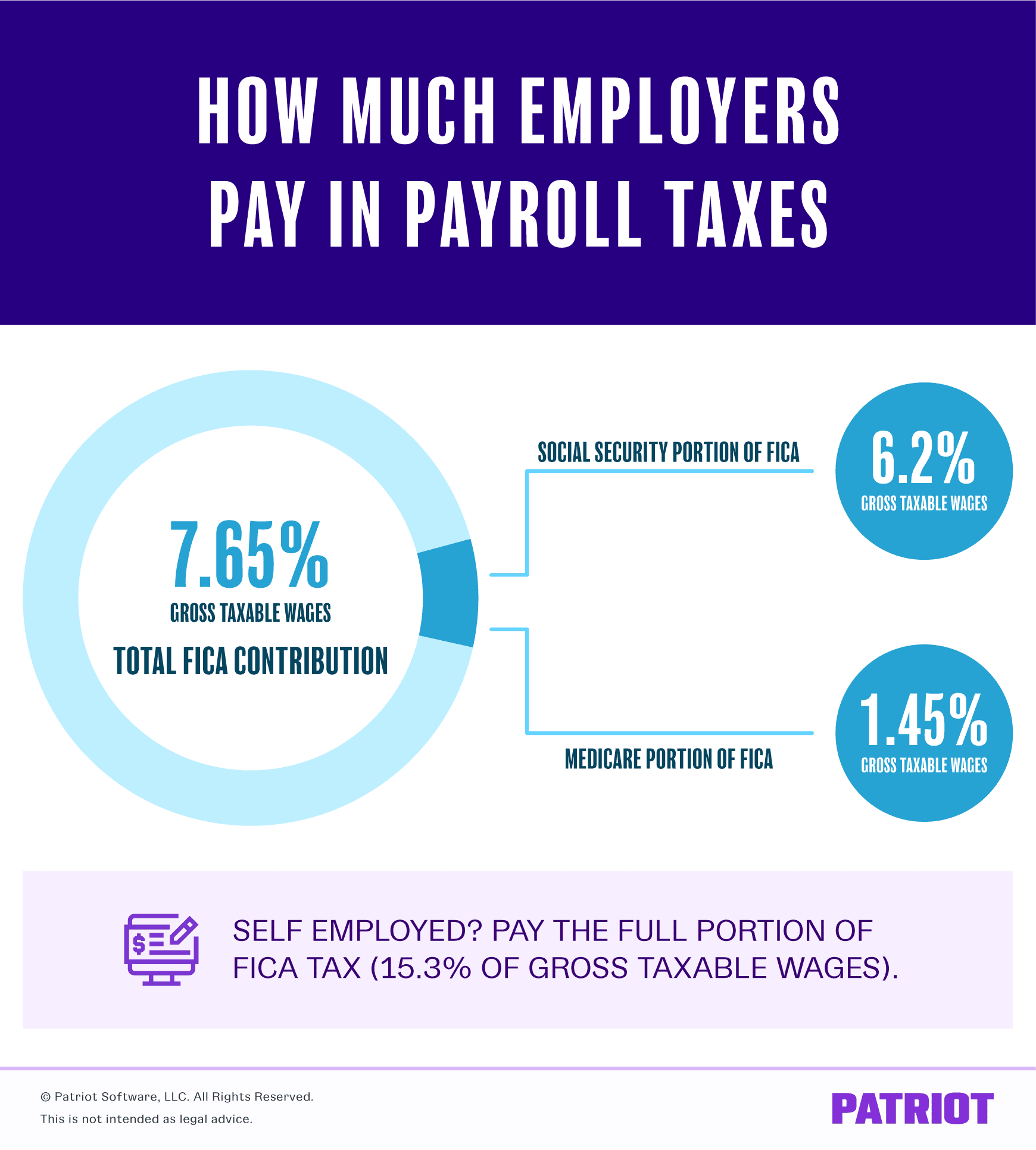

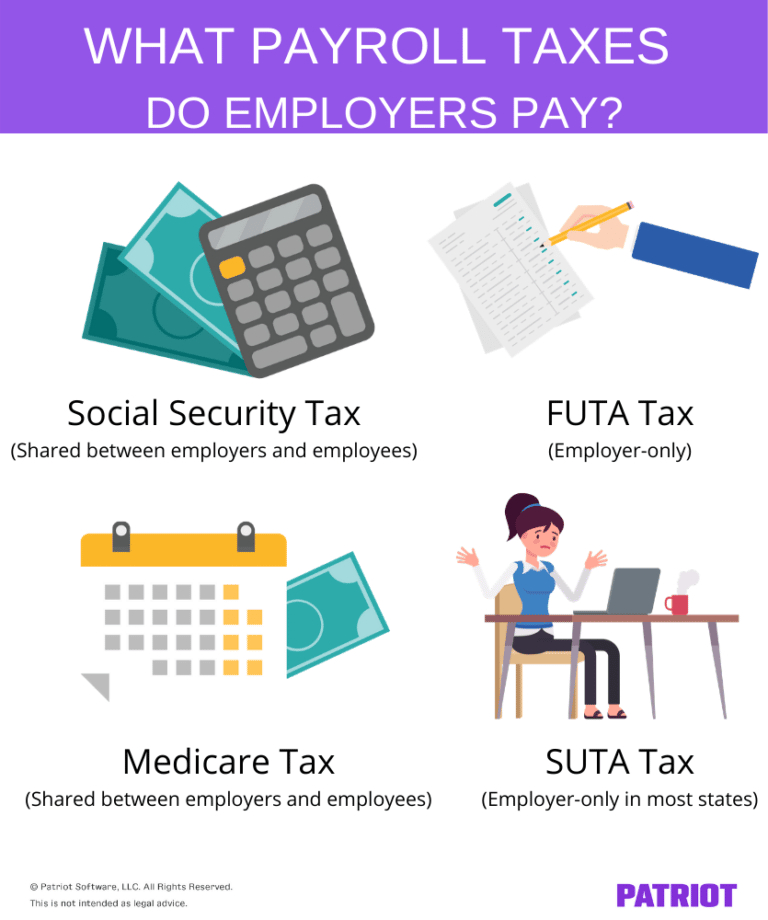

These regular tax payments are meant to cover Medicare, Social Security and your income tax. So, you should familiarize yourself with how those taxes break down: the income tax and the self-employment tax. Income tax follows the same income tax rates as salaried workers pay. Then, the self-employment tax clocks in at 15.3%. This covers both the Social Security and Medicare costs .

Don’t Miss: How Much Tax Is Deducted