Give Money To People While You Still Can

Would you rather give your money to your loved ones, causes near and dear to your heart, or to the government? You can start giving money to your heirs now, and it will reduce the value of your estate. If you can give enough away to stay below certain limits, you can reduce your estate taxes owed.

For example, suppose your estate is worth $15 million right now, and you dont expect it to change much because youre spending at an enjoyably high level, but also still earn good investment and other income to make up for it.

As part of how to avoid estate tax, start gifting money to family and friends up to $15,000 per person per year, or $30,000 if married and if you can get your estate value down below the exemption, you can avoid paying estate taxes later. Just keep in mind that these gifts do not count against your $11.58 million exemption.

If you have an ultra-high net worth estate that is valued far above the exemption limits, this strategy has limited effectiveness.

If youd like to talk to someone more knowledgeable about gifting and its impact on estate taxes, specifically as it applies to ultra-high net worth investors, contact Hutch Ashoo, Co-Founder of Pillar Wealth Management at the phone number or email address below. Hutch can give you the advice you need.

What Is The 7 Year Rule In Inheritance Tax

The rule enables a gift of money, property or other assets to become exempt from inheritance tax if the person giving it lives for seven years afterwards. This is a fundamental concept for any person planning to pass on wealth to the next generation, particularly if their estate exceeds the current IHT threshold. 2

Giving A Retirement Account

Retirement accounts can be tricky inheritances for your beneficiaries. Distributions from these accounts are generally taxable, and tax law is pretty strict about when distributions must be taken if you leave your accounts to anyone other than your spouse. Your 30-year-old child wouldn’t be able to sit on the account for 35 years until their retirement, letting it grow and grow undisturbed.

In most cases, your beneficiary must begin taking distributions in the year after your death, and these distributions are taxable as income to them. Exactly how much they must take depends on the method of calculation they use. Distributions can be spread out, resulting in less taxable income per year, if they use the single life method. This is based on their own age and life expectancy, not yours.

If you leave your retirement account to your spouse, however, they can simply take it over. They wouldnt have to begin taking required minimum distributions and paying taxes on those distributions until they reach age 70 1/2 or 72, depending on the year in which they reach age 70 1/2. The account would be treated just as if they had personally owned it all along.

Read Also: Are Lawyer Fees Tax Deductible

How Are Family Trusts Taxed

The taxation of family trusts can be complex. It’s always a good idea to consult a tax professional to determine how your specific family trust may be taxed.

Grantor trusts, where the grantor has control over the assets, generally require grantors to report all income from a trust on their own individual tax returns. Non-grantor trusts, on the other hand, work differently. Typically, the trust itself or its beneficiaries pay tax on taxable income.

Income kept in the trust is paid on a trust tax return using Form 1041. Income distributed to beneficiaries is reported to the beneficiaries by the trust using Form K-1. This form specifies how much of the distribution is a principal distribution, which generally isn’t taxable, versus an interest, capital gains or other income distribution, which may be taxable.

If a non-grantor trust has more than one beneficiary, the trust will divide the income between each beneficiary based on the terms of the trust. Then, it will issue a Form K-1 to each beneficiary specify each individual’s portion of the income. Beneficiaries input information from Form K-1 into their personal tax returns.

Determine Who Will Carry Out Your Estate Plan

In your will, you should specify who will have power of attorney if you die or are incapacitated. That person will make all financial decisions on your behalf. You may need to appoint a guardian for your children who are under-age. A health care power of attorney would make medical decisions for you if you are unable to do so.

Recommended Reading: How Are Taxes Calculated On Paycheck

Explore The Trusts Available To Help You

These are just some of the trusts that you might use to reduce the size of your estate and future estate tax liability.

If you are a high-net-worth individual, a trust can be a great tool for tax reduction.

However, for individuals with less than $11,180,000 or married couples with less than $22,360,000 you may be at risk too! After all, if invested prudently, your net-worth should grow over time, and potentially surpass these numbers for many.

That’s why it’s so important to have a wealth advisor who understands trusts while also specializing in tax-managed investing.

Ultimately, in order to be effective, trusts must be properly identified, established, and funded. You should also project the growth of your wealth over time to ensure your estate plan is built for today and tomorrow.

Mark has over 18 years of experience helping individuals and families invest and plan for retirement. He is a CERTIFIED FINANCIAL PLANNER and President of Covenant Wealth Advisors.

How Do I Avoid Inheritance Taxes

Here are 4 ways to protect your inheritance from taxes:

Recommended Reading: Wv State Tax Department Phone Number

How To Avoid Estate Taxes Using Trusts

Understanding how to protect your assets from estate taxes is one of the critical factors of giving your heirs the hard-earned wealth you have accumulated over a lifetime. Although a small percentage of Americans face the federal estate tax, the often financially burdensome tax negatively impacts more people than just the mega-rich.

If you want to avoid paying federal estate taxes, you could move to places such as Canada or New Zealand. However, why make a life-altering move over an issue that you can control by learning how to avoid estate taxes using trusts?

Navigating Family Trusts And Taxes

OVERVIEW

Family trusts offer a solution for managing assets such as a home or an investment portfolio and there are certain tax implications involved that taxpayers should know about.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

You May Like: When Is 2021 Tax Deadline

Abusive Trust Tax Evasion Schemes

- Domestic estates and trusts filed 2.99 million Form 1041 returns for tax year 2017 and 3.07 million Form 1041 returns for tax year 2018.

- Changes in bank secrecy laws of foreign jurisdictions have revealed a plethora of foreign tax evasion schemes involving trusts.

- The IRS is actively examining tax evasion schemes involving the use of foreign and domestic trusts.

- Facts about trusts:

- A trust is a legal entity formed under state law. To create a trust, legal title to property is conveyed to a trustee, who is then charged with the responsibility of using that property for the benefit of another person, called the beneficiary, who really has all the benefits of ownership, except for bare legal title.

- Legal trusts are used in such matters as estate planning to facilitate the genuine charitable transfer of assets and, to hold assets for minors and those unable to handle their financial affairs.

- A trustee is designated to hold legal title to the trust property, to exercise independent control over it, and to be responsible for its management.

- All trusts must comply with the tax laws as set forth by the Congress in the Internal Revenue Code, Sections 641-684.

- Trusts established to hide the true ownership of assets and income or to disguise the substance of financial transactions are considered fraudulent trusts.

- Taxpayers are responsible for payment of their taxes as set forth by Congress regardless of who prepares their return.

Want To Set Up A Trust

You can set up a trust now or write one into your will.

When you set up a trust, you need to clearly state:

- what the assets of the trust are

- who the trustee and beneficiaries are

- when the trust becomes active is it immediately, or only when you die?

The Law Societies keep searchable databases to help you find a qualified solicitor near you.

Find a solicitor in:

- Northern Ireland Law Society of Northern IrelandOpens in a new window

Recommended Reading: Long-term Hotel Stay Tax Exempt

Get Help From An Estate Planning Lawyer

A trust is one way to reduce your federal estate taxes. If you want a detailed plan to protect your wealth, make sure to speak to an experienced estate planning attorney. The Knee Law Firm has the knowledge and experience to help manage end-of-life taxes. Schedule a consultation by calling the Hackensack office at 996-1200 or by filling out our online contact form.

What Rate Are Trusts Taxed At

Trusts get taxed at 37% of all the trust income that exceeds $12,750. Today, most trusts are created as grantor trusts for federal income tax purposes. For a grantor tax, the trust does not pay any taxes. The trust income flows through the settlers personal income tax return. There are different types of grantor trusts, but the most common are revocable and irrevocable trusts.

The revocable grantor trust owners do not want their trust beneficiary to go through the court process after they pass on. Hence, they set up the grantor trust to avoid probate. This means that the trust does not have to pay income tax, as the grantor still holds the estate.

If your revocable living trust owns some rental property, an investment account, rental income, or investment income, the grantor will continue paying their tax. For irrevocable trust assets, the person who sets up the trust reports that income on their income tax return. For instance, a couple who file jointly can have up to $612 in a year without getting to the 37% income tax rates.

You May Like: How Long To Get Tax Refund 2022

Trustee And Tax Preparation Fees

The trust may deduct reasonable fees for trustee management and tax preparation. However, the trust may only deduct these fees based on the proportion of income that is taxable. For example, say that a trust received $20,000 worth of income in a given year. However, only $10,000 of that income was subject to taxes. The trust could then deduct half of its management and accounting fees.

Do Property Taxes Change If I Create A Revocable Living Trust

Some people are concerned that their property taxes will go up if their real property is placed in a Trust. The truth is that transfers into a Revocable Living Trust have no effect on your property taxes.

However, some states such as Florida require that your primary residence, if it is placed into the Trust, be titled in a specific manner, otherwise it may affect its ability to qualify for what is known as the homestead exemption. Relevant state law needs to be reviewed before any transfer is made.

What Is the Annual Fee for a Revocable Living Trust?

The exact cost of a Revocable Living Trust depends on how valuable and complicated your assets are, whether standard documents can be used, how many assets must be transferred to the Trustee, and whether tax planning is needed. However, if you are the Trustee, there is no annual fee associated with maintaining a Trust.

Fees are involved when an amendment to the Trust is made which involves changing the terms of the Trust. Additionally, when a spouse of the Trustee passes away and assistance is needed in administering the Trust, attorneys fees will be charged in order to handle the Trust Administration to take advantage of certain tax benefits, if applicable, and to follow the terms of the Trust.

How Do I Fund My Revocable Living Trust?

Read Also: What Percentage Is Self Employment Tax

Do I Need A Revocable Trust

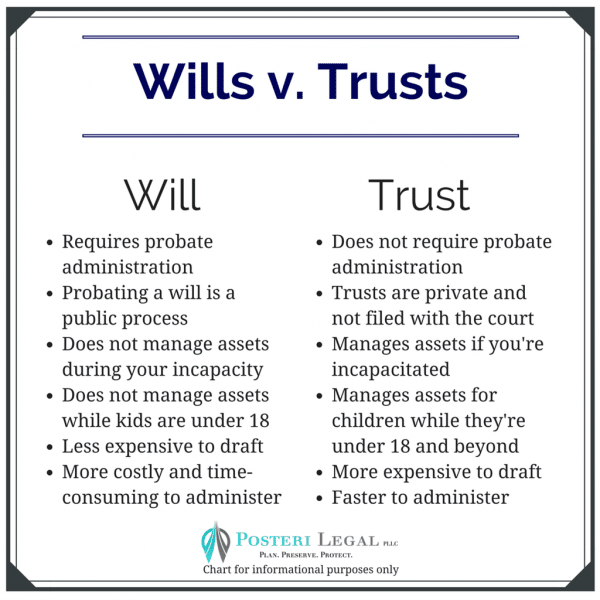

If a revocable trust does not reduce your estate tax bill, then why should you set one up? The answer consists of three compelling reasons.

First, you avoid the costly and time-consuming probate process. Second, a revocable trust gives you a way to pass on your assets if you become incapacitated. Finally, a revocable trust represents a private agreement, which means every term written into the trust agreement remains private after you die.

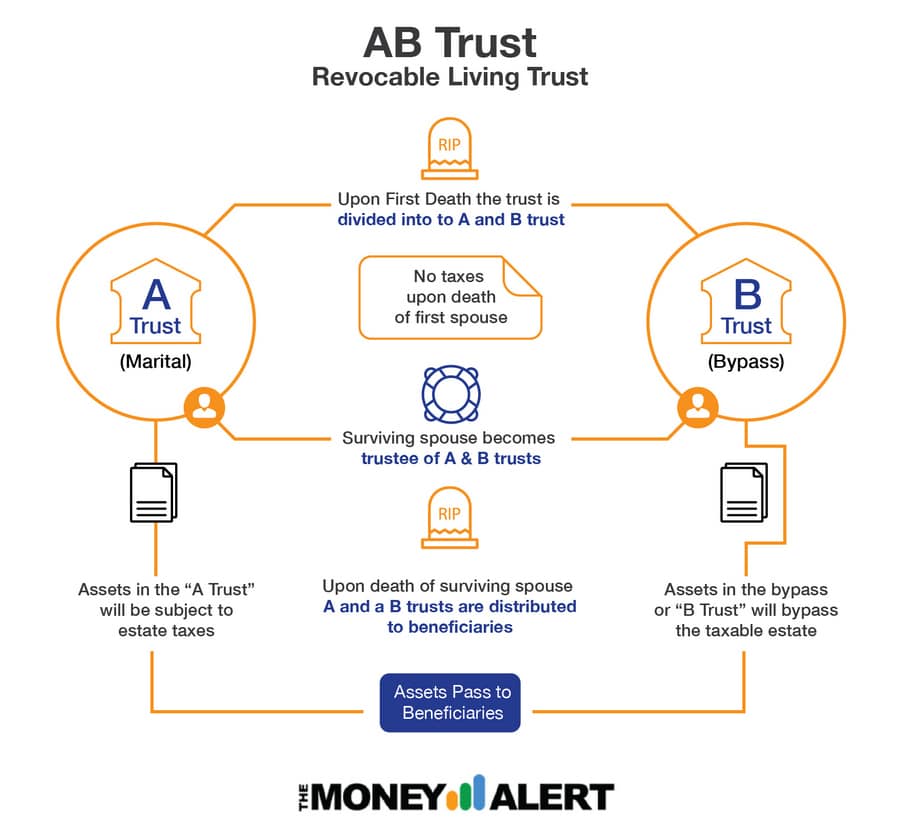

For married couples, drafting a revocable trust also delays the payment of estate taxes until both spouses die. To determine if a revocable living trust is your best option for protecting your assets,schedule a free consultation with one of the experienced estate planning attorneys at Cloud Peak Law Group.

Related Topics

- Cloud Peak Law Group, P.C.

- 1309 Coffeen Ave

Give Away Some Of The Money

It may seem counter-intuitive, but sometimes it makes sense to give a portion of your inheritance to others. In addition to helping those in need, you could potentially avoid taxable gains on appreciated property and receive a tax deduction by donating to a charitable organization.

If you’re expecting to leave money to people when you die, consider giving annual gifts to your beneficiaries while you’re still living. You can give a certain amount to each person$16,000 for 2022without being subject to gift taxes

Gifting not only provides an immediate benefit to your loved ones, it also reduces the size of your estate, which can be important if you’re close to the taxable amount. Talk with an estate planning professional to ensure you’re staying current with the frequent changes to estate tax laws.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Read Also: Are Real Estate Taxes The Same As Property Taxes

Revocable Vs Irrevocable Trusts

A revocable trust allows the grantor to make changes to it after it is put into effect. The assets in a revocable trust are still essentially owned and controlled by the grantor. This means they aren’t protected from lawsuits or lenders.

An irrevocable trust generally doesn’t allow the grantor to make many changes after it is established. The assets are placed in the trust’s name and are no longer owned by the grantor. This can protect the assets from lawsuits and creditors.

Do Trusts Pay Income Tax

- The most common type of trust in estate planning is a revocable trust. Revocable trusts generally are pass-through entities for federal income tax purposes. This means that the trust will not interfere with how you currently report your federal income tax to the IRS: all items of income, deduction, depreciation, and credit will continue to flow through to you on your personal Form 1040, and the trust will not be required to file its own income tax return during your lifetime. Many clients simply assign their social security number to their revocable trust during their lifetime. The general rule is that when you die, your revocable trust becomes irrevocable , at which time the taxation of the trust will change.

- The income taxation of irrevocable trusts is more nuanced . Essentially, an irrevocable trust can be designed to be taxed as its own entity , but there are also ways to have an irrevocable trust taxed to a particular person, such as the person who created it . Your estate planning attorney should discuss these options with you before the irrevocable trust is established.

Don’t Miss: Is Mortgage Interest Tax Deductible

Interest Vs Principal Distributions

When trust beneficiaries receive distributions from the trust’s principal balance, they do not have to pay taxes on the distribution. The Internal Revenue Service assumes this money was already taxed before it was placed into the trust. After the money is placed into the trust, the interest it accumulates is taxable as income, either to the beneficiary or the trust itself.

The trust must pay taxes on any interest income it holds and does not distribute past year-end. The interest income the trust distributes is taxable for the beneficiary who receives it.

The amount distributed to the beneficiary is considered to be from the current-year income first, then from the accumulated principal. This is usually the original contribution plus subsequent ones and is income in excess of the amount distributed. Capital gains from this amount may be taxable to either the trust or the beneficiary. All the amount distributed to and for the benefit of the beneficiary is taxable to him or her to the extent of the distribution deduction of the trust.

If the income or deduction is part of a change in the principal or part of the estate’s distributable income, income tax is paid by the trust and not passed on to the beneficiary. An irrevocable trust that has discretion in the distribution of amounts and retains earnings pays a trust tax that is $3,011.50 plus 37% of the excess over $12,500.

Invest In A Business Such That Your Heirs Become Part

You may have a friend or associate who wants to start up a business and needs capital. If the situation works out right, you may be able to arrange for your heirs to become partial owners of the new business, reaping some of the profits that eventually get generated.

This is certainly a riskier option, but if you are in the business-startup game and this kind of arrangement is familiar and attractive to you, this is a way to reduce the value of your estate while giving your heirs a stake in a new business. So, its one more option for how to avoid estate tax.

Recommended Reading: How Much Foreign Income Is Tax Free In Usa