How To Pay Tax On Cryptocurrency Uk

Once you’ve filed your Self Assessment Tax Return with HMRC reporting your crypto gains and income – HMRC will let you know how much tax you owe on your crypto. You’ll need to pay cryptocurrency taxes by the 31st of January 2023.

This is the same deadline as filing your taxes, so we recommend doing this before this date so you’re not stuck in the lurch with a large tax bill that needs paying straight away!

Capital Gain & Loss On Crypto

A capital gain or loss is incurred on trading or selling cryptocurrency. Just like traditional assets, capital gains will be incurred when the price of selling is greater than the price it has been acquired for . On the other hand, a capital loss is incurred when the price of selling is lesser than the price it was acquired for.

Before selling a capital asset, you must figure out if the investment was short-term or long-term. Long-term gains and losses are incurred when the assets were held for more than a year, whereas short-term capital gains and losses are incurred when the assets have been held for less than one year.

Is Any Crypto Tax Free

Let’s start with the good news – you won’t always pay tax on crypto in the UK. Transactions that are tax free include:

- Buying crypto with GBP.

- Transferring crypto between your own wallets.

- Donating crypto to charity.

- Gifting crypto to your spouse.

With that out the way… let’s get into all the transactions that are taxed.

Also Check: Last Day To Do 2021 Taxes

Strategies That May Help Reduce Cryptocurrency Taxes

Now that you know how crypto can be taxed, here are a few strategies that may help manage your tax bill:

- Hold investments for at least one year and a day before selling. Long-term capital gains are taxed at lower rates than short-term capital gains.

- Consider crypto tax-loss harvesting. That means offsetting your crypto losses against crypto gains or other capital gains to help reduce your tax bill.

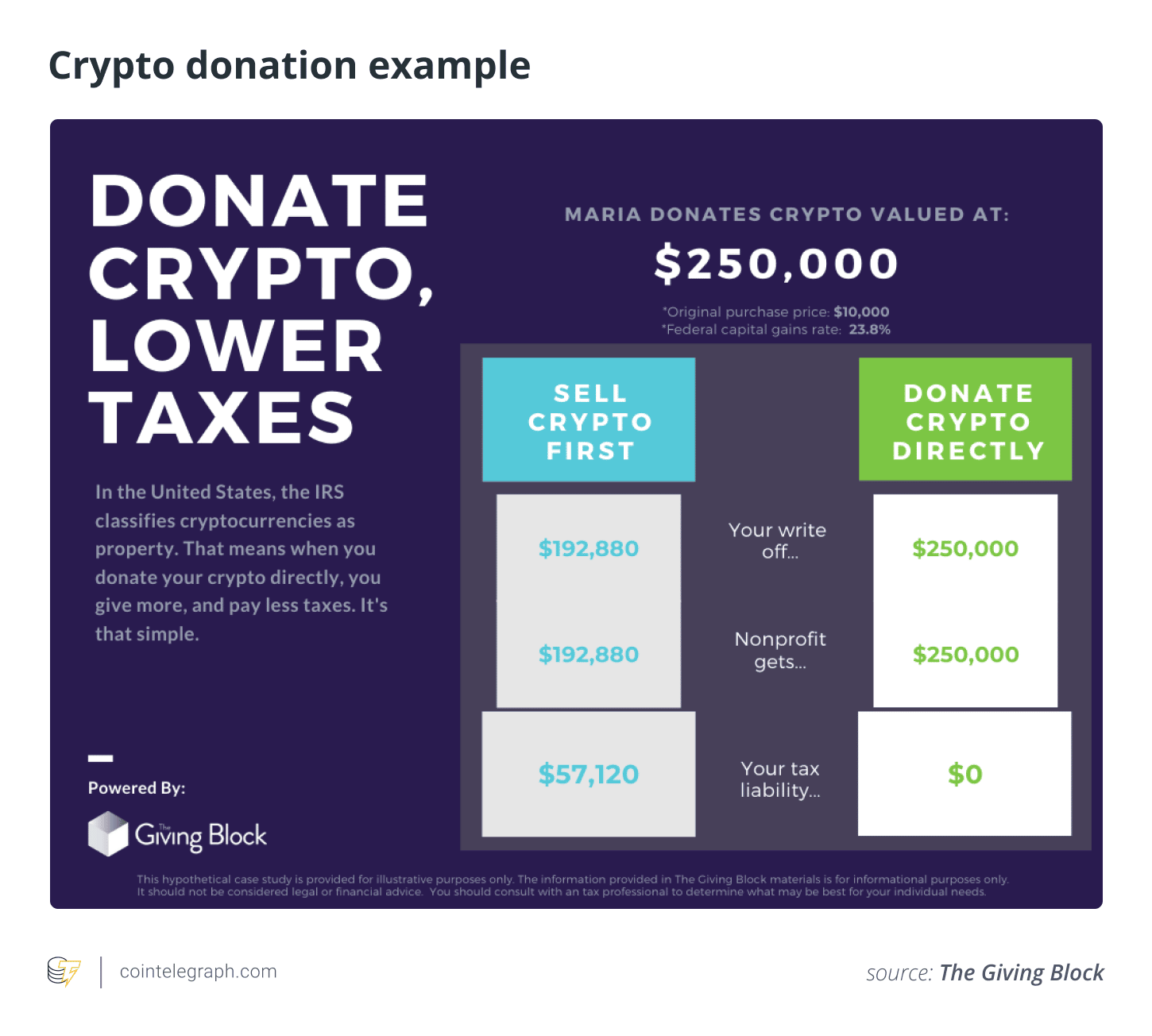

- Donate or gift your crypto. Donations could actively reduce your tax bill, while gifting could help you avoid paying taxes on gains. Gifting crypto is generally not taxable unless the value of the crypto exceeds the current year’s gift tax exclusion amount at the time of the gift. For example, in 2022, the annual gift tax exclusion is $16,000, so if the value of the crypto gifted is under $16,000, you likely won’t incur the gift tax.

- Remember self-employment deductions. If you earn crypto through a self-employed entity, don’t forget about potential deductions for legitimate business expenses, including inventory, rental, utility, and even travel costs.

Not all these strategies will be appropriate for your situation, but knowing the basic crypto tax rules may help you keep more of your profits. To avoid any unexpected surprises, always know how your trade will be taxed before you execute. Always consult a tax advisor about your specific situation.

How Does Hmrc Know About Your Crypto Assets

There is often a misconception that transactions carried out on blockchain networks like Bitcoin and Litecoin are anonymous. However, this is not correct as transactions are actually pseudonymous.

- In simple terms, while cryptocurrency transactions are tied to the identity of the sender or receiver, all transfers appear on the blockchain ledger which is public.

- And as such, there are now data analytical companies that have the capability to trace transactions to those involved in the transfer.

- Moreover, brokers and exchanges that have the legal remit to offer cryptocurrency trading services in the UK must submit documentation to government agencies like HMRC and the FCA when requested.

All in all, dont make the mistake of thinking that your cryptocurrency investments are anonymous.

You May Like: Irs Solar Tax Credit 2021 Form

Sell Assets During A Low

Whether you have short-term or long-term capital gains, your income determines the tax rate you pay. The lower your taxable income is, the lower your tax rate will be. You might save money on taxes by selling cryptocurrency that you know will experience gains in years in which you know youll pay taxes at a lower tax rate.

Selling cryptocurrency might result in some of the income being taxed at a higher rate, but that does not push all of your income into a higher tax bracket as many people believe.

What Are The Requirements For Specific Identification

The IRS, however, has imposed requirements upon taxpayers that want to use Specific Identification.

First, a taxpayer must, show the date and time each unit was acquired, your basis and the fair market value of each unit at the time it was acquired, the date and time each unit was sold, exchanged, or otherwise disposed of, and the fair market value of each unit when sold, exchanged, or disposed of, and the amount of money or the value of property received for each unit.

In simpler terms, the IRS requires a complete set of transaction records when a taxpayer wants to use Specific Identification.

Second, the IRS guidance requires that Specific Identification be done on a per account and per wallet basis. Specific Identification shouldnt be used when universally pooling assets.

TaxBit provides support for Specific Identification on a per account or wallet basis in order to legally minimize users’ taxes and reconcile to any Forms 1099 issued by exchanges. TaxBit automates the process by specifically identifying, by exchange, the assets with the highest cost basis for disposition to reduce taxable gains.

TaxBit also is able to provide the complete records necessary to support your use of Specific Identification. TaxBit supports a massive amount of cryptocurrencies so all of your information can be housed in a single, easy to navigate location.

Also Check: California Sales Tax By Zip Code

What Is Specific Identification

Taxpayers can also elect to use Specific Identification. Specific Identification allows a taxpayer to select which particular cryptocurrency unit is being disposed of in a transaction. This allows a taxpayer to optimize the tax calculation in order to minimize any gains or obtain losses.

In the example above, the taxpayer is able to identify theyre disposing of assets acquired on July 1 and September 1. Using Specific Identification would result in a $2,000 net capital loss as opposed to a $7,000 net capital gain under FIFO as shown above. Here, its preferable to use Specific Identification to dispose of assets with the highest cost basis first, an approach known as highest in first out .

How Much Taxes Do You Pay For Short

If you trade crypto and hold it for no more than 12 months before selling it, youll be subject to short-term capital gains tax rate for that particular trade, ranging from 10% to 37%.

The U.S. federal income tax brackets for 2022 are available here. Lets look at an example. Imagine that you have a $100,000 salary, a crypto trade netted you a $5,000 gain , and youre filing as a single person. This will get you in the $86,376 to $164,925 tax bracket range.

You May Like: Is Hazard Insurance Tax Deductible

Are Crypto Gains Taxed In Switzerland

As a direct consequence, Swiss taxation is very light, if not absent.

Indeed, when capital gains are generated as an individual and private activity, the individual is exempt from taxation, regardless of the amount of the capital gain.

Only very high incomes are subject to wealth tax, which is set by canton. The average rate is… 0.03 %!

But Switzerland is not a paradise for everyone. Minors, as auto-entrepreneurs, are subject to income tax.

As the tax rates are determined at the level of the cantons, we will not make a study for each of them.

Keep in mind that the observed rates generally range from 0% for low incomes to 30% for very high incomes, some cantons being more attractive than others, such as Zug, which will surprise no one.

Add to that a federal tax of up to 11.5%. Not much of a paradise!

Traders are subject to corporate tax as a sole proprietorship. The federal tax is a flat rate of 8.5%.

The cantonal tax varies considerably, but keep in mind that the total amount of tax is much lower than in many countries.

How Cryptocurrency Taxes Work

One of the most important things investors need to know before investing in cryptocurrency is how crypto taxes work. Additionally, investors should be aware that classification of cryptocurrencies varies depending on the federal government agency overseeing the investment activity.

The IRS issued guidance in 2014 to help individuals and businesses determine how the government treats cryptocurrency taxes. This notice defined cryptocurrencies as virtual currencies . Despite this name, the IRS stated that cryptocurrencies are not currency for federal tax purposes. Instead, transactions of cryptocurrencies are treated as property, like stocks, bonds, and other capital assets. So, when someone uses, sells, or is paid in a cryptocurrency, they are generally required to pay taxes on it.

Though the IRS treats cryptocurrencies as property for tax purposes, this categorization is not consistent across all federal government agencies.

The Commodity Futures Trading Commission , for example, classifies cryptocurrencies as a commodity when regulating a variety of crypto-related trading markets. According to the CFTC , it oversees cryptocurrencies when they are used in a derivatives contract, or if there is fraud or manipulation involving a virtual currency traded in interstate commerce. In contrast, the U.S. Securities and Exchange Commission can regulate cryptocurrencies as a security and investors can be subject to securities laws.

Also Check: What Happens If Your Late Filing Taxes

Centralised And Decentralised Exchanges

The way HMRC is able to deal with individuals cryptocurrency taxes depends on what type of exchange they were using.

Centralisedexchanges, such as Binance and Kucoin use a system referred to as KYC – Know Your Customer, which requires an Identify check to find out where you live and who you are, so your trades can be verified to you, similar to stock market trading.

Due to this KYC Identity check, your information will be passed along to HMRC, making them aware of any losses or gains you may have made in the past year.

On the other hand, such as Pancake Swap or Uniswap do not require any KYC, and are completely decentralized, often referred to as DeFi, or Decentralised Finance as there is no centralised body. Users engaging with DeFi through private wallets, where only they have access to the keys, are much harder to track down for HMRC and are required to personally make sure they are filing their taxes properly.

Remember: HMRC will come looking if suddenly a large deposit of fiat is made into your bank account, or a large amount of cryptocurrency, whether it be bitcoin, altcoins, or stablecoins, into an exchange wallet owned by you.

Gifting Crypto To A Friend

If you give cryptocurrency as a gift to someone other than your spouse or civil partner, you will have to figure out the market value of the crypto on the date that it was given away as a gift. This will be considered as sales proceeds for Capital Gains Tax purposes.

Importantly, if income tax has already been charged on the value of the tokens that are gifted, section 37 Taxation of the Capital Gains Tax Act 1992 will apply. This basically means that the “sales proceeds” will be reduced by the amount that has already been subject to income tax, and then be subjected to CGT.

Don’t Miss: How To Pay My Tax Online

How Do Crypto Taxes Work In The United States

While the US tax system is the most comprehensive, it is also the most complex.

Indeed, it is in the United States that all derivatives of bitcoin such as futures have been developed.

So, do you pay tax on cryptocurrency in the US?

This means that there are several tax systems to study and differentiate.

Above all, taxation is primarily the responsibility of the States, which could have complicated the study with 50 tax laws to be examined.

Fortunately, there is in fact a document applicable to the entire U.S. territory that determines the taxation of capital gains in cryptocurrencies.

Finally, unlike any other state in the world, an American cannot escape taxation in his country, regardless of where he lives.

How Do Capital Gains Taxes Work

If you’re buying and selling cryptocurrencies, you’ll pay capital gains taxes on the profits. However, the tax rate depends on your taxable income and whether you held on to the cryptocurrency for at least a year.

When you buy and sell cryptocurrencies within a year, the short-term gains are taxed as ordinary income. However, if you hold on to your cryptocurrency for a year or more, you’ll pay long-term capital gainswhich may be beneficial.

The income limits and tax rates can depend on your filing status, and may change from one year to the next. Here are the tax rates for single taxpayers for the 2021 tax year.

| 2021 Capital Gains Tax Rates for Single Filers |

|---|

| Sold Within One Year |

Recommended Reading: Penalty For Not Paying Taxes Quarterly

Where To Buy Crypto With The Best Rates

Those wishing to exchange cryptocurrencies can turn to an instant cryptocurrency exchange StealthEX. This service is free from registration and does not store users funds on the platform.

Just go to StealthEX. It will automatically guide you to the «Swap crypto» window.

You can also buy ETH with your debit or credit card. To do so, you need to open the «Buy crypto» window instead of «Swap crypto».

Follow us on Medium, , Telegram, , and Reddit to get StealthEX.io updates and the latest news about the crypto world. For all requests message us via

The views and opinions expressed here are solely those of the author. Every investment and trading move involves risk. You should conduct your own research when making a decision.

You are more than welcome to visit StealthEX exchange and see how fast and convenient it is.

What Is The Tax Rate On Crypto

All earnings from crypto mining, staking, or payments are taxed at your ordinary income rate, which varies depending on which income bracket you fall into.

The tax rate for capital gains, however, varies based on the length of time a trader held the asset. The U.S. encourages long-term trades by taxing them at a lower rate.

Short-term capital gains: If you hold a digital asset for a year or less, your proceeds will be considered short-term capital gains. They will be taxed at your ordinary income rate, which is determined by your overall income.

Long-term capital gains: If you hold cryptocurrency for more than a year, your proceeds will be taxed at the advantageous long-term gains rate. These rates also depend on your overall income, but are generally lower than the short-term gains rates.

According to the IRSs cryptocurrency tax FAQs, the holding period begins on the day after you receive an asset. The asset’s cost basis will be its purchase price, plus any applicable fees.

Note that these are the same as your short-term gain tax rates.

| Tax rate |

|---|

Also Check: Can You File Taxes On Ssi Disability

What Happens If You Dont Report Your Crypto Taxes

Intentionally not reporting your cryptocurrency gains, losses, and income on your taxes is considered tax fraud by the IRS.

The IRS can enforce a number of penalties for tax fraud, including criminal prosecution, five years in prison, and a fine of up to $250,000.

Over the past several years, the IRS has aggressively cracked down on cryptocurrency tax compliance issues. Itâs to include a question that every US taxpayer must answer under penalty of perjury:

As cryptocurrency adoption accelerates, itâs likely that weâll see more cryptocurrency tax audits and tax prosecutions.

How Is Crypto Taxed

If you buy, sell or exchange crypto in a non-retirement account, you’ll face capital gains or losses. Like other investments taxed by the IRS, your gain or loss may be short-term or long-term, depending on how long you held the cryptocurrency before selling or exchanging it.

- If you owned the cryptocurrency for one year or less before spending or selling it, any profits are typically short-term capital gains, which are taxed at your ordinary income rate.

- If you held the cryptocurrency for more than one year, any profits are typically long-term capital gains, subject to long-term capital gains tax rates.

For short-term capital gains or ordinary income earned through crypto activities, you should use the following table to calculate your capital gains taxes:

Recommended Reading: Florida Total Sales Tax Rate

Do You Have To Pay Us Taxes On Cryptocurrency Gains If You Live Abroad

You still need to pay U.S. taxes on cryptocurrency gains as an American living abroad. Because of that, expats need to learn the ins and outs of how crypto is taxed in the United States.

Generally, cryptocurrency gains can be subject to two taxes: short-term capital gains and long-term capital gains. Often, short-term capital gains, which are earnings on assets held for less than a year, are taxed at a higher rate than long-term capital gains. Calculating capital gains, especially if youve traded crypto or used it to pay for goods, can be confusing, which is why its wise to enlist a CPA for American expatriates to handle your taxes. In addition to paying taxes on cryptocurrency, expats will need to report foreign holdings and financial assets if they exceed a certain amount.

Our accountants can help you report your crypto gains properly to avoid unnecessary financial penalties from the IRS. To learn more about the CPAs for American expatriates at US Tax Help, call us today at 362-9127.