How Long Does Your Refund Stay In Processing

Speaking of paper returns, you will need to file all amended returns as a paper return. The IRS estimates the processing time for amended returns as somewhere between eight and 12 weeks. Even if you file electronically, you will have to wait longer if you elect to receive your refund as a paper check.

Is there a difference between still processing and being processed?

One is still being processed and the other is being processed and they both have different meanings. If you have the Being Processed message The being processed message is a good sign. If you are seeing this message most likely your tax return is done and your return was just resequenced to the next update.

I Have Moved To Another Address Since I Filed My Return My Refund Check Could Have Been Returned To The Department As An Undeliverable Check What Do I Need To Do To Get My Check Forwarded To My New Address

In most cases, the US Postal Service does not forward refund checks. To update your address, please complete the Change of Address Form for Individuals, call the Department toll-free at 1-877-252-3052, or write to: North Carolina Department of Revenue, Attn: Customer Service, P.O. Box 1168, Raleigh, NC 27602-1168.

Life Changes And Your Tax Refund

Tax credits and deductions are often connected to major life circumstances, so they may change from year to year based on your personal situation. For example, getting married, having a baby, or retiring could all have an impact on your taxes. Dont miss out on some of these commonly overlooked areas.

Also Check: Do I File Taxes For Doordash

Don’t Miss: Home Depot Tax Exempt Registration

Tax Refund Schedule For Extensions And Amended Tax Returns

The refund schedule should be the same if you filed for a tax extension however, there is no official schedule for tax refunds for amended tax returns. The above list only includes dates for e-filing an original tax return. Amended tax returns are processed manually and often take eight-12 weeks to process. If you do not receive an amended tax return refund within eight weeks after you file it, then you should contact the IRS to check on the status.us.

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit or Child Tax Credit amounts. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset or different refund amount when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

Recommended Reading: What State Has Lowest Property Taxes

How Long Does It Take For Taxes To Be Sent After Approved

about 21 daysAfter getting my return approved how long does it take to get your return back. It takes about 21 days for the IRS to issue a refund, once the Return has been Accepted. To get an actual date for when you will receive your refund, please go to www.irs.gov/refund.

Does the IRS only deposit refunds on certain days?

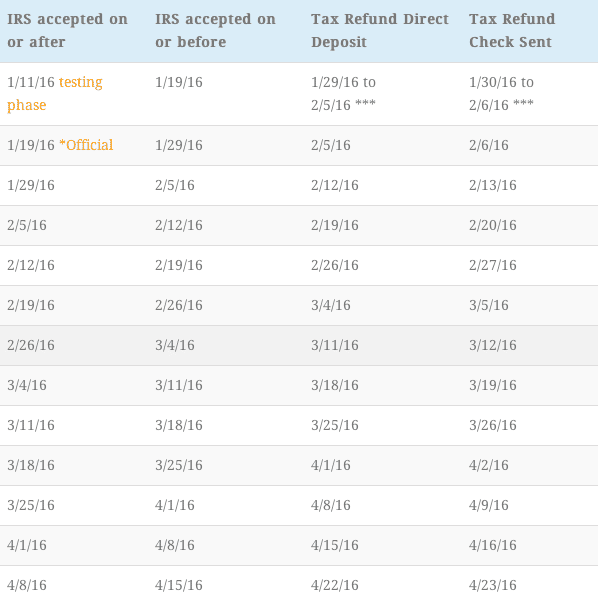

IRS Refund Schedule for Direct Deposits and Check Refunds The IRS only issued refunds once per week under the old system. They now issue refunds every business day, Monday through Friday . Due to changes in the IRS auditing system, they no longer release a full schedule as they did in previous years.

You May Face A Delay If You Claim These Tax Credits

There are a couple of issues that could cause delays, even if you do everything correctly.

The IRS notes that it can’t issue a refund that involves the Earned Income Tax Credit or the Child Tax Credit before mid-February. “The law provides this additional time to help the IRS stop fraudulent refunds from being issued,” the agency said this week.

That means if you file as soon as possible on January 24, you still might not receive a refund within the 21-day time frame if your tax return involves either of those tax credits. In fact, the IRS is informing those who claim these credits that they will most likely receive their refunds in early March, assuming they filed their returns on January 24 or close to that date.

The reason relates to a 2015 law that slows refunds for people who claim these credits, which was designed as a measure to combat fraudsters who rely on identity theft to grab taxpayer’s refunds.

With reporting by the Associated Press.

Also Check: How Much Taxes Deducted From Paycheck Pa

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Why Do Paper Returns Take So Long

Paper returns have to be input manually into the system for processing.

“Submitting a paper return circumvents the limited automation that the IRS has in place for cross-referencing returns with information received from third parties,” says Richard Lavinia, chief executive officer and co-founder of Taxfyle.

“Paper returns require this information to be inputted by hand and then manually reviewed by an IRS agent.”

Don’t Miss: Are 2022 Tax Forms Available

When Electronically Filing Amended Returns If A Field On Form 1040 Amended Return Is Blank Should The Corresponding Field On The Form 1040

For electronically filed Amended Returns: If an amount in a field on the Form 1040 or 1040-SR is blank, then the corresponding field on the Form 1040-X must also be left blank. If there is a zero in a field on the Form 1040 or 1040-SR, then the corresponding field on the Form 1040-X must also contain a zero.

What Happens After I E

After you submit your return with TaxSlayer, we time stamp your return and electronically send it to the IRS. Your return is now in the hands of the IRS. They typically take the next 24-48 to review your information to make sure it is correct.

If your personal information matches their records and you havent taken any credits or deductions that require further review, they will accept your return. You should receive an email notification once your return is accepted. After you receive confirmation, you can expect to receive your refund based on the estimated schedule above.

Also Check: Percent Of Taxes Taken Out Of Paycheck

Why Is It Taking So Long For The Irs To Approve My Refund

Paper Return Delays If you filed on paper, it may take 6 months or more to process your tax return. For service delay details, see Status of Operations. The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it’s possible your tax return may require additional review and take longer.

When Can I File My Tax Return

The first official day to file your 2021 tax return is Jan. 24, 2022. However, many tax software programs will allow you to complete your return and file it before that date, including IRS Free File, which opens Jan. 14. They will then hold the returns until the IRS begins accepting them. Some taxpayers who submit their electronic tax return early may be able to participate in the IRS HUB Testing program. This is a controlled testing of the federal tax return system. The IRS processes a small percentage of tax returns from major software providers to test the tax return submission process and allow for fixing bugs before opening the doors to all taxpayers.

Don’t Miss: Unexpected Tax Refund Check 2021

How Should You Request To Receive Your Refund

The IRS gives you three options for receiving your refund:

- Deposit into U.S. Savings Bonds

You can also apply a refund to any future taxes owed. This is a popular choice among some small business owners who are required to pay estimated taxes.

Of the three refund options available to you, direct deposit is the fastest and safest option. You can receive your refund via an ACH bank transaction in as little as a few days. Paper checks, however, can take over a week to process, several days to travel via the postal system, and several days to clear your bank.

*Note:Some tax software companies also offer the option of receiving a tax refund on a prepaid debit card. Im not particularly fond of this option, but it is available to some tax filers. In this case, the refund is first sent to the tax preparation company, then they issue you the prepaid debit card.

What Is Happening When Wheres My Refund Shows The Status Of My Tax Return Is Refund Sent

This means the IRS has sent your refund to your financial institution for direct deposit. It may take your financial institution 1 5 days to deposit the funds into your account. If you requested a paper check this means your check has been mailed. It could take several weeks for your check to arrive in the mail.

Recommended Reading: Self Employed Estimated Tax Calculator

Getting Refunds Within 21 Days Of Filing

If all goes well, though, taxpayers who e-file can receive their refunds via direct deposit as quickly as one week after filing based on previous years processing time, according to trade publication CPA Advisor.

Its important to note that processing time typically slows down as the tax season gets underway and the IRS handles more returns, the publication added.

In the meantime, tax experts say there are some steps that taxpayers can take to help ensure a quick tax refund, which is even more important this year given that the IRS is starting with a backlog. National Taxpayer Advocate Erin M. Collins issued a report to Congress in January that warned she is deeply concerned about the upcoming filing season given the backlog, among other issues.

The first thing you know if you are going to cook a meal, you have to have the kitchen cleaned up from the last meal, said Mark W. Everson, vice chairman at Alliantgroup and former Commissioner of the IRS. It just snowballs into a terrible situation.

Delays in processing tax returns count as one of the agencys most pressing problems, Collins said in her report, which described an agency in crisis.

Americans are hearing the message: Potential IRS processing delays ranked second among the three top concerns of people who are expecting a refund from the IRS this year, according to a Bankrate.com poll of almost 2,500 people released February 22.

Dont Miss: 1099 Doordash

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Don’t Miss: Self Employed Tax Deductions Worksheet

You May Also Be Interested In:

Facing a growing backlog of paper return the tax agency has urged filers to submit as quickly as they can to avoid seeing delays in their refund. However, while filing on or before the deadline is recommended, the IRS also warns against filing “prematurely” as mistakes can cause serious delays in reviving your refund.

How to do you check the status of your refund?

With many expecting larger refund this year, they are eager to check the status of their refund.

Refunds can be tracked through the Where’s My Refund? developed by the IRS. Those who file electronically will be able to use the tracker more quickly as the system will provide you with a status update within twenty-four hours of the return’s submission.Those who send in a paper return may need to wait up to four weeks before receiving an update.

While the return is being processed, it will go through three phases, all of which can be seen using the Where’s My Refund tool: Return Received, Refund Approved, and Refund Sent.

The federal government’s spending on Social Security has grown over the years, from 2.3% of GDP in the 1960s to 5% in 2020.

Tax Policy Center

How long does it take to receive a refund?

IRS offers tax filing tools

For those with low-incomes in need of correcting an issue related to an audit or refund with the IRS, the Low Income Taxpayer Clinics .

US NEWS

Are There Any Important Tax Dates To Know

Yes, the following dates are important to keep in mind for tax season.

- Deadline to file and pay your tax bill if you have one is April 18, 2023

- Deadline to file an extended return is October 16, 2023

Click here for a more complete list of important tax dates.

This article was last updated on 12/7/2022.

Recommended Reading: Amended Tax Return Deadline 2020

Getting Tax Relief If You Owe Money

If you go through the tax filing process and come out owing the government money, there are options for getting tax relief. You can negotiate directly with the IRS and state revenue agencies, or hire a tax relief company to negotiate on your behalf.

If you owe less than $10,000 and your case is not complicated, you may be better off dealing directly with the IRS. Otherwise, tax relief experts such as tax attorneys and enrolled agents can save you time and improve your chances of negotiating generous terms on your tax settlement.

Some of the top companies to help with getting relief for taxes owed are:

Get A Larger Tax Refund Next Year

If you want a bigger tax refund next year, then there are a few ways you can increase the amount of money the government will give you as a tax refund. One of the easiest ways is by contributing to a tax-deferred retirement plan such as a 401, the Thrift Savings Plan, or by opening a Traditional IRA, which allows you to deduct up to an additional $5,500 on your taxes each year . You can open an IRA in a variety of locations, including banks, brokerage firms, independent advisors and more.

You May Like: What Is The Threshold For Filing Taxes

How To Use The Wheres My Refund Tool On The Irs Site

To check the status of your 2021 income tax refund using the IRS tracker tools, youll need to provide some personal information: your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars, which you can find on your tax return. Make sure its been at least 24 hours before you start tracking your refund.

Using the IRS tool Wheres My Refund, go to the Get Refund Status page, enter your personal data, then press Submit. If you entered your information correctly, youll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, youll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

Wheres My Refund has information on the most recent tax refund that the IRS has on file within the past two years, so if youre looking for return information from previous years youll need to check your IRS online account for more information. Through your own personalized account, youll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices youve received from the IRS and your address on file.

What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

Read Also: How Much In Inheritance Tax