How Long Does It Take To Get A Tax Return In Canada For 2022

The length of time it takes to get a tax refund in Canada is typically between 2 to 16 weeks and depends on a few factors:How you filedWhether you have direct deposit enabled.

The deadline for filing taxes for the financial year 2021 is May 2, 2022. Typically, the deadline is April 30, but this year it falls on a Saturday, and therefore there is an extenstion on the deadline.

Here are the various timelines based on these factors:

What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

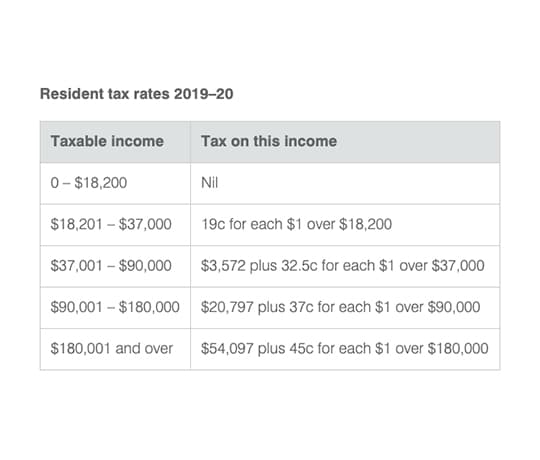

How Long Does Tax Return Take In Australia 2022

Tax agents and experts in Australia frequently face this question from their clients: When do I get my tax return? It indeed becomes frustrating for a taxpayer to wait for their tax refund. But one thing you must keep in mind is that even if there is a delay, you will never be denied your claims, provided you have lodged the tax return correctly.

Sometimes delays occur at the Australian Taxation Office or ATO, mainly in July. The reason behind it is that the ATO processes a significant portion of the countrys finances in July. Read this blog to know about how long you have to wait from the moment you lodge the tax to the moment of receiving the refunded amount into your Australian bank account.

Recommended Reading: Is Hazard Insurance Tax Deductible

You May Like: How To Calculate The Sales Tax

Why Would An Amended Tax Return Take So Long

There are a few reasons why it might take a long time for the IRS to process an amended tax return.

One possibility is that the IRS may need to contact the taxpayer or their representative for additional information. Another possibility is that the IRS may need to review prior tax returns to determine how the amendment affects the taxpayers overall tax liability.

Finally, another reason it may take a long time for an amended return to be processed is the high volume of returns received by the IRS during tax season.

The best way to ensure that ones amended return is processed as quickly as possible is by following the instructions carefully. Be sure to include all necessary forms and documents, and double-check ones work before submitting it. If one has any questions, be sure to contact the IRS directly.

Filing an amended tax return can have several benefits, including:

Consult a tax professional to learn more about the specific benefits of filing an amended return for ones situation.

What To Do Once Your Refund Arrives

For many people, their IRS tax refund is the biggest check they receive all year, the IRS says. In anticipation of your windfall, its wise to have a plan for how youre going to use your windfall. Deciding how to spend, save or invest the money in advance can help stop the shopping impulse from getting the best of you.

Your refund is yours to use how you see fit and can be used to help pay for day-to-day expenses or invested for long-term financial stability.

Recommended Reading: How To Do Taxes For Door Dash

Also Check: What Is Real Estate Tax

How Long After Identity Verification To Get Tax Refund

| To receive refund | |

| If your identity is stolen | Takes more time as it is a long process |

The IRS is actively going after fraudulent tax refunds this year, but the increase in fraud detection could make it even more frustrating for law-abiding taxpayers. Of these, already 1.9 million are flagged while screening for identity verification, while the rest are for income verification.

Keep in mind that the average wait time for identity verification is 10 days, but it can take up to 60 days if your SSN has been inactive for five years or more.

If you are waiting more than 60 days for identity verification, call the Social Security Administration to inquire about any possible delays.

It takes this long because of the increased fraudulent and identity theft problems. This is why the identity verification request may come off as a surprise, but it is a necessary procedure if you want the refund credited soon enough.

How To Track The Progress Of Your Refund

The IRS has eliminated the guesswork of waiting for your tax refund by creating IRS2Go, an app that allows you to track the status of your return. You can also check the status of your refund with the Wheres My Refund? online portal.

Both tools provide personalized daily updates for taxpayers 24 hours after a return is e-filed or four weeks after the IRS has received a paper return. After inputting some basic information , you can track your refunds progress through three stages:

Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail.

You May Like: Filing Taxes For Doordash

You May Like: How Long To Get Tax Return

Getting Refunds Within 21 Days Of Filing

If all goes well, though, taxpayers who e-file can receive their refunds via direct deposit as quickly as one week after filing based on previous years’ processing time, according to trade publication CPA Advisor.

It’s important to note that processing time typically slows down as the tax season gets underway and the IRS handles more returns, the publication added.

In the meantime, tax experts say there are some steps that taxpayers can take to help ensure a quick tax refund, which is even more important this year given that the IRS is starting with a backlog. National Taxpayer Advocate Erin M. Collins issued a report to Congress in January that warned she is “deeply concerned about the upcoming filing season” given the backlog, among other issues.

“The first thing you know if you are going to cook a meal, you have to have the kitchen cleaned up from the last meal,” said Mark W. Everson, vice chairman at Alliantgroup and former Commissioner of the IRS. “It just snowballs into a terrible situation.”

Delays in processing tax returns count as one of the agency’s most pressing problems, Collins said in her report, which described an agency in crisis.

Americans are hearing the message: Potential IRS processing delays ranked second among the three top concerns of people who are expecting a refund from the IRS this year, according to a Bankrate.com poll of almost 2,500 people released February 22.

Other Factors That Could Affect The Timing Of Your Refund

Additional factors could slow down the processing of your tax refund, such as errors, incomplete returns or fraud.

Taxpayers who claim the earned income tax credit or the additional child tax credit may see additional delays because of special rules that require the IRS to hold their refunds until Feb. 27. You should also expect to wait longer for your refund if the IRS determines that your tax return needs further review.

Refunds for returns that have errors or that need special handling could take up to four months, according to the IRS. Tax returns that need special handling include those that have an incorrect amount for the Recovery Rebate Credit and some that claim the EITC or the ACTC. Delays also occur when the IRS suspects identity theft or fraud with any return.

Respond quickly if the IRS contacts you by mail for more information or to verify a return. A delay in responding will increase the wait time for your refund.

If you submitted an amended tax form, it may take more than 20 weeks to receive a refund due to processing delays related to the pandemic.

Recommended Reading: Does Doordash Tax You

Recommended Reading: How Long Do Taxes Take To Process

About Wheres My Refund

Use Whereâs My Refund to check the status of individual income tax returns and amended individual income tax returns youâve filed within the last year.

Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount.

If you submitted your return electronically, please allow up to a week for your information to be entered into our system.

How Long Does California Tax Refund Take

The refund normally takes up to two weeks to receive if you e-filed and up to four weeks for paper return.

- California states that refund processing time is 2 weeks if you e-filed your tax return. However, some tax returns need extra review for accuracy, completeness, and to protect taxpayers from fraud and identity theft. Extra processing time may be necessary.

Recommended Reading: How To File Doordash Taxes

Also Check: How Much Do You Have To Make To Claim Taxes

What About My State Tax Refund

What weve covered so far applies to federal tax refunds. As you might expect, every state does things a little differently when it comes to issuing tax refunds and its not possible to say for sure when everyone will receive their state tax refunds. Although, state refunds often come faster than those being processed through the federal system. This isnt always the case, but it often is.

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive. To find out the status of your refund, youll need to contact your state tax agency or visit your states Department of Revenue website.

I Have Checked The Status Of My Return And I Was Told There Is No Record Of My Return Being Received What Should I Do

Due to the late approval of the state budget, which included multiple tax law changes, the Department has experienced delays processing returns. If you filed your return electronically and received an acknowledgment, your return has been received but may not have started processing. Follow the guidance below based on your filing method:

Filed Electronically:

If its been more than six weeks since you received an acknowledgment email, please call 1-877-252-3052.

Filed Paper:

If its been more than 12 weeks since you mailed your original return, you can mail a duplicate return to NC Department of Revenue, P O Box 2628, Raleigh, NC 27602, Attn: Duplicate Returns. The word “Duplicate” should be written at the top of the return that you are mailing. The duplicate return must be an original printed form and not a photocopy and include another copy of all wages statements as provided with the original return.

You May Like: Income Tax Rates In South Carolina

Check The Status Of Your Return

The fastest way to check the status of your return or refund is through your CRA My Account. You can find your most recent tax return status on the Overview page.

You can see more details by clicking Go toTax returns. If you click this link, make sure youre looking at the correct row . The CRA My Account system also displays the status of your 2022 return.

You can also check with the CRA, or you can see if youve successfully submitted your return using Wealthsimple Tax.

Note:

How Long Does It Take To Receive Your Tax Refund

The CRA issues tax refunds in a long timeline it can take anywhere from two weeks to 16 weeks. It depends on the type of return and when you filed it. They will send a Notice of Assessment and any applicable refund within:

- Two weeks of obtaining an electronically filed return

- Eight weeks of obtaining a paper-filed return

- 16 weeks of obtaining a nonresident paper-filed return

The fastest way to get your tax return processed is to file it electronically, and if you choose direct deposit, you will receive the refund quicker, too.

Also Check: Penalty For Missing Tax Deadline

How To Check On The Status Of Your Return

You can check on the status of your return by signing into the CRA My Account function or calling the CRA directly.

There are several reasons your return may not be processed promptly, cause a delay in receiving your refund.

The most common is if your return was selected for review, but the CRA may also delay your refund if:

- You owe or are about to owe a balance

- You have a wage garnishment order under the Family Orders and Agreements Enforcement Assistance Act.

- You have outstanding government debts like student loan debts, employment assistance, or others.

- You have a refund of $2 or less.

How Long Does It Take To Receive An Amended Refund

You should receive your amended refund within six months from the date filed. If it has been more than five months since you filed your amended return, please call 1-877-252-3052 for assistance. Select the option for l Individual Income Tax then listen for the Refund option to speak with an agent. Please do not call 1-877-252-4052 as instructed in the main greeting. Interest will be paid on amended refunds at the applicable rate.

Also Check: Can I Use Bank Statements As Receipts For Taxes

How Long Does It Take The Irs To Process A Tax Return

The IRS processes tax returns in a timely manner, but there is no set time frame that they use. Returns can be processed within minutes or it could take several weeks. In this post, we will give you an estimate of how long the IRS typically takes to process returns. We will also provide some tips on how you can speed up the process!

1. How long the IRS usually takes to process a tax return.

On average, the IRS processes most tax returns within two weeks. However, if your return is more complex, it could take longer. The IRS recommends that you wait at least four weeks before checking on the status of your return. You can check the status of your return by calling the IRS or by using their online tools.

If you are expecting a refund, the IRS issues most refunds within 21 days. However, if you filed your return early, it could take longer for the IRS to process your refund. The best way to check on the status of your refund is by using the IRS online tools. You can also call the IRS, but wait times can be long during peak periods.

It is important to note that if you owe taxes, the IRS will not issue your refund until they have processed and accepted your return. So, if you are expecting a refund and you owe taxes, it could take longer for the IRS to issue your refund.

2. What can you do to speed up the process?

Or you can always hire Tax Consultant for speedup the process.

3. What happens if your return is not processed on time?

How Long Does It Take To Get My Tax Return Done At Etax

You can finish your tax return easily online, in just minutes, at Etax.com.au. With no appointments or waiting, you can join tens of thousands of Australians who use our number one online tax return service anywhere, any time. Whats more, youll have year-round access to qualified Etax accountant advice, via Live Chat, My Messages or phone.

You May Like: Federal Small Business Tax Rate

Tax Refunds Are Delayed Due To A Large Backlog Of Returns From 2021

The backlog of 2021 tax returns is causing a significant delay for the IRS to process returns. As of July 29, the IRS has received more than 10 million unprocessed individual tax returns. Of those, about 1.8 million need special handling. This backlog is causing more than four months delay for some taxpayers. This is a major problem for many taxpayers, who are waiting for their tax refunds.

In addition to causing inconvenience for taxpayers, this backlog is costing the government a lot of money. Since the COVID-19 pandemic hit the IRS, the agency has had a much harder time processing returns. As a result, taxpayers face an unprecedented wait time before they can receive their refund.