How Fast Does Turbotax Refund

When you file with TurboTax, your tax refunds will arrive as soon as they would with any other tax software or service. Due to IRS security measures, this may take a little longer than it has in the past. The IRS estimates that most refunds will be sent within three weeks after your e-filed returns are accepted.

Responses To Wheres My Tax Refund If I Paid Turbotax Fees Out Of My Refund

I authorized Turbo tax to take the $120 out of my refund but it appears they took close to $300? Why would that be? ive tried calling but they play games on the phone and dont transfer you to a live agent. Please advise

Hello Elaine Marx,

You can check the status of your electronically filed tax return here: . If your status shows accepted, then your taxes have been submitted for the year.

Thank you,

You only paid for your Federal return the first time, the State fees were the cost to purchase the Turbo Tax software, even if done online. The second time you had to pay for Turbo Tax to submit your state return electronically, which the program doesnt charge you for on your Federal return. If you filed the State return by mailing it in it would have not cost anything when you actually filed it . As for not receiving the State return by 3 weeks, every state is different and Turbo Tax on proclaims that you will receive your Federal return within 2-3 weeks in 9 out of 10 cases. Anyway, I hope I helped clarify things a little and also hope you have received your state return by now as its been almost 3 more weeks since you asked this question. Good luck and enjoy your day and many happy returns!

Can I Track My Direct Deposit Tax Refund

Taxpayers can track their refund using Wheres My Refund? on IRS.gov or by downloading the IRS2Go mobile app. Wheres My Refund? is updated once daily, usually overnight, so theres no reason to check more than once per day or call the IRS to get information about a refund.

You May Like: How To Report Virtual Currency On Tax Return

When To File An Amended Tax Return

There are times when you should amend your return and times when you shouldn’t. Here are some common situations that call for an amendment:

- You realized you missed out on claiming a tax deduction or credit.

- You accidentally claimed the wrong tax filing status.

- You need to add or remove a dependent.

- You forgot to claim taxable income on your tax return.

- You realize you claimed an expense, deduction or credit that you weren’t eligible to claim.

You usually don’t need to file an amended return if you discover math or clerical errors on a recently filed tax return. The IRS will often correct those types of mistakes on its own and, if necessary, send you a bill for the additional tax due or a refund if the error was in your favor.

Before filing an amended return, make sure the IRS has already processed the tax return you need to amend. That way, it will be less likely that the IRS will get your original return and amended return mixed up. If you’ve already received your tax refund, then you know the IRS has already processed your return.

Just keep in mind that the IRS limits the amount of time you have to file an amended return to claim a refund to:

- Within three years from the original filing deadline, or

- Within two years of paying the tax due for that year, if that date is later.

If you’re outside of that window, you typically can’t claim a refund by amending your return.

Why Is Turbotax Taking So Long

Its been longer than 21 days since the IRS has received my tax return, and I have not received my tax refund. Some tax returns take longer than others to process depending on your tax situation. Some of the reasons it may take longer include incomplete information, an error, or the IRS may need to review it further.

You May Like: How To Pay Taxes On Stocks

Do I Have To File Taxes

Filing taxes will depend on your income, tax filing status, age, and other factors. Generally, you dont need to file a tax return each year unless your total income exceeds certain thresholds, or you meet specific filing requirements.

Usually, if your income is less than the standard deduction, you don’t need to file a tax return. However, you may still need to if you meet certain conditions in 2022. You don’t need to file a tax return if all of the following are true for your situation:

- Don’t have any special circumstances that require you to file

- Earn less than the 2022 standard deduction for your filing status

If you dont meet all of these conditions, you may need to file a tax return. Even if you do meet all of these conditions, you may want to file a tax return anyway. If you have federal taxes withheld from your income, you can only receive a tax refund when too much is withheld.

For example, suppose your filing status is single you cant be claimed as a dependent by someone else, and you had $600 of federal tax withheld from your $5,000 of earnings as an employee during the year. You likely can get that money back since you earned less than the standard deduction. However, you can only get it by filing a tax return to claim a refund.

The IRS doesn’t automatically issue refunds, so if you want to claim any tax refund due to you, you should file a tax return.

If you need to file your taxes, the easiest way is to file online.

How Much Does It Cost To E

If you’re looking for an excuse not to e-file, it isn’t cost, because the IRS and states do not charge for e-filing. The only costs associated with e-filing are those charged by a tax preparer or tax software. Depending on the software brand and version, electronic filing charges have ranged from free to around $25. Tax preparers may charge more.

Read Also: What Will My Tax Return Be

Filing An Incomplete Tax Return

A common cause of delayed tax return processing, leading to delayed refunds, is missing information on the return. “Failure to include basic information, such as the Social Security numbers of dependents, can significantly hold up a refund,” according to Lee E. Holland, CPA, CFP, and former IRS agent. For paper returns, failure to include copies of W-2 or 1099 forms increases processing time, as do missing forms or schedules.

When you use TurboTax to prepare your taxes, well check for common errors before you file.

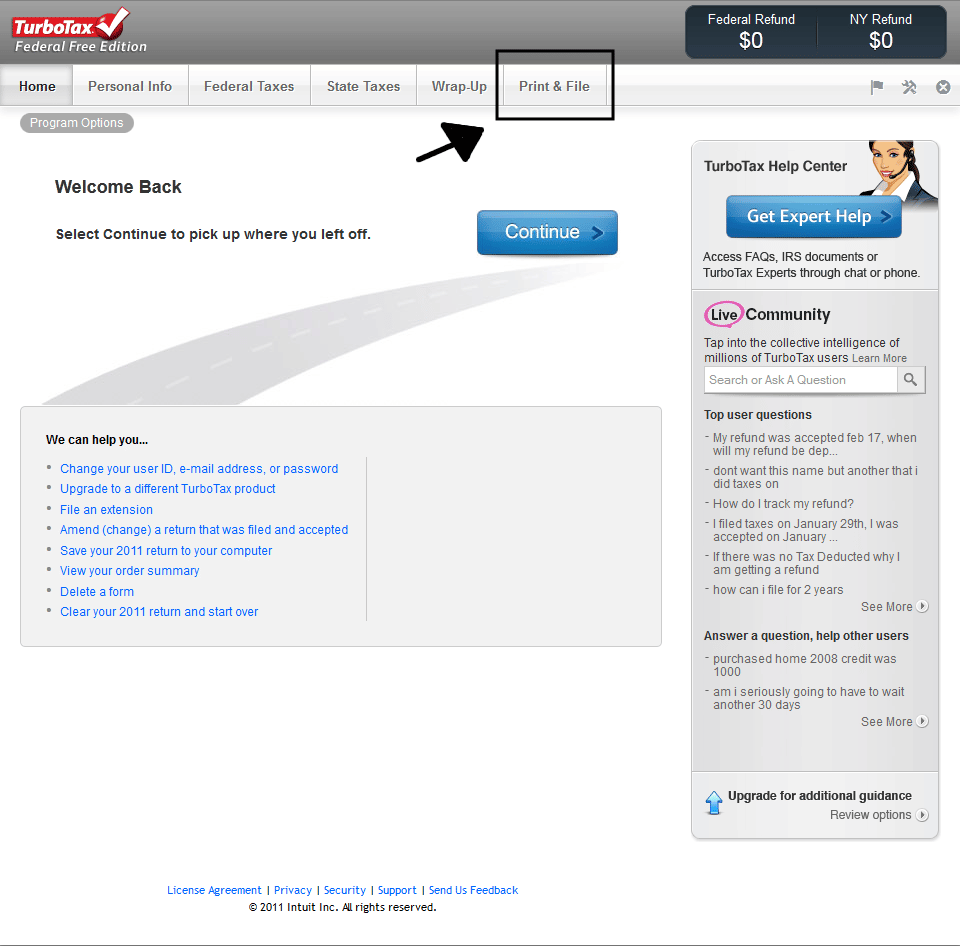

The Turbotax Login Experience: The First Hurdle I Faced

The first thing TurboTax asks you to do is sign in to your account. I was already unsure what to do.

Did my parents create an account for me last year that I could log in to now? Was I supposed to log in to their account? How did this work?

This prompted me to call my father within zero minutes of starting my taxes, a move I am not proud of but that I’m ultimately glad I did.

I found out I did need to create an account. He ended up emailing me my tax return from last year on the spot, allowing me to upload it to my new TurboTax account.

TurboTax then asked me how I was feeling about doing my taxes: “good,” “not so good,” or “don’t ask.” I’m not sure how each of these options affects your overall TurboTax experience, but I was honest and choose “not so good.”

Because I uploaded my 2016 tax return, TurboTax then asked me whether anything changed in the past year, including whether I moved or got married .

You May Like: Federal Capital Gains Tax Rates

Does Turbotax Take Longer To Get Refund

Even if everything on your return is accurate, filing on paper means it will take longer for you to receive your refund. The IRS estimates that refunds from electronically filed returns will be sent within three weeks. It may take up to six weeks, however, to send refunds from paper-filed returns.

How Long Will It Take To Receive Direct Deposit Refund

9 times out of 10 Direct Deposits typically take less than 21 days.

You can also track your refund by using :

- Our Wheres My Refund tool:

- Track your Federal refund using the IRS website:

- And track your State refund using:

Read Also: Property Taxes In New Hampshire

How Long Does It Take To Get Your Tax Refund In 2022

The Internal Revenue Service states that most taxpayers will receive their refund within 3 weeks after filing. However, there are several factors that can change that timeline and delay your money. Take a look at the tax refund process and what can cause potential issues along the way.

Rachel SlifkaJanuary 7, 2022

In This Article

Note: This information is not intended to be tax advice. Consult a tax preparation professional for tax advice.

Youre probably eager for your tax refund to hit your bank account to use or put away in savings. In fact, you may be wondering if theres a faster way to get your money.

The answer is: yes. There are ways to speed up the process however, the IRSs timeline can lag if there are errors with your tax return or other issues along the way. To find out how soon you can expect your refund, lets take a look at how the tax refund process works, the estimated tax refund schedule for 2022, and tips to get your funds earlier.

About How Long Does It Take For Turbotax To Send Your Return

Your return is sent to the IRS the same day you complete and file it. It normally takes a week to ten days to get your refund, but it can take up to three weeks.

TurboTax gives you an estimated date for receiving your refund based on a 21 day average from your date of acceptance, but it can take longer.

Once your federal return has been accepted by the IRS, only the IRS has any control. TurboTax does not receive any updates from the IRS. Your ONLY source of information about your refund now is the IRS.

You need your filing status, your Social Security number and the exact amount of your federal refund to track your Federal refund:

Recommended Reading: Will Property Taxes Go Up In 2022

Smart Things To Do With Your Tax Refund

OVERVIEW

Saving money is kind of like eating a healthy diet. You know you should do more of it, but its hard to resist making spur-of-the-moment choices that make you happier now but worse off later. A tax refund marks a great chance to set yourself in a better position for the future. If youre getting a windfall from the IRS, here are a dozen great ways to make sure your money continues to work for you.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Irs Refund Schedule 2022

How soon youre likely to receive your refund is determined in part by the IRS schedule. This schedule varies depending on when you file, how you file, and what credits you claim. The tax filing process for 2022 will most likely be back to normal, unlike the past 2 years, due to the pandemic. The IRS isnt expected toextend the tax filing deadlinefor 2022, as they did in 2020 and 2021.

According to CPA Practice Advisor, the chart below shows an estimated timeline for when taxpayers who use direct deposit can expect to receive their refunds, based on current information from the IRS and projections based on previous years. These are estimates of when you will receive your refund, and its not exact. These dates might change due to extenuating circumstances or taxpayer-specific situations.

The IRS will start accepting income tax returns on January 31, 2022. Here are the estimated dates for when you can expect your direct deposit:

| E-filing Return Accepted |

|---|

Since the IRS has the right to delay the start of tax season, these dates above could fluctuate or change.

Don’t Miss: Number For Irs Tax Refund

Why Is My Tax Return Taking A Long Time To Process

If your tax refund was accepted, but not yet processed and sent out, there may be a few reasons for the delay. As stated above, there could be an error with your filing, which could hold up the process as the IRS works to fix the issue. If you find that theres a long waiting period after filing, you can contact the IRS directly or monitor the status of your refund on a daily basis using the IRS Refund Status Tracker Tool.

Why Is Turbotax Taking So Long Refund

Some tax returns take longer than others to process depending on your tax situation. Some of the reasons it may take longer include incomplete information, an error, or the IRS may need to review it further. I requested my money be automatically deposited into my bank account, but I was mailed a check.

You May Like: Calculator For Taxes On Paycheck

What Time Does Turbotax Post Deposits

What time does the Turbo Debit card deposit? Turbo Debit charges bill payments and debits to your account at 1 p.m. EST. You should make sure there are enough funds in your account to handle your payments by this time each day.

Access Funds Typically Within A Couple Of Hours

The IRS is estimated to start accepting returns in late January. Here are estimated times your funds will be available once the IRS accepts your return:

- Use online bill pay

Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply. Credit Karma Visa® Debit Card issued by MVB Bank, Inc., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa terms and conditions apply. *Third-party fees may apply. Please see Account Terms & Disclosures for more information. **Free withdrawals available at ATMs in the Allpoint® network. Fees may apply for ATM transactions outside this network. ***Early access to paycheck is compared to standard payroll electronic deposit and is dependent on and subject to payor submitting payroll information to the bank before release date. Payor may not submit paycheck early.

Will the Refund Advance affect my credit?

No. Applying for the Refund Advance will not affect your credit score.

*For Credit Karma Money Spend account: Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply. Refund Advance is a loan provided by First Century Bank, N.A., Member FDIC, not affiliated with MVB Bank, Inc., Member FDIC.

Loan details and disclosures for the Refund Advance program:

¹ Most customers receive funds for Refund Advance within 1-2 hours after IRS E-file acceptance. Estimated IRS acceptance begins late-January.

You May Like: How Much Is Bonus Tax

What To Do If You Don’t Receive Your Tax Refund

If you chose to use direct deposit and still havent received your tax refund after 3 weeks, there may be a few reasons why.

First, your tax return may haveincluded errors, such as misspelled names, incorrect social security numbers, unsigned forms, or incorrect bank account information. To avoid errors, make sure to carefully review your tax return before you click submit. If a tax preparer is completing your return for you, make sure they have all of your correct information.

Another reason for a potential hold-up is if you were a victim of identity theft or fraud. In this situation, the IRS may hold onto your return until it can work with you to rectify the situation.

If you dont experience any of the mishaps above and are still feeling like things are moving slowly, here are 3 additional steps you can take to check on your funds:

Invest In The Stock Market

Historically, the stock market has offered greater return on investment than savings accounts, CDs or bonds. While its fluctuations make it a risky choice for money youll likely need in the coming months, the long-term outlook makes it a better option if you dont have an immediate financial need. Pick individual stocks or select an index fund that moves up and down along with the market.

Also Check: When Is The Last Day To Turn In Taxes