Filing Taxes Yourself: Pros And Cons

To file taxes yourself, you will need to gather all of the necessary paperwork, download the tax forms from the IRS website, fill them out in their entirety, and submit them yourself. You don’t need to submit a paper tax return, however. You can choose to e-file through the IRS website, as well. E-filing through the IRS website is free for everyone, and those with qualifying income below a certain threshold can even receive free tax help.

Pros:

- This method saves money because you don’t need to pay a tax preparer or spend money on tax preparation software.

- This method also keeps you in the driver’s seat and provides you with complete control over your finances.

- You are on your own schedule when you file your taxes , meaning you can work on your taxes all at once or over several days and don’t need to coordinate schedules with a tax professional.

Cons:

- It almost certainly takes more time on your part to complete your tax filing on your own.

- Interpreting tax instructions and documentation can be challenging, and filing your own return requires a great deal of comfort with personal finance.

- You carry all the error risk yourself, whereas accountants often offer guarantees against potential audits.

- You may also miss certain tax credits if you’re not aware of them, which could end up costing you more in the end, even though you didn’t have to pay to have your return prepared.

How Long Does It Take To Get A Tax Return In Canada

CRA processing times can confuse the inexperienced. Why is it taking so long? Have they found something in my files? Should I be coming up with excuses?

Fortunately, the long wait times for a tax refund have more to do with processing than anything else. So, we thought wed provide answers to questions like How long does it take to get a tax return in Canada?, Why the delays? and How can I check my status?

Strap in, and lets begin!

How Does This Expected Turnaround Compare To Last Year

Although the typical turnaround time of 21 days has not changed much, there is a considerable backlog causing millions of taxpayers to experience delays, said Zimmelman. This backlog goes back to the end of 2020 and is due to issues caused by the COVID pandemic, specifically, a much smaller IRS staff and past office closures due to quarantine.

Also Check: What Do You Need To Do Your Taxes

My Spouse Has Passed Away And My Tax Refund Check Was Issued In Both Names How Can I Get This Corrected

Since a joint return was filed, the refund check must be issued jointly. When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. You may return the check to the Department and we will include “Surviving Spouse” and “Deceased” next to the respective names on the check. Should you need to return the check, please mail to: NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh NC 27602-1168.

How Long Does A Refund Take Your Guide To Getting Your Tax Refund With Etax

OK, so your tax return is finished and Etax lodged it with the ATO for you. Now youre wondering how long it will take until you receive your hard-earned tax refund, right?

We know waiting for your tax refund is frustrating, and chances are its already on its way. However, it is important to bear in mind that sometimes there are delays at the ATO, especially in July.

Did you know, the ATO process the bulk of the nations finances during July? Thats pretty incredible when you think about it.

So, heres everything you need to know about the average waiting periods between ATO lodgement and your tax refund arriving in your bank account. Plus, a few reasons why it can take a little longer sometimes.

Also Check: Penalty For Not Paying Taxes Quarterly

Irs Tax Tracker: How Long Does It Take For Irs To Approve Refund

All the key information you need to know

- SAM

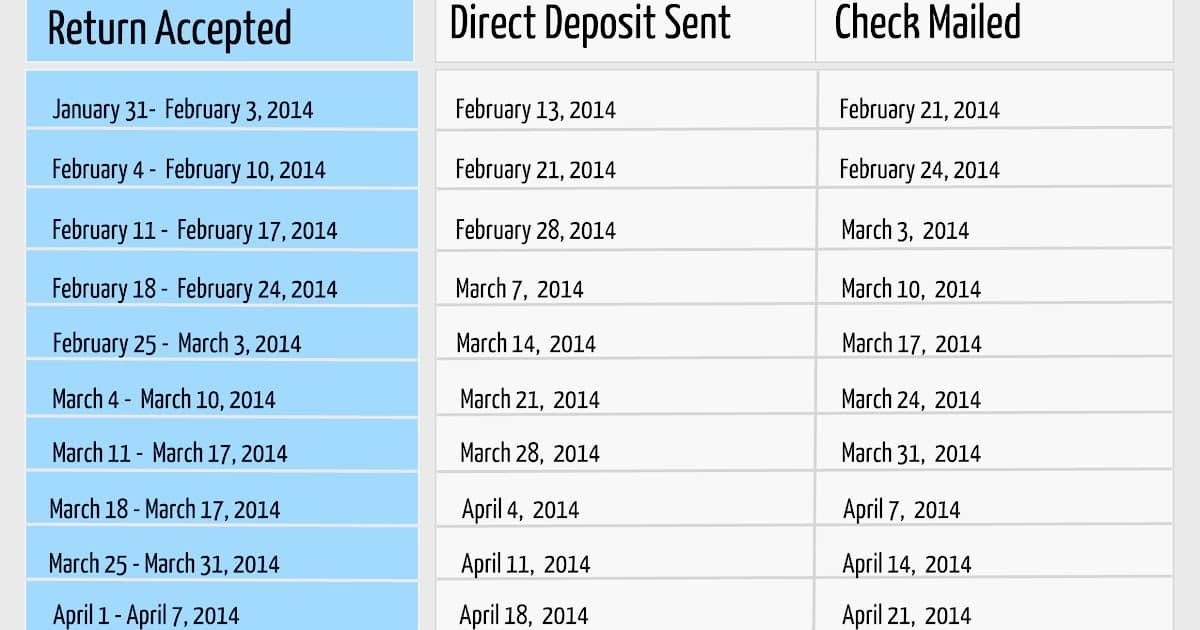

- IRS Deposit Dates 2022.When is the IRS sending refunds?

Tax season remains in full swing in the United States, but for anyone who might be expecting a tax refund this year, you might be wondering when the Internal Revenue Service give the green light for you to receive this money.

Once you have filed a complete paper tax return that contains no errors, you can expect your refund to be issued by the IRS roughly six to eight weeks from the date that they receive your return.

For anyone who filed their tax return electronically, however, you can expect your refund to be issued in less than three weeks. If you chose direct deposit, this can be even faster.

How To Check On The Status Of Your Return

You can check on the status of your return by signing into the CRA My Account function or calling the CRA directly.

There are several reasons your return may not be processed promptly, cause a delay in receiving your refund.

The most common is if your return was selected for review, but the CRA may also delay your refund if:

- You owe or are about to owe a balance

- You have a wage garnishment order under the Family Orders and Agreements Enforcement Assistance Act.

- You have outstanding government debts like student loan debts, employment assistance, or others.

- You have a refund of $2 or less.

You May Like: How To File Free Taxes

How To Check Your Tax Refund Status

You can check your tax return status online using the IRS Wheres My Refund? tool. To use this tool, youll need the following information:

- Your Social Security number or ITIN

- Your filing status

- Your exact refund amount

The tool can tell you the status of your refund from 24 hours after you e-file, or four weeks after you mail your return. The system is updated each day, usually overnight.

You can also call the IRS TeleTax System at 1-800- 829-4477 to check the status of your refund over the phone. Be aware that the volume of calls trying to reach IRS representatives is at an all-time high, and the IRS recommends that you do not attempt to call until 21 days after you e-file or four weeks after you mail your return.

How Long Does Tax Return Take In Australia 2022

Tax agents and experts in Australia frequently face this question from their clients: When do I get my tax return? It indeed becomes frustrating for a taxpayer to wait for their tax refund. But one thing you must keep in mind is that even if there is a delay, you will never be denied your claims, provided you have lodged the tax return correctly.

Sometimes delays occur at the Australian Taxation Office or ATO, mainly in July. The reason behind it is that the ATO processes a significant portion of the countrys finances in July. Read this blog to know about how long you have to wait from the moment you lodge the tax to the moment of receiving the refunded amount into your Australian bank account.

Recommended Reading: Is Hazard Insurance Tax Deductible

How Long Will My Federal Tax Refund Take

After you file, you may find yourself wondering how long it will be before you get a refund, assuming one is due. The time it takes to receive a refund can depend on how and when you filed, which return you used, and whether you requested a direct deposit into a bank account or a paper check in the mail.

According to the IRS website, 9 in 10 tax refunds are issued within 21 days. If you file electronically, your refund may be issued in as little as a week. If you file by mail, it can take much longer due to transit time and the time it takes to process your paper form.

Refunds issued by direct deposit will reach you faster than refunds issued by paper check, which must make it through the mail.

Common Reasons For A Tax Refund Delay

While its your tax agents job to help you check, maximise and lodge your tax return to the ATO in a timely manner, there are some reasons out of our control that may cause a delay in your tax refund.

For example, if you:

- didnt include all your income sources,

- added unusual deductions for someone in your industry,

- have an insolvency account and owe money,

- owe money to child support or another government agency,

- have an outstanding ATO debt,

- were just unlucky and the ATO decided to audit returns in your industry or with your type of deductions. .

Note: Tax returns are only ever held up by the Australian Tax Office, not your tax agent. At Etax we want you to get your tax refund as quick as possible, so its never in our interest to slow things down. Rather, its our job to work with you to overcome any delays caused by the ATO and get your tax refund back and into your bank account.

Recommended Reading: Montgomery County Texas Tax Office

Getting Refunds Within 21 Days Of Filing

If all goes well, though, taxpayers who e-file can receive their refunds via direct deposit as quickly as one week after filing based on previous years’ processing time, according to trade publication CPA Advisor.

It’s important to note that processing time typically slows down as the tax season gets underway and the IRS handles more returns, the publication added.

In the meantime, tax experts say there are some steps that taxpayers can take to help ensure a quick tax refund, which is even more important this year given that the IRS is starting with a backlog. National Taxpayer Advocate Erin M. Collins issued a report to Congress in January that warned she is “deeply concerned about the upcoming filing season” given the backlog, among other issues.

“The first thing you know if you are going to cook a meal, you have to have the kitchen cleaned up from the last meal,” said Mark W. Everson, vice chairman at Alliantgroup and former Commissioner of the IRS. “It just snowballs into a terrible situation.”

Delays in processing tax returns count as one of the agency’s most pressing problems, Collins said in her report, which described an agency in crisis.

Americans are hearing the message: Potential IRS processing delays ranked second among the three top concerns of people who are expecting a refund from the IRS this year, according to a Bankrate.com poll of almost 2,500 people released February 22.

My Tax Refund Was Accepted When Will It Be Approved

The IRS will provide a deposit or mail date as soon as it processes your tax return and approves your refund. Most refunds will beissued in less than 21 days, and you can check the status of your refund within 24 hours of filing your return electronically. Depending on your delivery option, timelines are subject to change.

Read Also: How Do Tax Write Offs Work

My Refund Check Is Now Six Months Old Will The Bank Still Cash The Check

A check from the NC Department of Revenue is valid up to six months after the date on the check. If a check date is older than six months, you should mail a letter along with the refund check to NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh, NC 27602-1168. Your check will be re-validated and re-mailed to you.

What Should You Double

Any error, no matter how small, could require a manual review of your return and lead to a delay of your refund , said Zimmelman. Double-check for mistakes. Make sure that all of the information youve provided on your return is completely accurate and nothing is missing. That goes for everything from your total income to your current address.

According to Zimmelman, the following are some common tax return errors that seem minor but could seriously delay your refund:

-

Selecting more than one filing status by mistake.

-

Putting the wrong name. If you got married or legally changed your name, make sure youve updated that information with Social Security.

-

Not printing your information clearly.

-

Leaving out important information.

-

Entering information on the wrong line.

-

Forgetting to sign and date your tax return.

-

Giving the incorrect bank account information if you requested direct deposit.

-

Sending it to the wrong address if you filed by mail.

-

Making computational errors. The IRS will usually correct that for you, but it may still result in a delay.

Explore: Top Tips for Painless Tax Prep

Steber also pointed out that reporting an incorrect advanced Child Tax Credit payment amount on your return could cause a delay in your refund.

Also Check: Penalty For Filing Taxes Late If I Owe Nothing

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

About Tracking Your Refund

How fast will I receive my refund?

How quickly you receive your tax refund depends on when you file, how you file, how you choose to receive your refund, and whether you claim certain credits and deductions.

When you file your return electronically, most refunds are funded within 21 days of filing, according to the IRS. That clock starts after the IRS begins processing tax returns for the year.

Please note that due to tax laws in place to reduce fraudulent claims for refunds, taxpayers who claim the EITC or refundable Child Tax Credit will not receive a refund before February 15th.

How fast can I get my refund?

If you chose direct deposit, your tax refund will be sent to your bank the same day the IRS sends your tax refund. It will typically take 3-5 days for your bank to process, depending on your bank.

You may receive your refund as early as the same day it was sent by the IRS up to two days faster* than standard direct deposit if you chose to have it loaded onto an American Express Serve® Card.

How can I check the status of my return on the MyJH account I created?

You’ll be able to see your return status!

How can I access my tax documents on the MyJH account I created?

You May Like: Sale Of Second Home Tax Treatment

Why Is Wheres My Refund Not Available

An incomplete return, an inaccurate return, an amended return, tax fraud, claiming tax credits, owing certain debts for which the government can take part or all of your refund, and sending your refund to the wrong bank due to an incorrect routing number are all reasons that a tax refund can be delayed.

Are out of state sales taxable in New Mexico?

As of 7/1/21, New Mexico is considered a destination-based sales tax state. The Gross Receipts tax rate now is calculated based on where the goods or products of services are delivered. The New Mexico gross receipts tax rate is 5.125%.

If I Owe The Irs Or A State Agency Will I Receive My Nc Refund

In some cases debts owed to certain State, local, and county agencies will be collected from an individual income tax refund. If the agency files a claim with the Department for a debt of at least $50.00 and the refund is at least $50.00, the debt will be set off and paid from the refund. The Department will notify the debtor of the set-off and will refund any balance which may be due. The agency receiving the amount set-off will also notify the debtor and give the debtor an opportunity to contest the debt. If an individual has an outstanding federal income tax liability of at least $50.00, the Internal Revenue Service may claim the individual’s North Carolina income tax refund. For more information, see G.S. §105-241.7 and Chapter 105A of the North Carolina General Statutes.

You May Like: Do Retirees Need To File Taxes

How Long Does It Take To Get A Tax Refund From Hmrc

| How long does it take to get a tax rebate? | Tax refunds in the UK can take up to 12 weeks to be processed by HMRC with a further 5 days to 5 weeks added to receive your money. |

There are a number of reasons why you may be owed a tax refund, or tax rebate, from HMRC. If you are employed and pay tax through PAYE, this may have been calculated incorrectly, or your self assessment tax return may have included errors meaning that you overpaid your tax. If this is the case and you are owed a repayment from HMRC then you will no doubt be wondering how long does a tax rebate take?

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit or Child Tax Credit amounts. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset or different refund amount when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

You May Like: When Are Llc Taxes Due