Capital Gains On Sale Of Second Home

If you own multiple homes, it may not be as easy to shelter sale profits as it was in the past.

The Housing Assistance Act of 2008 was designed to provide relief for homeowners on the edge of foreclosure, yet it could cost the owners when they decide to sell.

You used to be able to move into the second property, make it your primary residence, live there for two years, and profit from the gains.

Even when your second piece of real estate is converted into your primary home, you will be taxed on part of the gains based on how long the home was used as a second home and not the primary residence.

Section 54ec: Exemption On Sale Of House Property On Reinvesting In Specific Bonds

Exemption is available under Section 54EC when capital gains from sale of the first property are reinvested into specific bonds.

- If you are not keen to reinvest your profit from the sale of your first property into another one, then you can invest them in bonds for up to Rs. 50 lakhs issued by National Highway Authority of India or Rural Electrification Corporation .

- The money invested can be redeemed after 5 years, but they cannot be sold before the lapse of 5 years from the date of sale.

- The homeowner has six months time to invest the profit in these bonds. But to be able to claim this exemption, you will have to invest before the tax filing deadline.

Understanding The Capital Gains Tax

When stock shares or any other taxable investment assets are sold, the capital gains, or profits, are referred to as having been “realized.” The tax doesn’t apply to unsold investments or “unrealized capital gains.” Stock shares will not incur taxes until they are sold, no matter how long the shares are held or how much they increase in value.

Under current U.S. federal tax policy, the capital gains tax rate applies only to profits from the sale of assets held for more than a year, referred to as “long-term capital gains.” The current rates are 0%, 15%, or 20%, depending on the taxpayer’s tax bracket for that year.

Most taxpayers pay a higher rate on their income than on any long-term capital gains they may have realized. That gives them a financial incentive to hold investments for at least a year, after which the tax on the profit will be lower.

Day traders and others taking advantage of the ease and speed of trading online need to be aware that any profits they make from buying and selling assets held less than a year are not just taxedthey are taxed at a higher rate than assets that are held long-term.

Taxable capital gains for the year can be reduced by the total capital losses incurred in that year. In other words, your tax is due on the net capital gain. There is a $3,000 maximum per year on reported net losses, but leftover losses can be carried forward to the following tax years.

Also Check: Tax Software For Tax Preparer

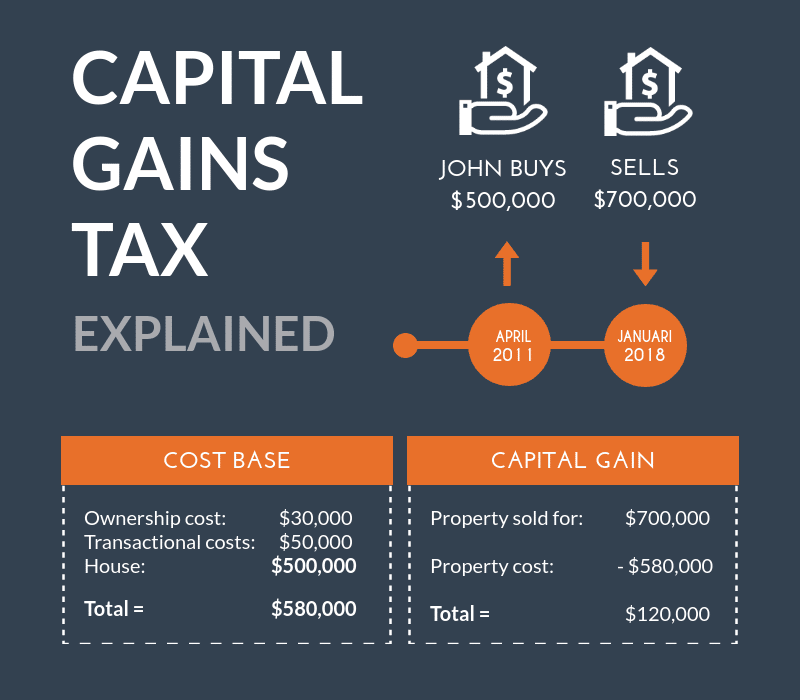

How Do You Calculate Capital Gains

Every capital asset you own has a basis, which is generally the amount you paid for the property initially, plus any taxes or commissions. If you received the asset as a gift or from inheritance, there’s a special calculation for figuring out your adjusted tax basis.

To calculate the amount of gain , simply subtract the proceeds received on the date of the sale from your adjusted tax basis. If the proceeds are more than your basis, you’ll generate a gain. If the proceeds are less than your basis, you’ll generate a loss.

The capital gains tax rates apply to your net capital gains. If you had capital losses during the tax year , you may be able to use it to offset your gains.

Stay Invested And Know When To Sell

As weve emphasized, your income tax rate is a dominant factor when considering capital gains. By waiting to sell profitable investments until you stop working, you could significantly decrease your tax liability, especially if your income is low. In some cases, you might owe no taxes at all.

The same could be true if you retire early, leave your job, or your taxable income drastically changes. In essence, you can evaluate your financial situation each year and decide when the optimal time to sell an investment is.

Don’t Miss: Can You Write Off Food On Taxes

What Are The Exceptions To The Capital Gains Tax Rate For Long

One major exception to a reduced long-term capital gains rate applies to collectible assets, such as antiques, fine art, coins, or even valuable vintages of wine. Typically, any profits from the sale of these collectibles will be taxed at 28% regardless of how long you have held the item.

Another major exception comes from the Net Investment Income Tax , which adds a 3.8% surtax to certain investment sales by individuals, estates, and trusts above a set threshold. Typically, this surtax applies to those with high incomes who also have a significant amount of capital gains from investment, interest, and dividend income.

How To Address Volatility In Capital Gains

Capital gains income and thus capital gains tax revenue can rise or fall rapidly in response to economic changes. States can manage this volatility by, for example, relying on a variety of taxes, some of which respond less dramatically to swings in the business cycle.

The best way to address volatility in capital gains and other taxes is to establish a rainy day fund and make deposits when strong economic growth boosts revenues, so these funds can smooth out revenue downturns. States can tie these provisions directly to capital gains taxes, if desired. For example, Massachusetts deposits all capital gains revenue above a specific threshold into its rainy day fund. Similarly, in Connecticut, when income taxes collected through quarterly payments from taxpayers and at the time of filing exceed a specified threshold, the surplus is deposited into the states reserves. These are mainly taxes on investment income.

Don’t Miss: Percent Of Taxes Taken Out Of Paycheck

Calculating Tax On Your Capital Gain

Your taxable capital gain is generally equal to the value that you receive when you sell or exchange a capital asset minus your “basis” in the asset. Your basis is generally what you paid for the asset. Sometimes this is an easy calculation if you paid $10 for stock and sold it for $100, your capital gain is $90. But in other situations, determining your basis can more be complicated.

Tax Tip: Since your basis is subtracted from the amount you receive when disposing of a capital asset, you want the highest basis possible so that the taxable portion of your profit is as low as possible.

Your basis can include more than simply your initial purchase price. For example, your basis can also include expenses related to buying, selling, producing, or improving your capital asset that are not currently deductible. This will reduce your gain when you sell. Home improvement expenses, and brokers’ fees and commissions that are clearly identified with a particular asset, can raise your basis. Just make sure you keep receipts and other records related to these additional costs. Also note that certain investment-related expenses are miscellaneous itemized expenses and disallowed through 2025 .

Use 1031 Exchanges To Avoid Taxes

Homeowners can avoid paying taxes on the sale of a home by reinvesting the proceeds from the sale into a similar property through a 1031 exchange. This like-for-like exchangenamed after Internal Revenue Code Section 1031allows for the exchange of like property with no other consideration or like property including other considerations, such as cash. The 1031 exchange allows for the tax on the gain from the sale of a property to be deferred, rather than eliminated.

Ownersincluding corporations, individuals, trust, partnerships, and limited liability companies of investment and business properties can take advantage of the 1031 exchange when exchanging business or investment properties for those of like kind.

The properties subject to the 1031 exchange must be for business or investment purposes, not for personal use. The party to the 1031 exchange must identify in writing replacement properties within 45 days from the sale and must complete the exchange for a property comparable to that in the notice within 180 days from the sale.

To prevent someone from taking advantage of the 1031 exchange and capital gains exclusion, the American Jobs Creation Act of 2004 stipulates that the exclusion applies if the exchanged property had been held for at least five years after the exchange.

You May Like: Pay Federal Estimated Tax Online

What Is The Capital Gains Tax

The capital gains tax is the levy on the profit that an investor makes when an investment is sold. It is owed for the tax year during which the investment is sold.

The long-term capital gains tax rates for the 2022 and 2023 tax years are 0%, 15%, or 20% of the profit, depending on the income of the filer. The income brackets are adjusted annually.

An investor will owe long-term capital gains tax on the profits of any investment owned for at least one year. If the investor owns the investment for one year or less, short-term capital gains tax applies. The short-term rate is determined by the taxpayer’s ordinary income bracket. For all but the highest-paid taxpayers, that is a higher tax rate than the capital gains rate.

What Is Capital Gains Taxand Who Pays It

In a nutshell, capital gains tax is a tax levied on possessions and propertyincluding your homethat you sell for a profit.

If you sell it in one year or less, you have a short-term capital gain.

If you sell the home after you hold it for longer than one year, you have a long-term capital gain. Unlike short-term gains, long-term gains are subject to preferential capital gains tax rates.

Watch: How Much a Home Inspection Costsand Why You Need One

Recommended Reading: Local County Tax Assessor Collector Office

Do I Have To Buy Another House To Avoid Capital Gains

No, but there is a limit. Profits earned on the sale of real estate are regarded as capital gains. However, suppose you utilized the property as your principal residence and met specific additional criteria. In that case, you may deduct up to $250,000 of the gain , regardless of whether you purchase another home.

As An Obstacle To Sale

The CGT can be considered a cost of selling which can be greater than for example transaction costs or provisions. The literature provides information that barriers for trading negatively affects the investors’ willingness to trade, which in turn can change assets prices.

Companies especially with tax-sensitive customers react to capital gains tax and its change. CGT and its changes affect trading and selling stocks on the market. Investors have to be ready to react in a sensible way to these changes, taking into account the cumulative capital gains of their customers. Sometimes they are forced to delay the sale due to an unfavorable situation. A study by Li Jin showed that great capital gains discourage selling. On the contrary to this fact, small capital gains stimulate the trade and investors are more likely to sell.”It is easy to show that to be willing to sell now the investor must believe that the stock price will go down permanently. Thus, a capital gains tax can create a potentially large barrier to selling. Of course, the foregoing calculation ignores the possibility that there might be another taxtiming option: Given capital gains tax rates fluctuate over time, it might be worthwhile to time the realization of capital gains and wait until a subsequent regime lowers the capital gains tax rate.”

You May Like: How Are State Income Taxes Calculated

Capital Gains Tax Rate For Collectibles

There are a few exceptions to the general capital gains tax rates. Perhaps the most common exception involves gains from the sale of collectibles that qualify as capital assets. For this special rule, a “collectible” can be a work of art, antique, stamp, coin, bottle of wine or other alcoholic beverage, gold or other precious metal, gem, historic object, or another similar item. If you sell an interest in a partnership, S corporation, or trust, any gain from that sale attributable to the unrealized appreciation in the value of collectibles is also treated as gain from the sale of collectibles.

Instead of a 20% maximum tax rate, long-term gains from the sale of collectibles can be hit with a capital gains tax as high as 28%. If your ordinary tax rate is lower than 28%, then that rate will apply. But if you’re in a higher tax bracket , then the capital gains tax on your collectible gains is capped at 28%.

The 28% limit doesn’t apply to short-term capital gains. So, if you don’t own a collectible for at least one year before selling it, you’ll still be taxed on any gain at your ordinary tax rate .

Do You Pay State Taxes On Capital Gains

In general, youll pay state taxes on your capital gains in addition to federal taxes, though there are some exceptions. Most states simply tax your investment income at the same rate that they already charge for earned income, but some tax them differently

Just seven states have no income tax Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. Two other states New Hampshire and Tennessee dont tax earned income but do tax investment income, including dividends.

Of states that do levy an income tax, nine of them tax long-term capital gains less than ordinary income. These states include Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont and Wisconsin. However, this lower rate may take different forms, including deductions or credits that reduce the effective tax rate on capital gains.

Some other states provide breaks on capital gains taxes only on in-state investments or specific industries.

Read Also: Income Tax Rates In South Carolina

Example Of How Capital Gains Taxes Work

For example, let’s say you had a $2,000 capital loss from the sale of a stock you held for 18 months that’s a long-term capital loss. And you also had $3,000 in capital gain from the sale of another stock you held for 24 months.

Since both assets were held long-term, you can net them against each other: $3,000 gain – $2,000 loss = $1,000 net gain taxed at long-term capital gains rates.

Say your taxable income for 2022 was $50,000 and you file your tax return as single. Your capital gains will be taxed at 15%, unless the asset is a collectible or real estate.

Percent Capital Gains Rate For Certain Real Estate

However, the rules differ for investment property, which is typically depreciated over time. In this case, a 25 percent rate applies to the part of the gain from selling real estate you depreciated. The IRS wants to recapture some of the tax breaks youve been getting via depreciation throughout the years on assets known as Section 1250 property. Basically, this rule keeps you from getting a double tax break on the same asset.

Youll have to complete the worksheet in the instructions for Schedule D on your tax return to figure your gain for this asset, or your tax software will do the figuring for you. More details on this type of holding and its taxation are available in IRS Publication 544.

If youre considering a real estate investment, compare mortgage rates on Bankrate.

Read Also: Walmart Tax Refund Advance 2022

Capital Gains Taxes On Collectibles

If you realize long-term capital gains from the sale of collectibles, such as precious metals, coins or art, they are taxed at a maximum rate of 28%. Remember, short-term capital gains from collectible assets are still taxed as ordinary income. The IRS classifies collectible assets as:

- Works of art, rugs and antiques

- Musical instruments and historical objects

- Stamps and coins

- Alcoholic beverages

- Any metal or gem

The latter point is worth reiterating: The IRS considers precious metals to be collectibles. That means long-term capital gains from the sale of shares in any pass-through investing vehicle that invests in precious metals are generally taxed at the 28% rate.

What Is Adjusted Home Basis

The cost basis of a home can change. Reductions in cost basis occur when you receive a return of your cost. For example, you purchased a house for $250,000 and later experienced a loss from a fire. Your home insurer issues a payment of $100,000, reducing your cost basis to $150,000 .

Improvements that are necessary to maintain the home with no added value, have a useful life of less than one year, or are no longer part of your home will not increase your cost basis.

Likewise, some events and activities can increase the cost basis. For example, you spend $15,000 to add a bathroom to your home. Your new cost basis will increase by the amount that you spent to improve your home.

You May Like: Is Mortgage Interest Tax Deductible

What’s The Difference Between A Short

Generally, capital gains and losses are handled according to how long you’ve held a particular asset known as the holding period. Profits you make from selling assets youve held for a year or less are called short-term capital gains. Alternatively, gains from assets youve held for longer than a year are known as long-term capital gains. Typically, there are specific rules and different tax rates applied to short-term and long-term capital gains. In general, you will pay less in taxes on long-term capital gains than you will on short-term capital gains. Likewise, capital losses are also typically categorized as short term or long term using the same criteria.