Adjust Gross Pay For Social Security Wages

Now that you have gross wages, we can take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

Is It Better To Withhold Taxes

Remember, one of the big reasons you file a tax return is to calculate the income tax on all of your taxable income for the year and see how much of that tax youve already paid via withholding tax. If it turns out youve overpaid, youll probably get a tax refund. If it turns out youve underpaid, youll have a tax bill to pay.

If you ended up with a huge tax bill this year and dont want another, you can use Form W-4 to increase your tax withholding. Thatll help you owe less next year.

If you got a huge tax refund, consider using Form W-4 to reduce your tax withholding. Youre giving the government a free loan and even worse you might be needlessly living on less of your paycheck all year. It may feel great to get a tax refund from the IRS, but think of how life mightve been last year if youd had that extra money when you needed it for groceries, overdue bills, getting the car fixed, paying off a credit card or investing.

Promotion: NerdWallet users get 25% off federal and state filing costs. |

Promotion: NerdWallet users can save up to $15 on TurboTax. |

How Are These Taxes Being Calculated

If you are employed under a U.S.-registered business, the burden is off your shoulder as your employer will make the computation for you and automatically deducts it on your gross pay. However, if you are a self-employed or a freelancer, you need to make the calculations for yourself. You can use this app to compute your federal tax withholding. For state taxes, you may refer directly to your State Department of Revenue to know the imposed individual tax systems.

Read Also: How To Not Owe Taxes

What Is My Filing Status

The filing status you use largely depends on the answer to one question: Were you considered married on the last day of the year? If yes, you are considered married for tax filing that year. If not, you are considered not married.

Some particular circumstances under which married persons may be viewed as not married. For example, someone may qualify for Head of Household status even if they are not legally separated or divorced.

Types of filing statuses include:

Don’t Overpay The Irs By Having Too Much Tax Withheld From Your Paycheck

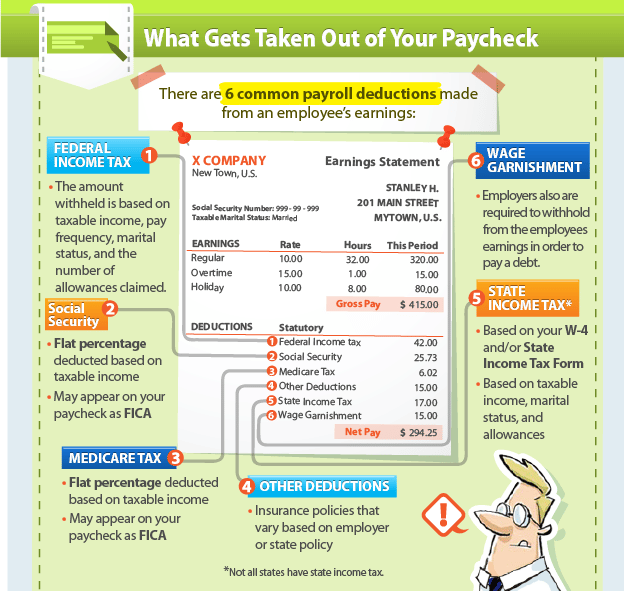

The United States has a “pay as you go” federal income tax. This means you must pay your income taxes to the IRS throughout the year, instead of paying the whole amount due on April 15. If you’re an employee, this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS.

The average taxpayer gets a tax refund of about $2,800 every year. This is because they have too much tax withheld from their paychecks.

In effect, taxpayers who get refunds are giving the IRS an interest-free loan of their money. Nevertheless, many taxpayers like getting refunds. Indeed, there were widespread complaints when many taxpayers received smaller refunds for 2018 than in past years because the IRS recalculated their withholding to take into account the changes brought about by the Tax Cuts and Jobs Act.

If you like getting a refund, go ahead and overpay your withholding. Some people view this as a form of forced savings. However, you’ll be better off if you don’t have too much tax withheld. Ideally, your withholding should match the actual amount of tax you owe for the year. This way you’ll have more money in your pocket each month.

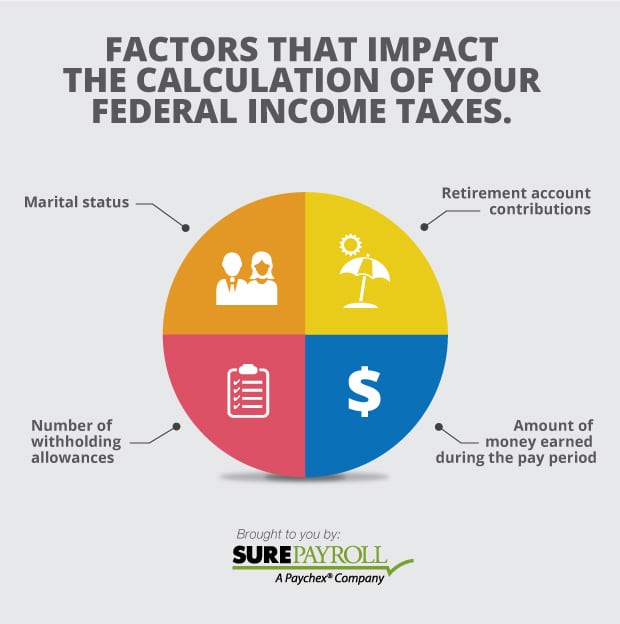

The amount of income tax your employer withholds from your regular pay depends on two things:

- the amount you earn, and

- the information you give your employer on Form W4.

Tax preparation software can also calculate your withholding.

Don’t Miss: Will Property Taxes Go Up In 2022

How You Can Affect Your California Paycheck

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you choose to save more of each paycheck for retirement, for example, your take-home pay will go down. Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise, so they dont experience a smaller paycheck and get discouraged from saving.

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your companys insurance offerings.

If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of your paychecks. If you take more allowances, you might get a smaller refund but you should get bigger paychecks. Conversely, if you always owe tax money come April, you may want to claim fewer allowances so that more money is withheld throughout the year.

How Much Of Your Paycheck Goes To Social Security Tax It Depends How Much You Make

Photo: 401kcalculator.org via Flickr

The Social Security tax rate in the United States is currently 12.4%. However, you only pay half of this amount, or 6.2%, out of your paycheck — the other half is paid by your employer. And, Social Security taxes are only applied to the first $118,500 in wages for the 2015 tax year, which can make the effective Social Security tax rate less for higher-income individuals.

ExamplesFor a basic example, consider the case of a worker who earns a salary of $50,000 per year. Since this is below the wage limit, the 6.2% Social Security tax rate would apply to the entire income — so this person would pay $3,100 in Social Security taxes throughout the course of the year. Assuming a bi-weekly pay schedule, this amount translates to about $119 per paycheck.

Or, consider a higher-income individual who’s salary is $250,000. Because this is over the wage cap, only the first $118,500 of this person’s earnings is subject to the 6.2% tax. So, $7,347 of this worker’s income is paid as Social Security tax, making the effective Social Security tax rate just 2.9%.

Self-employed individualsIf you are self-employed, you are responsible for paying both the employer’s and employee’s portion of the Social Security tax — also known as the “self-employment tax.” The combined rate is 12.4% , and the same $118,500 wage cap applies for the Social Security tax. Medicare tax is paid on all wages.

You May Like: How To File Back Taxes Without Records

Is Georgia A Tax Friendly State

Most individuals focus solely on the state income tax rate but there are other factors to consider such as sales tax, property taxes and even estate taxes. SmartAsset reported Georgia is very tax-friendly toward retirees. Georgia has big, culturally rich cities like Atlanta.

The Irs Is Changing Paycheck Withholding Rules: Whats Next

Most taxpayers will appreciate the 2020 W-4 changes. The new form allows you to include additional sources of income. Equally as important, a company is required to withhold payroll taxes for your side earnings.

Additionally, working individuals may receive a larger paycheck when they add childcare allowances and an expanded standard deduction to their W-4s.

However, all of this means that you should keep a close eye on your annual refunds, which will most likely change.

Firstly, to enjoy these advantages, employees must file the new W-4 this year. Otherwise, a company is required to withhold payroll taxes for workers based on past W-4 submissions. These are outdated in comparison to the recently-overhauled tax code.

Sure, filling out a new form may seem like a time consuming process. In the short term, it is certainly easier to use the previous document.

Yet by taking a few hours to redo your W-4 for the entire year, you could bring home several hours worth work each week. Equally as important, you dont need to update the same form in the future if your expenses stay the same.

Read Also: Walmart Tax Refund Advance 2022

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of whats due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Also Check: Government Grants Anyone Can Get

Why Do I Owe So Much In Taxes 2020

Well the more allowances you claimed on that form the less tax they will withhold from your paychecks. The less tax that is withheld during the year, the more likely you are to end up paying at tax time. … In a nutshell, over-withholding means you’ll get a refund at tax time. Under-withholding means you’ll owe.

Recommended Reading: States With No Tax On Retirement Income

What Is Gross Income

Before we can understand why your taxes are so high on your paycheck, we need first to define one key term: gross income. Gross income is simply the total amount of money you earn in a period before any deductions are taken out.

It includes wages, salaries, bonuses, commissions, and other taxable income. You subtract any deductions or exemptions you qualify for when calculating your taxable income, which is taxed at various rates depending on your filing status.

Most taxpayers’ gross income and taxable incomes are one and the same. However, there are a few instances where that’s not the case. For example, if you have income from investments or rental property, that would be considered gross income but not taxable income.

State And Local Payroll Tax

Employers are also responsible for paying state and local payroll tax on behalf of employees.

As with federal payroll tax, part of this tax is employer-paid, and part is employee-paid. Keep in mind that âemployee-paidâ just means that you, the employer, withhold a certain amount from your employeeâs paycheck and then remit it as part of your payroll taxes.

In addition to state payroll tax , employers are also responsible for remitting state income tax on behalf of their employees.

State and local payroll taxes are governed at the state and local levels, and payroll tax rates and rules vary by jurisdiction. To find out more about payroll tax in your state and local area, check out the Federation of Tax Administratorsâ list of each stateâs taxing authority.

Read Also: How To Add Sales Tax On Square

State And Local Income Tax

State and local income taxes vary from state to state. Some states have multiple tax brackets. Some states like California and New York have a tax bracket for high-income taxpayers referred to as the millionaire tax. State and local income taxes are solely on the employee the employer does not cover these costs. On the other hand, nine states have no income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

How Do I Create A Paycheck For An Employee

Employers typically have two basic options for creating paychecks:

Also Check: Hr Block Free Tax Filing

You Live And Work In Different States

Withholding tax can get fairly complicated if you work remotely, in a different state than where your employer is found. Each state law on taxes has its own reciprocities and follows special rules when calculating that withheld tax.

For example, a resident of Alabama whose employer is outside of Alabama will not have their federal income tax withheld by Alabama. That being said, the employer will still be subjected to wage taxes by the end of the year. The same thing goes for states like Mississippi or North Dakota.

However, there are states such as Oklahoma that have slightly different rules. If the state where your employer is located withholds state income tax, you wont have to pay income tax to Oklahoma. However, if the state of your employer doesnt charge federal income tax, then the state of Oklahoma will charge that tax instead.

Should I Claim 1 Or 0 On My W 4 Tax Form

The total number of exemptions you are claiming should be based on your filing status . However, knowing if you should claim 1 or 0 on your W4 tax form also depends on how much money you want in your hands each new paydayas well as the tax burden youre willing to face when its time to file.

In the event you claim 0 federal withholding allowances instead of 1 on your W 4 tax form, youll receive less money every paycheck, though your tax bill will likely be reduced at the end of the year. When you claim 1, youll benefit from higher take-home pay but will probably face a higher bill when tax time comes around.

Dont Miss: Grieved Taxes

Also Check: How To File Your Own Taxes

How You Can Affect Your Louisiana Paycheck

If you want to shelter more of your earnings from taxes, you can always contribute to tax-advantaged accounts. You can put pre-tax dollars in a 401 and let that money grow tax-free until you start taking distributions in retirement. You can also put pre-tax dollars in a flexible spending account or health savings account account to use for medical expenses. Some workplaces offer other benefits you can pay for with pre-tax dollars, such as commuter cards that let you pay for parking or public transit.

If, on the other hand, your focus is on having more take-home pay in your paycheck, you can ask for a raise or seek supplemental wages. This includes overtime, but also bonus pay, award money and commissions. These supplemental wages are subject to Louisiana income taxes at the regular rate.

With average income tax rates and low property taxes, Louisiana may be on your list of potential places to call home. If youre looking to become a resident, take a glance at our Louisiana mortgage guide to understanding mortgages in the Pelican State.

How You Can Affect Your North Carolina Paycheck

North Carolina taxpayers who find themselves facing a large IRS bill each tax season should review their W-4 forms, as there’s a simple way to use the form to address this issue. Specifically, you can elect to have an extra dollar amount withheld from each of your paychecks to go toward your taxes. While your paychecks will be slightly smaller, youll lower the chances of owing money to Uncle Sam during tax season.

You can also save on taxes by putting your money into pre-tax accounts like a 401, 403 or health savings account , provided your employer offers these options. Retirement accounts like a 401 and 403 not only help you save money for your future, but can also help lower how much you owe in taxes. The money that goes into these accounts comes out of your paycheck before taxes are deducted, so you are effectively lowering your taxable income while saving for the future. HSAs work in a similar manner and you can use the money you put in there toward medical-related expenses like copays or certain prescriptions.

Not yet a North Carolina taxpayer, but planning a move to the state soon? Take a look at our North Carolina mortgage guide for important information about rates and getting a mortgage in the state.

Don’t Miss: Free Irs Approved Tax Preparation Courses