What Are Payroll Taxes

When you think of payroll taxes, you might think of all taxes you withhold from your employees paychecks. However, payroll taxes are just one type of employment tax. Payroll taxes include FICA and self-employment taxes. Both self-employment and FICA taxes cover Social Security and Medicare taxes.

Most employers must calculate and withhold payroll taxes from their employees gross taxable wages.

Do you need to calculate self-employment taxes for yourself? Well, that depends on your type of business entity. Typically, if you do not receive a salary like your employees, you must pay self-employment taxes.

You May Like: What Is The Sales Tax In Nebraska

Do I Have To Pay Taxes On My Federal Pension

Pension Income Taxes You will be subject to federal income tax at your regular rate while you receive the money from pension annuities and periodic pension payments. But if you take a direct lump sum payment of your pension instead, you have to pay the total tax due when you file your return for the year you receive the money.

How much of my federal pension is taxable?

In my experience your contributions usually amount to about 2% to 5% of your annual pension income for FERS and about 5% to 10% for CSRS. So that means about 90% to 98% of your FERS or CSRS pension. will be taxed. So most of your FERS or CSRS pension will be taxable.

Recommended Reading: How Do You Qualify For A Free Government Phone

Understanding Your First Paycheck

You get your first job out of college. You can finally breathe a sigh of relief you have post-grad plans! You can confidently answer that nerve-racking question: What are you doing after graduation?

But as soon as you accept that job offer, the train leaves the station pretty quickly! A whole lot of big financial decisions come at you fast like getting an apartment, paying your bills and setting up a budget to make sure your math checks out.

One of the most shocking things is when you get that first paycheck and how small it really is! You knew some taxes would be taken out but most of us are unprepared for how much really comes out.

A lot of times when people accept their new job offer, they think, Oh my goodness, like $40,000 a year is like winning the lottery when youve gone from making like $4,000 a year over the summer, you know? said Sophia Bera, a financial advisor at Gen Y Planning. And so I think what people dont realize is, then how little that actually translates to in their net pay.

Recommended Reading: Where Can Senior Citizens Get Their Taxes Done Free

How Do I Sign Up For Direct Deposit

Many employers will put your paycheck into your bank or credit union account. This is called direct deposit. You do not have to pay fees to cash your check. You will get your money sooner.

Ask your employer if it has direct deposit. To sign up for direct deposit, give your employer information about your bank or credit union account.

Form Td1x Statement Of Commission Income And Expenses For Payroll Tax Deductions

If your employees want you to adjust their tax deductions to allow for commission expenses, they have to complete Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions.

You deduct tax from your employees’ commission pay using the “Total claim amount” on their TD1 forms in the following situations:

- if your employees do not complete a Form TD1X or

- if they tell you in writing that they want to cancel a previously completed Form TD1X

You May Like: Check The Status Of Tax Refund

Dont Overpay The Irs By Having Too Much Tax Withheld From Your Paycheck

The United States has a pay as you go federal income tax. This means you must pay your income taxes to the IRS throughout the year, instead of paying the whole amount due on April 15. If youre an employee, this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS.

The average taxpayer gets a tax refund of about $2,800 every year. This is because they have too much tax withheld from their paychecks.

In effect, taxpayers who get refunds are giving the IRS an interest-free loan of their money. Nevertheless, many taxpayers like getting refunds. Indeed, there were widespread complaints when many taxpayers received smaller refunds for 2018 than in past years because the IRS recalculated their withholding to take into account the changes brought about by the Tax Cuts and Jobs Act.

If you like getting a refund, go ahead and overpay your withholding. Some people view this as a form of forced savings. However, youll be better off if you dont have too much tax withheld. Ideally, your withholding should match the actual amount of tax you owe for the year. This way youll have more money in your pocket each month.

The amount of income tax your employer withholds from your regular pay depends on two things:

- the amount you earn, and

- the information you give your employer on Form W4.

Tax preparation software can also calculate your withholding.

Dont Miss: Will Property Taxes Go Up In 2022

How Much Is Typically Taken Out Of A Paycheck For Taxes

Every first-time jobholder is probably a bit surprised to find the amount on their first paycheck is less than their total earnings. The difference between the amount of money earned, or gross pay, and the amount a worker takes home is due to taxes. All wage earners are required to pay certain federal taxes that are automatically withheld from their wages. Some states also withhold for state income tax. Understanding exactly how much in taxes is taken out of your paycheck can help lessen the shock.

You May Like: Capital Gains Tax Calculator New York

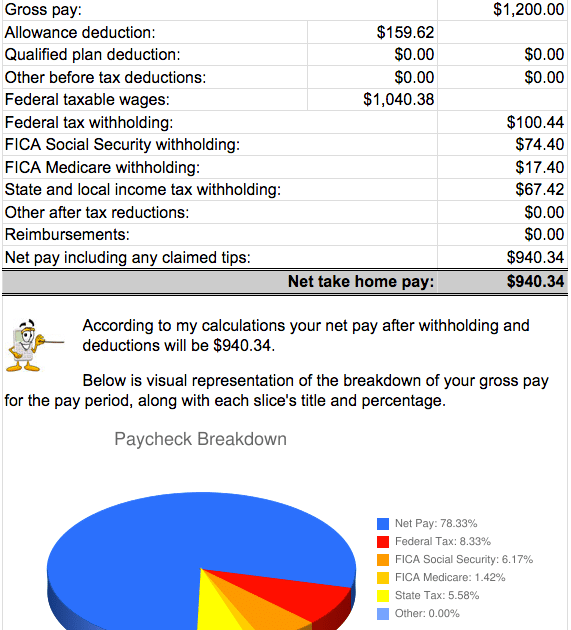

Paycheck Deductions For $1000 Paycheck

Looking at a simple example can help clarify exactly how federal tax withholding works. For a single taxpayer, a $1,000 biweekly check means an annual gross income of $26,000. If a taxpayer claims one withholding allowance, $4,150 will be withheld per year for federal income taxes. The amount withheld per paycheck is $4,150 divided by 26 paychecks, or $159.62. In each paycheck, $62 will be withheld for Social Security taxes and $14.50 for Medicare . Depending on the state where the employee resides, an additional amount may be withheld for state income tax.

Why Are My Taxes So High On My Paycheck

Its tax season again, and youre resisting the urge to call your accountant and vent. When you look at your paycheck, it’s understandable to wonder why your taxes are high. After all, you’re only taking home a fraction of what you earn.

But, believe it or not, that’s how it’s supposed to work, and there’s more to tax withholding than what meets the eye.

In this article, we’ll look at why your taxes are so high on your paycheck and what that means for you. We’ll also explore some options for reducing that burden in the future. Read on if you want to learn more about tax withholding and how to keep more of your hard-earned money in your pocket!

Don’t Miss: How To Add Sales Tax On Square

When Do I Need To Change My Tax Withholdings

Check your withholdings when you have a big change in your life. You might owe more or less money in taxes than before. You would want to withhold more money if you owe more in taxes. You would want to withhold less money if you owe less in taxes.

Changes that affect your taxes could be if you:

- get married or divorced

Your paycheck is the money your employer pays you to do your job. You also get a pay stub, sometimes called an earnings statement. A pay stub tells you how much you earned and how much money your employer took out for taxes and benefits.

New York Median Household Income

| Year | |

|---|---|

| 2011 | $55,246 |

What your tax burden looks like in New York depends on where in the state you live. If you live in New York City, you’re going to face a heavier tax burden compared to taxpayers who live elsewhere. Thats because NYC imposes an additional local income tax.

New York States progressive income tax system is structured similarly to the federal income tax system. There are eight tax brackets that vary based on income level and filing status. Wealthier individuals pay higher tax rates than lower-income individuals. New Yorks income tax rates range from 4% to 10.9%. The top tax rate is one of the highest in the country, though only taxpayers whose taxable income exceeds $25,000,000 pay that rate.

Taxpayers in New York City have to pay local income taxes in addition to state taxes. Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. There are four tax brackets starting at 3.078% on taxable income up to $12,000 for single filers and married people filing separately. The top rate for individual taxpayers is 3.876% on income over $50,000. The rates are the same for couples filing jointly and heads of households, but the income levels are different.

Yonkers also levies local income tax. Residents pay 16.75% of their net state tax, while non-residents pay 0.5% of wages.

Recommended Reading: When Will I Receive My Tax Refund 2022

Determining Federal Income Tax Withholding

The Internal Revenue Service expects taxpayers to pay taxes on wages at the time theyre earned. This is done through federal income tax withholding. The amount of federal income tax withheld varies by individual, based on the data in Form W-4, which all employees are required to submit to their employer.

The form includes information about whether a worker will file a tax return as married or single, the number of withholding allowances claimed by the worker and whether an additional amount should be withheld from each paycheck. Form W-4 includes a worksheet to help employees determine the correct amount of allowances for their financial situation. The IRS also provides a free online paycheck calculator to help determine the correct number of withholding allowances.

Read Also: How Is Retirement Income Taxed

How Do I Calculate Payroll Taxes

Using this payroll tax calculator allows you to estimate your payroll taxes. Remember, itâs one tool for planning. Our payroll solution offers small businesses the powerful support they need, with mobile, reliable and flexible options for running payroll.

Payroll by Fingercheck calculates everything for you. Our app provides you with accurate and reliable information at the click of a button. Our automated payroll process uses internal timesheet data to calculate pay and to eliminate the risk of error with no additional input.

Our free payroll tax calculator can help you answer questions about federal and state withholding. Fingercheckâs payroll solution offers more in-depth information about such topics as federal income tax withholding or wage garnishment. Our solution can help with:

- Compliance with federal, state and municipal taxes.

- Year-end reporting and filing.

Also Check: What Is The Tax Rate On 401k Withdrawals

Adjust Gross Pay For Social Security Wages

Now that you have gross wages, we can take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but dont take it out when calculating federal income tax withholding.

Heres another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

Whats The Difference Between A Deduction And Withholding

In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. These are known as âpre-tax deductionsâ and include contributions to retirement accounts and some health care costs. For example, when you look at your paycheck you might see an amount deducted for your companyâs health insurance plan and for your 401k plan. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. Some deductions are âpost-taxâ, like Roth 401, and are deducted after being taxed.

In our calculators, you can add deductions under âVoluntary Deductionsâ and select if itâs a fixed amount , a percentage of the gross-pay , or a percentage of the net pay . For hourly calculators, you can also select a fixed amount per hour .

You May Like: What Is Federal Income Tax Liabilities

The Irs Is Changing Paycheck Withholding Rules: Whats Next

Most taxpayers will appreciate the 2020 W-4 changes. The new form allows you to include additional sources of income. Equally as important, a company is required to withhold payroll taxes for your side earnings.

Additionally, working individuals may receive a larger paycheck when they add childcare allowances and an expanded standard deduction to their W-4s.

However, all of this means that you should keep a close eye on your annual refunds, which will most likely change.

Firstly, to enjoy these advantages, employees must file the new W-4 this year. Otherwise, a company is required to withhold payroll taxes for workers based on past W-4 submissions. These are outdated in comparison to the recently-overhauled tax code.

Sure, filling out a new form may seem like a time consuming process. In the short term, it is certainly easier to use the previous document.

Yet by taking a few hours to redo your W-4 for the entire year, you could bring home several hours worth work each week. Equally as important, you dont need to update the same form in the future if your expenses stay the same.

Read Also: Which Pages Of Tax Return To Print

Theres No Income Tax In Your State

If the tax was not withheld from your paycheck, it might also be because your state does not charge income tax. If you live in Alaska, Florida, Nevada, Tennessee, South Dakota, New Hampshire, Washington, Texas, or Wyoming, you will not have to pay income taxes. However, they might charge dividends and interests , so you might want to do a little bit of research on that.

States that do not charge income tax will have their own way of raising revenue for the maintenance of their infrastructure. One common way to do so is sales tax. Florida, for instance, takes a 6% tax on sales, whereas Tennessee takes a 9.55% sales tax. Washington charges a 49.4 cent fuel tax for every gallon of gasoline, which is among the nations highest rates.

So, if you live in one of the states mentioned above and you see that there is no income tax, dont stress yourself out. Youll be paying that tax money one way or another, only that you wont be paying it through federal income tax.

Read Also: Government Land Auctions Washington State

Recommended Reading: Irs Income Tax Deadline 2022

Financial Adulting 101 Will Regularly Explore Basic Money Issues Heres Why Your Paycheck Is Less Than You Thought It Would Be

I couldnt help but snicker each time one of my adult children got their first paycheck.

All three asked: What is FICA, and why is he taking so much of my money?

I laughed not out of financial superiority but because it made me recall my ownreaction when I realized that my pay wasnt all my own. So many boxes. So many deductions!

What many of us have accepted as a fact of working is shockingly frustrating to young people just starting out. My children refer to this irritating transition as adulting, the period where you are expected to move from childhood to adulthood, which includes taking control of your financial life.

There is so much to learn when you begin paying your own bills, starting with whats taken out of your paycheck. With this in mind, Ive decided to devote my column occasionally to Financial Adulting 101, focusing on money basics.

I will keep the adulting columns as simple as possible because experience with my own three has shown methat imparting too much information at one time can prompt them to tune out. After explaining FICA to my children, for example, I attempted to talk about other sections of their pay stub, and they were like, Im out.

So, lets begin with a paycheck primer.

On your pay slip, you will find a section related to FICA, or the Federal Insurance Contributions Act, which funds the Social Security and Medicare programs.

Where Does All That Money Go

Federal income tax is the governments biggest source of revenue. It is used to pay the countrys ongoing expenses, such as national defense, infrastructure needs, social assistance programs, and paying interest on the national debt.

Many people are surprised to learn that all of the income you make is not taxed at one rate. Lets say you are the single filer in the example above, earning $41,600 per year. Your income falls into the 22% tax bracket. But, if you paid a flat 22% tax rate, you’d owe $9,152. Yikes. What gives?

Federal income taxes are paid in tiers. For a single filer, the first $9,875 you earn is taxed at 10%. The next $30,249 you earn–the amount from $9,876 to $40,125–is taxed at 15%. Only the very last $1,475 you earned would be taxed at the 22% rate. This IRS Tax Table can help you figure out how much federal income tax you owe.

Also Check: Income Tax Rates In South Carolina