California Family Members Exceptions

Two voter-approved propositions enable reassessment exceptions for homes transferred between family members. This means the supplemental tax will not apply.

Transfer of ownership of a home between a parent and a child creates an exception under Proposition 58.

Transfer of ownership between a grandparent and a grandchild comes under the Proposition 193 exception.

Qualifying for these exceptions requires:

- A principal place of residence was granted a Homeowners Exemption or Disabled Veterans Exemption prior to the transfer.

- No limits exist for the assessed value of the principal residence for an exception.

- On top of the principal residence tax relief, exceptions exist for other real properties with an assessed value up to $1 million for each property.

- A $2 million limit applies to marital community real property.

- Transfers by gift, sale, or inheritance qualify for the exception.

- Transfers between parent and children as individuals, between joint tenants, between grandparents and grandchildren as individuals, and individuals to trusts may qualify for the exception.

Not eligible for exception includes:

- Transfer of ownership by legal entities, aside from most trusts.

- Transfers from grandchildren to grandparents.

For more information, read the Guide to Proposition 58 & 193.

Have questions?

The California State Franchise Tax Board

While most states that charge an income tax do so structured after the IRS, California takes some special interpretations towards tax policy. It is an expensive state in which to do business! It taxes at a higher than average rate for personal state tax, and charges both personal and business taxes to small business owners. The IRS does not collect personal income taxes from business owners, because they see that as double-taxing. California subscribes to no such niceties! To add to that, California also charges non-residents on their income based within the state, if applicable.

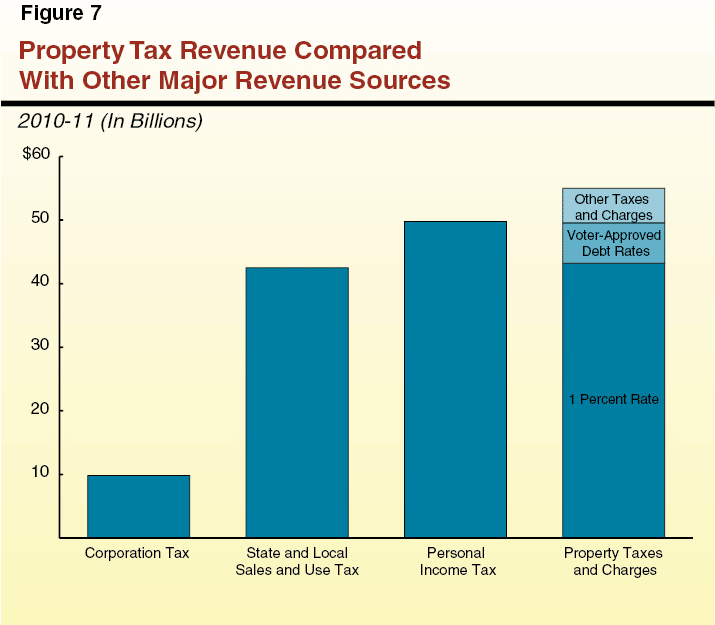

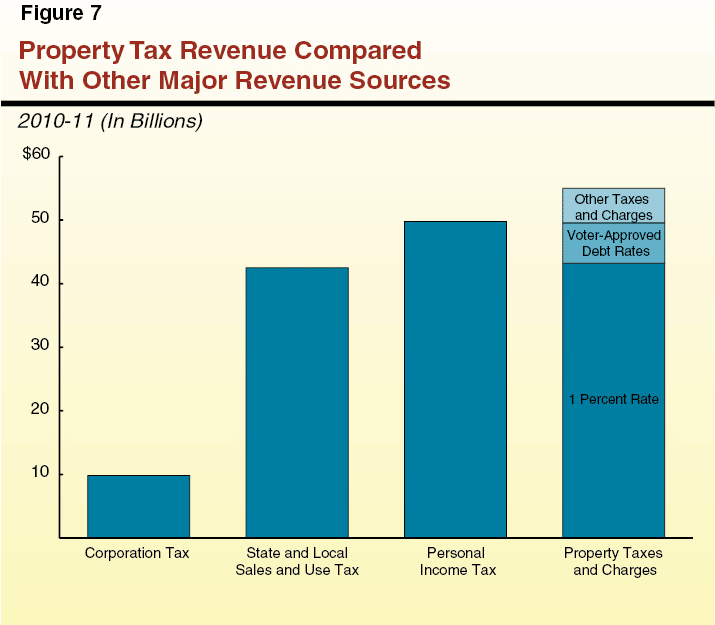

The California Franchise Tax Board collects more than $50 billion in annual personal income tax alone, and an additional $9.5 billion in annual corporate income taxes. The California FTB is one of the few US tax agencies which have been convicted for fraud this was 6 years ago in Nevada. It goes to show that sometimes, California has a bit too much weight to throw around.

Can I Save My Property

You can, up until a point. The way California property tax works is the five years given to a taxpayer is the time to redeem the property which means paying the delinquent property taxes. Even when youre served notice of intent to auction your home, you still have a chance to redeem the home. However, your clock runs out at the close of business on the last business day before the auction. Once the auction happens, theres virtually no way to redeem your house.

There is, of course, one exception to this if by some miracle, the buyer backs out of the house they just bid on and doesnt pay for it, then the county will give you another chance. Please keep in mind there may be more fees attached to redeeming your house at this point as the county had to go through the expense of organizing the auction and paying for all the associated costs.

Recommended Reading: Sales Tax In North Dakota

What Happens If I Dont Pay My Property Taxes

If you dont pay your taxes by the due date, come July 1st, your property becomes known as tax-defaulted land. Once you hit the fifth anniversary of tax-defaulted land, the local tax assessor has the ability to sell your land to recoup the taxes due. The most common method is through public auction.

But, it doesnt have to go that far. Most counties in California will accept installment payments on past due taxes. Why? Because seizing a piece of property especially one that is a residence is a huge headache. Not to mention, the county will have to evict the residents of the home if they dont choose to leave. Then theres the expense of the auction. Most tax assessors would prefer to accept installment payments.

How Much Does Property Tax Cost In California

4.3/5Property taxCaliforniaaverageaverage property taxCaliforniaanswered comprehensively

California’s overall property taxes are below the national average. The average effective property tax rate in California is 0.79%, compared with a national average of 1.19%.

Also, which county in California has the lowest property tax rate? Marin County collects the highest property tax in California, levying an average of $5,500.00 yearly in property taxes, while Modoc County has the lowest property tax in the state, collecting an average tax of $953.00 per year.

Secondly, does property tax increase in California?

Under Proposition 13, the annual real estate tax on a parcel of property is limited to 1 percent of its assessed value. This “assessed value,” may be increased only by a maximum of 2 percent per year, until and unless the property has a change of ownership.

How much is property tax on a million dollar home in California?

Nationally, the median property tax rate is 1.31%. This means that a buyer of a home valued at $2million will, on average, pay annual total property taxes of $26,200. For a $5 million property it would be $65,500 and for a $10 million it would be $131,000.

Also Check: How Much Will I Get Paid After Taxes

Do You Still Pay Property Tax After House Is Paid Off

The simple answer: yes. Property taxes dont stop after your house is paid off or even if a homeowner passes away. After your house is 100% paid off, you still have to pay property taxes. And since you no longer have a mortgage you will pay directly to your local government.

Expansion Of State Government

Another explanation that has been offered is that spending by California’s government had increased dramatically during the years prior to 1978, and voters sought to limit further growth. The evidence supporting this explanation is limited, as there have been no studies relating Californians’ views on the size and role of government to their views on Proposition 13. It is true that California’s government had grown. Between 1973 and 1977, California state and local government expenditures per $1,000 of personal income were 8.2% higher than the national norm. From 1949 to 1979, public sector employment in California outstripped employment growth in the private sector. By 1978, 14.7% of California’s civilian work force were state and local government employees, almost double the proportion of the early 1950s.

Read Also: When Is An Estate Tax Return Required

How Does Measure Ula Work

At present, both the city of Los Angeles and the county of Los Angeles levy a documentary transfer tax on every instrument that conveys land sold within the city. When the value of the property exceeds $100, the city tax is collected at a rate of $4.50 per $1,000 of consideration, while the county tax is levied at a rate of $1.10 per $1,000 of consideration, for a total of $5.60 per $1,000 of consideration.

If Measure ULA passes, effective April 1, 2023, there will be a drastic increase in the transfer tax amounts by imposing an additional tax on the sale or transfer of “high-value” real properties within the boundaries of the city. A tax of 4 percent of the property’s value will be imposed on the sale of properties valued between $5 million and $10 million. If the property is valued at $10 million or more, the sale will be subject to a 5.5 percent tax. The value of the property for the purposes of the measure will include the value of any lien or encumbrance remaining on the property when it is sold. By way of example, starting on April 1, 2023, a seller of real property valued at $100 million will pay $5.5 million more in transfer taxes to the city. Note that if it passes, Measure ULA will become law on Jan. 1, 2023, but it will not impact transactions until April 1, 2023.

How Much Are Property Taxes In Contra Costa County California

A lot of our readers and clients have questions about the cost of living here in Contra Costa County. One of the most common questions is: How much are property taxes in Contra Costa County, California.

The short answer: The current property tax rate for most homes located within the county is 1% plus any general obligation bond tax rates. This means it can vary slightly from one city to the next. Even so, the average property tax rate for homes in Contra Costa County is somewhere in the low 1% range.

Dont Miss: Do You Get Taxed On Doordash

You May Like: New York Sales Tax Rate

How To Calculate Property Taxes In California

Property taxes in California are calculated by the state-approved 1-percent rate, Mello-Roos taxes, parcel taxes, and any additional local government taxes and levies.

Property taxes in California have become an enigma to taxpayers. Everyone in California has heard of Proposition 13 , the initial state guideline which proscribed a minimum 1-percent tax. Naturally, taxpayers assume this means their tax will only be 1-percent of the assessed value of their home. But, thats just the bare minimum. Its really no different than sales tax. Theres the state sales tax then the local sales tax.

When Do You Pay Property Taxes

Tax day comes around pretty fast and if youâre not careful, it might meet you unprepared. In addition to filing your income taxes, you should keep an eye on your property taxes too. The State of Californiaâs fiscal year begins on July 1st and runs through to June 30th.

Property taxes are assessed and collected by the county your home is located in.

First off, it is essential to remember that there are two installments due, as well as recall the date of these installments.

The first installment runs from July 1st through December 31st and tax payment is slated for November 1st, and only becomes delinquent on December 10th. Failure to make a payment by 5 p.m. on the delinquent date attracts a penalty of 10%.

The second installment is due by 1st February and becomes delinquent on 10th April. To recall, just have the mnemonic âNo Darn Fooling Aroundâ ringing in your head and you would remember for sure!

Remember that failure to pay property taxes as at when due see your penalties rising consistently.

If you pay your property taxes alongside your mortgage, you would not have any unpaid balance by November 1.

Also Check: Boat Loan Calculator With Tax

What Are California Tax Assessments

Property taxes typically are based on assessed value rather than current fair market value. In most states, tax assessments are conducted every one to five years and are not changed when a property is sold or transferred as a gift.

However, in California, laws have been passed that artificially limit the tax assessed value over time, explained Wolberg.

In 1978, California voters approved Prop. 13, a constitutional amendment known as ‘The People’s Initiative to Limit Property Taxation’ that was meant to protect older residents who were unable to keep up with large property tax increases,” said Wolberg. Several propositions since then have tinkered with property taxes.”

Homeowners who plan to transfer their residence to their children now or as part of their inheritance should seek professional advice, so they understand the impact of the new property tax rules, said Bruce M. Macdonald, an attorney with Carico Macdonald Kil & Benz LLP in El Segundo, Ca.

The change in property tax rules could be significant for some families, because it’s not that unusual in California to have a house that was assessed at $150,000 when the parents bought it to be worth $5 million 40 years later,” said Macdonald.

When the kids could inherit their parents’ house at the assessed value of $150,000, the property taxes would be approximately $1,500. Now, if the house is assessed at $5 million, that would incur a significantly higher tax bill,” he explained.

How Are My Property Taxes In California Calculated

As mentioned before, the absolute minimum for California property tax is the 1-percent tax rate. By 1-percent, the law refers to the value of 1-percent of the property. For example, a house at 123 Lazy Lane is valued at $400,000. By taking the value of the property and multiplying it by 0.01, the amount would come out to $4,000.

So, a property valued at $400,000 will have a minimum property tax of $4,000.

In California, it is common for utilities to be taxed annually on the property tax. Different parts of California charge varying amounts for their water district/utilities. In larger metropolitan areas, the need for utilities increases and is usually more expensive.

In the case of county-specific taxes, every tax is voted on, usually by popular vote. In some cases, this vote may have been enacted by representatives . The county-specific taxes exist to fund special projects for the city such as infrastructure like repaving roads, funding public services, etc.

One of the most popular county-specific taxes is that of the Mello-Roos tax. For almost four years, it wasnt a permitted tax. Though the Mello-Roos tax charges a nominal tax to maintain public services and facilities, it was once the center of controversy. Its more commonly accepted today as it is a necessary tax for the functioning of a county. It is now heavily regulated by the state of California which seeks to protect its residents from a gross amount of property tax.

Read Also: California Tax On Capital Gains

Property Taxes California Ca

Most jurisdictions in the United States levy a tax on real property interests that are deemed ownership rights under state law. The rules differ greatly depending on the jurisdiction. Certain characteristics, on the other hand, are almost ubiquitous. Certain categories of commercial personal property, such as inventory and equipment, are taxed in some jurisdictions. Property taxes are not commonly imposed by states.

The same property may be taxed by many jurisdictions. County or parish governments, cities and/or towns, school districts, utility districts, and special taxation bodies differ by state. Only a few states levy a property tax. The tax is calculated using the subject propertys fair market value and is applied to it on a certain date. The tax is payable by the owner of the property at that time.

Contents

California Property Tax Rates

Property taxes in California are applied to assessed values. Each county collects a general property tax equal to 1% of assessed value. This is the single largest tax, but there are other smaller taxes that vary by city and district.

Voter-approved taxes for specific projects or purposes are common, as are Mello-Roos taxes. Mello-Roos taxes are voted on by property owners and are used to support special districts through financing for services, public works or other improvements.

A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their home’s purchase price by 1.25%. This incorporates the base rate of 1% and additional local taxes, which are usually about 0.25%.

The table below shows effective property tax rates, as well as median annual property tax payments and median home values, for each county in California. Assessed value is often lower than market value, so effective tax rates in California are typically lower than 1%, even though nominal tax rates are always at least 1%.

| County |

|---|

Want to learn more about your mortgage payments? Check out our mortgage payment calculator.

Read Also: How Property Taxes Are Calculated

What Are Property Taxes

Simply put, property taxes are taxes levied on real estate by governments, typically on the state, county and local levels. Property taxes are one of the oldest forms of taxation. In fact, the earliest known record of property taxes dates back to the 6th century B.C. In the U.S., property taxes predate even income taxes. While some states don’t levy an income tax, all states, as well as Washington, D.C., have property taxes.

For state and local governments, property taxes are necessary to function. They account for most of the revenue needed to fund infrastructure, public safety and public schools, not to mention the county government itself.

You may have noticed already that the best public schools are typically in municipalities with high home values and high property taxes. While some states provide state funds for county projects, other states leave counties to levy and use taxes fully at their discretion. For the latter group, this means funding all county services through property taxes.

To get an idea of where your property tax money might go, take a look at the breakdown of property taxes in Avondale, Arizona.

Property Assessments In Ontario

Properties in Ontario are assessed every four years by the Municipal Property Assessment Corporation . Most properties are assessed using a market value-based approach. There are three ways that MPAC uses to determine a propertys market value:

Direct Comparison Approach

Residential properties are valued under this approach. This compares the sales of similar properties in the assessment year to determine a valuation for the property. The assessed value may not equal the actual market value or sale value of a property.

Cost Approach

Unique and rarely traded properties are valued under this approach. This uses the cost of the property if someone were to rebuild it to determine a valuation for the property minus depreciation due to age or other factors. This includes the price of the land and the price of all improvements on top of it. While this takes into account the market value of the land, it does not consider the market value of the property as a whole.

Income Approach

For properties that are dedicated to generating income like rental properties or offices, an income-based approach is used. This approach uses the income generated by the property as well as the sales price to determine its assessed value.

You May Like: How Much Is The Tax In Texas