File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How To Calculate Your Social Security Tax

If youre planning to tap into your Social Security retirement benefits this year, you can figure out how much of it will be taxed based on how you file and your income amount.

When January rolls around you should receive an SSA-1099 form from the IRS. This form basically tells you how much Social Security youve received for the entire year and youll use it to calculate how much youll owe in Social Security taxes.

How To Report Social Security Income On Your Federal Taxes

Every Social Security recipient receives a benefit statement, Form SSA-1099, in January showing the total dollar amount of benefits received during the previous year. This includes retirement, survivor’s, and disability benefits.

Take that total shown in Box 5 and report it on Line 6a of Form 1040 or Form 1040-SR The IRS provides a worksheet to help you calculate what portion of your benefits are taxable and add the amount to your other income. More simply, you can use online tax software or consult a tax professional to crunch the numbers.

Recommended Reading: When Is Taxes Due 2021

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

If You Work More Than One Job

Keep the wage base in mind if you work for more than one employer. If you’ve earned $69,000 from one job and $69,000 from the other, you’ve crossed over the wage base threshold. Neither employer should withhold any further Social Security tax from your payor pay half the 12.4% on your behalfuntil year’s end.

It doesn’t matter that individually, neither job has reached the wage base threshold. The wage base threshold applies to all your earned income. But separate employers might not be aware you’ve collectively reached this limit, so you’ll have to notify both employers they should stop withholding for the time being. However, you can always receive reimbursement of any overpayment when you file your taxes.

These are annual figures, so the Social Security tax starts right back up again on Jan. 1 until you hit the next year’s Social Security wage base.

Recommended Reading: Whats The Earliest You Can File Taxes 2022

Should I File A Tax Return If I Receive Social Security Here’s What To Know

Are you required to file a tax return if you receive Social Security benefits? We break it down for you.

With tax season officially beginning on Monday, the question of whether Social Security beneficiaries should file tax returns might be on the minds of the nearly 66 million Americans who receive benefits. If you received Social Security payments in 2022, whether you need to file a return depends on a few factors.

Your age, your marriage status and how much income you earn outside of Social Security benefits all have an impact on whether you need to file a tax return. And even if you aren’t required to file, you may still want to in order to receive refundable tax credits or a refund for income taxes you paid during the year.

For more information on tax season, here’s an explanation of your Social Security Benefits Statement and the best tax software for filing your return in 2023.

How Much Social Security Income Is Taxable

Not all taxpayers are required to pay federal income taxes on their Social Security benefits. Typically, only those individuals who have substantial income in addition to their Social Security benefits are required to pay federal income taxes on Social Security benefits. If you do have to pay taxes on your Social Security benefits, you can either make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your benefits.

How much of your Social Security income is taxable is based on your combined income. Your combined income is calculated by adding your adjusted gross income, nontaxable interest, and one-half of your Social Security benefits.

If you file your federal income taxes as a single person, and your combined incomeis between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of your benefits may be taxable. If your combined income is below $25,000, all of your Social Security income is tax-free.

If you are married and file a joint return, and you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, up to 85% of your benefits may be taxable. If your combined income is below $32,000, all of your Social Security income is tax-free.

Also Check: Turbotax Premier 2021 Tax Software

Retirement Earnings Test Exempt Amounts

Workers who receive benefits before they reach full retirement age are subject to the retirement earnings test. If your income exceeds certain thresholds, then Social Security will withhold benefits until you reach FRA. Like the Social Security tax limit, these thresholds typically increase annually with the national wage index.

There are two annual earnings test exempt amounts. The first applies to individuals younger than retirement age and the other applies to individuals who reach FRA during that year. For younger recipients, Social Security withholds $1 for every $2 in excess of their exempt amount. Individuals who reach retirement age will have $1 withheld for every $3 in excess of their exempt amount.

In 2023, the earnings test exemption amounts will increase to:

- $21,240 for individuals younger than the FRA

- $56,520 for those who reach their FRA

In other words, an individual who earns $21,240 or less in 2023 may be eligible to receive full Social Security benefits. This is up from $19,560 in 2022.

Tax Withholding And Estimated Tax Payments For Social Security Benefits

If you know in advance that a portion of your Social Security benefits will be taxed, it’s a good idea to have federal income taxes withheld from your payment each month. Simply fill out Form W-4V to request withholding at a rate of 7%, 10%, 12% or 22%, and then send the form to your local Social Security office.

If you don’t want to have taxes withheld from your monthly payments, you can make quarterly estimated tax payments instead. Either way, you just want to make sure you have enough withheld or paid quarterly to avoid an IRS underpayment penalty when you file your income tax return for the year.

Read Also: Can I Use Bank Statements As Receipts For Taxes

State Taxation Of Social Security Benefits

In addition to federal taxes, some states tax Social Security benefits, too. The methods and extent to which states tax benefits vary. For example, New Mexico treats Social Security benefits the same way as the federal government. On the other hand, some states tax Social Security benefits only if income exceeds a specified threshold amount. Missouri, for instance, taxes Social Security benefits only if your income is at least $85,000, or $100,000 if you’re married filing a joint return. Utah includes Social Security benefits in taxable income but allows a tax credit for a portion of the benefits subject to tax.

Although you can’t have state taxes withheld from your Social Security benefits, you generally can make estimated state tax payments. Check with the state tax agency where you live for information about the your state’s estimated tax payment rules.

How To Minimize Taxes On Your Social Security

If your Social Security benefit is relatively fixed, albeit with small annual increases, you really have only two avenues left to get into that tax-free zone: reducing tax-exempt interest or adjusted gross income. And since most people dont have tax-exempt interest, youre left with one option.

Therefore, the secret is to reduce your adjusted gross income in order to prevent provisional income from triggering a tax on Social Security, says Kelly Crane, president and chief investment officer at Napa Valley Wealth Management in St. Helena, California.

Here are a few ways to reduce your adjusted gross income to get into the tax-free zone:

Don’t Miss: Tax Preparation Services Springfield Il

How Are Social Security Benefits Taxed

Social Security benefitsincluding retirement, survivors and disability benefitsmay be taxable. The amount of taxes youll pay depends on your income and filing status. The IRS can collect taxes on up to 85% of a persons benefits, though not everyone pays the tax.

To determine whether your benefits are taxable, youll need to do some math and know how much you receive from Social Security and what you pull in from other income sources.

To start:

- Confirm your tax filing status.

- Add up the Social Security benefits you received during the year.

- Calculate 50% of those benefits.

- Tally all of your other income, including wages, pensions, interest, dividends and capital gains.

- Add that total to the half portion of your Social Security benefits.

For instance, say you received $24,000 during the year from Social Security, $11,000 from a part-time job and $1,000 from investment income. Your filing status is single. Your calculations would look like this:

- Half of your Social Security benefits: $24,000 x 50% = $12,000

- Your other income: $11,000 + $1,000 = $12,000

- Your adjusted income: $12,000 + $12,000 = $24,000

Next, take that adjusted income and compare it to the current thresholds that can make Social Security benefits taxable. If your adjusted income exceeds the amount for your filing status, then part of your benefits may be taxable.

| Filing Status |

|---|

Minimize Withdrawals From Your Retirement Plans

Money that you pull from your traditional IRA or traditional 401 will count as income in the year that you withdraw it. So if you can minimize those withdrawals or even not withdraw that money at all, it will help you get close to the tax-free threshold. Of course, this may not apply if youre forced to take a required minimum distribution that pushes you over the edge.

If youre not forced to take an RMD in a given year, consider taking money from your Roth IRA or Roth 401 instead and avoid generating taxable income.

Also Check: Nj State Income Tax Rate

The Tax Is Also Subject To An Income Cap

The Old-Age, Survivors, and Disability Insurance program taxmore commonly called the Social Security taxis calculated by taking a set percentage of your income from each paycheck. Social Security tax rates are determined by law each year and apply to both employees and employers.

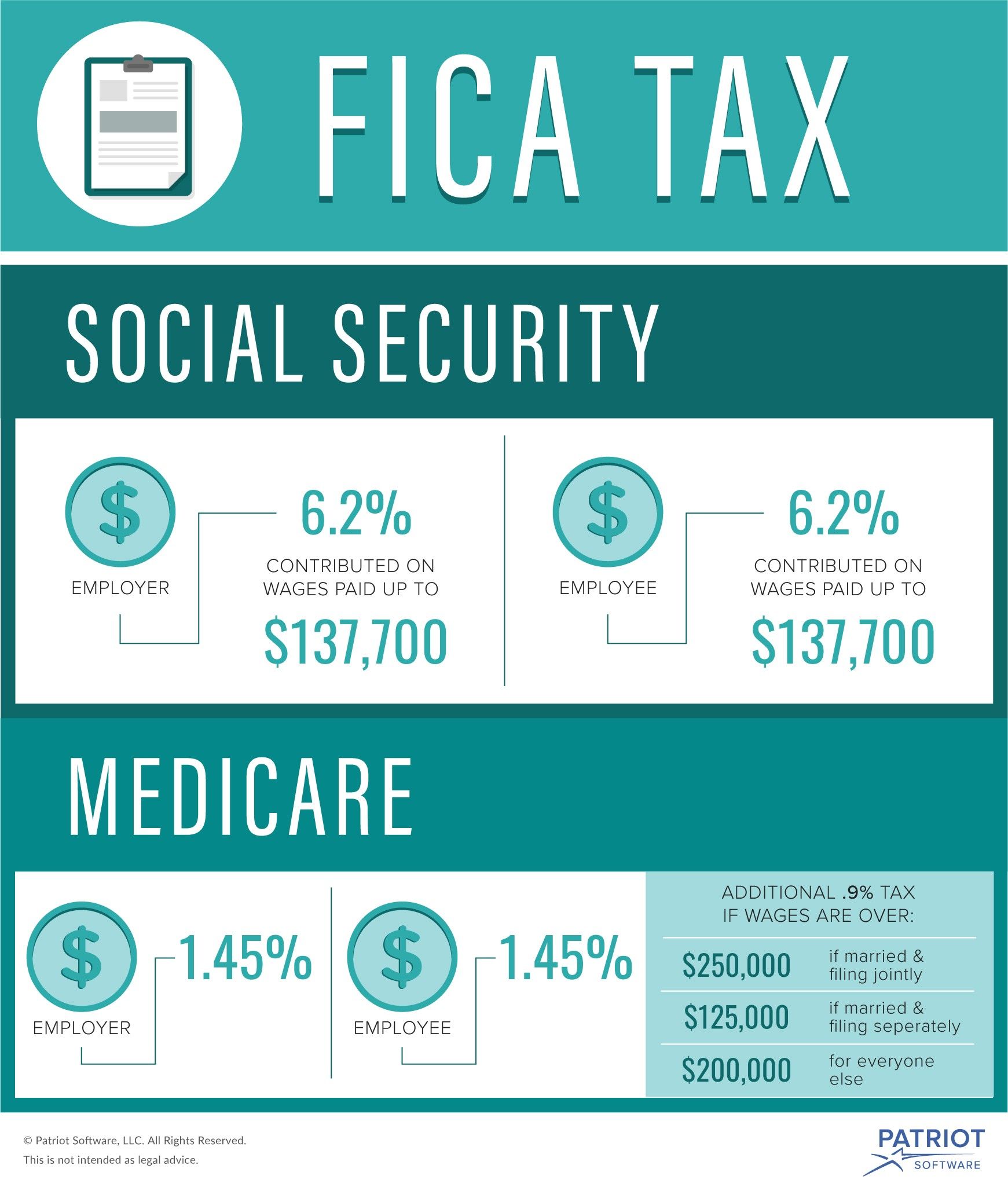

The Social Security tax rate for employees and employers is 6.2% of employee compensation, for a total of 12.4%. Those who are self-employed are liable for the full 12.4%.

The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act . On your pay statement, Social Security taxes are referred to as OASDI, and Medicare is shown as Fed Med/EE. Both Social Security and Medicare are federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

How The Social Security Tax Works

According to the Social Security Administration , an average of 66 million people per month received Social Security benefits on average of $1,681 per month in 2022. Benefit recipients will begin receiving a slightly larger amount of $1,827 due to the cost-of-living adjustment. These payments are funded by the Social Security tax, which is also known as the Old Age, Survivors, and Disability Insurance .

The tax has two parts:

- The first is the payroll tax mandated by the Federal Insurance Contributions Act and the self-employment tax mandated by the Self-Employment Contributions Act

- Medicare tax, or hospital insurance tax, makes up the second part

Payroll taxes are based on an employees gross wages, salaries, and tips. These taxes are typically withheld by an employer and forwarded to the government on the employees behalf. In 2023, the Social Security tax rate is 6.2% for the employer and 6.2% for the employee.

Medicare taxes are split between the employer and the employee, with a total tax rate of 2.9% for the 2022 and 2023 tax years.

Recommended Reading: What Happens If You Don’t Pay Doordash Taxes

How Is The Social Security Tax Used

Income taxes you pay are deposited into the general fund of the United States. They can be used for any purpose, but Social Security taxes are different.

These taxes are paid into special trust funds that should only be used to pay current and future Social Security retirement benefits, as well as disability benefits and benefits for widows and widowers. Today’s workers contribute their percentage, which in turn is paid to today’s beneficiariesthose workers who have retired and who are now collecting Social Security benefits. When today’s workers retire, they’ll tap into the benefits being paid by tomorrow’s workers.

Will You Owe Taxes On Your Social Security Benefits In 2023

Social Security benefits look different than they did a month ago, thanks to the latest cost-of-living adjustment . You might be sizing up how far your new, larger check will buy each month — but you might have less available for spending than you think.

Not everyone knows this, but the government can tax some of your Social Security checks if your income is high enough. A lot of people are likely to encounter this rule for the first time in 2023. Here’s how to know if you’ll be one of them.

You May Like: How To Not Owe Taxes

Individual Social Security Tax Rates

If youre a single filer, and your combined income for the entire year is between $25,000 and $34,000, then up to 50% of your benefits will be taxed. Side noteif you bring in more than $34,000, that percentage goes up to 85%.2

Lets look at an example. Lets say you bring in $65,000 in annual income and you receive $1,750 a month in Social Security benefits. Because youre bringing in more than the $34,000 threshold for single filers, youll pay taxes on 85% of your $21,000 in annual benefitsor $17,850 .

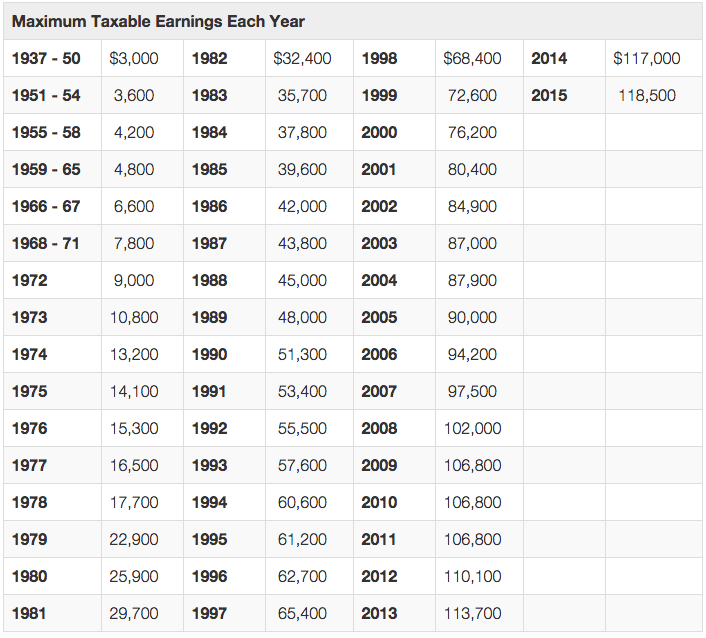

History Of Social Security Tax Limits

The Social Security tax rate rarely changes, as employees have been paying 6.2% since 1990 however, unlike the tax rate, the Social Security tax limit is adjusted annually.

The federal government increased the Social Security tax limit in 10 out of the past 11 years. The largest increase was in 2023 when it was raised almost 9% from $147,000 in 2022 to $160,200 in 2023.

Also Check: File Income Tax For Free

It Isnt Just Retirement Benefits

The taxation rules apply to all forms of benefits paid out of Social Securitys trust funds retirement benefits, survivor benefits and Social Security Disability Insurance . Whichever type of Social Security benefit youre getting, you could owe taxes on it, depending on your overall income.

AARP NEWSLETTERS

Paying Tax On Social Security Benefits

If you do owe taxes on your Social Security benefits, you have two options for paying them. You can pay them by making estimated quarterly payments to the IRS, or you can fill out a form with the SSA and have the taxes deducted from your benefits before you receive them, just as your taxes are deducted from a regular paycheck.

Recommended Reading: Doordash How Much Should I Set Aside For Taxes

Recommended Reading: District Of Columbia Tax And Revenue

Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $147,000 is subject to the Social Security tax for 2022. Since $147,000 divided by $6,885 is 21.3, this threshold is reached after the 22nd paycheck.

For the first 21 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining three pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,964.27 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee’s take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,928.54 to Social Security and $4,791.96 to Medicare.