Calculating Property Taxes In California

California Property Tax Calculator

Californias overall property taxes are below the national average. The average effective property tax rate in California is 0.79%, compared with a national average of 1.19%.

The California Property Tax Calculator provides a free online calculation of ones property tax. Simply type in the propertys zip code and select the assessed home value. Instant results include the Average Tax Rate Percentage and the annual Property Tax. Also includes the average property tax rate in the specific county, the State of California, and nationally.

San Diego County

The San Diego County Treasurer Tax Collector website provides an online payment system for property owners to determine their property tax and pay their tax bill online.

Property owners can easily search their tax bill by inputting their mailing address, parcel/bill number, or unsecured bill number. Then, they view the bill and select the installment and add it to their shopping cart for payment.

In addition, the San Diego County Tax Collector site provides a link to a private vendor called ParcelQuest which provides free information from the San Diego County Assessors Office.

Los Angeles County

The Los Angeles County Assessor provides useful information explaining California property taxes on its website.

In addition, their website provides a Supplemental Tax Estimatorcalculatorfor Los Angeles County property owners. This provides estimated taxes for a recently purchased property.

What State Has No Property Tax

10 States with the Lowest Property Tax in 2020 1) Hawaii Real Estate Market. 2) Alabama Real Estate Market. 3) Colorado Real Estate Market. 4) Louisiana Real Estate Market. 5) District of Columbia Real Estate Market. 6) Delaware Real Estate Market. 7) South Carolina Real Estate Market. 8) West Virginia Real Estate Market.

What Is The Property Tax System And How Does It Work

Three separate government departments are involved in this system.

First, the county assessor determines the worth of your property. After that, an auditor calculates the tax rates based on the assessed value. This gives you the amount of property taxes youll owe.

Once the propertys value and tax assessments are determined, a percentage of your tax payment is distributed to different state, local, and county services. For example, San Diego County gives 45.6 percent of all property taxes received to public schools for upkeep, programs, and renovations.

Finally, the Treasurer-Tax Collector issues tax invoices and collects property taxes.

Read Also: Doordash State Id Number For Unemployment California

Don’t Miss: Free Tax Filing H& r Block

Property Assessments In Ontario

Properties in Ontario are assessed every four years by the Municipal Property Assessment Corporation . Most properties are assessed using a market value-based approach. There are three ways that MPAC uses to determine a propertys market value:

Direct Comparison Approach

Residential properties are valued under this approach. This compares the sales of similar properties in the assessment year to determine a valuation for the property. The assessed value may not equal the actual market value or sale value of a property.

Cost Approach

Unique and rarely traded properties are valued under this approach. This uses the cost of the property if someone were to rebuild it to determine a valuation for the property minus depreciation due to age or other factors. This includes the price of the land and the price of all improvements on top of it. While this takes into account the market value of the land, it does not consider the market value of the property as a whole.

Income Approach

For properties that are dedicated to generating income like rental properties or offices, an income-based approach is used. This approach uses the income generated by the property as well as the sales price to determine its assessed value.

How Much Are Property Taxes In Orange County Ca

The average effective property tax rate in Orange County is 0.69%, while the median annual property tax bill is $4,499.

How do you calculate property tax in California?

A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their homes purchase price by 1.25%. This incorporates the base rate of 1% and additional local taxes, which are usually about 0.25%.

You May Like: What States Have No Income Taxes

How Do Property Taxes Work

Let’s define a couple of key terms before we get into the details of how property taxes work. First, you must become familiar with the “assessment ratio.” The assessment ratio is the ratio of the home value as determined by an official appraisal and the value as determined by the market. So if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% . The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes.

Wondering how the county assessor appraises your property? Again, this will depend on your countys practices, but its common for appraisals to occur once a year, once every five years or somewhere in between. The process can sometimes get complicated. In a few states, your assessed value is equal to the current market rate of your home. The assessor determines this by comparing recent sales of homes similar to yours. In other states, your assessed value is thousands less than the market value. Almost every county government explains how property taxes work within its boundaries, and you can find more information either in person or via your local governments website.

To put it all together, take your assessed value and subtract any applicable exemptions for which you’re eligible and you get the taxable value of your property.

Property Taxes California Ca

Most jurisdictions in the United States levy a tax on real property interests that are deemed ownership rights under state law. The rules differ greatly depending on the jurisdiction. Certain characteristics, on the other hand, are almost ubiquitous. Certain categories of commercial personal property, such as inventory and equipment, are taxed in some jurisdictions. Property taxes are not commonly imposed by states.

The same property may be taxed by many jurisdictions. County or parish governments, cities and/or towns, school districts, utility districts, and special taxation bodies differ by state. Only a few states levy a property tax. The tax is calculated using the subject propertys fair market value and is applied to it on a certain date. The tax is payable by the owner of the property at that time.

Contents

Also Check: Sales And Use Tax Exemption Certificate

What Are The Taxes In Orange County Ca

The minimum combined 2021 sales tax rate for Orange County, California is 7.75%. This is the total of state and county sales tax rates. The California state sales tax rate is currently 6%. The Orange County sales tax rate is 0.25%.

Which county in California has the highest property tax rate?

How much is property tax in Corona CA?

Riverside County Property Tax Rates

| City |

|---|

| 0.81% |

How much is property tax in Pasadena CA?

Property Tax A total tax of 1.0 percent is levied on the assessed value of property as determined by the Los Angeles County Assessor. The City receives approximately 21.0 percent of the 1.0 percent levy on the assessed value. Property tax revenue for FY 2018 is projected at $61.38 million.

Understanding Rate Of Increase Limits

The assessed value of a property is limited to an increase no greater than 2% each year unless a change in ownership or new construction occurs. The 2% increase is originally applied to the base year value, and is thus referred to as the factored base year value. In the case of real property, the factored base year value is the upper limit for property tax purposes. The maximum 2% increase per year continues to be applied until a change in ownership or new construction occurs, even if a temporarily reduced value has been put on the roll under Proposition 8.

Recommended Reading: Penalty For Not Paying Taxes Quarterly

How You Pay Property Tax In California

If youve already made a monthly mortgage payment, its likely that youve paid some of your annual property taxes. Your real estate agent or mortgage lender should be able to tell you more about your property taxes. The initial mortgage payment you make when you first move into your new home is paid from your escrow account. When you receive a bill for your monthly mortgage payment, there should be four separate components that make up the full payment. These components include:

- The principal of your loan

- The interest rate thats attached to your loan amount

- Homeowners insurance payments

- California real property taxes

To make sure that your property taxes are part of your monthly mortgage payment, all you need to do is look at the last mortgage statement you received. You should notice property taxes as a line item somewhere on the statement. If you pay property taxes as part of your mortgage, you shouldnt give much thought to these taxes.

However, there is a deadline for when annual property taxes must be paid. This deadline applies to any homeowner who doesnt make property taxes payments as part of their mortgage payments. Your property taxes are due in full by November 1 every year. In the event that your taxes are paid on a monthly basis, you should notice a $0 balance on November 1.

How Does The Santa Clara County Tax Board Work

In cases of extreme property tax delinquency, the Santa Clara County Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. Proceeds of the sale first go to pay the propertys tax lien, and additional proceeds may be remitted to the original owner.

Where do you find property tax rates in California?

1 California Property Tax Rates. Property taxes in California are applied to assessed values. 2 Los Angeles County. 3 San Diego County. 4 Orange County. 5 Riverside County. 6 San Bernardino County. 7 Santa Clara County. 8 Alameda County. 9 Sacramento County. 10 Contra Costa County.

Is there an app for Santa Clara County?

Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC, a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500,000 property owners with convenient access to pay their secured property tax payments. Learn more about SCC DTAC, Property Tax Payment App.

Don’t Miss: How Do The Rich Avoid Taxes

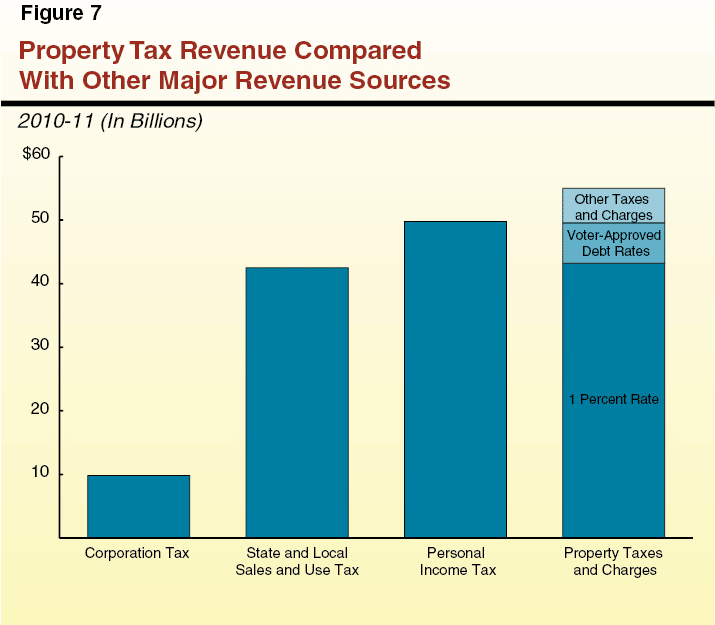

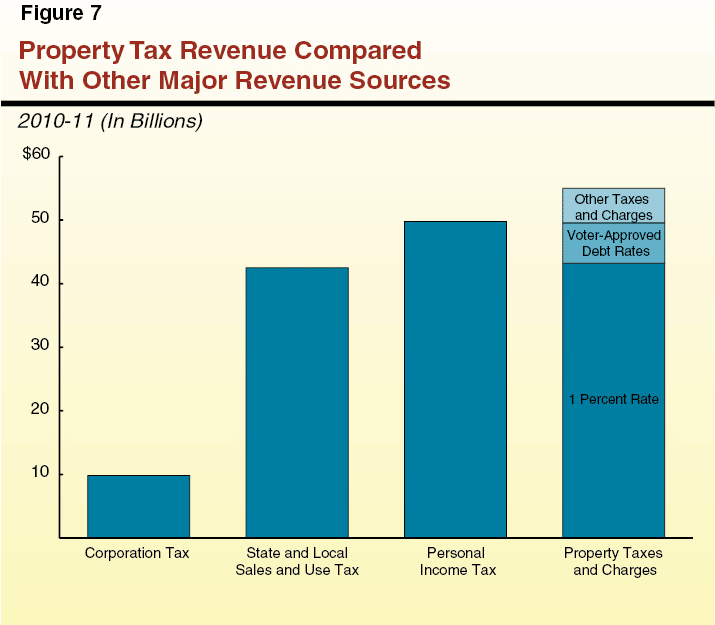

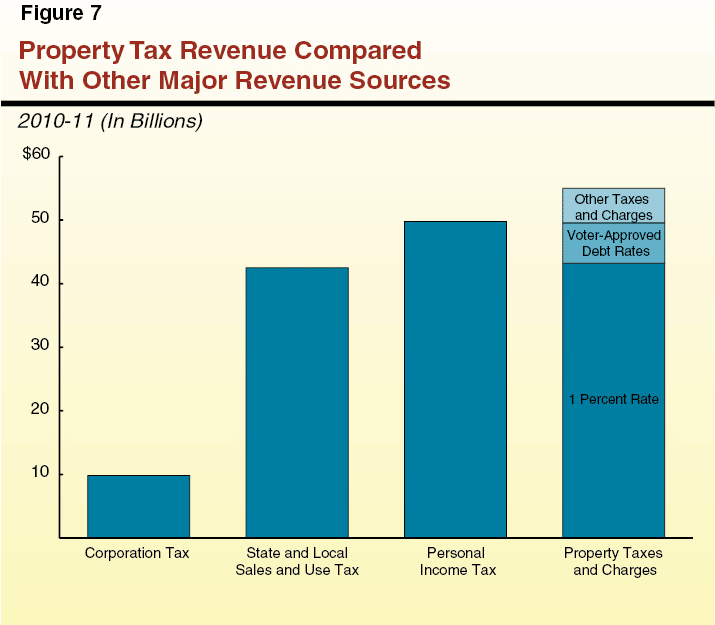

How Do California Property Tax Rates Work

The local government, when assessing property taxes, first uses the 1-percent tax from Proposition 13 .

This is also known as the General Tax Levy. Its just step one in the assessment.

The second step in the assessment is the voter-approved taxes such as school district, city, and water taxes. The same taxes most people pay as part of their property tax.

The third step in the assessment is the specialty taxes such as Mello-Roos taxes, a tax designed to fund special public facilities such as schools and parks.

This method is used to insure various public services are funded.

How Much California Homeowners Pay In Property Taxes Each Year

- Samuel Stebbins, 24/7 Wall St. via The Center Square

Property taxes are the lifeblood of local governments and municipalities across the United States, accounting for over 70% of all local tax revenue. Property taxes – such as taxes levied on homeowners and landowners – go to fund schools, parks, roads, and other public works and services.

While states typically impose a minimum property tax, property taxes are mostly determined at the local level – and are often a percentage of a property or home’s overall value. Depending on where you choose to buy a home, property taxes can range from negligible amounts to nearly matching a mortgage payment.

Across California, the effective annual property tax rate stands at 0.70%, the 17th lowest among states. For context, homeowners in the U.S. pay an average of 1.03% of their housing value in property taxes a year.

The effective property tax rate is calculated by taking the total amount of taxes paid on owner-occupied homes in a given area as a share of the total value of those homes. While an effective property tax rate is useful for comparing taxes at the state level, it is important to note that property tax rates can still vary considerably within a given state.

All data in this story is from the Tax Foundation, a tax policy research organization, and the U.S. Census Bureau’s 2019 American Community Survey.

Don’t Miss: Short Term Capital Gains Tax Rates 2021

Three Types Of California Property Taxes

California property taxes compose of three types of levies.

Los Angeles County Homestead Exemption

For properties considered the primary residence of the taxpayer, a homestead exemption may exist. The Los Angeles County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes.

Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid Los Angeles County property taxes or other types of other debt.

In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. To get a copy of the Los Angeles County Homestead Exemption Application, call the Los Angeles County Assessor’s Office and ask for details on the homestead exemption program. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space.

Also Check: 401k Roth Or Pre Tax

History Of The Property Tax

From the pharaohs of ancient Egypt through the monarchies of Europe and Asia Minor to modern democratic representative governments, taxes on property have been a central form of revenue. The need to identify property and its owners led to the earliest census efforts extending into ancient times. Tax collectors are mentioned often in both the Old and New testaments of the Bible. Whether for a medieval potentate’s war-making efforts or a modern state’s need to provide public service, property taxes are vital, because they are based on the measure of wealth in the area governed.

Los Angeles County Property Tax Deduction

You can usually deduct 100% of your Los Angeles County property taxes from your taxable income on your Federal Income Tax Return as an itemized deduction. California may also let you deduct some or all of your Los Angeles County property taxes on your California income tax return.

Has this page helped you? Let us know!

Read Also: How To Get Copy Of Tax Return

Three Types Of California Property Tax

There are three types of property taxes that California assesses. The first type is the general tax levy, which has been in place since 1978. The tax rate is currently set at 1% of the property value. Another type involves voter-approved bond debts, which are designed to cover the repayment of local and state bonds. The covering of these debts must typically be approved by a 2/3 majority of the voting public. The third and final type of tax in California is a voter-approved assessment for special districts. These districts usually involve fire and school districts.

What Is The Property Tax Rate In California 2020

$2,839.00. The median property tax in California is $2,839.00 per year for a home worth the median value of $384,200.00. Counties in California collect an average of 0.74% of a propertys assesed fair market value as property tax per year.

What is Texas property tax rate?

Texas Property Taxes Property taxes in Texas are the seventh-highest in the U.S., as the average effective property tax rate in the Lone Star State is 1.69%. Compare that to the national average, which currently stands at 1.07%. The typical Texas homeowner pays $3,390 annually in property taxes.

How can I avoid paying property taxes in Texas?

You may apply for homestead exemptions on your principal residence. Homestead exemptions remove part of your homes value from taxation so they lower taxes. For example, your home is appraised at $50,000, and you qualify for a $15,000 exemption, you will pay taxes on the home as if it was worth only $35,000.

Recommended Reading: What Taxes Do You Pay In Texas

How To Calculate Property Taxes In California

Property taxes in California are calculated by the state-approved 1-percent rate, Mello-Roos taxes, parcel taxes, and any additional local government taxes and levies.

Property taxes in California have become an enigma to taxpayers. Everyone in California has heard of Proposition 13 , the initial state guideline which proscribed a minimum 1-percent tax. Naturally, taxpayers assume this means their tax will only be 1-percent of the assessed value of their home. But, thats just the bare minimum. Its really no different than sales tax. Theres the state sales tax then the local sales tax.

The California State Franchise Tax Board

While most states that charge an income tax do so structured after the IRS, California takes some special interpretations towards tax policy. It is an expensive state in which to do business! It taxes at a higher than average rate for personal state tax, and charges both personal and business taxes to small business owners. The IRS does not collect personal income taxes from business owners, because they see that as double-taxing. California subscribes to no such niceties! To add to that, California also charges non-residents on their income based within the state, if applicable.

The California Franchise Tax Board collects more than $50 billion in annual personal income tax alone, and an additional $9.5 billion in annual corporate income taxes. The California FTB is one of the few US tax agencies which have been convicted for fraud this was 6 years ago in Nevada. It goes to show that sometimes, California has a bit too much weight to throw around.

Don’t Miss: Tax Preparation Services Springfield Il