Laws Concerning Child Labor

Minors aged 14 and 15 are not permitted to work during school hours under Florida or federal law, although they are permitted to work up to 15 hours per week, with no more than three hours per day on school days.

Minors aged 16 and 17 may work for a total of 30 hours per week, but not during school hours. There are some exceptions for educational purposes, but 16- and 17-year-old in Florida are not permitted to work before 6:30 a.m. or after 11 p.m. There are exceptions if they have completed high school or work for their parents.

Lowest Income Tax Rates

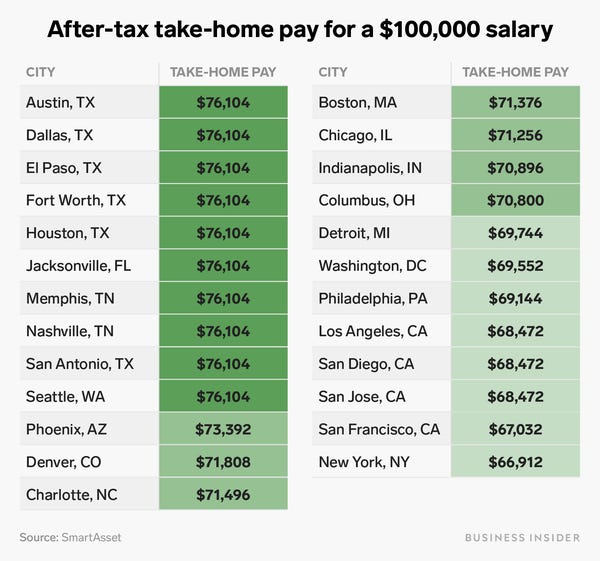

Moving to Florida is a smart choice for many reasons, but one of them will undoubtedly be its low state income tax. Many new residents will be pleasantly surprised by how much they save in taxesand how quickly it adds up, especially if you’re an employee with a competitive salary. With no personal and state income taxes and no inheritance or estate taxes, Florida offers some of America’s most favorable living conditions.

The rates are generally low throughout all income levels, with no bracket above 5.5 percent. Many states’ top brackets start at higher levels than that, even on lower incomes. In fact, if you’re single and earn less than $20,000 a year, you won’t have to pay any state tax at allFlorida doesn’t have an income tax for low-income workers or retirees. This can give you an excellent opportunity to save for your future.

Minimum Wage And Tips

In addition to tips, Florida’s current minimum wage is $8.65 per hour, with a minimum of $5.63 per hour for tipped employees. It adheres to government guidelines on minimum wage exemptions.

In 2019, Florida’s minimum wage surpassed the federal rate to prevent compliance concerns, it’s best to pay the higher state rate. If you have tipped staff, your state rates will be significantly higher than the federal rates. The difference between the state minimum pay of $8.46 per hour and the federal minimum wage of $7.25 per hour is only $1.

The state wage for tipped employees, however, is $5.44 per hour, which is more than double the federal rate of $2.13 per hour.

This is significant since you’ll need to compensate for a significant differential in tipped employees’ weekly pay. In addition to the tips, it is your responsibility to cover whatever amount is required to make up for the minimum wage.

You should also keep in mind that displaying a Florida minimum wage banner prominently in your workplace is required by law. You must also post the Florida Reemployment Help notice in your workplace, including the eligibility conditions for unemployment assistance.

Florida’s minimum wage is set to increase to $15 per hour by 2026. The Consumer Price Index for Urban Wage Earners and Clerical Workers will then be used to alter the price.

Employers in Florida can apply up to $3.02 per hour in tip credit to tip-earning employees.

|

New Wage As Of |

|

$11.98/hour + tips |

Also Check: Irs Track My Tax Return

What Is The Tax Percentage In Florida

The tax percentage rate in Florida is 0% for personal income taxes. While individuals dont have to pay Florida income tax, corporations do. In fact, Florida imposes a 4.458% corporate income tax.

Taxpayers are required to file Florida corporate income tax returns electronically if required to file federal income tax returns electronically, or if $20,000 or more in Florida corporate income tax was paid during the prior state fiscal year.

View more information about who files corporate tax in Florida.

How Calculate Payroll Taxes In Florida

Now that you have a firm grasp of the legalities and numbers you need to pay attention to when processing payroll, youre half-equipped with what you need to know to set up and run your payroll system on your own.

Several factors determine the effectiveness and efficiency of certain tools and functionalities for running a payroll system. However, in the following sections, well show you how to combine the necessary factors to implement and manage your payroll management system in just six easy-to-follow steps. Read on to find out how to take advantage of various payroll tools and resources to implement your payroll on your own seamlessly.

You May Like: How Much In Taxes Do I Owe

How Much Tax Is Taken Out Of Paycheck In Florida

Overview of Florida Taxes

| FICA and State Insurance Taxes | 7.80% |

What percent of your paycheck goes to taxes in Florida?

- How Your Florida Paycheck Works. Every pay period your employer will withhold 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Your employer will match that by contributing the same amount. So, if youre self-employed youll need to withhold 12.4% and 2.9% of your earnings.

Calculate Your Employees Pay

This is usually the most complex step of the process, but you can simplify things using one of these top payroll software options. You can use a timesheet, attendance systems, or digital time to keep track of your employees working hours. When calculating earnings from working hours, you can only apply the regular hourly rate to 40 hours in a week any extra hours must be counted as overtime, which is 50% more of the normal hourly rate. But besides their working hours, you also need to factor in overtime, tips, commissions, PTO, etc. when calculating your employees earnings.

The calculation of a salaried employees pay is much more straightforward than that of employees paid hourly. You only need to divide their annual pay by the number of paydays in a calendar year.

Check out our complete guide on how to calculate payroll if you need more help.

Also Check: How To Fill Out Federal Tax Form

Additional Deductions On Florida Paychecks

In addition to federal taxes, Florida employers can make other deductions. This income goes toward services like health insurance and retirement planning. These deductions apply before taxes, so they lower an employees total taxable income.

The most common pre-tax deductions include:

- Court-ordered garnishments such as alimony, child support, outstanding loans, and back taxes

- Commuter benefits

Note: Our calculator can only account for federal and state deductions. As a result, pre-tax deductions do not factor into our estimated paychecks.

Florida Worker’s Compensation Insurance

Employees working in various occupations in Florida also enjoy institutional access to insurance coverage for work-related accidents and illnesses. Employers in certain fields must run workers compensation insurance for all their employees in Florida, with the cost of each policy determined by factors like the nature of the occupation and the claim history of the business. Minimum level plans are required for construction companies with at least one employee, non-construction companies with a minimum of four employers , and agricultural businesses with at least six part-time and/or at least 12 part-time employees.

Subcontractors are also required to provide coverage if theyve hired at least one employee for at least 30 days. Businesses issuing the contracts are also obliged to check for the subcontractors compliance with this coverage.

Nonetheless, certain categories of business owners are exempted from workers compensation requirements. You have the liberty to decline to offer workers compensation if youre a corporate officer, sole proprietor, or a partner working with non-construction companies.

You May Like: What Is The Oasdi Tax

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

What States Have Local Taxes

There are 15 states with municipalities, counties, school districts, or special districts that impose local income taxes: Alabama, Maryland, Ohio, Colorado, Michigan, Oregon, Delaware, Missouri, Pennsylvania, Indiana, New Jersey, Washington, Kentucky, New York, and West Virginia.

To find your local taxes, head to our Florida local taxes resources. To learn more about how local taxes work, read this guide to local taxes.

Don’t Miss: Irs Free Tax Filing 2022

Florida New Hire Reporting

Youre required by both federal and state laws to report new hires and rehires to the Florida New Hire Reporting Center within 20 days from their assumption date. You may be fined up to $25 per employee for neglecting to report them or up to $500 per new employee if you intentionally failed to report them. You might even be fined for not reporting yourself you need to report yourself if youre self-employed.

Hiring laws currently prevailing in Florida also prohibit the consideration of several factors in the hiring process. These include race, color, religion, sex, age, country of origin, and health conditions such as AIDs, sickle cell, genetic conditions, etc.

Payroll Management For Florida Businesses

Even though Florida has fewer tax considerations than other states, managing payroll is never easy. Investing in payroll services takes some of the work off your plate and ensures your employees receive fair pay. By setting this work aside, you and your employees can focus on providing service customers love.

If you need help getting started on payroll management, QuickBooks team of payroll experts is here to help.

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.s money transmission licenses, please visit .

Read Also: Your Tax Return Is Still Being Processed 2022

How Your Florida Paycheck Works

Living in Florida or one of the other states without an income tax means your employer will withhold less money from each of your paychecks to pass on to tax authorities. But theres no escaping federal tax withholding, as that includes both FICA and federal income taxes. FICA taxes combine to go toward Social Security and Medicare. The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that youll benefit from in your retirement years.

Every pay period, your employer will withhold 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Your employer will match that by contributing the same amount. Note that if youre self-employed, youll need to pay the self-employment tax, which is the equivalent of twice the FICA taxes – 12.4% and 2.9% of your earnings. Half of those are tax-deductible, though. Earnings over $200,000 will be subject to an additional Medicare tax of 0.9%, not matched by your employer.

Your employer will also withhold money from every paycheck for your federal income taxes. This lets you pay your taxes gradually throughout the year rather than owing one giant tax payment in April. The rate at which your employer will apply federal income taxes will depend on your earnings on your filing status and on taxable income and/or tax credits you indicate W-4 form.

Requirements For Breaks Lunches And Time Off

Florida’s paid time off restrictions are in accordance with federal guidelines, which are rather lenient. We provide a basic introduction below, but our guide to PTO contains more in-depth information as well as advice on how to create a time-off policy.

Every four hours, minors must take a 30-minute break. Employers in Florida are not required to provide breaks to employees aged 18 and above, but if they do, the breaks are normally 20 minutes long and must be paid.

Don’t Miss: Advance Premium Tax Credit Repayment

What Percentage Of My Paycheck Is Withheld For Federal Tax 2021

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether youre filing as single, married jointly or married separately, or head of household.

How Much Is $15 An Hour After Taxes

What is $15 an hour annually after taxes? With the average single American contributing 29.8% of their earnings to income taxes, Medicare and Social Security, your average take home salary annually on $15 an hour after taxes will be $21,902.40.

You May Like: Pre Tax Or Roth 401k

Florida Meal Break Laws

The state law stipulates a mandatory meal break for minor employees younger than 18 years, while it defers to federal labor laws for the regulation of mealtime for adult employees. Employers are not required by federal law to provide meal breaks for adult employees. Those who provide meal breaks lasting less than 20 minutes are required to pay for the period, but break periods lasting 30 minutes or longer can go unpaid, provided the employees are allowed to do as they please during that period.

Calculate And Subtract Federal Taxes:

Federal Taxes are taxes deducted from almost every employee, regardless of which state or county they work in.

Federal Taxes are calculated according to the details provided by the employee on Form W-4, which comprises of income, filing status, number of dependents, number of allowances, number of jobs, etc.

The details are form W-4, are assessed and used by the employer to deduce the federal tax bracket, in which the employee’s taxable wage lay upon.

Federal Taxes ranges from 0% to 37% have seven tax brackets, depending on filing status, income and number of allowances claimed. Below is the income tax details for the year 2019:

| 37% |

You May Like: How Much Tax Is Taken From My Check

How Much Are The Payroll Taxes In Florida

Payroll taxes include Medicare tax, with a tax rate of 1.45% on all earnings and Social Security tax, with a rate of 6.2% on the first $147,000 as of 2022. Youre also responsible for paying state and federal unemployment taxes.

- Youre required to pay a reemployment rate of 2.7% if youre a new employer. That rate applies to $7,000 on an annual basis for every employee. Earnings above the $7,000 are not taxable under Florida payroll taxes.

- If youre a new owner taking over a business, you can use the tax rate from the previous owner but youre also liable then for any outstanding amounts that might be due.

- If youve been in business for more than 10 quarters, the tax rate can range from 0.10% to 5.4% per employee.

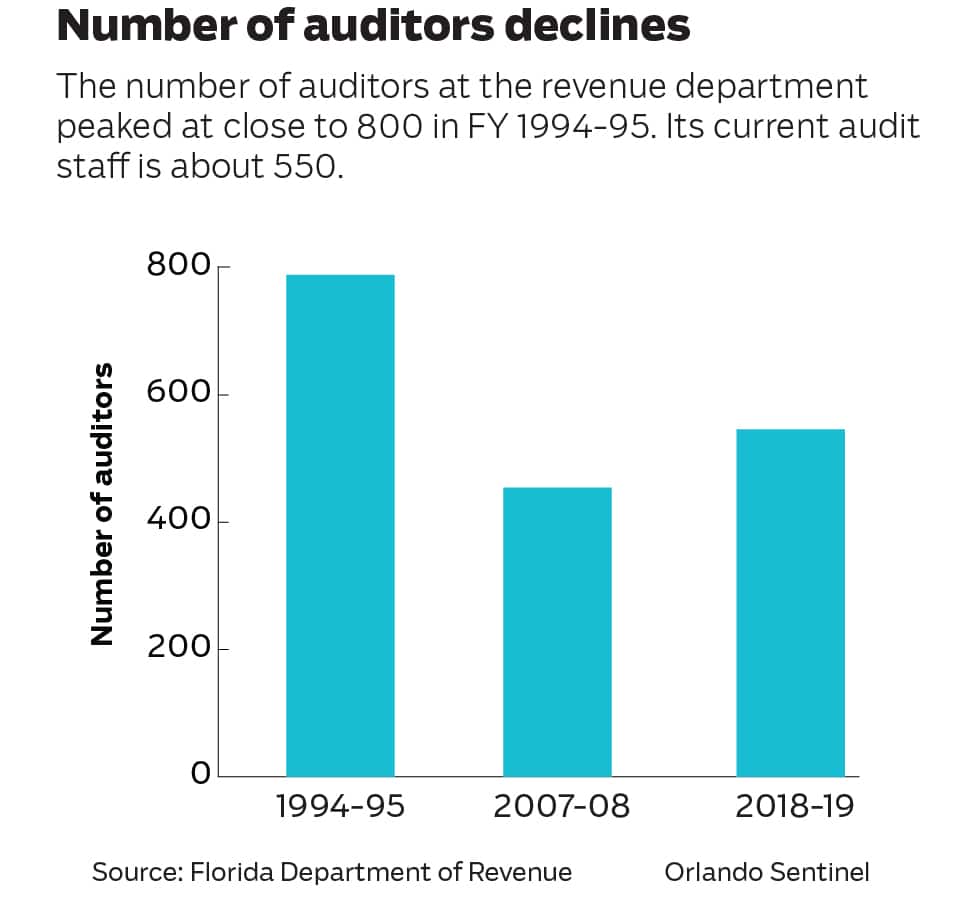

The maximum rate is 5.4%, but it can also be used as a penalty for late or delinquent payments of more than a year. An auditor can also assign the 5.4% if requests are not fully met and complied with. If you are assigned a high tax rate, you can appeal it if you file the appropriate paperwork, within 20 days.

Florida Is A Popular Destination For Retirees Not Only Because Of The Great Weather But Also Because Of The Absence Of State Income Tax

Just because Florida doesnt have state income tax doesnt mean that you dont have to worry about other types of taxes. As one of the 2.3 million Americans who own a small business in Florida, you are responsible for payroll taxes.

While its similar to the process for other states, you may find the process in Florida easier and more streamlined. For example, the laws about overtime and leave are not as restrictive as what you would find in other states. You can take advantage of the Paid Time Off laws that require that employees use their time off within the year they accrued it. Its the use-it-or-lose-it policy, which is beneficial to you as an employer for a variety of reasons.

Recommended Reading: When Are Taxes Due By

In Washington Some Taxes Are Exempt

Taxes can vary greatly depending on where and who is required to file. And when taxes are deducted from your paycheck, they can be even more variable.

Thats why many people wonder what taxes are deducted from their paycheck, when working in Washington because, unlike in other states, several taxes dont apply to local workers.

Florida State Income Tax

Florida has a population of over 21 million and is famous for its miles of beautiful beaches. The median household income is $52,594 .

Brief summary of Florida state income tax:

- zero state income tax

Florida tax year starts from July 01 the year before to June 30 the current year. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Recommended Reading: Capital Gains Tax On Primary Residence

Why Is Compliance So Important

Its essential that you comply with requests for information and records, but its also important to stay on top of payment schedules and any other documentation requirements.

- Report new hires .

- Verify weekly earnings.

- Report separations.

To avoid penalties and higher tax rates, its important to stay on top of all compliance documentation and payments, but its easy to overlook or miss the deadlines. Thats why so many companies are now turning to payroll services. The fact that they dont have to worry about incorrectly filed documents or missed deadlines are just one small part of why payroll services really do save companies time and money.

Gone are: the frustration, the confusion, the guesswork, and indecision. Atlantic Payroll Partners offer the best payroll services to meet your needs. We can pick up where you left off and make it a streamlined, effective, accurate, and secure payroll solution that just runs like clockwork. You wont ever have to worry about payroll taxes again.