What Is The Federal Tax On $10000

Income Tax Calculator California

If you make $10,000 a year living in the region of California, USA, you will be taxed $885. That means that your net pay will be $9,115 per year, or $760 per month. Your average tax rate is 8.9% and your marginal tax rate is 8.9%.

You May Like: How Can I Make Payments For My Taxes

Massachusetts Tax Refund 2022

But it’s important to note that the 2022 tax refund program in Massachusetts is a little different than other state stimulus programs because eligible Massachusetts taxpayers will each receive a different amount of money in their tax refund checks. Thats because Massachusetts will mail a check or provide a direct deposit that amounts to about 14% of each eligible taxpayers state income tax liability from their 2021 tax return.

How You Can Affect Your Ohio Paycheck

If you want a bigger Ohio paycheck, there are several steps you can take. For starters, you can fill out a new W-4 form so that you can adjust your withholdings. This can decrease the amount your employer withholds and thus make each paycheck bigger. Just remember that you might have a bill during tax season if you dont withhold enough throughout that year. Another option to increase the size of your Ohio paycheck is to seek supplemental wages, such as commissions, overtime, bonus pay, etc. The tax withholding rate on supplemental wages is a flat 3.5%.

On the other hand, you may want to shrink the size of each paycheck for tax reasons. If youre getting a big tax bill every year, you might want to fill out a new W-4 form and request additional withholding. You can also specify a dollar amount to withhold from each paycheck in addition to what your employer is already withholding. There is a line on the W-4 where you can write in any additional withholding you want. If youre unsure how much to write in, use the paycheck calculator to get an idea of what your tax liability is. The end result of requesting an additional withholding is receiving smaller paychecks, but you may have a smaller tax bill or even a refund come tax season.

Also Check: Can I Use Bank Statements As Receipts For Taxes

Overview Of Florida Taxes

Florida has no state income tax, which makes it a popular state for retirees and tax-averse workers. If youre moving to Florida from a state that levies an income tax, youll get a pleasant surprise when you see your first paycheck. Additionally, no Florida cities charge a local income tax. That means the only taxes youll see withheld from your paycheck are federal taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

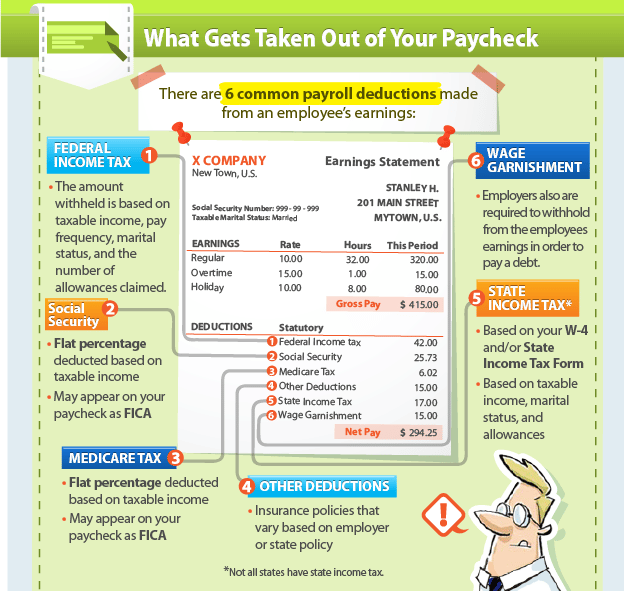

How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

Read Also: Can You Write Off Property Tax

Massachusetts Median Household Income

| 2011 | $62,859 |

In Massachusetts, your employer will withhold money from your paychecks to put toward your state income taxes. You can fill out Form M-4 and give it to your employer to indicate withholding exemptions.

The M-4 is like the W-4, but for Massachusetts state taxes. As on the W-4, you can indicate on your M-4 that youd like your employer to withhold an additional amount of money. Like the W-4, the M-4 can be revised and filed again at any point during the year if your situation changes . But if your information is the same on both your M-4 and W-4, you dont have to fill out the former. You can just give your employer your W-4 and leave it at that.

If you earn money in Massachusetts, your employer will withhold state income taxes from your earnings, regardless of whether or not you are a Massachusetts resident. To report your Massachusetts income you must file a non-resident income tax return in Massachusetts.

If youre a Massachusetts resident, but you work for a company in another state that doesnt do business in Massachusetts or have a Massachusetts office, your employer may or may not withhold Massachusetts income tax payments from your paychecks. Its up to you to negotiate this with your employer. If your employer doesnt withhold for Massachusetts taxes, you will have to pay those taxes in a lump sum at tax time or make estimated tax payments to the state .

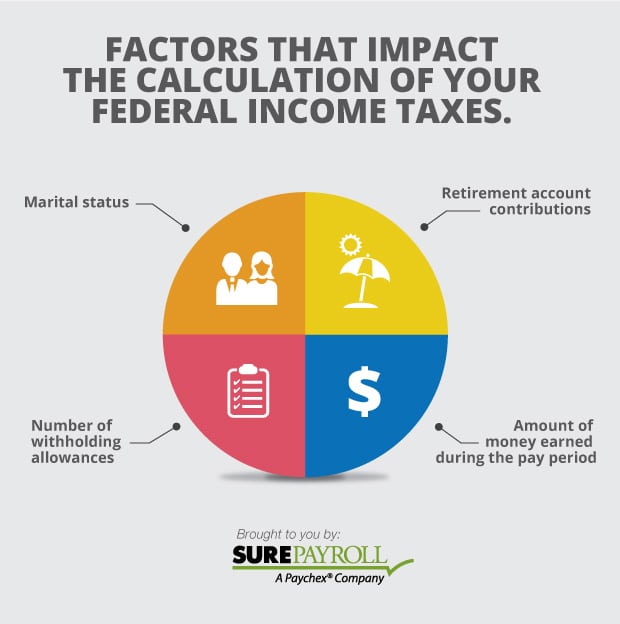

How You Can Affect Your California Paycheck

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you choose to save more of each paycheck for retirement, for example, your take-home pay will go down. Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise, so they dont experience a smaller paycheck and get discouraged from saving.

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your companys insurance offerings.

If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of your paychecks. If you take more allowances, you might get a smaller refund but you should get bigger paychecks. Conversely, if you always owe tax money come April, you may want to claim fewer allowances so that more money is withheld throughout the year.

Recommended Reading: Are Medical Insurance Premiums Tax Deductible

Whos Eligible For The 2022 Massachusetts Tax Refund

If you paid personal income taxes in Massachusetts in 2021 and filed your 2021 Massachusetts tax return by October 17, 2022, you are eligible to receive a 2022 Massachusetts tax rebate by the end of the year.

However, if you haven’t filed your Massachusetts tax return, you still have time to do so. As long as you file by September 15, 2023, you can still receive the 2022 Massachusetts tax refund,according to state officials.

How Much In Taxes Is Taken Out Of Your Paycheck

Where does the money go, and what is it used for?

If you’re making money, chances are you’ll have to pay taxes on it. In fact, Uncle Sam takes a decent-sized chunk of your paycheck before it even hits your bank account. Before you sign a lease or nail down your budget, youll need to figure out your “take-home pay,” or the amount of your hard-earned money that will actually end up in your pocket.

In this article, well answer two questions: How much can you expect to pay in taxes, and just what is that tax money used for?

You May Like: Travis County Tax Office – Main

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

Overview Of Texas Taxes

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Don’t Miss: What Is Real Estate Tax

How Your California Paycheck Works

Your job probably pays you either an hourly wage or an annual salary. But unless youre getting paid under the table, your actual take-home pay will be lower than the hourly or annual wage listed on your job contract. The reason for this discrepancy between your salary and your take-home pay has to do with the tax withholdings from your wages that happen before your employer pays you. There may also be contributions toward insurance coverage, retirement funds, and other optional contributions, all of which can lower your final paycheck.

When calculating your take-home pay, the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Your employer withholds a 6.2% Social Security tax and a 1.45% Medicare tax from your earnings after each pay period. If you earn over $200,000, youll also pay a 0.9% Medicare surtax. Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you work for yourself, youll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

Tennessee Median Household Income

| 2010 | $41,461 |

You won’t pay any state income tax earned in Tennessee. You also won’t have to pay any local income taxes, regardless of which city you reside in.

Prior to 2021, Tennessee levied a flat tax on income earned from interest and dividends. This was called the “Hall Income Tax” after Sen. Frank Hall, the senator who sponsored it in 1929. At its peak, this tax rate used to be 6%, but a bill signed in 2016 by Governor Bill Haslam set the Hall Income Tax on a track to get repealed by 2021. The tax rate was lowered by 1% each year, meaning it was 1% in 2020, 2% in 2019, 3% in 2018 and so on. So as of Jan. 1, 2021, the Hall Income Tax is fully repealed, meaning Tennessee now has no income taxes of any kind.

While you won’t feel a significant impact from a traditional state income tax in Tennessee, the downside is that Tennessee sales tax rates deal a tough hit to taxpayers’ cash flows during the year. Tennessee residents pay the highest overall sales tax nationwide, with rates ranging from 8.50% to 9.75% depending on where you live. This doesn’t affect your paycheck, but your wallet will feel it whenever you make a purchase.

A financial advisor in Tennessee can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Read Also: Hr Block Free Tax Filing

You Live And Work In Different States

Withholding tax can get fairly complicated if you work remotely, in a different state than where your employer is found. Each state law on taxes has its own reciprocities and follows special rules when calculating that withheld tax.

For example, a resident of Alabama whose employer is outside of Alabama will not have their federal income tax withheld by Alabama. That being said, the employer will still be subjected to wage taxes by the end of the year. The same thing goes for states like Mississippi or North Dakota.

However, there are states such as Oklahoma that have slightly different rules. If the state where your employer is located withholds state income tax, you wont have to pay income tax to Oklahoma. However, if the state of your employer doesnt charge federal income tax, then the state of Oklahoma will charge that tax instead.

How Your Florida Paycheck Works

Living in Florida or one of the other states without an income tax means your employer will withhold less money from each of your paychecks to pass on to tax authorities. But theres no escaping federal tax withholding, as that includes both FICA and federal income taxes. FICA taxes combine to go toward Social Security and Medicare. The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that youll benefit from in your retirement years.

Every pay period, your employer will withhold 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Your employer will match that by contributing the same amount. Note that if youre self-employed, youll need to pay the self-employment tax, which is the equivalent of twice the FICA taxes – 12.4% and 2.9% of your earnings. Half of those are tax-deductible, though. Earnings over $200,000 will be subject to an additional Medicare tax of 0.9%, not matched by your employer.

Your employer will also withhold money from every paycheck for your federal income taxes. This lets you pay your taxes gradually throughout the year rather than owing one giant tax payment in April. The rate at which your employer will apply federal income taxes will depend on your earnings on your filing status and on taxable income and/or tax credits you indicate W-4 form.

You May Like: Johnson County Property Tax Search

What Should I Do If I Havent Gotten Any Child Tax Credit Payments

The 2021 advance monthly child tax credit payments started automatically in July. Even though child tax credit payments are scheduled to arrive on certain dates, you may not have gotten the money as expected for a few reasons. The IRS may not have an up-to-date mailing address or banking information for you. The mailed check may be held up by the US Postal Service or, if it was a recent payment, the direct deposit payment may still be being processed.

Its also important to note that if youve been a victim of tax-related identity theft, you wont receive child tax credit payments until those issues have been resolved with the IRS. If the issues arent cleared up this year, youll get the full amount when you file taxes in 2022. And keep in mind that even if you have unpaid state or federal debt, you should still receive child tax credit money if youre eligible.

In September, roughly 700,000 families did not receive a payment due to an IRS technical error. Problems with missing payments were also reported in previous months among mixed-status families, where one parent is a US citizen and the other is an immigrant, though that issue should have been corrected for later payments.

Ohio Median Household Income

| 2010 | $45,090 |

When you look at your Ohio paycheck, youll see the federal withholding as described above, plus any additional withholdings that you may have set up, such as for your 401 contributions or health insurance premiums. But youll also see a withholding for state taxes. Because Ohio collects a state income tax, your employer will withhold money from your paycheck for that tax as well.

As mentioned above, Ohio state income tax rates range from 0% to 3.99% across six brackets. The same brackets apply to all taxpayers, regardless of filing status. The first bracket covers income up to $25,000, while the highest bracket covers income higher than $110,650.

Also Check: Still Haven’t Received My Tax Refund 2022

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.