How To Take Taxes Out Of Your Employees Paychecks

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.There are 18 references cited in this article, which can be found at the bottom of the page. This article has been viewed 15,048 times.

If you are an employer who has one or more employees, you will most likely be required to withhold various taxes from every employees paycheck. To set up your withholding procedures, you will need to apply for tax identification numbers with your state department of revenue and the Internal Revenue Service . When it comes time to withhold taxes, you will generally withhold state and federal income tax as well as federal social security and Medicare taxes. You may also be required to withhold other taxes periodically . In addition to withholding funds from every employees paycheck, you are also required to deposit those funds with your state and federal government periodically. Finally, either quarterly or once a year, you will be required to file a return as an employer.

What Should I Put On My W

If you got a huge tax bill when you filed your tax return last year and dont want another, you can use Form W-4 to increase your withholding. Thatll help you owe less next time you file. If you got a huge refund last year, youre giving the government a free loan and could be needlessly living on less of your paycheck all year. Consider using Form W-4 to reduce your withholding.

Here are some steps you might take toward a specific outcome:

Account For Multiple Jobs

If you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding.

-

For the highest paying jobs W-4, fill out steps 2 to 4 of the W-4. Leave those steps blank on the W-4s for the other jobs.

-

If youre married and filing jointly, and you both earn about the same amount, you can check a box indicating as much. The trick: Both spouses must do that on their W-4s.

-

If you dont want to reveal to your employer that you have a second job, or that you get income from other non-job sources, you have a few options: On line 4, you can instruct your employer to withhold an extra amount of tax from your paycheck. Alternatively, dont factor the extra income into your W-4. Instead of having the tax come directly out of your paycheck, send estimated tax payments to the IRS yourself instead.

Also Check: H & R Block Free Online Taxes

Disagree With Your 1099

Important:

If you disagree with any of the information provided on your 1099-G tax form, you should complete the Request for 1099-G Review.

You may send the form back to NYSDOL via your online account, by fax, or by mail. Follow the instructions on the bottom of the form.

Once NYSDOL receives your completed Request for 1099-G Review form, it will be reviewed, and we will send you an amended 1099-G tax form or a letter of explanation.

Everyone Should Check Withholding

The IRS recommends that everyone do a Paycheck Checkup in 2019. Though especially important for anyone with a 2018 tax bill, its also important for anyone whose refund is larger or smaller than expected. By changing withholding now, taxpayers can get the refund they want next year. For those who owe, boosting tax withholding in 2019 is the best way to head off a tax bill next year. In addition, taxpayers should always check their withholding when a major life event occurs or when their income changes.

Don’t Miss: Who Does Not Have To File Federal Taxes

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

California Median Household Income

| 2011 | $57,287 |

So what makes Californias payroll system different from the systems you might have encountered in other states? For one thing, taxes here are considerably higher. The state has ten income tax brackets and the system is progressive. So if your income is on the low side, you’ll pay a lower tax rate than you likely would in a flat tax state. Californias notoriously high top marginal tax rate of 13.3%, which is the highest in the country, only applies to income above $1 million for single filers and $2 million for joint filers.

While the income taxes in California are high, the property tax rates are fortunately below the national average. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.

California also does not have any cities that charge their own income taxes. However, sales tax in California does vary by city and county. This wont affect your paycheck, but it might affect your overall budget.

California is one of the few states to require deductions for disability insurance. This may seem like a drag, but having disability insurance is a good idea to protect yourself and your family from any loss of earnings you might suffer in the event of a short- or long-term disability.

You May Like: How Can Tax Identity Theft Occur

How You Can Affect Your Florida Paycheck

If you want a bigger Florida paycheck you can ask your employer about overtime, bonuses, commissions, stock options and other forms of supplemental wage pay. Just like regular income, supplemental wages are not taxed at the state level in Florida. However, your employer will withhold federal income taxes from your supplemental wage payments.

If you want to shelter more of your Florida earnings from a federal tax bite, you can max out your 401 so that more of your paycheck is going to tax-advantaged retirement savings. You can also contribute to a tax-free FSA or HSA to use for medical expenses. If you opt to contribute to an FSA account, remember that the money is use-it-or-lose-it and doesnt roll over from year to year.

But dont stop there. Ask your employer or HR department about other tax-advantaged places for your money, such as commuter benefits that let you pay for parking or public transit with pre-tax dollars.

How Are These Taxes Being Calculated

If you are employed under a U.S.-registered business, the burden is off your shoulder as your employer will make the computation for you and automatically deducts it on your gross pay. However, if you are a self-employed or a freelancer, you need to make the calculations for yourself. You can use this app to compute your federal tax withholding. For state taxes, you may refer directly to your State Department of Revenue to know the imposed individual tax systems.

Don’t Miss: What Are State Income Taxes

Dont Overpay The Irs By Having Too Much Tax Withheld From Your Paycheck

The United States has a pay as you go federal income tax. This means you must pay your income taxes to the IRS throughout the year, instead of paying the whole amount due on April 15. If youre an employee, this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS.

The average taxpayer gets a tax refund of about $2,800 every year. This is because they have too much tax withheld from their paychecks.

In effect, taxpayers who get refunds are giving the IRS an interest-free loan of their money. Nevertheless, many taxpayers like getting refunds. Indeed, there were widespread complaints when many taxpayers received smaller refunds for 2018 than in past years because the IRS recalculated their withholding to take into account the changes brought about by the Tax Cuts and Jobs Act.

If you like getting a refund, go ahead and overpay your withholding. Some people view this as a form of forced savings. However, youll be better off if you dont have too much tax withheld. Ideally, your withholding should match the actual amount of tax you owe for the year. This way youll have more money in your pocket each month.

The amount of income tax your employer withholds from your regular pay depends on two things:

- the amount you earn, and

- the information you give your employer on Form W4.

Tax preparation software can also calculate your withholding.

Dont Miss: Will Property Taxes Go Up In 2022

What Are Withholding Allowances

Withholding allowances were exemptions that employees used to use to claim from federal income tax, using Form W-4. Withholding allowances were used to determine an employees withholding tax amount on their paychecks. The more allowances an employee choose to claim, the less federal tax their employer deducted from their pay.

Withholding allowances are no longer used on the 2020 W-4 form.

Don’t Miss: E File Income Tax India

How Do I File Taxes If Im Unemployed

You file taxes similarly to how youd file if you were employed. Youll still receive your W-2 form from your employer, along with any other tax forms, such as those associated with a severance package or self-employment work. Plus, your state will send you a Form 1099-G for any unemployment you received. All of this income will need to be claimed on your tax return.

Also Check: How To File Quarterly Taxes

What Is A W

A W-2 is a form your employer sends you at the end of every year. A W-2 says how much money you earned during the year. Your W-2 also says how much money was taken out of your paycheck for taxes during the year. You use your W-2 when you file your taxes with the Internal Revenue Service and some states.

Also Check: How Much Is Sales Tax In Washington

When To Check Withholding:

- If the tax law changes

- When life changes occur:

- Lifestyle Marriage, divorce, birth or adoption of a child, home purchase, retirement, filing chapter 11 bankruptcy

- Wage income The taxpayer or their spouse starts or stops working or starts or stops a second job

- Taxable income not subject to withholding Interest, dividends, capital gains, self-employment and gig economy income and IRA distributions

- Itemized deductions or tax credits – Medical expenses, taxes, interest expense, gifts to charity, dependent care expenses, education credit, Child Tax Credit, Earned Income Tax Credit

State And Local Payroll Deductions

Forty-one states have income taxes and while some have flat-rate deductions, others base certain taxes according to a table.

- Localities within 17 states levy taxes that are automatically withheld from wages.

- Some such local taxes are in flat dollar amounts, some are calculated as a percentage of income to withhold, and others use IRS-like tables.

- In six states and U.S. territories, employees pay disability taxes.

- Three states have unemployment insurance taxes.

- One state has a workers’ compensation tax.

You May Like: How Long To Receive Tax Refund 2022

Will I Owe Taxes On Stimulus Checks

No, stimulus checks arenât considered income by the IRS. They are prepaid tax credits for your 2020 tax return, authorized by two relief bills passed last year that aimed at stabilizing the struggling U.S. economy in the wake of the pandemic. Because the stimulus payments arent considered income by the tax agency, it wont impact your refund by increasing your adjusted gross income or putting you in a higher tax bracket, for instance.

When it comes to getting paperwork ready, youâll want to dig up the IRS Notice 1444 for the stimulus payment amount you were issued in 2020. And the second round of payments would be outlined in Notice 1444-B.

Jessica Menton and Aimee Picchi

Follow Jessica on Twitter @JessicaMenton and Aimee @aimeepicchi

What Are Tax Withholdings

The law says your employer must take money out of your paycheck for taxes. You can choose how much money to withhold from or take out of your paycheck. When you have a big change in your life, you might owe more or less money in taxes than before. To have the right amount of money come out of your paycheck for taxes, you change your withholdings.

Also Check: Department Of Tax Debt And Financial Settlement Services

How Do I File A Peuc Claim In Maryland

Connect with IVR System to File Telecerts and More

Donât Miss: Www.njuifile.net 1099

What Are Fica Taxes

taxes are commonly called the payroll tax however, they dont include all taxes related to payroll. FICA taxes consist of Social Security and Medicare taxes. These amounts are paid by both employees and employers. For 2022, employees will pay 6.2% in Social Security on the first $147,000 of wages. The Medicare tax rate is 1.45%.

Also Check: If You File Taxes Late What Happens

Where Will There Be Tax Headaches

Families who received the monthly advance payments for the child tax credit should plan to take extra time when preparing their own returns or getting the paperwork ready for tax professionals.

The IRS even has posted a special web page calledUnderstanding Your Letter 6419at IRS.gov.

About 36 million families received more than $93 billion in monthly child tax credit payments from July through December 2021.

People, of course, have bad habits and throw away letters they dont understand. IRS letters sometimes dont arrive early enough for some if youre in a rush to file a return in late January or early February.

Make sure you have all of your documents and have received everything rather than rushing off to file, Walker said.

If you rush, you could run into a similar problem that some experienced when dealing with the stimulus payouts for 2020 on the tax returns filed last year. Mistakes happened and delays mounted.

Last year, the IRS ended up manually processing more than 11 million tax returns because of inconsistencies between what people received for the first and second stimulus payments and what they were claiming for the recovery rebate credit.

The National Taxpayer Advocate predicts the IRS will be faced with the daunting task of reviewing millions of returns by hand this year, too, as tens of millions of individuals claim a recovery rebate credit on 2021 returns and the child tax credit.

Read Also: How To File Unemployment On Taxes

How Do I Sign Up For Direct Deposit

Many employers will put your paycheck into your bank or credit union account. This is called direct deposit. You do not have to pay fees to cash your check. You will get your money sooner.

Ask your employer if it has direct deposit. To sign up for direct deposit, give your employer information about your bank or credit union account.

Recommended Reading: Capital Gains Tax In California Real Estate

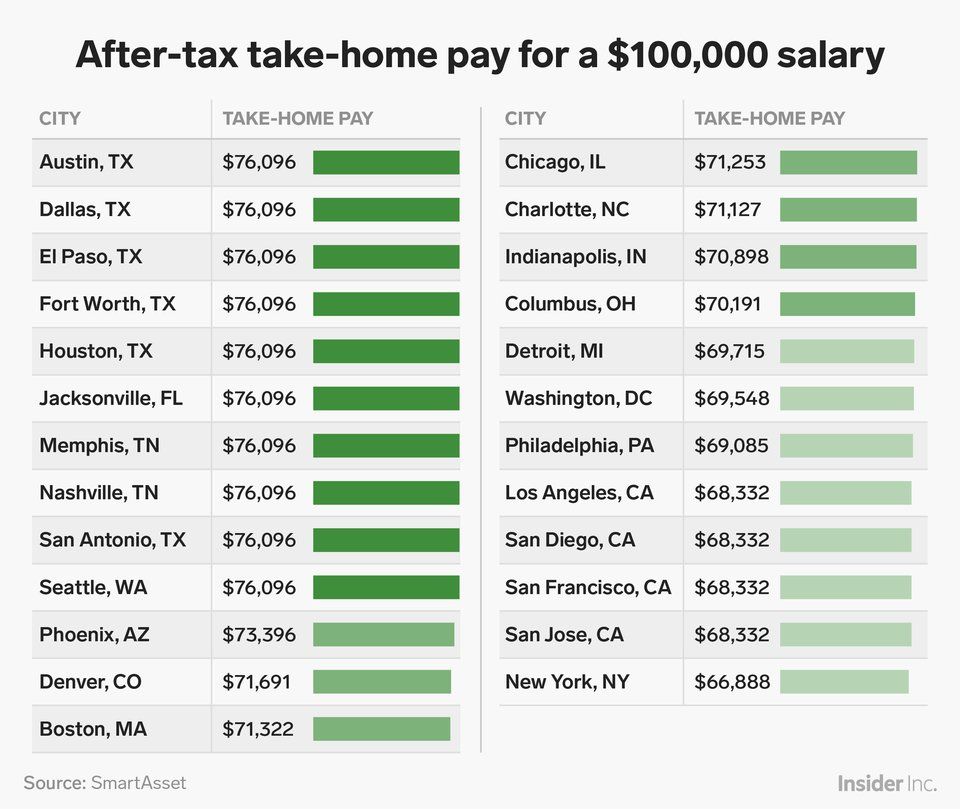

Theres No Income Tax In Your State

If the tax was not withheld from your paycheck, it might also be because your state does not charge income tax. If you live in Alaska, Florida, Nevada, Tennessee, South Dakota, New Hampshire, Washington, Texas, or Wyoming, you will not have to pay income taxes. However, they might charge dividends and interests , so you might want to do a little bit of research on that.

States that do not charge income tax will have their own way of raising revenue for the maintenance of their infrastructure. One common way to do so is sales tax. Florida, for instance, takes a 6% tax on sales, whereas Tennessee takes a 9.55% sales tax. Washington charges a 49.4 cent fuel tax for every gallon of gasoline, which is among the nations highest rates.

So, if you live in one of the states mentioned above and you see that there is no income tax, dont stress yourself out. Youll be paying that tax money one way or another, only that you wont be paying it through federal income tax.

Determining Federal Income Tax Withholding

The Internal Revenue Service expects taxpayers to pay taxes on wages at the time theyre earned. This is done through federal income tax withholding. The amount of federal income tax withheld varies by individual, based on the data in Form W-4, which all employees are required to submit to their employer.

The form includes information about whether a worker will file a tax return as married or single, the number of withholding allowances claimed by the worker and whether an additional amount should be withheld from each paycheck. Form W-4 includes a worksheet to help employees determine the correct amount of allowances for their financial situation. The IRS also provides a free online paycheck calculator to help determine the correct number of withholding allowances.

Read Also: How Is Retirement Income Taxed

Also Check: What States Don T Have Sales Tax

How Your Ohio Paycheck Works

Calculating your paychecks is tough to do because your employer withholds multiple taxes from your pay. The calculations are even tougher in a state like Ohio, where there are state and often local income taxes on top of the federal tax withholding.

First of all, no matter what state you live in, your employer withholds 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Your employer will also match your contributions. Together, Medicare and Social Security taxes are referred to as FICA taxes. Any earnings you make in excess of $200,000 are subject to an additional 0.9% Medicare tax that your employer does not match.

In addition to FICA taxes, your employer will also withhold federal income taxes from your earnings. This withholding will depend on things like your income, filing status and number of dependents and exemptions. Employees must fill out Form W-4 to indicate any changes to these factors. The recently updated version of Form W-4 no longer uses allowances. Instead, it features a five-step process that lets you enter personal information, claim dependents and indicate any additional income or jobs.

Your marital status will indirectly affect your paycheck size because it will affect your tax filing status. It can also affect your paycheck if you pay more in health insurance premiums to cover a spouse or children. These premiums will be deducted from each of your paychecks.