Request To Withhold Taxes

Submit a request to pay taxes on your Social Security benefit throughout the year instead of paying a large bill at tax time.

You will pay federal income taxes on your benefits if your combined income exceeds $25,000/year filing individually or $32,000/year filing jointly. You can pay the IRS directly or have taxes withheld from your payment.

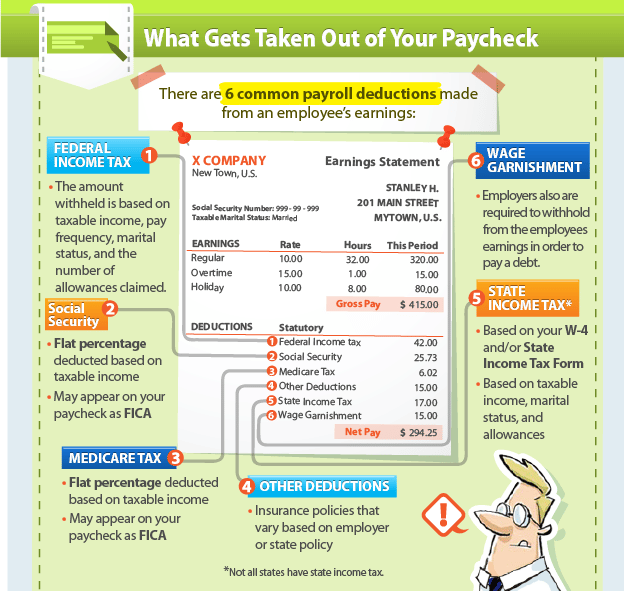

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 . So any income you earn above that cap doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts for tax years 2022 and 2023:

- $200,000 for single filers, heads of household and qualifying widows with dependent children

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

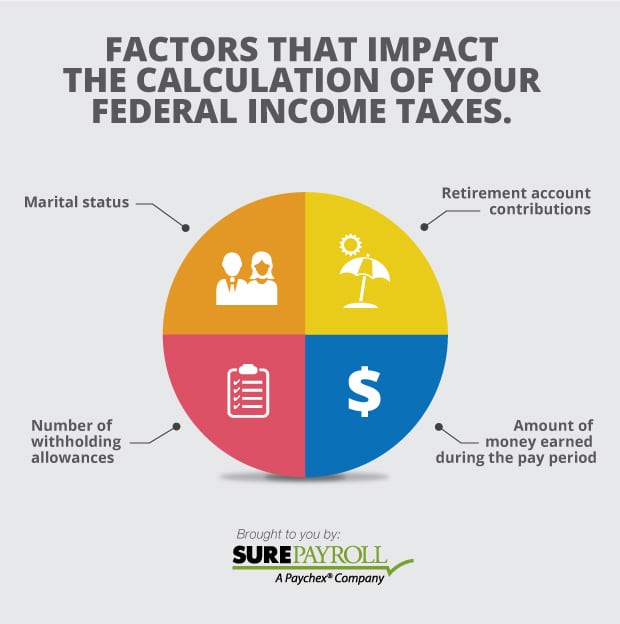

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Also Check: How Do Tax Write Offs Work

An Example Of An Employee Pay Stub

In the case of the employee above, the weekly pay stub would look like this:

| Employee Pay Stub |

|---|

You must make deposits with the IRS of the taxes withheld from employees’ pay for federal income taxes, FICA taxes, and the amounts you owe as an employer. Specifically, after each payroll, you must:

- Pay the federal income tax withholding from all employees

- Pay the FICA tax withholding from all employees, and

- Pay your half of the FICA tax for all employees.

Depending on the size of your payroll, you must make deposits monthly or semi-weekly.

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid.

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

Also Check: At What Income Do You Have To File Taxes

How Much Money Gets Taken Out Of Paychecks In Every State

How Much Money Gets Taken Out of Paychecks in Every State

Its payday, and you log on to your bank account hoping to see a hefty deposit, but it has a lot less heft than you expected. You can thank payroll taxes for that. They take a big bite out of paychecks each month, and just how big depends on where you live. If youre single and you live in Tennessee, expect 16.5% of your paycheck to go to taxes and thats the state with the lowest tax burden in the nation.

Support Small Biz: Dont Miss Out on Nominating Your Favorite Small Business To Be Featured on GOBankingRates Ends May 31

To find out just how much taxpayers in each state can expect to have withheld from their biweekly paychecks, GOBankingRates analyzed the average income data from the U.S. Census Bureau and combined that information with federal and state tax rates provided by the Tax Foundation. The result is precisely what gets pulled out of the typical persons biweekly paycheck in each state, sorted from the lowest amount for single filers to the highest.

- Total income taxes paid: $8,797

- Tax burden: 16.5%

- Amount taken out of an average biweekly paycheck: $338

Joint Filing

- Total income taxes paid: $7,067

- Tax burden: 13.25%

- Total income taxes paid: $9,113

- Tax burden: 20.22%

- Amount taken out of an average biweekly paycheck: $351

Joint Filing

- Total income taxes paid: $7,293

- Tax burden: 16.18%

- Amount taken out of an average biweekly paycheck: $281

Joint Filing

Joint Filing

Joint Filing

Whats The Difference Between A Deduction And Withholding

In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. These are known as âpre-tax deductionsâ and include contributions to retirement accounts and some health care costs. For example, when you look at your paycheck you might see an amount deducted for your companyâs health insurance plan and for your 401k plan. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. Some deductions are âpost-taxâ, like Roth 401, and are deducted after being taxed.

In our calculators, you can add deductions under âVoluntary Deductionsâ and select if itâs a fixed amount , a percentage of the gross-pay , or a percentage of the net pay . For hourly calculators, you can also select a fixed amount per hour .

Recommended Reading: State Of Oklahoma Tax Commission

How Does A Tax Directive Work

A tax directive is an instruction from SARS to an employer on how to deduct employees tax from certain lump sum payments which are not covered by the prescribed tax tables. The resulting tax calculation varies according to the type of tax directive being applied for.

What is a tax directive percentage?

The fixed percentage directive is issued to commission earners and personal service companies and trusts. It instructs tax to be deducted at a pre-determined set rate each month, irrespective of the amount earned. This is beneficial when earnings fluctuate from month to month.

What are the reasons the IRS will reject your return?

Common Causes & Rejection CodesMismatched Personal Information. Previously Accepted Return. Dependent Claimed On Another Return. Dependent Files Own Return. Electronic Signature Mismatch. EIN Does Not Match.

Who qualifies for tax directive?

Those facing unforeseen financial hardship

In rare cases where the taxpayer has encountered financial hardship through no control of their own, such as through the national lockdowns, taxpayers can submit a hardship directive application asking SARS to reconsider their rate of taxation to alleviate their hardship.

What is issuing a directive?

A directive is an official instruction that is given by someone in authority.

How Are Pensions Taxed

Pensions are fully taxable at your ordinary tax rate if you didnt contribute anything to the pension. If you contributed after-tax dollars to your pension, then your pension payments are partially taxable. If the payments start before age 59 1/2, you may also be subject to a 10% early distribution penalty.

You May Like: How To Find Your Employers Ein

Don’t Miss: 6 Months And Still No Tax Refund 2021

How Do The Percentage Vs Aggregate Method Differ

The next question you probably have is about how your bonus checks are taxed. The answer? It depends, as the IRS uses one of two methods:

- Percentage: In many cases, the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. With this tax method, the IRS taxes your bonus at a flat-rate of 25 percent, whether you receive $5000, $500 or $50 however, if your bonus is more than $1 million, the tax rate is 39.6 percent. This percentage method may seem ideal as it tends to take less out of your bonus, which means more money for you initially, but be prepared to pay more when filing taxes the following year if you are in a higher tax bracket.

- Aggregate: The other tax for supplemental wages is the aggregate method. If your employer tacks on your bonus to your regular paycheck, the IRS will use this method, which references the withholding tables to determine how much to take out of your wages. In most cases, you lose more of your bonus compared to the percentage method because of a higher tax obligation. Depending on the size of your bonus, you may even move up a tax bracket.

Sign up for our newsletter and get the latest news and updates

Money Help Center

How Much Social Security Income Is Taxable

Not all taxpayers are required to pay federal income taxes on their Social Security benefits. Typically, only those individuals who have substantial income in addition to their Social Security benefits are required to pay federal income taxes on Social Security Benefits. If you do have to pay taxes on your Social Security benefits, you can either make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your benefits.

How much of your Social Security income is taxable is based on your combined income. Your combined income is calculated by adding your adjusted gross income, nontaxable interest, and one-half of your Social Security benefits.

If you file your federal income taxes as a single person, and your combined incomeis between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of your benefits may be taxable. If your combined income is below $25,000, all of your Social Security income is tax-free.

If you are married and file a joint return, and you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, up to 85% of your benefits may be taxable. If your combined income is below $32,000, all of your Social Security income is tax-free.

Recommended Reading: When Is Tax Returns Due

Calculating Employee Payroll Taxes In 5 Steps

Once your employees are set up , youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheld. And, if necessary, making deductions for things like health insurance, retirement benefits, or garnishments, as well as adding back expense reimbursements.

In technical terms, this is called going from gross pay to net pay.

If youre trying to figure out a specific step, feel free to skip to the one youre looking for:

- Step 1: Figure out gross pay

- Step 2: Calculate employee tax withholdings

How Much Of Your Paycheck Goes To Social Security Tax It Depends How Much You Make

Photo: 401kcalculator.org via Flickr

The Social Security tax rate in the United States is currently 12.4%. However, you only pay half of this amount, or 6.2%, out of your paycheck — the other half is paid by your employer. And, Social Security taxes are only applied to the first $118,500 in wages for the 2015 tax year, which can make the effective Social Security tax rate less for higher-income individuals.

ExamplesFor a basic example, consider the case of a worker who earns a salary of $50,000 per year. Since this is below the wage limit, the 6.2% Social Security tax rate would apply to the entire income — so this person would pay $3,100 in Social Security taxes throughout the course of the year. Assuming a bi-weekly pay schedule, this amount translates to about $119 per paycheck.

Or, consider a higher-income individual who’s salary is $250,000. Because this is over the wage cap, only the first $118,500 of this person’s earnings is subject to the 6.2% tax. So, $7,347 of this worker’s income is paid as Social Security tax, making the effective Social Security tax rate just 2.9%.

Self-employed individualsIf you are self-employed, you are responsible for paying both the employer’s and employee’s portion of the Social Security tax — also known as the “self-employment tax.” The combined rate is 12.4% , and the same $118,500 wage cap applies for the Social Security tax. Medicare tax is paid on all wages.

You May Like: How To Pay Capital Gains Tax

Five: Calculate Federal Income Tax Withholding Amount

To calculate federal income tax withholding you will need:

- The employee’s adjusted gross pay for the pay period

- The employee’s W-4 form, and

- A copy of the tax tables from the IRS in Publication 15-T: Employer’s Tax Guide. Make sure you have the table for the correct year.

The 2022 income tax brackets are as follows:

- 37% for incomes over $578,125

- 35% for incomes over $231,250

- 32% for incomes over $182,100

- 24% for incomes over $95,375

- 22% for incomes over $44,725

- 12% for incomes over $11,000

You must withhold FICA taxes from employee paychecks.

Do Seniors On Social Security Have To File Taxes

The IRS typically requires you to file a tax return when your gross income exceeds the standard deduction for your filing status. These filing rules still apply to senior citizens who are living on Social Security benefits. If Social Security is your sole source of income, then you don’t need to file a tax return.

Also Check: California Capital Gains Tax Calculator

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

Delaware Resident Working Out Of State

Q. Im considering taking a job in Maryland. I know the states do not have a reciprocal agreement. How does the credit work for taxes paid to another state? Will I owe County taxes in MD?

A. If you are a resident of Delaware who works in Maryland, you may take credit on line 10 of the Delaware return for taxes imposed by other states. You must attach a signed copy of your Maryland return in order to take this credit.

Even though you may not be liable for Maryland County Taxes, Maryland imposes a Special Non-resident tax on their non-resident income tax return.

Don’t Miss: What Is Tax Form 5498

How Much Money Does The Irs Take Out Of Your Paycheck

4.2/5IRS can takeyour paycheckIRS can takeyour checkpay

Moreover, can the IRS take all the money in your bank account?

When placing a levy, the IRS contacts the bank and asks it to hold the funds in your bank account for a period of 21 days. The bank cannot refuse to send the money to the IRS. The IRS can seize up to the total amount of your tax debt from your bank account.

One may also ask, what money is taken out of my paycheck? Social Security & MedicareThe federal government also deducts money as your contribution to its Social Security and Medicare programs. Youll be required to give a percentage of your income, currently 6.2% for Social Security and 1.45% for Medicare, to help fund these programs.

In respect to this, how can I get all the money taken out of my paycheck?

5 Ways to Keep More of Your Paycheck

Does IRS check your bank account?

The IRS does not have access to monitor bank accounts, nor do they know where everyone has an account to monitor them. Banks are required to report certain transactions to the IRS, such as interest earned on an account.

Which Turbotax Is Best For You

Figuring out all these specifics can be stressful. But doing your income taxes doesnt need to be, when you use TurboTax Online.

However, if you do feel a bit overwhelmed, consider TurboTax Live Assist & Review and get unlimited help and advice from a real person as you do your taxes. Plus, theres a final review before you file. Or, choose TurboTax Live Full Service and have one of our tax experts do you return from start to finish.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Dont Miss: Is Doordash Pay Taxed

Read Also: Income Tax Comparison By State