Will I Get My Stimulus On My Turbo Card

Important: Government Benefits and Stimulus Information According to the IRS, 80% of tax filers will qualify for a stimulus payment. If you have received a notification that your stimulus payment has been deposited on your Turbo Visa Debit Card, you can access it by simply logging in to your account.

The Tax Deadline Is April 18 2023

Why is the 2023 tax deadline April 18 instead of April 15? Because April 15, the standard deadline, falls on a Saturday. When the deadline falls on a weekend, the IRS moves the deadline day to the next business day. However, that Monday, April 17, 2023, is Emancipation Day, a holiday recognized in Washington, D.C., where the IRS is headquartered.

Depending on when a taxpayer files, they can often receive their tax refund payments within only 2-3 weeks.

How Does The Jackson Hewitt Refund Advance Loan Work

The Jackson Hewitt Loan Advance for 2022, 2023 works with MetaBank to issue refund advances. So depending on your expected refund, you could take out a Holiday, Christmas, or emergency loan for as little as $200 or a loan thats worth as much as $4,000.

It typically takes just a few hours to get your money if youre loading it onto a prepaid debit card. However, take note that direct deposits could take up to five business days.

To be eligible, you must make sure that you have your taxes prepared at Jackson Hewitt, and you must have some form of income verification. The Jackson Hewitt Refund Advance Loan option starts on December 14th and ends on January 17th.

You May Like: How To Calculate Tax On Social Security

Calculation Of Income Tax Refund

When you are filing your IT returns, you can do your income tax refund calculation after taking all deductions and exemptions into consideration.

Income Tax Refund = Total Tax Paid for the Year Total Tax Payable for the Year

The total tax paid for the year will include any advance taxes, TDS, TCS , and self-assessment tax. In case this exceeds your actual tax liability, you can claim an ITR refund. When using an income tax calculator, you can use the same for income tax refund calculation.Here is an example of all that may go into your income tax refund calculation:

| Income Tax Refund Calculator | |

|---|---|

| Income that is taxable | Rs. 5,00,000 |

| Gross tax liability on above | Rs. 12,875 |

| Less: Foreign tax credit | Rs. 1,000 |

| Add: Interest on tax liability | NIL |

| Tax refund | Rs. 13,125 |

As you can see, when B< C, you will be eligible for an income tax refund.In case C< B, then you will be liable to pay income tax in lieu of your tax liability.

My Tax Refund Was Accepted When Will It Be Approved

The IRS will provide a deposit date or mail date as soon your return has been processed and your refund approved. Most refunds will be issued in less than 21 days, and you can keep track of your refund status starting 24 hours after electronically filing your return. Depending on your delivery option, timelines are subject to change.

Also Check: What Is The Corporate Tax Rate

How To Track The Progress Of Your Refund

The IRS has eliminated the guesswork of waiting for your tax refund by creating IRS2Go, an app that allows you to track the status of your return. You can also check the status of your refund with the Wheres My Refund? online portal.

Both tools provide personalized daily updates for taxpayers 24 hours after a return is e-filed or four weeks after the IRS has received a paper return. After inputting some basic information , you can track your refunds progress through three stages:

Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail.

When To Expect 2023 Irs Income Tax Refunds Estimated Date Chart For Tax Refunds

This chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on information we have now, and using projections based on previous years- and depending on when a person files their return.

Its still a bit too early to think about it, but in case you are wondering, heres our annual chart for the #1 question we get every year: When will I get my tax refund? The answer is never exact, but we are able to make some educated guesses based on a few factors.

Now is also a good time to take advantage of year-end strategies that can lower your tax bill, or increase your refund.

If youve had major income changes this year, had a child, got married or divorced, retired, bought a house, or changed investments, or made any other really significant life changes, you should definitely seek the advice of a tax professional like a CPA or EA before the end of the year. The sooner the better. Even if you cant reach one until early January, such a professional can still offer valuable advice that can make a real different on your taxes.

Most individual taxpayers wont have such issues for this tax season. For clarification, the weeks leading up to the , deadline is when Americans file tax returns for income they received during the 2022 calendar year, or they can file an automatic extension, which gives them an additional six months to file.

Recommended Reading: Tax Credit For Wood Stove

I Am Eligible For A Refund As Per My Itr But Havent Received It Yet

Refund processing by the tax department starts only after the return is e-verified by the tax filer. Usually, it takes 25-60 days for the refund to be credited to your account. However, If you haven’t received your refund during this time duration, you must check for discrepancies in your ITR check your email for any notification from the IT department regarding the refund.

How To Check Income Tax Refund Status

As already mentioned above, you can track ITR refund status online on the income tax e-filing portal or through the NSDL website.

Income Tax E-Filing Website

| The status calls for a waiting game. It means the refund will be processed soon. | |

| Invalid Return | If the Income Tax Department finds that your returns are invalid, this is the status you will see. You will have to file your returns again. |

| Return Processed. Refund Adjusted Against Demand | If the IT department finds that there is an outstanding amount from earlier, it may adjust the same with your refund claim. |

Read Also: Purchases Subject To Use Tax

I Missed My Itr Filing By The Due Date Can I Still Claim My Refund Now

The deadline to file your ITR for non-audit cases was 31st July 2022. However, if you could not manage filing your taxes before the deadline, you can still file a late return, known as Belated Return. The last date to file a belated return is 31st December 2022. You can claim your tax refund through a belated return

Some Tax Refunds May Be Delayed In 2022

If you claimed the Earned Income Tax Credit and the Additional Child Tax Credit , your tax refund may be delayed. The IRS will issue tax refunds for returns that claim these credits starting in mid-February.

Your financial institution may also play a role in when you receive your refund. Since some banks dont process financial transactions during the weekends or holidays, you may experience a delay in processing. If you opt to receive your tax refund by paper check, use our tax refund schedule to determine when you can expect to receive your refund.

Finally, you can expect your tax refund to be delayed if you filed an amended tax return. The IRS warns that it is taking more than 20 weeks to process amended tax returns.

You May Like: How Are Taxes Calculated On Paycheck

Whats Taking So Long To Receive Refunds

If you dont receive your refund in 21 days, your tax return might need further review. This may happen if your return was incomplete or incorrect. The IRS may send you instructions through the mail if it needs additional information in order to process your return.

You may also experience delays if you claimed the Earned Income Tax Credit or the Additional Child Tax Credit. Under the Protecting Americans from Tax Hikes Act of 2015, the IRS is required to hold tax returns for folks who claimed those credits until Feb. 15. If you claimed either of those tax breaks, a PATH Act message may appear when you use the Wheres My Refund? tool.

If you havent received your refund and youre becoming impatient, calling the IRS will likely not help. Its best to avoid contacting the IRS directly unless the Wheres My Refund? tool prompted you to do so or its been 21 days since you filed your tax return electronically .

How To Get Your Tax Refund Earlier

Ready to file your tax return and get your refund up to five days sooner? today. Its only $4.99 per month and also includes these features:

- A Visa debit card with a secured chip and tap-to-pay functionality

- Early direct deposit

- Three Savings Pods that pay you 4.00% Annual Percentage Yield2 on your money

- Fee-free overdraft protection

- Instant removal of gas station authorization holds

- Generous cashback rewards

- Fee-free ATM withdrawals at Allpoint ATMs in the US4

- Instant money transfers and mobile check deposits

- Spending insights, real-time purchase alerts, and money management tools

Download the Current mobile app and open up your account in less than two minutes today! Its available on Google Play and in the AppStore.

Don’t Miss: Live In One State Work In Another Taxes

What To Do If You Don’t Receive Your Tax Refund

If you chose to use direct deposit and still havent received your tax refund after 3 weeks, there may be a few reasons why.

First, your tax return may haveincluded errors, such as misspelled names, incorrect social security numbers, unsigned forms, or incorrect bank account information. To avoid errors, make sure to carefully review your tax return before you click submit. If a tax preparer is completing your return for you, make sure they have all of your correct information.

Another reason for a potential hold-up is if you were a victim of identity theft or fraud. In this situation, the IRS may hold onto your return until it can work with you to rectify the situation.

If you dont experience any of the mishaps above and are still feeling like things are moving slowly, here are 3 additional steps you can take to check on your funds:

Income Tax Refund Information

You can check the status of your current year refund online, or by calling the automated line at 260-7701 or 1-800-218-8160. Be sure you have a copy of your return on hand to verify information. You can also e-mail us at to check on your refund. Remember to include your name, Social Security number and refund amount in your e-mail request.

If you’re expecting a tax refund and want it quickly, file electronically – instead of using a paper return.

If you choose direct deposit, we will transfer your refund to your bank account within a few days from the date your return is accepted and processed.

Electronic filers

We usually process electronically filed tax returns the same day that the return is transmitted to us.

If you filed electronically through a professional tax preparer and haven’t received your refund check our online system. If not there, call your preparer to make sure that your return was transmitted to us and on what date. If sufficient time has passed from that date, call our Refund line.

Paper filers

Paper returns take approximately 30 days to process. Keep in mind that acknowledgment of the receipt of your return takes place when your return has processed and appears in our computer system.

Typically, a refund can also be delayed when the return contains:

- Missing entries in the required sections.

- An amount claimed for estimated taxes paid that doesn’t correspond with the amount we have on file.

Check cashing services

Splitting your Direct Deposit

Paper filers

Recommended Reading: Do You Have To Pay Taxes On Inheritance

Check Income Tax Refund Status Online

Income Tax Department says : “Checking the online refund status is always good. It’s free and it tells you what’s going on?”

Please Note: Refund Status of income tax return that have been filed this year, must be updated in the Income Tax Department systems. You can check the latest status of tax refund by using this utility. Use the tool & check refund status now!

If you think your friends/network would find this useful, please share it with them We’d really appreciate it.

How Soon Can I Get My Tax Refund 5 Things To Know

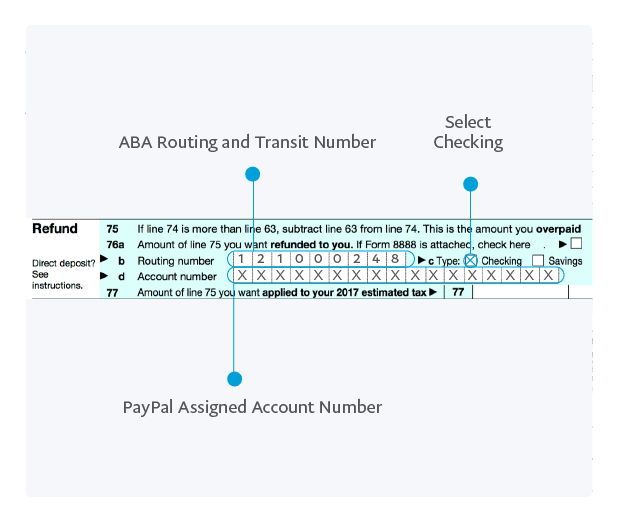

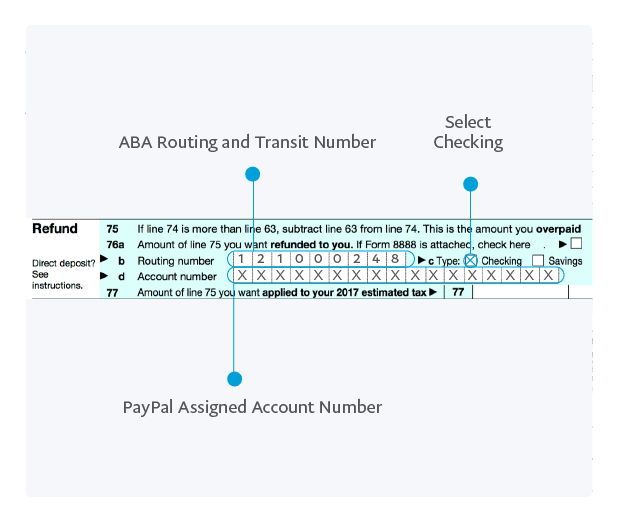

Got your 2017 tax return filed yet?

OK, you still have some time. But here’s a reminder that the tax season just kicked off Monday morning, as the Internal Revenue Service began accepting returns.

The deadline this year is April 17.

Many tax software companies and tax professionals began accepting returns a few weeks ago and will now submit those returns as the IRS systems open.

Here are five things you need to know early in the tax season:

Also Check: Does Arizona Have State Income Tax

What Can Be The Reasons For The Refund Failure

There could be numerous reasons for not getting an income tax refund in time, but the following are some of the most common:

- If the taxpayer has given incorrect bank details such as account no, IFSC code, name mismatch, MICR code, etc.

- If the mentioned address by the taxpayer is not correct.

- If the details such as the payment date, BSR code, and challan number are incorrect.

- If there is a discrepancy between Form 26AS and tax information when submitting an income tax return.

- KYC for the account holder is pending.

For Taxpayers Who Have Yet To File

The extended May 17, 2021, deadline to submit your 2020 tax return is really just around the corner.

If you’ve procrastinated, we have a few tips for you:

-

Cost

Costs may vary depending on the plan selected – see breakdown by plan in the description below

-

Free version

For simple tax returns only. See if you qualify.

Recommended Reading: After Tax Contribution To 401k

Get The Help Of A Financial Professional

Filing your taxes as soon as the IRS accepts them provides benefits that include faster refunds and a lower risk of identity theft. However, filing taxes and maximizing deductions and credits can be complicated.

Even if you think your return is simple, a CPA might be able to clue you in on tax credits you didnt know existed.

Choose Best Bank Account To Deposit Your Refund

You want to ensure the account information listed on your tax refund is accurate to prevent any processing delays. Its equally important to use an account that lets you access your money as soon as possible.

Consider an account from an online banking platform, like Current, that gets you access to your tax refund up to five days sooner1. All you have to do is file your return with TurboTax and elect to have your refund electronically deposited to your Current Premium account.

Also Check: Last Day To Do 2021 Taxes

Are Tax Refunds Delayed 2022

The processing and refund delays seen in 2021 and likely to be repeated in 2022 can be traced in part to pandemic-related challenges, as well as issues with IRS staffing and funding. … If your tax refund is delayed, the IRS is required to pay interest on that refund if it not received within 45 days of filing.