Business And Personal Tax Returns And Estimated Tax

Most business owners pay tax on their business income through their personal tax returns. These are called pass-through taxes, because the tax liability passes through to the owner.

In these cases, business owners have a special schedule included with their 1040 form showing business income. For sole proprietors and single-member LLC owners, thats Schedule C. For partners, multiple-member LLC owners, and S corporation owners, thats Schedule K-1.

In addition, partnerships, S corporations, and corporations must file a business tax return and a separate extension application for it.

The IRS extended the filing and payment deadline to May 17, 2021, for 2020 tax returns. The filing and payment were further extended to June 15, 2021, for taxpayers in Texas, Louisiana, and Oklahoma, which were declared winter-storm disaster areas.

What Is A Payment Plan

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. If you qualify for a short-term payment plan you will not be liable for a user fee. Not paying your taxes when they are due may cause the filing of a Notice of Federal Tax Lien and/or an IRS levy action. See Publication 594, The IRS Collection ProcessPDF.

Applying For An Extension For Your Income Tax Return

You can apply for an extension for filing your income tax return in various ways . You can do so until the date that is stated on the declaration letter sent by the Dutch Tax and Customs Administration. In most cases, this will be 1 May of the year following that over which you have to file the return. The Tax and Customs Administration will send you a written response within 3 weeks of your application. Do you want an extension of more than 5 months? Then you must explain why you need such a long extension in your application.

Don’t Miss: Capital Gains Tax Calculator New York

Business Tax Extensions: A Chart

| Business Type |

| 7004 or online |

The exact due date for a specific year may change if it falls on a weekend or holiday. Check this article on business tax return due dates for the exact dates for the current year.

Here are details on extension applications for specific business types:

- Sole proprietorship and single-member LLC tax returns, filed on Schedule C and included with the owners personal tax return, are due on April 15 for the previous tax year. If you want an extension, you must file the extension application for a Schedule C and personal return by the tax return due date of April 15.

For the 2020 tax year, the deadline for sole proprietors and single-member LLC tax returns filed on Schedule C with the owners personal tax return was extended to May 17, 2021. In Texas, Oklahoma, and Louisiana, the deadline was extended to June 15, 2021, in regions declared winter-storm disaster areas by FEMA.

Also Check: How Do You File Doordash On Your Taxes

Facts About Filing For An Extension

IRS Tax Tip 2018-59, April 17, 2018

This years tax-filing deadline is today. Taxpayers needing more time to file their taxes can get an automatic six-month extension from the IRS.

There are a few different ways taxpayers can file for an extension.

-

IRS Free File. While taxpayers can use IRS Free File to prepare and e-file their taxes for free, they can also use it to e-file a free extension request. Midnight on April 17 is the deadline for the IRS to receive an e-filed extension request. Taxpayers can access Free File to prepare and e-file their return through October 17.

-

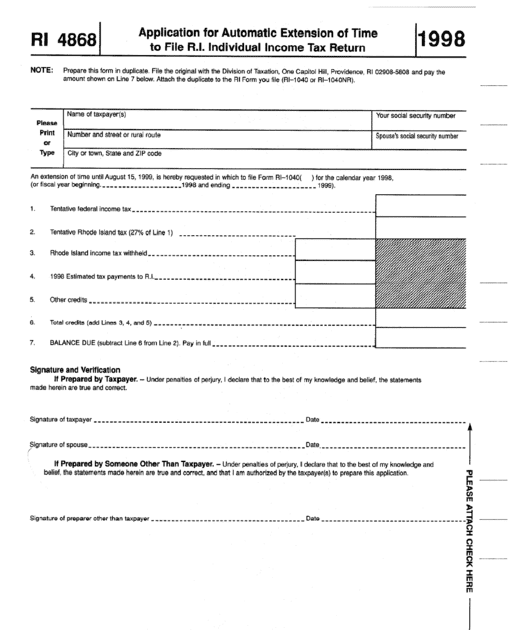

Form 4868. Taxpayers can request an extension using the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. The deadline for mailing the form to the IRS is April 17.

-

Electronic Payment Options. The IRS will automatically process an extension of time to file when taxpayers pay all or part of their taxes electronically by April 17. They dont need to file a paper or electronic Form 4868 when making a payment with IRS Direct Pay, the Electronic Federal Tax Payment System or with a debit or credit card. When paying one of these ways, taxpayers will select Form 4868 as the payment type. Taxpayers should print out a confirmation as proof of payment and keep it with their records.

Here are a couple things for people filing an extension to remember:

Read Also: States That Are Tax Free

Using Turbotax Easy Extension To File A Tax Extension

TurboTax EasyExtension is a simple, online tool that allows you to file a tax extension in minutes. Try it here.

Heads up – filing Form 4868 only provides you with an extension of time to file. You must still pay 100% of the tax you owe by the original filing deadline to avoid interest and late-payment penalties.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Here Are A Few Ways Taxpayers Can File For An Extension

- File Extension Form 4868 electronically. Taxpayers, or their preparers, can use IRS Free File to e-file a free extension request. The form is available on IRS.gov and through tax software packages. The IRS must receive an electronically filed extension request by 11:59 p.m., Wednesday, April 15, 2020.

- Electronic payment options. The IRS will automatically process an extension of time to file when taxpayers pay all or part of their tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System, or a . This way taxpayers won’t have to file form 4868 and will receive a confirmation number for their records.

- Mail Form 4868. Taxpayers can request an extension using the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return by mailing the form to the address in the instructions.

The IRS offers payment options for taxpayers who can’t pay all the tax they owe. In most cases, they can apply for an installment agreement with the Online Payment Agreement application on IRS.gov. They may also file Form 9465, Installment Agreement Request. The IRS will work with taxpayers who can’t make payments.

Taxpayers must request the automatic extension by the due date for their return. They can file their return any time before the six-month extension period ends on October 15, 2020. The taxpayer enters any payment they made related to the extension of time to file on Schedule 3 Form 1040 or 1040-SR, line 10.

Recommended Reading: How Much Is Tax At Walmart

How Will This Affect Me

The IRS will send you a letter as soon as possible if it doesnt approve your extension request.

Penalties

The IRS can assess a failure to file penalty for filing late. Filing for an extension may help you avoid this penalty. Generally, though, if you dont also send a payment of your estimated tax, youll be assessed a failure to pay penalty. If you want to appeal the penalty, follow the directions on the notice, or use IRS.govs Appeals Online Self-Help Tools.

I filed an extension but the IRS sent me a notice saying I didnt

If the IRS sends you a notice assessing the failure to file penalty, youll need to respond with the information you have and ask it to remove the penalty. Depending on how you requested the extension, you should have documentation, such as the confirmation receipt for an electronically filed extension, or proof of mailing .

If you didnt file an extension in time, but something happened that you believe amounts to reasonable cause for not filing, you can ask the IRS to abate the penalty. Youll need to write a statement describing what kept you from filing on time.

Dont Forget Extensions On State Income Taxes

States that have state income tax have different rules for extending the state return. Some states may go along with the IRS extension, while others require you to file a separate extension. Check with your state’s taxing authority to make sure you are complying with your state’s requirements for filing an extension.

Also Check: Local County Tax Assessor Collector Office

Who Qualifies For An Extension On Taxes

The only qualification to apply for an income tax extension is the requirement that you file by the original due date of the return. You must also estimate and pay any taxes due by this due date to avoid penalties.

The due date for personal income tax returns on Form 1040 is April 15 of the year after the tax year. If April 15 is a weekend or holiday, the extension is due the next business day.

What If I Am Out Of The Country On April 15th Should I Apply For An Extension

If you are required to file a North Carolina individual income tax return and you are Out of the Country on April 15th, you will automatically receive a four-month extension. The time for payment of your tax is also extended however, interest will accrue on any remaining balance from the original due date of the return until you pay the remaining tax due.

Note. For this purpose, Out of the country means either you live outside the United States and Puerto Rico and your main place of work is outside the United States or Puerto Rico, or you are in the military or naval service outside the United States and Puerto Rico

To receive an Out of the Country extension, you must file Form D-400 within four months of the due date of the income tax return and fill in the Out of the Country circle on page 1. If you need an additional two months to file your individual income tax return, you must file Form D-410 by August 15th and fill in the Out of the Country circle located at the bottom right of the form.

Read Also: Nj State Income Tax Rate

Easy Options For Filing An Extension

Option 1: E-file your federal tax extension in minutes withTurboTax Easy Extension

Using TurboTax Easy Extension, you can:

- E-file your federal extension

- Make a payment of any tax due directly from your checking or savings account

- Print a PDF copy of your e-filed extension

- Receive notifications when your extension has been accepted by the IRS

- Get easy instructions on how to file a state extension by mail

Note: Once your extension is approved, youll have until October 17, 2022 to file your return. If youre expecting a refund, it will not be processed until once you have completed your tax filing. If you think you owe, the estimated amount of taxes due will need to be paid to the IRS by the April tax return filing due date.

Option 2: Print and mail your completed IRS extension form

If youd rather mail your extension directly to the IRS, simply refer to IRS Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, complete and print the form, and send it to the IRS address for your state.

If you owe federal taxes, include your estimated payment with your Form 4868 and mail itpostmarked by April 18, 2022 to avoid any penalties or interest. Then complete and file your return on or before October 17, 2022.

Tax Extension Filing Faqs

If you need more time to file your individual federal income tax return, you can request an automatic extension from the IRS using Form 4868. The filing deadline to request a tax extension is the same as filing your return, April 18, 2022.

A tax extension will give you an additional six months to file your taxes this years tax extension due date is Oct. 17, 2022.

No, a tax extension only gives you more time to file your return it doesnt give you extra time to pay any taxes you owe. You must pay your tax bill by the Tax Day deadline to avoid late payment penalties.

When you request a tax extension with Form 4868, you can estimate and pay your total tax liability for the tax year. To help estimate your potential tax liability, try to complete your return as much as possible, estimating wherever necessary.

Filing for an extension is an excellent option for many taxpayers who feel stressed about tax season or have other commitments on their plate and just need more time.

Requesting an extension from the IRS is also an easy process, and you dont need to give a compelling reason why you need more time to file. So long as you submit your extension request form on time and correctly, approval is typically automatic, and youre granted an extension.

The downside of filing a tax extension is that it only gives you more time to file, not more time to pay. As discussed in the last section, youll still need to estimate and pay any taxes you might owe by the tax filing deadline .

Recommended Reading: Irs File Taxes For Free

How Do I Apply For An Extension To File My Nc Income Tax Return If I Did Not Receive An Automatic Extension To File My Federal Individual Income Tax Return

If you did not receive an automatic state extension to file your N.C. individual income tax return, you may still request an extension of time to file your return by filing Form D-410, Application for Extension for Filing Individual Income Tax Return, by the original due date of the N.C. tax return.

Do I Have To Pay The Tax I Owe To Receive An Extension

No. You are not required to send payment for the amount of tax you estimate to be due in order to receive an extension. However, it will benefit you to pay as much as you can with the application for extension because you can minimize the amount of penalties and interest due on the remaining balance. For more information on penalties and interest, see Penalties and Interest.

Don’t Miss: Selling House Capital Gain Tax

How Long Is A Tax Extension

A tax extension gives you until October 17, 2022, to file your tax return.

However, getting an extension does not give you more time to pay it only gives you more time to file your return. If you cant file your return by the April 18 deadline, you need to estimate your tax bill and pay as much of that as possible at that time.

-

Anything you owe after the deadline is subject to interest and a late-payment penalty even if you get an extension.

-

You might be able to catch a break on the late-payment penalty if youve paid at least 90% of your actual tax liability by the deadline and you pay the rest with your return.

What Are Payment Plan Costs And Fees

If the IRS approves your payment plan , one of the following fees will be added to your tax bill. Changes to user fees are effective for installment agreements entered into on or after April 10, 2018. For individuals, balances over $25,000 must be paid by Direct Debit. For businesses, balances over $10,000 must be paid by Direct Debit.

|

Note: If making a debit/credit card payment, processing fees apply. Processing fees go to a payment processor and limits apply.

Also Check: Is Auto Insurance Tax Deductible

How To Request An Extension To File

To get an extension to file, the IRS urges taxpayers to do one of the following:

- File Form 4868 through their tax professional, tax software or by using IRS Free File on IRS.gov. Individual taxpayers, regardless of income, can use Free File to electronically request an automatic tax-filing extension.

- Submit an electronic payment with Direct Pay, Electronic Federal Tax Payment System or by debit, credit card or digital wallet and select Form 4868 or extension as the payment type. Taxpayers don’t need to file Form 4868 when making an electronic payment and indicating it’s for an extension. The IRS will automatically count it as an extension.

Some taxpayers may have extra time to file their tax returns and pay any taxes due. This includes some disaster victims, taxpayers living overseas, including members of the military, and eligible support personnel serving in combat zones.

Important Reminders On Extensions

The IRS reminds taxpayers that a request for an extension provides extra time to file a tax return, but not extra time to pay any taxes owed. Payments are still due by the original deadline. Taxpayers should file even if they can’t pay the full amount. By filing either a return on time or requesting an extension by the April 18 filing deadline, they’ll avoid the late-filing penalty, which can be 10 times as costly as the penalty for not paying.

Taxpayers who pay as much as they can by the due date, reduce the overall amount subject to penalty and interest charges. The interest rate is currently four percent per year, compounded daily. The late-filing penalty is generally five percent per month and the late-payment penalty is normally 0.5 percent per month.

The IRS will work with taxpayers who cannot pay the full amount of tax they owe. Other options to pay, such as getting a loan or paying by credit card, may help resolve a tax debt. Most people can set up a payment plan on IRS.gov to pay off their balance over time.

Don’t Miss: When Are Tax Payments Due 2022