Do I Owe Crypto Taxes

In the U.S., crypto is considered a digital asset, and the IRS treats it generally like stocks, bonds, and other capital assets. Like these assets, the money you gain from crypto is taxed at different rates, either as capital gains or as income, depending on how you got your crypto and how long you held on to it.

To understand if you owe taxes, its important to look at how you used your crypto in 2021. Transactions that result in a tax are called taxable events. Those that dont are called non-taxable events. Lets break them down:

Not taxable

Taxable as capital gains

-

Selling crypto for cash: Did you sell your crypto for U.S. dollars? Youll owe taxes if you sell your assets for more than you paid for them. If you sell at a loss, you may be able to deduct that loss on your taxes.

-

Converting one crypto to another: When you use bitcoin to buy ether, for example, you technically have to sell your bitcoin before you buy a new asset. Because this is a sale, the IRS considers it taxable. Youll owe taxes if you sold your bitcoin for more than you paid for it.

-

Spending crypto on goods and services: If you use bitcoin to buy a pizza, for example, youll likely owe taxes on the transaction. To the IRS, spending crypto isnt that much different from selling it. You need to sell the asset before it can be exchanged for a good or service, and selling crypto makes it subject to capital gains taxes.

Taxable as income

Good news for hodlers

Tax Treatment Of Cryptocurrency For Income Tax Purposes

Cryptocurrency is a digital representation of value that is not legal tender. It is a digital asset, sometimes also referred to as a crypto asset or altcoin that works as a medium of exchange for goods and services between the parties who agree to use it. Strong encryption techniques are used to control how units of cryptocurrency are created and to verify transactions. Cryptocurrencies generally operate independently of a central bank, central authority or government.

The following pages outline the income tax implications of common transactions involving cryptocurrency. When we refer to cryptocurrency in this publication, we are talking about Bitcoin or other similar virtual currencies.

How To Report Cryptocurrency On Your Taxes

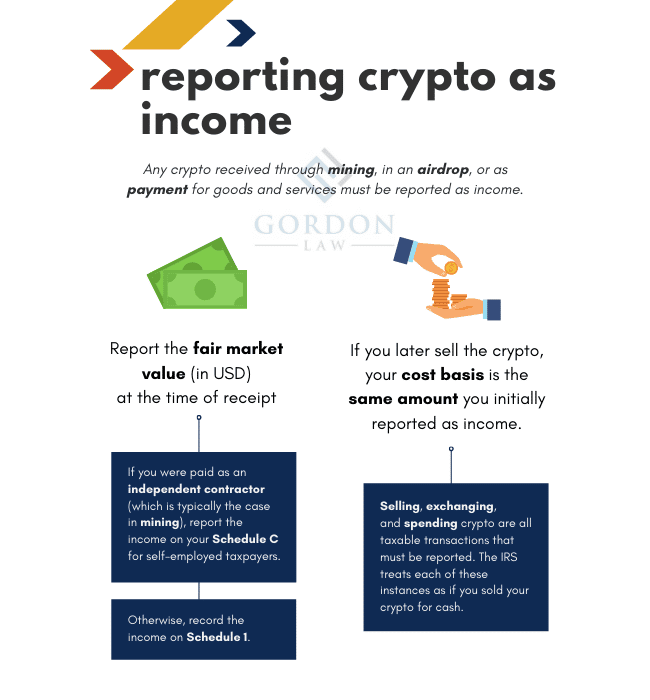

In general, you will report your crypto transactions on the following forms.

- Capital gains are reported on Schedule D . It’s likely you’ll need to complete Form 8949 first in order to complete Schedule D accurately.

- Gains classified as income are reported on Schedules C and SE if you received them as a self-employed entity.

- Gains classified as income are reported on Schedule 1 if you received them as an employee.

Your exchange may provide a statement you can use to prepare your tax return if you bought or traded through their platform.

The list above is not exhaustive. Consider consulting a licensed tax professional to help accurately manage your tax bill.

Read Also: California Used Car Sales Tax

Invest In Crypto Using A Self

Retirement accounts are investment vehicles that help you save for retirement. Traditional individual retirement accounts defer taxes until you make withdrawals. But since most traditional retirement accounts dont let you directly invest in cryptocurrency, you may opt for a self-directed IRA, which lets you invest in alternative investments, such as real estate and cryptocurrencies, while deferring taxes until retirement.

Keep in mind that self-directed IRAs require that you manage all the investments and handle compliance yourself. And like most retirement plans, you cant access the funds until youre 59-and-a-half without incurring a penalty. Plus, with cryptos innately volatile nature, youll need to be comfortable with your retirement portfolio potentially experiencing extreme price swings.

How Is Crypto Taxed In Canada

As is the case with other types of capital investments, you only report gains or losses in the tax year that you dispose of themin other words, when you cash out or trade your holdings. So, if you buy and hold cryptocurrency, its not a taxable event. Same goes if you send crypto from one exchange to another, assuming both wallets are yours. Thats the only major crypto transaction thats not taxed, says Storozuk.

All other crypto transactions, including trading one cryptocurrency for another, cashing out your coins, buying goods or services, or gifting crypto to charity, friends or family, are taxable events. Any increase in the value of your crypto between the time you got it and when you disposed of it is a capital gain any decrease in value is a capital loss .

As for crypto ETFs, which hold either crypto coins or shares of cryptocurrency-related companies, they follow the taxation rules for securities. If you hold crypto ETFs in a registered account, such as a registered retirement savings plan or a tax-free savings account , however, their growth is tax-sheltered.

Recommended Reading: What Age Do You Start Paying Tax

Lower Your Taxable Earnings

Reduced taxable income is another tried-and-true tax reduction strategy. In a low-income year, this is akin to selling valuable investments. This includes looking for tax credits and deductions to see whether they can help you lower your taxable income.

You can use the money to pay for pricey medical treatments, contribute to a traditional IRA or 401 plan, establish a health savings account, or donate cash or property to charity, for example. You may also qualify for several other tax advantages and credits. You should also consult a tax specialist to determine if there are any extra tax benefits available to you.

You May Like: How To File 2016 Taxes

How To Avoid Paying Taxes On Crypto Using An Ira

Paying taxes on crypto is a major hassle, requiring you to report every trade, purchase, sale, or exchange to the IRS. The good news is theres an easy way to invest in crypto tax-free. And you dont have to renounce your citizenship, start a business in Puerto Rico, or open an offshore life insurance policy.

Its called a crypto IRA, and it works like any traditional or Roth IRA, providing you a tax-free or tax-deferred method for investing in cryptocurrencies like Bitcoin, Ethereum, or Solana.

In this post, well:

- Discuss how to avoid paying crypto taxes with an IRA

- Review the basics of cryptocurrency taxes

- Weigh the pros and cons of crypto in an IRA

Read Also: Mortgage Calculator Taxes And Insurance

How Is Cryptocurrency Mining Treated By The Cra

Mining cryptocurrency involves solving complex computer problems in exchange for an award of cryptocurrency. This type of computer problem requires high processing power, often resulting in high electricity costs. The CRA has suggested personal mining may be treated as a non-taxable hobby or personal activity, whereas mining for commercial or business purposes should be reported as income. The electricity costs reasonably attributable to the cryptocurrency business may be deducted as business income.

Determining Capital Gains Vs Capital Losses

Subtract your original asset purchase price from the net sale price. This is your capital gain or loss, and its on this amount that you will be taxed. This goes for stocks, bonds, real estate, art, and now cryptocurrency. The amount you pay depends on your income bracket, how long you hold an asset, and how much you can offset. There are limits to when you can do it, how much you can offset, and what type of assets are allowed.

The income threshold for capital gains tax is $40,000, above which youll pay 15%. Once your income is north of $500K, you pay at the full rate of 20%. Theres more to it than that as in certain circumstances only 50% of your capital gain is taxable. Check it out here, if you like. Did I mention there are 2,652 pages of it?

The take-home message is this. With certain restrictions, if you lose money on one asset, you can subtract the loss from your winnings on another, before they tax you.

Read Also: Home Depot Tax Exempt Registration

Give Up Your Us Citizenship

The most dramatic way to stop paying the IRS for your cryptocurrency gains is to give up your US citizenship. Once you expatriate, the IRS no longer has any right to your earnings. Would you give up your citizenship simply to avoid taxation? Its become a hot topic of late due to excess gains US citizens have pulled in in recent years.

Again, US citizens pay US tax on their capital gains and cryptocurrency gains no matter where they live. If you move to Panama, but keep your US passport, you still pay US tax on your trading profits. The only way to get rid of the IRS forever is to turn in your blue passport.

To give up your US citizenship, you may need to pay an exit tax and must have a second passport in hand before turning in your US travel document. Without a second passport, theres no way to expatriate from the United States.

You have two choices when it comes to getting a second passport. You can buy one from countries like Malta , Dominica or St. Lucia , or you can earn one over time by becoming a resident of a foreign country.

For example, you can become a resident of Panama with an investment of $20,000. After 5 years of residency, you can apply for citizenship and a second passport. So, you can either buy a passport or earn one through residency.

The Basic Personal Amount

If your only income is through crypto, the basic personal amount allows you to earn $13,808 before you need to pay taxes. For anyone that only makes income through cryptocurrency investments and trading, this effectively ensures you can maintain a basic level of income before being taxed.

Investor taxes, covered

With TurboTax Live Full Service, your tax expert gets to know your unique investment profile and finds every credit and deduction you qualify for, so you can keep more money in your pocket.

Don’t Miss: Do I Pay Taxes On Social Security

Invest In A Retirement Savings Plan

HODLing for the moon? Plan for the future with a Registered Retirement Savings Plan .

Any time you make a contribution to an RRSP, you can claim a tax deduction for that contribution, letting you reduce your tax bill. When you then want to withdraw funds, you’ll pay tax – but by retirement you should be in a much lower tax bracket.

There is a limit as to how much you can contribute each year – either 18% of the previous year’s income or the prescribed maximum of $29,210 for the 2022 tax year.

Is Moving Cryptocurrency Between Wallets Taxable

The transfer of cryptocurrency between wallets is not considered a taxable event. You should, however, keep track of these transfers to ensure that you can easily calculate your cost basis if a tax-related event occurs.

Want to earn $50 in the next 6 minutes?

giving new users $50Offer ends October 32, 2022.

Don’t Miss: Does The Post Office Have Tax Forms

Can You Avoid Paying Taxes On Crypto

Cryptocurrency has taken the world by storm, and with it, a whole new set of tax laws. The IRS has said that cryptocurrencies are taxable, but there are ways to avoid paying taxes on your gains. In this article, we will discuss how cryptocurrencies are taxed, the tax rate on crypto gains, how they can be calculated, and most importantly, how to avoid paying taxes on crypto.

How Much Do I Owe In Crypto Taxes

So it looks like some of your crypto activity is taxable what now? You can estimate how much youll owe in taxes by calculating your income, gains, and losses. Heres what that means:

Calculating crypto income

If youre a U.S. taxpayer, youre probably used to seeing your federal and state income tax deducted from your pay stubs. The crypto you receive as income is also subject to these same income taxes, which often won’t be deducted or withheld. When you report your earnings, youll generally owe according to the income tax rate appropriate to your tax bracket. Word of caution: If youve earned a lot from crypto activity, it might affect what tax bracket youre in and you may end up paying a higher tax rate on some of your earnings.

Visit IRS.gov for the latest guidance on federal income taxes.

Calculating capital gains and losses

To calculate the amount you gained or lost, youll first need to know how much crypto you started with. This is called your cost basis.

Knowing your cost basis

When you buy cryptocurrency, your cost basis is generally determined by how much you paid for it. However, if you received crypto from mining or staking, your cost basis is determined by the fair market value when you received it. Your cost basis for gifted crypto will depend on both the basis the person who transferred it to you had and the fair market value when you received it.

Short-term vs. long-term capital gains

Understanding your capital losses

Coinbase Gain/Loss Report

Recommended Reading: Department Of Tax Debt And Financial Settlement Services

Hold Cryptocurrency In A Tfsa/rrsp

Every Canadian above the age of 18 is eligible for a tax-free saving account . You can use this account to grow your savings without paying capital gains tax. For the 2022 tax year, the TFSA contribution limit is $6,000.

Alternatively, you can contribute to a Registered Retirement Saving Plan . For the 2022 tax year, the RRSP contribution is 18% of your earned income or $29,210 â whichever is lower. In addition, all contributions are tax-deductible. However, withdrawals are subject to income tax.

At this time, you canât directly hold cryptocurrencies in a TFSA or RRSP. However, you can hold ETFs that track the price of assets like Bitcoin and Ethereum.

Use A Crypto Tax Calculator To Spot Unrealized Losses

It’s unlikely you’ll be able to spot crypto tax minimizing opportunities if you don’t know how your portfolio is looking. Tax offices like the IRS in America, the ATO in Australia and the HRMC is the UK all recommend that crypto investors use a crypto tax app like Koinly to pay the right amount of taxes. But crypto tax software is just as good at helping you to pay less tax, when you use it strategically.

For example. say you’ve got a high Capital Gains Tax bill on the horizon. Jump into your portfolio dashboard on Koinly and look at your unrealized losses. If youve got assets that are underperforming, you can sell at a loss. This turns them into realized losses, which you can offset against your capital gains to reduce your tax bill. This is also known as tax loss harvesting.

In some countries, you can also offset losses against ordinary income up to a certain amount. Make sure to check your countrys crypto tax laws to see if this is the case where you live.

Read Also: What Percent Of Your Check Goes To Taxes

Should I Pay Business Income Or Capital Gains

You must pay business income tax if you operate a cryptocurrency company. Here are some indicators that you’re running a crypto company:

- Operating in a businesslike manner, which includes keeping a business plan, annual reports, and making projections for investors

- Promoting a product or service

- Seeking to make a profit, even if its unlikely to do so in the short term

The boundaries between business and individual investing are sometimes blurred. Even a single transaction may have to be recorded as company income if the aim of the deal was to produce a short-term gain.

How Does The Cra View Cryptocurrency

In 2014, the Bank of Canada did an analysis of cryptocurrency and determined that it does not meet the definition of money and is not a true currency like Canadian dollars or euros. The CRA subsequently issued a guide explaining that, for tax purposes, it generally treats crypto as a commodity, like oil or gold. As such, any earnings from transactions involving cryptocurrency are generally treated as business income or as a capital gain, depending on the circumstances.

The distinction is important because business income is fully taxable, whereas only 50% of capital gains are taxable. In other words, if you made $100 from crypto activity, youd pay taxes on the full amount if its considered business income, but youd pay tax on only $50 if its considered a capital gain.

You May Like: Where’s My Tax Credit

How Will Cra Know About My Profits

Not reporting income from cryptocurrency transactions is illegal. In order to ensure a fair tax system, the CRA actively pursues non-compliance with respect to reporting income from cryptocurrency trading. Cryptocurrency exchanges increasingly require personal information in order to set up an account. CRA may be able to access this information and verify it with other sources to identify individuals who seek to avoid paying taxes on transactions.

Take Out A Loan On Your Cryptocurrency

Instead of disposing of your cryptocurrency, consider taking out a loan using your cryptocurrency as collateral.

While selling your cryptocurrency will be subject to capital gains tax, taking out a loan is not considered a taxable event.

Still, itâs important to weigh potential risks before taking out a crypto loan. Your cryptocurrency may be subject to liquidation if its value drops significantly.

Recommended Reading: Sales Tax In Alameda County

Invest In An Opportunity Zone Fund

Want to do good for your community and your taxes? Invest in an opportunity zone fund.

Taxpayers who invest in opportunity zone funds can defer and reduce their capital gains taxes if they put the proceeds from their sold asset into an opportunity zone fund. You can defer your Capital Gains Tax until 2026 by doing this. If you hold the investment beyond this point, you’ll reduce your tax bill by up to 10%.