How Do I Know If Im Exempt From Federal Taxes

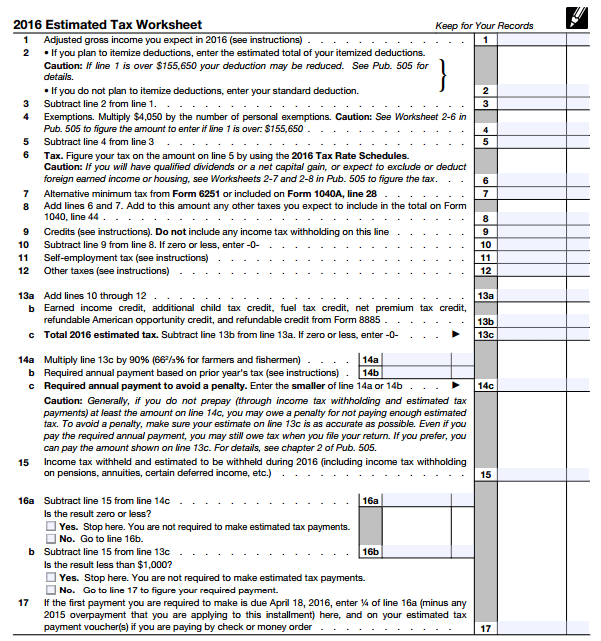

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For 2022, you need to make less than $12,950 for single filers, $25,900 for joint filers, or $19,400 for heads of household. For 2023 the standard deductions increased to $13,850 for single filers, $27,700 for joint filers, and $20,800 for heads of household.

If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication 505 for current laws.

Claiming exempt from federal tax withholding on your W4 when you arenât eligible isnât illegal but it can have major consequences. You might receive a large tax bill and possible penalties after you file your tax return.

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

Do Sole Proprietors Pay Payroll Taxes

Self-employed individuals must also pay their federal and state taxes, along with social security and Medicare . The differences are:

- Self-employed individuals pay the full amount once per year when filing their personal income tax returns.

- Self-employed individuals have to pay the full amounts themselves. Because they are self-employed, there is no employer to share the costs with.

It is advisable that self-employed individuals put aside a certain percentage of their small business earnings throughout the year so that they are prepared and capable of paying the taxes owed, at tax time.

Read Also: Last Date For Filing Taxes

How To Calculate Payroll Taxes For Your Small Business

by |Updated Aug. 5, 2022 – First published on May 18, 2022

Image source: Getty Images

Of all the taxes business owners must pay, payroll taxes can be the most vexing. If you think paying your employees is confusing, just wait until you have to calculate payroll taxes.

While you can find plenty of payroll services eager to take this task off your hands, even if you do turn payroll over to payroll software or a service provider, you should still know how to calculate payroll taxes.

Federal Insurance Contributions Act

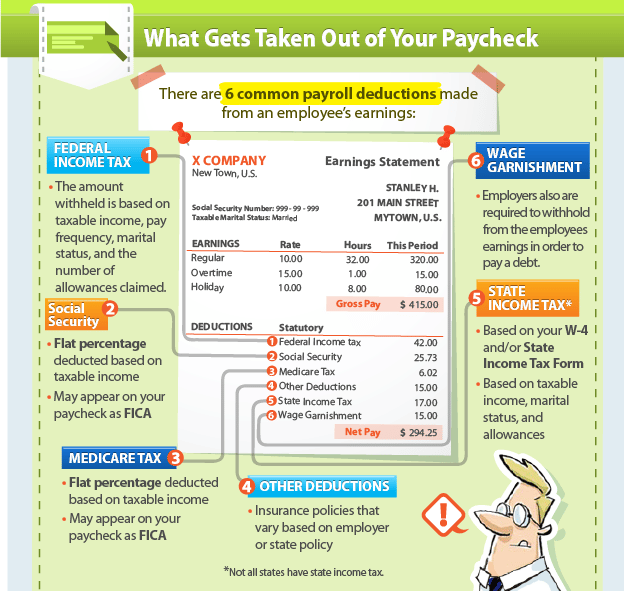

Also known as paycheck tax or payroll tax, these taxes are taken from your paycheck directly and are used to fund social security and medicare.

For example, in the tax year 2020 Social Security tax is 6.2% for employee and 1.45% for Medicare tax.If your monthly paycheck is $6000, $372 goes to Social Security and $87 goes to Medicare, leaving you with $6000 $372 $87 = $5541

Social Security

Read Also: How To File Self Employed Taxes

How To Calculate Payroll Tax For An Employer

Even small businesses with just a few employees are required to calculate and collect payroll taxes. In most cases a business will contract payroll processing out to a specialized service if it isn’t large enough to justify the administrative cost of doing payroll internally. However, if you run or manage a small business, you still need to know how payroll taxes for your employees are calculated, even if you never have to pick up a calculator and do the job manually.

1.

Determine the employee’s gross pay. Include hourly wages or salary plus tips, commissions and other taxable compensation. You should not include mileage or other reimbursements for business expenses.

2.

Multiply the number of withholding allowances the employee has claimed on his W4 form by the amount of one allowance for his filing status and the length of the pay period. For example, if his filing status is single with two allowances claimed and your pay period is weekly, you have 2 X $70.19 for a total of $140.38. Subtract this amount from the gross wages. In addition, subtract any tax deductions, such as contributions to a tax-deferred retirement plan. The remainder is the employee’s federal taxable income.

References

Calculate Employee Gross Pay

Before you can calculate taxes, youll need to calculate employee payroll.

In our example, lets say that Aaron currently works in New Mexico. Hes a salaried employee, earns $60,000, and is paid semi-monthly, which means hes paid 24 times a year. Aarons gross pay each pay period is the same, $2,500, which is calculated by dividing his annual salary by 24:

$60,000 ÷ 24 = $$2,500

Now that we know Aarons gross pay for the period, we can calculate his payroll taxes.

Also Check: New York State Income Tax Rate 2021

Why Do You Need To Adjust Your Tax Withholding

If you adjust your withholding so you break even at tax time, you end up with more cash in your pocket throughout the year. In other words, you dont send the IRS a big check, and you dont get a huge refund back either.

IRS data shows that the average tax refund for the 2022 tax season was $3,039.2 So, lets say you got paid twice a month and received the average refund. That means you shouldve had almost an extra $127 in every paycheck last year! Think of what you could do with $254 or more each month!

And if you went through a major life change over the past year that might impact how much you owe in taxesyou got married, bought a house, or welcomed a baby into the worldits a good idea to take a fresh look at your tax withholding and make any adjustments.

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

When using the Wage Bracket Method, there are two possible calculations: one for employees with a Form W-4 from 2019 or earlier, the other for employees with a Form W-4 from 2020 or later.

Employees with a Form W-4 from 2019 or earlier:

In IRS Publication 15-T, find the worksheet marked âWage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier.â

Check Form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Enter the employeeâs total taxable wages for the payroll period on line 1a. This includes any earnings an employee pays taxes on, including salaries and cash tips.

Use the amount on line 1a to look up the Tentative Withholding Amount. Find the table that corresponds to your payroll period and the marital status of the employee

Find the wage amount on the left side of the table. Once youâve identified the row, use the number of allowances the employee has reported on Form W-4 to locate the corresponding column. The cell where these two meet will give you the tentative withholding amount for this employee.

Take the tentative withholding amount from this table and input it on line 1b.

On line 2a, enter any additional amount to be withheld as reported on Form W-4

Add lines 1b and 2a to find the amount to withhold from the employeeâs wages and record it in line 2b.

Employees with a Form W-4 from 2020 or later:

Also Check: How Long Does Turbo Tax Take

How Do I Create A Paycheck For An Employee

Employers typically have two basic options for creating paychecks:

How To Calculate Voluntary Paycheck Deductions

While FICA, federal income tax, and state and local income taxes all require mandatory payroll deductions, there are some other voluntary sources that could lead to additional paycheck withholdings. Potential voluntary paycheck deductions include:

- Health insurance Based on the plans offered and which of those plans your employees choose

- Retirement Based on how much each employee opts to have withheld from each paycheck

- Life insurance Based on whether employee opts to have deductions to go toward a life insurance premium

- Job expenses Varying deductions based on any business expenses made by an employee that are either not or only partly covered by the employer

Also Check: Nys Dtf Pit Tax Paymnt

Whats New As Of January 1 2022

The major changes made to this guide since the last edition are outlined.

This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2022. At the time of publishing, some of these proposed changes were not law. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2022.

For 2022, employers can use a Federal Basic Personal Amounts of $14,398 for all employees.

The federal income tax thresholds have been indexed for 2022.

The federal Canada Employment Amount has been indexed to $1,287 for 2022.

For 2022, employers can use BPAYT of $14,398 for all employees.

The first three Yukon income thresholds, the Canada Employment Amount and some personal amounts have been indexed for 2022.

How Your Indiana Paycheck Works

Employers will withhold federal and FICA taxes from your paycheck. Medicare and Social Security taxes together make up FICA taxes. Employers withhold 1.45% in Medicare taxes and 6.2% in Social Security taxes per paycheck. Employers also match this amount for a total FICA contribution of 2.9% for Medicare and 12.4% for Social Security. Note that if you are self-employed, you need to pay that total yourself. However, there are some deductions to help self-employed workers recoup some of those taxes. Additionally, wages that exceed $200,000 are subject to a 0.9% Medicare surtax.

The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes. The amount of federal taxes taken out depends on the information you provided on your W-4 form. Remember that whenever you start a new job or want to make changes, youll need to fill out a new W-4. Withholding affects how much you will pay in taxes each pay period.

In recent years, the IRS has made multiple changes to the W-4. The updated form doesnt let you to list total allowances anymore. Instead, it requires you to enter annual dollar amounts for things like non-wage income, income tax credits, total annual taxable wages and itemized and other deductions. The form also includes a five-step process that asks filers to enter personal information, claim dependents and indicate any additional income or jobs.

Don’t Miss: Is Credit Card Interest Tax Deductible

How To Pay Self

Self-employment comes with its own amazing freedoms and power in your work. But it also comes with its own unique challenges.

How to calculate payroll taxes – Self-employment will have you handling a lot of work by yourself. But hey! Youâve got control. Surround yourself with plants and have at it.

Self-employed payroll taxes are often referred to as SECA, or the Self-Employment Contributions Act tax. Similar to a business, you will be responsible for Medicare and Social Security tax. And the same percentages apply that an employee and employer contribute. FICA taxes amount to 15.3% of your total net wages: 12.4% for Social Security and 2.9% for Medicare.

While those percentages would be split between employee and employer for a business â 7.65% paid by each party â you will have to cover both sides. However, you can deduct the employer equivalent contribution from your gross income when calculating your income tax.

And, of course, youâve got to file.

For your yearly filing, you will submit your Form 1040 with your calculated income. As for the question of when are payroll taxes due for self-employment, you will need to file and submit your self-employed payroll taxes quarterly with Form 1040-ES.

Renting Out A Second Property

If the space you host on Airbnb is a second property or a property that you dont live in, you can earn up to £1,000 tax-free each year. Any rent over that amount is taxable rental income and will be subject to Income Tax. The amount of Income Tax you pay is based on your income band. You can use the TaxScouts rental income tax calculator to easily calculate what you owe.

UK income tax bands for 2022/2023 and 2023/2024 are as follows:

| Income |

- Other utilities

Recommended Reading: When Will I Receive My Tax Refund 2022

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employeeâs wages.

Do any of your employees make over $147,700? If so, the rules are a little different, and they may owe additional Medicare tax. Read more at the IRS.gov website.

The Federal Income Tax: How Are You Taxed

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

Don’t Miss: Capital Gains Tax On Cryptocurrency

How To Calculate Employer Payroll Taxes

Payroll taxes are figured according to an employee’s Form W-4. This form tells the employer the employee’s marital status and whether additional withholding should be made to cover certain personal taxes to which an employee may be entitled that reduce his or her income taxes. If no W-4 is provided, then an employer withholds as if the employee were single with no other adjustments.

Employers relying on outside payroll service providers, such as Paychex, can leave the calculations to them. Some employers who do payroll in-house use software or rely on tables provided by the IRS in Circular E to calculate payroll taxes.

Whats The Difference Between A Deduction And Withholding

In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. These are known as âpre-tax deductionsâ and include contributions to retirement accounts and some health care costs. For example, when you look at your paycheck you might see an amount deducted for your companyâs health insurance plan and for your 401k plan. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. Some deductions are âpost-taxâ, like Roth 401, and are deducted after being taxed.

In our calculators, you can add deductions under âVoluntary Deductionsâ and select if itâs a fixed amount , a percentage of the gross-pay , or a percentage of the net pay . For hourly calculators, you can also select a fixed amount per hour .

Also Check: California Capital Gains Tax Rate 2022

How Much Of Rental Earnings Are Tax

There are a number of ways in which you can reduce the amount of income tax you owe:

Property allowance

You can receive up to £1,000 of tax-free rental income from a property you own personally. This is known as your property allowance and you dont have to declare it to HMRC.

If, however, you earn between £1,000 and £2,500 after allowable expenses , you need to contact HMRC directly, as they may be able to collect your tax via PAYE.

Any income more than £2,500 must be declared on a self-assessment tax return and you also have to choose between deducting expenses from your rental income and receiving the property allowance.

Allowable expenses

When calculating your profit, make sure you deduct any money you spend on maintaining and managing your property. Some examples of allowable expenses include:

- Buildings, contents and landlord insurance

- Estate agent fees

- Utility bills and council tax

- Ground rent and service charges

- Property maintenance and repairs

Other tax relief

If you own a holiday home that you rent out, you may also be able to subtract expenses for equipment like air conditioning and CCTV, as well as replacing items like beds, carpets, sofas, curtains and fridges in furnished holiday lets.

With regards to commercial property, deductible expenses can include money spent on escalators, lifts and electrical systems.

Remember to keep hold of any receipts in case HMRC wants proof of your expenses.

Federal Income Tax: 1099 Employees

Independent contractors, unlike W-2 employees, will not have any federal tax deducted from their pay. This means that because they are not considered employees, they are responsible for their own federal payroll taxes .

Both 1099 workers and W-2 employees must pay FICA taxes for Social Security and Medicare. But, whereas W-2 employees split the combined FICA tax rate of 15.3% with their employers, 1099 workers are responsible for the entire amount.

The IRS mandates employers to send 1099 forms to workers who are paid more than $600 during a tax year.

A financial advisor can help you understand how taxes fit into your overall financial goals. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

Also Check: Amended Tax Return Deadline 2020