Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

Determine Your Tax Withheld Bracket By Referring To Birs Withholding Tax Table

The BIR’s withholding tax chart may help you determine where your result from Step 2 falls in relation to the tax bracket. Then figure out how much tax you owe.

Let’s again see the two examples given below:

Case # 1: P23,974.95 is in bracket 2 for Employee 1 since his compensation exceeds Php 20, 833.33. This implies that we must deduct Php 20, 833.33 from the total and then multiply the resulting amount by 20 percent.

x 0.20 = P628.32

Case # 2: In the case of Employee 2, the amount of Php 99, 602.03 is classified as bracket 4, since the compensation exceeds Php 66, 666.67. In order to do this, we must deduct Php 66, 666.67, multiply the difference by 30, and then add Php 10, 833.33 to the total.

+ 10,833.33 = P20,713.94

Meanwhile, if you have a business aside from your monthly salary in the company, you can compute your total income tax due by following these steps:

Computation of income tax due on business income using the 8% tax rate

In order to get the yearly gross revenue, multiply your monthly income by 12 months. For example:

Php 15 ,000 x 12 = Php 180, 000

Then, in order to figure out your income tax due, multiply your gross income by 8%:

Php 180, 000 x 0.08 = Php 14, 400

Computation of total income tax due

The Federal Income Tax: How Are You Taxed

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

You May Like: Florida Total Sales Tax Rate

Calculator Variables And Results

Choose the year that you want to calculate your US Federal Tax

Filing Status

Choose one of the following: Single, Married Filing Jointly, Married Filing Separately, or Head of Household

Taxable Income

The income amount that will be taxed

Estimated Tax

The estimated tax you will pay

Tax Bracket

The tax bracket you fall into based on your filing status and level of taxable income

Tax as a percentage of your taxable income

Since taxes are calculated in tiers, the actual tax you pay as a percentage of your taxable income will always be less than your tax bracket.

Net Income after Tax is paid

This is the amount you have left over after you pay your Federal taxes. This does not account for state and local taxes.

Federal Income Tax Return Calculator

Estimate how much you’ll owe in federal taxes, using your income, deductions and credits all in just a few steps with our tax calculator.

How we got here

The United States taxes income progressively, meaning that how much you make will place you within one of seven federal tax brackets:

Single filers

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$157,804.25 plus 37% of the amount over $523,600 |

|

$1,990 plus 12% of the amount over $19,900 |

|

|

$9,328 plus 22% of the amount over $81,050 |

|

|

$29,502 plus 24% of the amount over $172,750 |

|

|

$67,206 plus 32% of the amount over $329,850 |

|

|

$95,686 plus 35% of the amount over $418,850 |

|

|

$168,993.50 plus 37% of the amount over $628,300 |

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$84,496.75 plus 37% of the amount over $314,150 |

Head of household

|

$1,420 plus 12% of the amount over $14,200 |

||

|

$6,220 plus 22% of the amount over $54,200 |

||

|

$13,293 plus 24% of the amount over $86,350 |

||

|

$32,145 plus 32% of the amount over $164,900 |

||

|

$46,385 plus 35% of the amount over $209,400 |

||

|

$523,601 or more |

$156,355 plus 37% of the amount over $523,600 |

Don’t Miss: How Much In Taxes Do I Owe

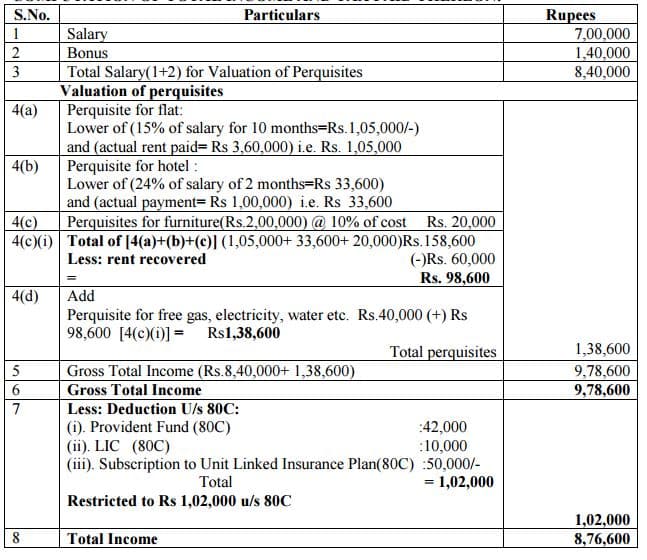

Section 80c 80ccd And 80ccc

There are tax savings options wherein salaried employees can invest and claim an income tax deduction on salary up to Rs. 1.5 lacs. Some of the investments covered under the sections mentioned above include Employee Provident Fund , Life Insurance Premium, Equity Linked Savings Scheme , Pension schemes, etc. There are also many other government savings schemes included under these sections.

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Recommended Reading: Mail Tax Return To Irs Address

How To Use The Income Tax Calculator

The income tax calculator is an easy-to-use online tool which provides you with an estimation of the taxable income and tax payable once you provide the necessary details.

The steps to use the tool are as given below –

- Choose your age bracket. This determines your applicable tax slab rates

- Enter your annual salary. You can include the total salary inclusive of all bonuses and variable components

Once you enter these details, subsequent fields open up where you can enter your investment details

- Enter your investment amount under Section 80C and 80CCD

- Enter your medical insurance premium u/s 80D , if you have a health insurance policy

- If you live in a rented property, enter your HRA received and rent paid. You can calculate yourHRA exemption here

- If you have a home loan you’re paying back, enter the interest paid, as the same is eligible for deduction from taxable income

- If you have an educational loan you’re paying back, enter the interest paid, as the same is eligible for deduction from taxable income

Note: Whichever fields are not applicable, you can enter 0

You can see your taxable income and the tax payable on the Summary tab!

How Do I Lower My Taxable Income

Ending the year with a taxable income can put you into a higher tax bracket, which means you’ll have a higher tax bill. Most people lower this figure by taking the standard deduction when you file your return. Or, if you itemize, make sure you factor in every deduction possible. But there are ways to lower your taxable income even before you file. Contributing to a retirement account like a 401 or an individual retirement account, setting money aside in a flexible spending or health savings account.

Also Check: Travel Trailer Tax Deduction 2021

How To Calculate Income Tax Expenses

The Indeed Editorial Team comprises a diverse and talented team of writers, researchers and subject matter experts equipped with Indeed’s data and insights to deliver useful tips to help guide your career journey.

Accountants and bookkeeping professionals can use several metrics to track an organisation’s expenses and financial status. One of these is income tax expense, which measures the amount of money an individual or business owes the government on taxable income. Understanding how to calculate income tax expenses can help you manage your finances. In this article, we explain what income tax expenses are, discuss how to calculate them, give examples, compare income tax expenses to income tax payable and provide answers to FAQ.

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

You May Like: Tax Implications Of Selling Stock

Add Your Income Tax Expense To Your Income Statement

An income statement is a financial document that you may use to convey your financial performance, often after every quarter of a financial year. They typically have four parts: losses, gross profit, expenses and revenue. The income tax expense comes under expenses.

Related:What is an income statement?

Which Formats Can You Use When Recording Income Tax Expenses On Income Statements

You can use a single- or multi-step formula to create an income statement. The single-step method involves placing all revenue on one line and expenses on another. When using the multi-step approach, place different revenue streams and expenses on separate lines. You can only use the multi-step formula if you want to create an income statement featuring income tax expenses. The income tax expense appears right above the expenses’ bottom line.

Recommended Reading: When Are Corporation Taxes Due 2021

Bir Form No 1701a: Annual Income Tax Return For Individuals Earning Income Purely From Business/profession

Individuals using the flat 8 percent income tax rate and those who fall within the graduated income tax rates with OSD as a method of deduction. Individuals who make their money solely via trade, commerce, or the practice of the profession are required to submit a tax return.

1. A resident citizen 2. A resident alien, non-resident citizen or non-resident alien

The return may only be utilized by the following individuals:

-

individuals whose subject to graduated income tax rates and who use the standard deduction as a strategy of tax planning, whether or not they have any sales or receipts or other non-operational revenue OR

-

anybody earning less than Php 3 million in sales/receipts or other non-operating income but who took advantage of the 8% flat income tax rate

Filing date: Taxpayers are required to submit this form on or before April 15 of each year, which covers the preceding taxable year’s income.

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

There are numerous other credits, including credits for the installation of energy-efficient equipment, a credit for foreign taxes paid and a credit for health insurance payments in some situations.

Don’t Miss: Married Filing Jointly Tax Deduction

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is Net Income

Net income , also called net earnings, is calculated as sales minus cost of goods sold, selling, general and administrative expenses, operating expenses, depreciation, interest, taxes, and other expenses. It is a useful number for investors to assess how much revenue exceeds the expenses of an organization. This number appears on a company’s income statement and is also an indicator of a company’s profitability.

You May Like: How Long Does Taxes Take To Process

Reduce Your Taxes With Credits And Deductions

You may be able to reduce the amount of tax your business pays by taking advantage of targeted tax breaks, including both tax credits and deductions.

For tax deductions, you can choose to either itemize your deductions or take one standard deduction .

If you donât have many deductions to claim, youâll probably want to claim the standard deduction.

If youâve got lots of deductions, youâll probably want to itemize. To claim every deduction you possibly can, check out The Big List of Small Business Tax Deductions.

To see what tax credits you might qualify for, check out The Big List of U.S. Small Business Tax Credits.

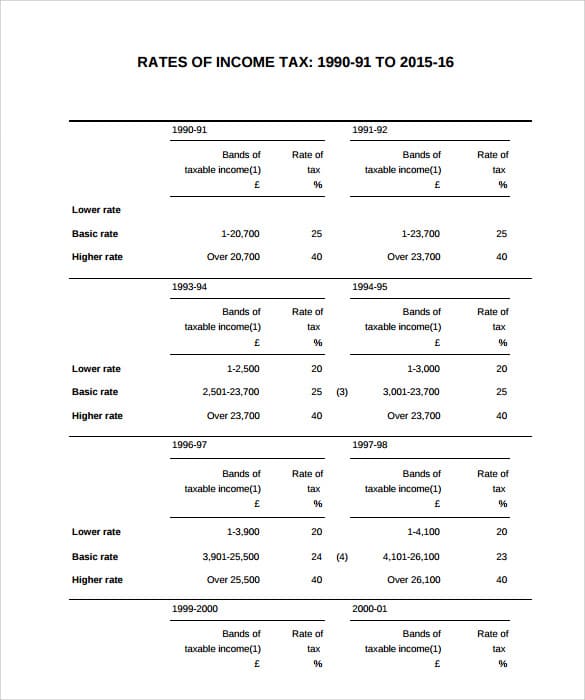

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2012 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

Read Also: How Long Receive Tax Refund

Frequently Asked Questions About The Income Tax Calculator

How much income tax you pay on your salary depends on your taxable income and the income tax slab you fall under. Your taxable income is what you get when you subtract the exemptions and deductions from your Gross Total Income, which includes your salary and income from other sources.

The tax slab depends on your taxable income and age and is different for the old and new regime.

The income tax calculator is a simple online tool that makes your life easy when it comes to tax calculations. You simply have to enter the relevant details in the empty fields:

- Enter the interest paid Home loan

- Enter the principal repaid on home loan

Your Total Income Tax Benefit will be instantly displayed to the right of the calculator along with your tax payable before Home Loan and after Home Loan.

Under Section 80C, you can claim deductions of up to Rs. 1.5 lakh per financial year. However, there is an additional deduction of up to Rs. 50,000 permitted for deposits made to an NPS account.

The Section 80C deduction applies to investments like EPF, PPF, ELSS, and tax saving FD as well as to LIC premiums, home loan principal repayment and more. The limit of Rs. 1.5 lakh is inclusive of subsections like 80CCC, 80CCD, and 80CCD.

When repaying a home loan, you can claim:

However, under both regimes, you can claim a rebate of up to Rs. 12,500 under Section 87A if your taxable income does not exceed Rs. 5 lakh. Hence, no income tax may be paid for taxable incomes up to Rs. 5 lakh.