What Are The Federal Tip Credit Rules

The Fair Labor Standards Act sets out the basic rules for how to calculate payroll for tipped employees. The legislation includes a few key figures that you need to know:

-

Minimum wage is $7.25.

-

Maximum tip credit is $5.12.

-

Overtime rates apply after 40 hours worked in one week.

Unless youre subject to other state or municipal laws regarding minimum wage, you have to stay within FLSA guidelines.

How To Calculate Ifta Tax: Fuel Tax Reporting

To remain compliant and understand how to file quarterly IFTA taxes, companies must begin by creating a process on how to accurately record the amount of fuel consumed in different jurisdictions along their trucking routes. In addition, they must educate drivers on how to record their odometer readings whenever they cross U.S. state or Canadian province lines. In some cases, there is fleet management software that can help companies make calculating IFTA tax quicker and easier.

Next, its necessary to calculate the total number of gallons of fuel that was purchased in each state, province, or jurisdiction. NOTE: Its important to remember that drivers/carriers must retain all original receipts and/or invoices to prove that upfront fuel taxes were paid during purchases.

Information like the fuel purchase date, type of fuel purchased, price per gallon, drivers name, and vehicle license plate number are necessary components that will be needed when completing IFTA forms.

1. Calculating IFTA Taxable Miles by State

To begin, gather records of total miles driven and fuel amounts purchased in each jurisdiction where your fleet vehicles traveled. The formula is rather simple from this point. Simply divide the total miles driven by total gallons to obtain the overall fuel mileage. NOTE: You can round off the miles per gallon to two decimal points.

Total Miles Driven in Each State/Province X ÷ Overall Fuel Mileage = Fuel Consumed in Each State/Province X

3. How to Do Your IFTA

How Do I Credit Tips On Cards

You must give the tip amount to the employee when tips are included in credit or debit card payments. Unless prohibited by state law, you can reduce the tip by the transaction fee amount that’s charged by a credit card company. For example, you can give the employee $4.85 if the credit card transaction fee is 3% and an employee’s tip is $5.

But the Department of Labor says this reduction can’t bring the employee’s pay down to less than the minimum wage, and you must reimburse the employee on the next payday. You can’t wait until you receive the reimbursement from the credit card company.

Don’t Miss: Are Medical Insurance Premiums Tax Deductible

Calculating And Paying Your Taxes

Youâll pay all these federal taxes together, four times a year when you pay estimated quarterly taxes.

To calculate how much tax you need to pay, use the Estimated Tax Worksheet, which is part of Form 1040-ES.

Youâll also use Form 1040-ES to file your quarterly estimated taxes.

Or if you want to get straight to calculating, use our Self-Employed Tax Calculator.

Additional Medicare Tax On Tips

Beginning in 2013, a 0.9% Additional Medicare Tax applies to Medicare wages and an employer is required to withhold this Additional Medicare Tax on any Medicare wages or RRTA compensation it pays to an employee in excess of $200,000 in a calendar year without regard to the employee’s filing status. Additional Medicare Tax is only imposed on the employee. There is no employer share of Additional Medicare Tax.

All wages and compensation that are subject to Medicare tax are subject to Additional Medicare Tax withholding if paid in excess of the $200,000 withholding threshold. Tips are subject to Additional Medicare Tax withholding, if, in combination with other wages or other RRTA compensation paid by the employer, they exceed the $200,000 withholding threshold.

For more information, see Topic 560 – Additional Medicare Tax.

Don’t Miss: Selling House Capital Gain Tax

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

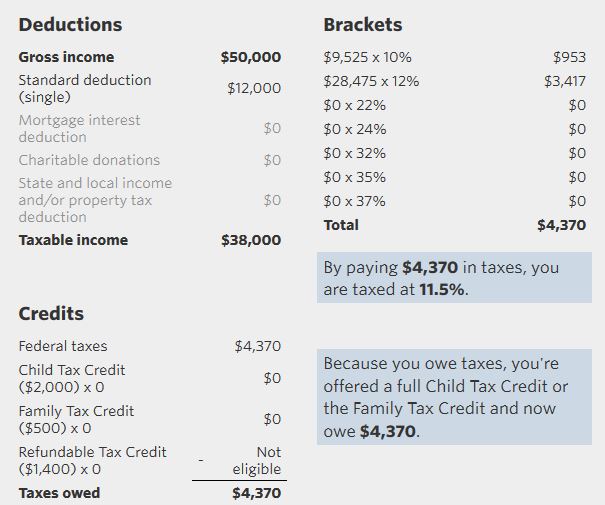

Determine Your Total Taxable Income

Your taxable income is the portion of your wages subject to government taxation. It may include salaries, tips, wages, bonuses, unearned income, investment income and assets you sold during the taxable year. Unearned income refers to lottery payments, strike benefits, disability and unemployment benefits and cancelled debts.

To determine your taxable income, subtract your expenses from your gross income to derive your business income. Next, subtract deductions from the business income. Deductions are tax credits you might benefit from based on age, company size and household status. You can also consult tax specialists, such as tax attorneys and certified public accountants , to calculate your taxable income.

Related:How to calculate net income

Read Also: Local County Tax Assessor Collector Office

So What Are Payroll Taxes Again

Alright. Before we even start on how to calculate payroll taxes, letâs do a short recap.

Payroll taxes are taxes employers pay per employee determined from an employeeâs wage, salary, and tips. They are employee and employer-paid taxes, meaning both you and your employee contribute to them.

As an employer, you might ask yourself, how do I pay taxes for my employees?

After all, itâs your responsibility to calculate that amount and withhold the employee contribution from their paycheck.

These payroll taxes refer to FICA , which funds Medicare and Social Security and is contributed to by employees and employers, as well as FUTA , which funds unemployment benefits and is only paid by the employer.

For more on these acts, check out our Payroll Compliance 101 guide.

Overview: What Is A Tip Credit

In most states, tipped workers arent subject to the same minimum wage as non-tipped workers. A tip credit sets the state minimum wage for tipped workers, called a minimum cash wage.

Minimum Cash Wage = Minimum Wage Maximum Tip Credit

For example, New Jersey has an $11-per-hour minimum wage and a $7.87 tip credit, so employers must pay tipped workers at least $3.13 per hour .

Tipped workers pay comprises employer-paid wages and customer-paid tips, which should add up to at least the highest applicable minimum wage, whether it be the city, state, or federal minimum wage. When a tipped employees earnings dont reach the applicable minimum wage, the employer must step in to cover the difference.

The Fair Labor Standards Act sets the federal minimum wage and federal maximum tip credit, which states defer to only when theres either no state minimum wage or its lower than the federal minimum wage. With a $7.25 federal minimum wage and the $5.18 maximum federal tip credit, the federal minimum cash wage is $2.13.

FLSA tip law demands the following employers when paying tipped employees:

A note on the last requirement: The takeaway is tipped employees must earn at least the minimum wage.

Read Also: Federal Tax Return By Mail

Income Tax Expense Vs Income Tax Payable

People often use these two terms interchangeably, but they don’t mean the same thing. Income tax expense is the amount of taxable income a business or individual believes they owe the government. Organisations often enlist a tax specialist to help determine this value and then list it on their income statements. Comparatively, income tax payable is the amount of taxable income that a business or individual formally owes the government. Organisations don’t list their income tax payable on their income statements using standard accounting rules and practices. Instead, they put this figure on their balance sheets.

Discrepancies often occur between income tax payable and income tax expenses because of depreciation, individual accounting measures and tax credits. For example, if assets depreciate, the tax payable is likely to be lower than the income tax expense.

Do I Have To Allocate Tips

If you operate a large food or beverage establishment, you must allocate tips to your employees. Youre considered a large food or beverage establishment if

- you provide food or beverages for consumption on your premises

- you normally employ more than 10 people, who work more than 80 hours on a typical business day and

- tipping by customers is customary.

If your employees received less than 8% of your businesss gross sales in tips for the payroll period, then you must allocate at least 8% of your monthly sales to your employees, . For example, if you had $100,000 in sales for the month, you must allocate $8,000 to your employees.

At the end of the year, youll report allocated tip money in Box 8 on your employees W-2. You dont withhold taxes from those tips, so your employees will have to report them on their tax return and pay an additional tax. Youll also have to report the allocated tips on Form 8027, Employers Annual Information Return of Tip Income and Allocated Tips. Your employees will use Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to calculate how much taxes they owe on their allocated tips.

**If you have any questions or concerns about withholding taxes on your employees tips, please talk to your accountant or a tax professional.**

You May Like: When Is An Estate Tax Return Required

How Should My Employees Report Tips

Your employees must report their tips to you monthly . The IRS expects your employees to keep a detailed record of how much tip money they earned every day. Your employees, then, must report that information to you on or before the 10th day of the month following the month the tips were received. So, for example, if one of your employees was tipped $100 in January, they would have to report that to you by February 10.

Your employees must give you a report that includes:

- the employees name, address, and social security number

- their employers name and address

- the month the report covers

- the total tips received, including cash, tips paid by credit or debit card, and the value of non-cash tips received and

- the amount of any tips paid to other employees through tip pooling or splitting, with the names of those recipients.

There are a few ways your employees can turn in a tip report to you each month. They can

- complete any other paper or electronic log, if it includes the required information.

What Happens If An Employee Fails To Report Their Tips

According to the IRS, If an employee fails to report tips to his or her employer, the employer is not liable for the employer share of Social Security and Medicare taxes on the unreported tips until notice and demand for the taxes is made to the employer by the IRS.

Also, he employer is not liable to withhold and pay the employee share of Social Security and Medicare taxes on the unreported tips.

Read Also: How Much Will I Get Paid After Taxes

Keep A Daily Tip Record

Employees must keep a daily record of tips received. You can use Form 4070A, Employee’s Daily Record of Tips, included in Publication 1244, Employee’s Daily Record of Tips and Report of Tips to Employer. In addition to the information asked for on Form 4070A, you also need to keep a record of the date and value of any noncash tips you get, such as tickets, passes, or other items of value. Although you do not report these tips to your employer, you must report them on your tax return.

What About Allocated Tips

If you work at a bigger restaurant you may have tips allocated to you. Thatâs because the IRS requires large establishments to allocate 8% of their total gross receipts as tip income to employees â even if theyâre not actually paid out to employees.

Allocated tips can be a confusing concept to wrap your head around. Letâs talk about the thought process behind them.

How do allocated tips work?

Standard tipping rates range from 10-20%. So employees at a large restaurant collectively report less than 8% in tips, something was probably missed â or so the thought process goes.

Enter allocated tips. Theyâre a way of ensuring that all cash tips are accounted for, even if employees fail to report them.

Think of allocated tips as an on-paper adjustment or âreporting deviceâ â not an actual payment you get. Thatâs right: theyâre usually not paid out to employees. Theyâre simply a way for companies to meet their reporting requirements, without forcing them to account for every dollar. Who has to deal with allocated tips?

Employees who report tip income of less than 8% for the pay period may get assigned allocated tips .

Hereâs how it works: The company will calculate the difference between gross sales and reported tips at the end of each year . If employee tips account for less than 8% of the companyâs gross receipts for that pay period, the difference becomes allocated tips.

What if you received less than whatâs allocated?

Melissa Pedigo, CPA

Read Also: Sales Tax Exempt Form Ny

How The Required Cash Wage Works

You must first pay a tipped employee at least $2.13 an hour before tips are counted. Then the employee tips are reported to you by the employee. The $2.13 plus the tips reported by the employee should equal at least the minimum wage. You must make up the difference if the two amounts don’t equal the minimum wage.

Some states have different minimum wage rates for tipped employees. Some require that employees be paid the full minimum wage before tips, while other states have a higher minimum required cash wage than the federal amount. You must use the state’s minimum wage rate amount if the state minimum wage law requires a higher amount than the federal rate.

Are Income Tax Expenses Operating Expenses

No, they’re not. Operating tax expenses cover selling, general and administrative expenses, amortisation and depreciation. These don’t include taxes or investments in other companies and interest expenses.

Please note that none of the companies, institutions or organisations mentioned in this article are affiliated with Indeed.

Also Check: How Much Medicare Tax Is Withheld

How To Calculate Tax Shield

The value of a tax shield is calculated as the amount of the taxable expense, multiplied by the tax rate. Thus, if the tax rate is 21% and the business has $1,000 of interest expense, the tax shield value of the interest expense is $210.

What is the formula for tax shield?

- Calculating the tax shield can be simplified by using this formula: Tax Shield = Value of Tax Deductible-Expense x Tax Rate. So, for instance, if you have $1,000 in mortgage interest and your tax rate is 24 percent, your tax shield will be $240.

First Make Sure You Understand Your Business Structure

Most independent contractors are technically small business owners that operate either as a sole proprietorship, limited liability company , partnership, or S corporation. With any of these business structures, your earnings are reported as part of your personal income for tax purposes.

In the USA, approximately 73% of businesses are registered as sole proprietorshipsâclearly the most popular business structure for entrepreneurs going it on their own. Setting one up is quick and easy: if you donât formally register as a certain type of business entity, the IRS will treat you as a sole proprietor by default.

If you run your business part time, and youâre also someoneâs employee, youâll need to file your own business taxes with Form 1040 . Your employer also files a Form W-2 for you.

Note: taxes work the exact same way for independent contractors and freelancers. As long as youâre self-employed, the IRS only looks at you through the lens of your business entity. So if you understand how your entity type works, youâll know how your taxes work.

Read Also: Pay Federal Estimated Tax Online

Federal Taxes Vs State And Municipal Taxes

For the most part, this guide covers federal taxes.

But your state and municipality may also expect you to pay taxes. Since every state and municipality is different in this regard, itâs beyond the scope of this guide to cover them all.

To find out what you need to pay in addition to federal taxes, visit the tax authorities for your state and municipality. Hereâs a directory to every US stateâs tax authority, and hereâs a list of every tax-collecting municipality in the USA.

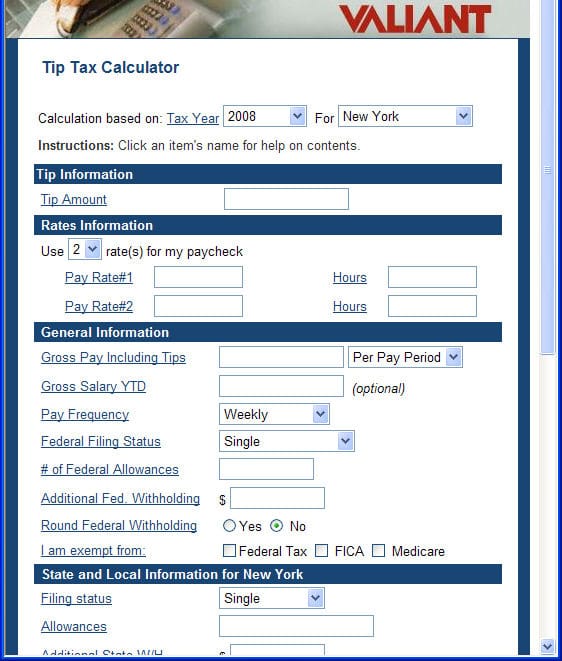

Calculating Withholding: Wage Bracket Method

Under the wage bracket method,you simply locate an IRS Publication 15-Tthe proper table for your payroll periodand the employee’s marital status as shownon the employee’s Form W-4.

Then look at the employee’s Form W-4 for the numberof withholding allowances claimed.

Using the number of allowances claimed on the Form W-4,and the amount of taxable wages paid,follow the column and row to find the amountof tax to withhold.

For withholding computations for employees claiming morethan 10 withholding allowances,you will need to refer to the special wagebracket instructions in IRS Publication 15-T.

Recommended Reading: California Tax On Capital Gains

Add Your Income Tax Expense To Your Income Statement

An income statement is a financial document that you may use to convey your financial performance, often after every quarter of a financial year. They typically have four parts: losses, gross profit, expenses and revenue. The income tax expense comes under expenses.

Related:What is an income statement?

Employer Share Of Social Security And Medicare Taxes On Unreported Tips

If an employee fails to report tips to his or her employer, then the employer is not liable for the employer share of Social Security and Medicare taxes on the unreported tips until notice and demand for the taxes is made to the employer by the IRS. The employer is not liable to withhold and pay the employee share of Social Security and Medicare taxes on the unreported tips.

For more information on the Section 3121 Notice and Demand, see Revenue Ruling 2012-18, which sets forth additional guidance on Social Security and Medicare taxes on tips.

Also Check: Can You Write Off Property Tax