How Does An Amended Tax Return Work

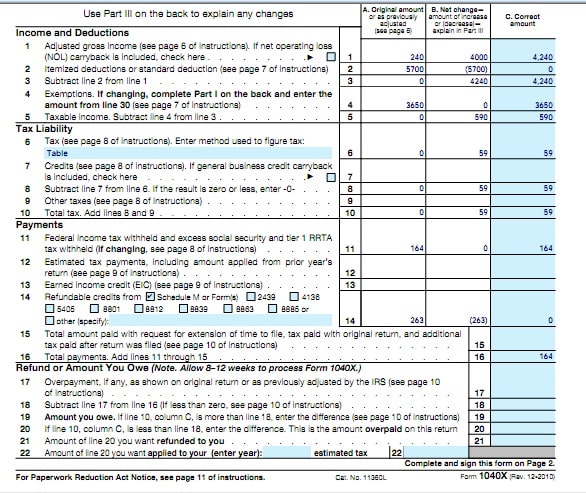

IRS Form 1040-X is the form you fill out to amend or correct a tax return. On that form, you show the IRS your changes to your tax return and the correct tax amount.

-

If youre fixing more than one year of returns, youll need to fill out a separate Form 1040-X for each. Youll also need to include forms or schedules affected by the changes.

-

If you’re filing Form 1040-X to get money back, you generally need to do so within three years of filing your original return or within two years of paying the tax, whichever is later.

You might catch an error before the IRS does, or you might receive new tax documents after youve already filed if your employer sends you a revised W-2, for example. In those cases, dont fire off a letter to the IRS saying, Forgot to include some income. Heres 10 bucks” or “You owe me $50.” Fill out Form 1040-X.

The IRS also has an interview-style tool that can help you to determine whether your situation requires filing an amended return.

In 2020, the IRS began allowing taxpayers to file Form 1040-X electronically. This means you can file an amended 1040 and 1040-SR form for tax years 2019, 2020, 2021 online. If you need to file an amended return for an older return , the amended return must be filed with the IRS by mail.

» MORE:See a list of IRS phone numbers you can call for help

What Is An Amended Return

Form 1040-X, the Amended U.S. Individual Income Tax Return, lets the IRS know that you’ve made a mistake. But it isn’t simply a matter of waving a red flag. Form 1040-X includes columns where you can enter information as it appeared on your original return and the correct information as it should have appeared. The IRS will take a look at the information youve updated and it will correct it in its system.

You may be asked to complete Form 1040-X if the IRS gets in touch with you to notify you of a problem with the first return you submitted, or to request additional information. You can file the form electronically beginning with the 2019 tax year.

File Your Amended Return Before It’s Too Late

Generally, you must file an amended tax return within three years from the date you filed your original return or within two years from the date you paid any tax due, whichever is later. If you filed your original return before the due date , it’s considered filed on the due date. There are a number of special due-date rules for amended returns that are based on changes related to bad debts, foreign tax credits, net operating losses, natural disasters, service or injury in a combat zone, and a few other situationsâcheck the instructions for Form 1040-X for details.

Don’t file your amended tax return too quickly, though. If you’re due a refund on your original return, wait until you actually receive the refund before filing an amended return for that tax year.

Also Check: Deadline To File 2020 Taxes

Keep An Eye On The Calendar

Generally, the IRS audits only returns from the previous three tax years though there are major exceptions. So although it might be tempting to wait and see if the IRS will catch you in an error, it might be cheaper to fess up sooner rather than later.

The IRS charges interest and penalties on outstanding tax liabilities going all the way back to the original due date of the tax payment. So the longer you wait to fix a mistake, the more expensive that mistake can get.

How To Check Amended Tax Return Status

- Your taxpayer identification number

- Your date of birth

Amended Tax Return Status

- Using the Where’s My Amended Return? online tool, you can find out the status of your amended return that was filed on paper or electronically.

Balance Due :State Tax Returns :Additional Details :Who can file an amended tax return using Form 1040X?How is a amended tax return submitted?What are causes that an Amended Return cannot be filed electronically?

- At present moment, only tax returns for the tax years 2019, 2020, and 2021 , as well as tax returns for the tax year 2021 , can be changed electronically. Amended/Corrected Paper returns must be filed for all other tax years and tax types.

- If you are modifying a return from a previous year and the original return was submitted on paper during the current processing year, the modified return must also be submitted on paper.

How do I electronically file my amended return?How many amended returns can be electronically filed?Can I file my amended return for prior tax years electronically?What forms must accompany an amended return filed electronically?How can I find out the status of my amended return that I filed electronically?When Not to File an Amended Return ?

- If you get a CP2000 notification

- If you calculate your return incorrectly

- If you wish to reduce the punishments imposed on you

How long will the processing of a amended return take?What are the benefits of filing an amended return?

Also Check: Self Employment Tax Rates 2021

Watch For New Laws Applied Retroactively

If there are any retroactive tax laws enacted that include new or expanded tax breaks, you’ll want to check your previous tax returns to see if you can take advantage of the new law or laws. If a new or expanded tax break that benefits you materializes later in the year, submit your Form 1040-X as soon as possible to get a refund for some of the taxes you already paid.

Stay Tuned: Congress triggers a lot of amended returns when it passes a “tax extenders” bill. The term “tax extenders” refers to a collection of tax breaks that keep expiring but are then retroactively extended by Congress for another year or two. This cycle has repeated itself over and over again for years. The Inflation Reduction Act of 2022 extended a couple of tax credits for individuals that expired in 2021, but that shouldn’t generate the need to file an amended tax return because the law didn’t change anything for tax years before 2022.

Otherwise, as of press time, other tax breaks for ordinary Americans that expired at the end of 2021 have not yet been extended for the 2022 tax year or beyond . However, if a tax extenders bill is enacted after you file your 2022 tax return, make sure you file an amended return if you qualify for any of the extended tax breaks.

When Are Amended Returns Used

You can use Form 1040-X for several purposes:

- To make corrections to Forms 1040, 1040-SR, 1040-NR, or 1040NR-EZ

- To make elections after the tax deadline has passed

- To change amounts that the IRS has previously adjusted for you

- To make a carryback claim if you have an unused credit

You can amend your income tax return up to within three years from the date you filed the return, or two years from the date when you paid any tax due on that return, whichever is later. Form 1040-X can only amend your federal return. Check with your state’s Department of Revenue for its rules for amending a state tax return.

Recommended Reading: States With The Lowest Sales Tax

Key Facts Of Amended Tax Return

- A IRS amended return is one that has been filed to update a prior year’s tax return.

- Amended returns must be filed using IRS form 1040X.

- If there is a change in your filing status, income, deductions, credits, or tax liability, you must file an amended return.

- For a specific tax year, you have two or three years to file an amended tax return.

- An updated return can fix mistakes and assert a more favorable tax status, such a refund.

- The statute of limitations on issuing tax refund checks is three years.

- In some circumstances, Form 1040-X can be submitted electronically or by mail.

How Will This Affect Me

Your state tax amount may be affected by changes on your federal tax return. For information on how to correct your state tax return, contact your state tax agency.

The normal processing time for Form 1040-X, Amended U.S. Individual Income Tax Return, is between 8 and 12 weeks from the time the IRS receives your tax return. However, in some cases, processing could take up to 16 weeks. Due to COVID-19 return processing timeframes may be longer. Check IRS.gov for updated timeframes.

If you owe a balance from the changes on your amended tax return and it is before the original due date of your individual tax return , file Form 1040-X, and pay the tax by the due date for that year to avoid penalties and interest. In other words, if you file and pay after the original due date of your individual tax return, the IRS may charge interest and penalties.

The IRS wont process your amended tax return if:

- You dont attach all the forms and schedules youre changing.

- The amounts from column A on Form 1040-X dont match the IRSs records, whether column A is as originally filed or as previously adjusted. Its important to review a transcript of your account to verify the amounts shown on your original return and/or any adjustments the IRS may have made to avoid this mistake .

You May Like: Lee County Tax Collector Fort Myers

Correcting Mistakes Or Omissions

If you made any mistakes on your return and you only discovered them after filing it, you can use an amended return to fix this. Perhaps you left some income off the return, for instance. Correcting any error or omission is necessary.

This should be done whether you will owe more to the IRS in taxes or if you should receive a larger return. The IRS will end up sending a CP2000 notice to you if you dont amend the return but owe more in taxes. Whats worse is that this would also bring some extra penalties.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Also Check: How To Pay Taxes On Stocks

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

Reasons For Processing Delays

Mistakes on your 1040-X can delay processing. There could be something wrong if your return seems to be stuck in the system after a couple of months. Common reasons for delays include errors in calculations or information, such as entering the wrong Social Security number. Processing can be delayed if you leave crucial sections of the tax form blank or fail to sign and date it.

Read more:How to Track Down Your Tax Refund

Read Also: Do I Have To Pay Taxes On Inherited Money

When Can I Amend My Tax Return

Another example could be someone taking too much of a deduction for state and local taxes . The write-off was limited to $10,000 under the tax overhaul signed in December 2017 by President Donald Trump.

Taxpayers also amend their returns if they had a change in filing status, change in the number of claimed dependents, incorrectly claimed tax credits and deductions or incorrectly reported income, says Daniel Gibson, a partner at New York-based tax and accounting firm EisnerAmper.

If you realize you made a mistake or left out some pertinent information, you should amend your tax return as soon as possible. You dont want to face interest and penalties if an error or oversight led you to underpay your taxes.

If youre unsure about whether to amend a tax return, you can use the IRS Should I File an Amended Return? interactive tool.

Where Is My Amended Tax Return

To track an amended tax return, you can use the Wheres My Amended Return? tool on the IRS website starting three weeks after you filed your amendment, or you can try calling the agency at 866-464-2050.

When you enter your information into the online tool, it will indicate whether your amended return has been received, adjusted or completed.

The system updates each day, usually at night.

Also Check: What Happens If You Can T Pay Your Taxes

You Receive New Information After Filing Your Return

You’ll need to file an amended tax return if you receive information after filing your original return that significantly changes your taxable income. For example, you might receive an amended W-2 form or a 1099 form showing previously unreported income . If the new information affects the deductions or credits that you claimed on your original returnâfor example, by upping your income to a point where the tax break is reduced or no longer available to youâyou’ll need to file an amended return for that too.

You won’t receive a refund for those types of changes, but you still need to file an amended tax return to avoid penalties and additional interest.

Changes you make on an amended tax return that affect your income, tax deductions, or tax liability may also affect the amount of the alternative minimum tax. So be sure to check that as well.

Let The Irs Correct Certain Errors

You don’t need to file an amended return if you discover a simple math or clerical error on your return. The IRS can correct those types of mistakes on its own. Also, if you forgot to attach a particular form or schedule to your tax return, you don’t need to file an amended return to address that. The IRS will contact you by mail if they need additional information to fix those kinds of errors. However, you should file an amended tax return if there’s an issue that changes your filing status, income, deductions, or credits.

Read Also: When Are Tax Payments Due 2022

Wait I Still Need Help

The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers rights. We can offer you help if your tax problem is causing a financial difficulty, youve tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isnt working as it should. If you qualify for our assistance, which is always free, we will do everything possible to help you.

Visit www.taxpayeradvocate.irs.gov or call 1-877-777-4778.

Low Income Taxpayer Clinics are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee. For more information or to find an LITC near you, see the LITC page on the TAS website or Publication 4134, Low Income Taxpayer Clinic List.

You Can File An Amended Tax Return On Your Own

People with simple tax situations and small changes might be able to file an amended tax return on their own. Many major tax software packages include modules that will file an amended tax return. Many tax preparers are happy to file amended returns as well.

And note: Amending your federal tax return could mean having to amend your state tax return, too.

Read Also: How To Know If You Owe Taxes

Reasons You Need To File An Amended Virginia Income Tax Return

Changes to Your Federal Return

If you or the IRS changes your federal return, youre required to fix or correct your Virginia return to reflect the changes on your federal return within one year of the final determination date of the federal change.

IRS CP2000 Notices & Federal Tax Adjustments

The IRS reports changes to federal returns to Virginia Tax. However, this can happen years after you receive your IRS notice, and interest will continue to accrue on any additional balance due starting from the original due date. To avoid additional interest on any tax due, file your amended Virginia return as soon as you are notified of a change to your federal income tax return by the IRS – dont wait for us to notify you.

You have one year from the resolution of your federal audit to file an amended Virginia return. If you dont file an amended return, or notify us in writing of IRS audit results, we can adjust your return based on the IRS audit findings at any time in the future, which may result in additional tax and interest.

If youre not sure if you need to file an amended Virginia tax return, give us a call.

Changes to Another States Return Affecting Your Virginia Return

If you file an amended return with any other state that affects your Virginia income tax, you must file an amended Virginia return within one year.

Correcting an Error