Why Is The Amended Return Im Tracking Taking So Long

After filing an amended return, you may realize that it takes very long for it to process. Usually, the IRS accepts amended returns, so most people do not have to worry about this aspect. But everything may take longer to process because amended returns have to be mailed to the IRS.

So, if you filed an amended return and you have to receive a refund, it may take up to three months for it to reach you. The IRS website allows you to check the amended return status with ease.

The IRS doesnt always agree with the changes you want to make to an amended return. If this happens to you, then the IRS will make sure to send you a notice of claim disallowance, which is a denial letter or a more formal letter.

Of course, you do not have to simply accept this if you believe the amended return changes are necessary. You can either appeal the decision of the IRS or take this case to court.

People do not always know why the amended return was denied by the IRS, to begin with, as the amended return denial notices tend to be quite vague. If you dont want this amended return process to take even longer, you should ask a trusted IRS expert for help.

Can You File Twice In One Year

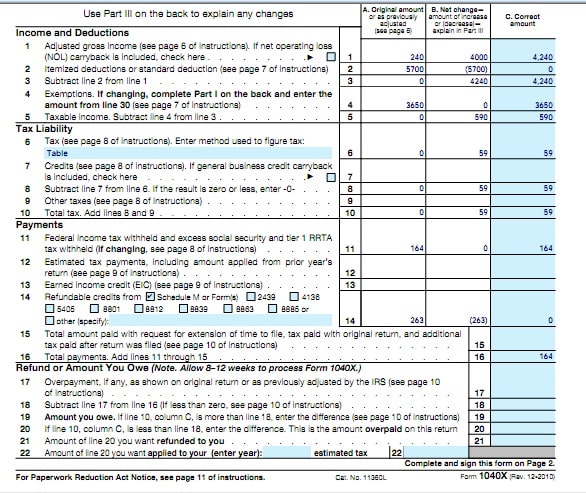

Use Form 1040X to amend a federal income tax return that you filed before. … You should explain what you are changing and the reasons why on the back of the form. More than one year. If you file an amended return for more than one year, use a separate 1040X for each tax year. Mail them in separate envelopes to the IRS.

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News

Read Also: Income Tax Rates In South Carolina

Where Is My Amended Tax Return

To track an amended tax return, you can use the Wheres My Amended Return? tool on the IRS website starting three weeks after you filed your amendment, or you can try calling the agency at 866-464-2050.

When you enter your information into the online tool, it will indicate whether your amended return has been received, adjusted or completed.

The system updates each day, usually at night.

Why Do I Need To File An Amended Tax Return

You may need to file an amended return to claim a bigger refundor because you owe the IRS more money than you initially thought.

People often file tax return amendments because they forgot to report some income, or have realized they should or shouldnt have claimed certain credits or that they incorrectly claimed dependents, says Curtis, the accounting instructor.

Other common reasons for filing an amended tax return include tax forms like W-2s or 1099s arriving late after you have already filed your return. An amended return is necessary to report any income that was left off your first return.

Tax laws often changetax credits and deductions are often expanded or taken away, notes Daniel Fan, managing director, head of wealth planning at First Foundation Advisors, an Irvine, California-based financial institution.

For example, at the height of the pandemic, in 2021, the child tax credit temporarily increased to $3,600 and included children ages 17 and under.

Don’t Miss: What Is The Small Business Tax Rate For 2021

How Are Amended Returns Paid

If you owe money as a result of the correction, you should include a check or money order with your 1040X submission. You can pay the balance you owe online, using Direct Pay or the Electronic Federal Tax Payment System . If you cant pay right now, file the amended return and apply for an IRS Installment Plan.

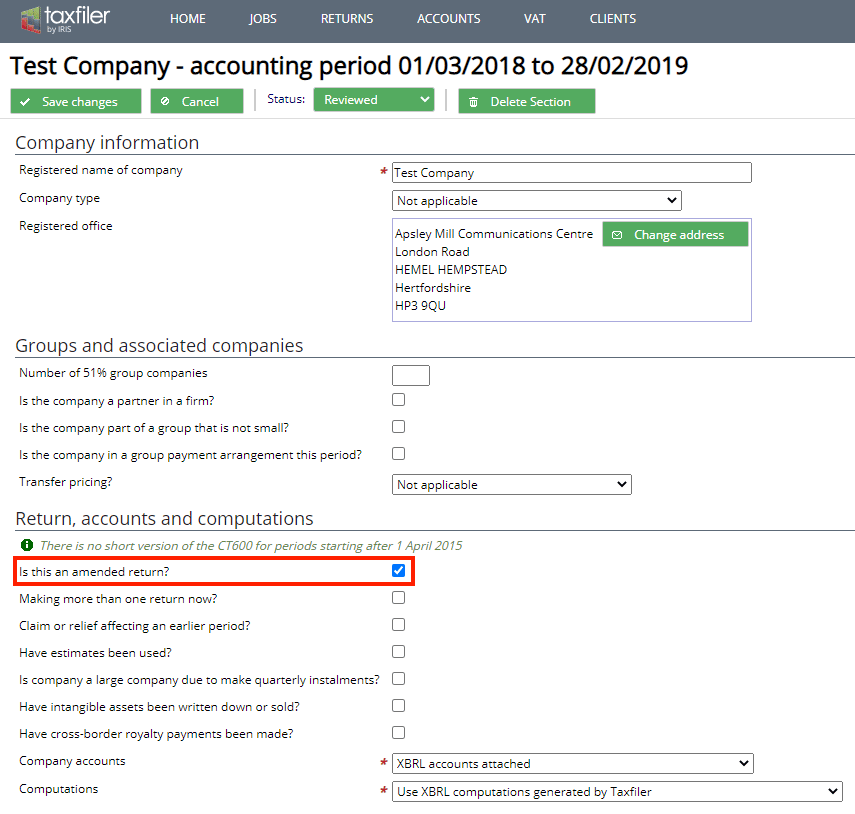

If You Must Amend Your Return

If you need to make a change or adjustment on a return already filed, you can file an amended return. Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions.

You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

However, you dont have to amend a return because of math errors you made the IRS will correct those. You also usually wont have to file an amended return because you forgot to include forms, such as W-2s or schedules, when you filed the IRS will normally request those forms from you.

Also Check: How To Pay Taxes Quarterly

Reasons For Processing Delays

Mistakes on your 1040-X can delay processing. There could be something wrong if your return seems to be stuck in the system after a couple of months. Common reasons for delays include errors in calculations or information, such as entering the wrong Social Security number. Processing can be delayed if you leave crucial sections of the tax form blank or fail to sign and date it.

Read more:How to Track Down Your Tax Refund

Where Is My Amended Return Not Showing

Be sure you are entering your SSN, DOB, and zip code correctly in the Wheres My Amended Return tool. Heres how to speak to someone at the IRS to see if they can tell you if they received it. If they say they dont show it on their system, tell them its been 5 weeks and not showing up in that tool.

Recommended Reading: Are Medical Insurance Premiums Tax Deductible

The Internal Revenue Service Makes It Easy To File An Amended Tax Return

Have you realized you made a mistake on your tax return or failed to claim a deduction or credit you were entitled to?

To rectify this, simply submit an amended tax return. The Internal Revenue Service makes it easy to file an amended tax return.

Justifications for Filing an Amended Return

File an amended return if you realize you forgot to include income or if you received a revised information statement that reflects a change in your income or withholding amounts.

That holds true whether you expect a bigger tax refund or anticipate having to pay more. A CP2000 notification from the IRS is likely if youll have a larger tax bill and dont file an amended return.

If the conditions are right, you can switch to a more advantageous filing status.

The standard deduction would be reduced by $3,000 if you claimed single status when you were actually eligible for the more generous head-of-household filing status. Changing your filing status is not always possible , but it is a valid cause to file an updated return.

You need to file an updated return if you made a mistake on your original return, such as failing to properly itemize your deductions or including or excluding a dependant. This may help avoid complications down the road like notices or an audit by the IRS.

How to File an Amended Tax Return

License:

- 0

What Do The Statuses Mean

Your amendment can be in one of three stages.

Also Check: State Income Tax By States

When Should I Start Checking The Status Of My Amended Tax Return

When the IRS has to deal with a mailed form, things can slow down.

It can take up to three weeks for an amended return to show up in the IRS system, so its probably best to wait at least that long before you start checking. But once your amended return shows in the system, you can check its status daily if you want, because the tool updates every day.

How To Check Your Amended Tax Return Status

Tax season can be stressful. It’s easy to miss or overlook something with all the pressure to meet the deadline. But you can file an amended return if you make a mistake. You can check the status of that return at the Where’s My Amended Return? page on the IRS website after you’ve filed.

You May Like: Tax Credits For Electric Vehicles

Irs Transcripts Are Free

Your other option is to order a tax transcript from the IRS rather than an actual copy of your return. The IRS makes two types of transcripts available: a tax return transcript and a tax account transcript, and both are free. A transcript is more or less a summary of the information included in your return and your payment and refund histories.

Mail in Form 4506T-EZ if you want a tax return transcript, or Form 4506T if you want a tax account transcript. You can also request a transcript online from the Get Transcript Online page of the IRS website, or even call the agency, although the IRS isnt taking phone calls in spring 2020 due to the coronavirus pandemic.

It will take from five to 30 days to get the transcript, depending on whether you make the request online or via USPS mail, and theyre only available for four years the current year and the previous three.

I Have Not Received My Amended Tax Refund

Again, please allow 16 weeks to pass before worrying about your tax refund. The IRS states specifically that a refund can take this amount of time to process. With that being said, if you have not received your tax refund or credit within that timeframe and you have utilized their Wheres My Amended Return tool to check on your amended return status, then call the IRS at 1-866-464-2050 to inquire about your case.

Don’t Miss: Calculate Ca State Income Tax

When Can I Amend My Tax Return

Another example could be someone taking too much of a deduction for state and local taxes . The write-off was limited to $10,000 under the tax overhaul signed in December 2017 by President Donald Trump.

Taxpayers also amend their returns if they had a change in filing status, change in the number of claimed dependents, incorrectly claimed tax credits and deductions or incorrectly reported income, says Daniel Gibson, a partner at New York-based tax and accounting firm EisnerAmper.

If you realize you made a mistake or left out some pertinent information, you should amend your tax return as soon as possible. You dont want to face interest and penalties if an error or oversight led you to underpay your taxes.

If youre unsure about whether to amend a tax return, you can use the IRS Should I File an Amended Return? interactive tool.

Can I Contact The Irs For Additional Help With My Taxes

While you could try calling the IRS to check your status, the agencys live phone assistance is extremely limited. You shouldnt file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if youre eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if its been 21 days or more since you filed your taxes online, or if the Wheres My Refund tool tells you to contact the IRS. You can call 800-829-1040 or 800-829-8374 during regular business hours.

You May Like: Do Unemployment Benefits Get Taxed

Recommended Reading: What Is The Estate Tax Exemption

How Do I Obtain A Copy Of A Prior Year Return

Returns prior to 2018 are not available through our system.

If you electronically filed your return with us previously you will be able to print a copy of your return by selecting the Prior Year tab on the My Account page. You will then need to click on View or Print Return next to the return you need to print or view. If your return was never e-filed and accepted, we will be unable to provide a copy in PDF format.

If you do not remember your username or password and your email address has changed or is deactivated, you can use request a change of email address by completing the form at the following link and then complete and fax the form to us at 706-868-2326. You can also attach the E-mail Change Request Form in an e-mail. Be sure to include a valid form of ID. If you do not know the old email address associated with the account please include two forms of identification. If the account is a married filing joint account identification must be included for both the taxpayer and the spouse.

You can also request a copy of your prior year return directly from the IRS. Copies of prior year federal returns can be obtained through the IRS however there is a cost as opposed to our regulations, we provide it for free.

The following article is from the IRS website:

How Long Will It Take To Process My Amended Tax Return

Processing an amended tax return takes time and sometimes a lot of it.

The IRS says processing an amended return can take up to 16 weeks. And certain situations may require more review, making the processing time even longer. Here are some reasons for delays.

- Errors on the amended return

- The amended return was not completed

- You forgot to sign the return

- The IRS sends the amended return back to you with a request for more information

- You or your spouse sought injured spouse relief

- Possible identity theft or fraud

- The amended return needs to be routed to a specialized area

- The IRS bankruptcy team needs to review the amended return

- A revenue office needs to review and approve the amended return

- You have an appeal or request for reconsideration pending IRS review and decision

You May Like: How To File Taxes Without W2 Or Paystub

When Shouldnt You File An Amended Return

If you made a simple errorlike a math errorthe IRS will fix it for you. You dont need to file an amended return. Ditto if you forgot to attach forms to your return. In that case, the IRS will send you a letter asking for the informationif they need it.

You should not file an amended return if you receive certain notices from the IRSlike a CP2000. Instead, follow the instructions on the notice. Those instructions typically ask for specific information or documentation.

If the IRS files a substitute return for you because you did not file a timely tax return, you should not file an amended return. However, you dont want to simply accept the return either since the IRS will use the documentation it has on handtypically, Forms W-2 and 1099to prepare your return and wont include items like medical expenses or freelance-related deductions that would lower your tax bill. In that event, it typically makes sense to file your own Form 1040 to replace the substitute return.

If youre requesting a refund or abatement of interest, penalties, or additions to tax, you shouldnt file an amended returnyoull want to file Form 843. Form 843 is appropriate, for example, when there was an unreasonable error or delay caused by the IRS.

How Do I Get A Copy Of The 2020 Return I Filed In Turbotax Online

If access to your 2020 return has expired, youll get a link with instructions on how to regain access.

Related Information:

Also Check: What Will I Get Back In Taxes

Don’t Miss: States With No Retirement Income Tax