When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

I Still Dont Have My Refund What Should I Do Next

If you have waited the maximum number of weeks it should take to process a refund, we encourage you to check the status of your return or refund online one more time before contacting the Department.

Please note that our tax examiners do not have information about the status of your refund beyond what is available to you from our website. Although the Department is always available to answer your questions and concerns, calling us will not speed up the process. If you would still like to contact the Department, you may reach us at:

Phone: 828-2865 or .

Our staff is working hard to process your return. Our precautions may increase processing time, and we would like to ask for your patience as we strive to provide the protection you have come to expect and deserve.

We appreciate your patience and welcome your feedback to help us continue to improve our services.

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Wheres My State Tax Refund Kentucky

Check the status of your Kentucky tax refund by visiting the revenue departments Wheres My Refund? page.

If you e-filed and opted for direct deposit, you can expect your refund in two to three weeks. Getting a refund as a paper check will take three to four weeks. If you filed a paper return, your refund will take significantly longer to arrive. The state says it could take eight to 12 weeks.

The Wheres My Refund Page only allows you to check the current years tax return. The status of previous tax returns is available if you call 502-564-4581 and speak to an examiner. It may take more than 20 weeks to process prior year tax returns.

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

Read Also: State Of California Estimated Taxes

Wheres My State Tax Refund Massachusetts

The Massachusetts Department of Revenue allows you to check the status of your refund on the MassTax Connect page. Simply click on the Wheres my refund? link. When the state approves your refund, you will be able to see the date when it direct-deposited or mailed your refund.

The turnaround time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. If you opted to get your refund as a paper check, you can expect to wait about one week longer than the times mentioned above.

If You Choose Direct Deposit

Your tax refund will be sent to your bank the same day the IRS sends your tax refund. It will typically take 3-5 days for your bank to process, depending on your bank.

*Faster access compared to standard tax refund electronic deposit and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

*Faster access compared to standard tax refund electronic deposit and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

All timing is based on IRS estimates.

Read Also: Do You Have To Pay Taxes On Life Insurance

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Read Also: Where Do I Put Business Expenses On Tax Return

Protecting Your Tax Refund

Although we try to process your refund within the timeframes stated above, it may take longer due to our rigorous fraud detection procedures. Each year, the Department detects new schemes to commit tax refund fraud, and our staff works hard to stop criminals from stealing your refund.

The Department employs many review and fraud prevention measures to safeguard taxpayer funds. These measures may result in refund wait times of more than of 10 weeks. We apologize for this inconvenience and are actively working to release these refunds.

Recommended Reading: I Claimed 0 And Still Owe Taxes 2021

Don’t Let Things Go Too Long

If you haven’t received your tax refund after at least 21 days of filing online or six months of mailing your paper return, go to a local IRS office or call the federal agency . Taking these steps wont necessarily fast-track your refund, according to the IRS, but you may be able to get more information about what’s holding up your refund or return.

Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measures to prevent fraudulent returns and this has increased processing times.

You May Like: Do I Have To Pay Taxes On Inherited Money

Haven’t Received Your California Middle Class Tax Refund Here’s What’s Happening

In October, millions of Californians were to start receiving relief payments of up to $1,050 as part of the state’s “Middle Class Tax Refund.” But now it’s November, and many Golden State residents are still waiting.

California, which posted a record $97 billion surplus, is sending rebates of between $200 and $1,050 to individuals earning less than $250,000 annually and households earning less than $500,000.

Californians will receive their Middle Class Tax Refund payment by direct deposit or debit card.

Wondering if you’ll get your refund in time for the holidays? The state’s Franchise Tax Board has published a schedule for issuing payments. The board said Friday that it has issued 4.5 million direct deposits and mailed out 905,000 debit cards so far.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 state tax return and received their tax refund by direct deposit. MCTR debit card payments are to be mailed to the remaining eligible taxpayers.

If you qualify for the MCTR, expect to receive your payment by mail in the form of a debit card if you:

-

Filed a paper return

-

Received your Golden State Stimulus payment by check

-

Received your tax refund by check regardless of filing method

-

Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number

-

Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund

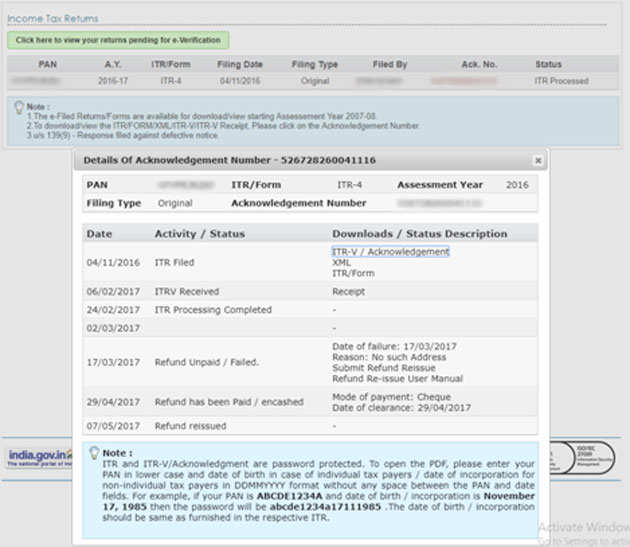

Checking Your Tax Refund Status Online

Step 1Wait

Wait at least three days after e-filing your tax return before checking a refund status. When you e-file your tax return to the IRS, it needs approximately three days to update your information on the website.

If you e-filed your tax return using TurboTax, you can check your e-file status online, to ensure it was accepted by the IRS. You’ll also receive an e-mail confirmation directly from the IRS.

However, if you mail a paper copy of your tax return, the IRS recommends that you wait three weeks before you begin checking your refund status. Most taxpayers who e-file will receive their tax refund sooner.

Step 2Obtain a copy of your tax return

Before you sit down to check your refund status, the IRS requires that you have some of the information from your tax return. If you printed a copy of your tax return, grab ityoull need the following information from it:

- The Social Security number that you entered at the top of your tax return

- The filing status you chose, which you can locate in the top portion of the first page to your tax form.

- The exact amount of your tax refund. You can find this at the end of your tax return.

Step 3Go to the “Wheres My Refund?” page on the IRS website

When you access the “Where’s My Refund?” tool, you will see three separate boxes to enter your filing status, refund amount and Social Security number. When you finish entering this information, click on the “Submit” button on the page to see the status of your refund.

You May Like: How Do I Report Crypto On Taxes

If You Do Not Have A Personal Tax Account

You need a Government Gateway user ID and password to set up a personal tax account. If you do not already have a user ID you can create one when you sign in for the first time.

Youll need your National Insurance number and 2 of the following:

- a valid UK passport

- a UK driving licence issued by the DVLA

- a payslip from the last 3 months or a P60 from your employer for the last tax year

- details of your tax credit claim

- details from your Self Assessment tax return

- information held on your credit record if you have one

The Most Accurate Tax Calculator

At Etax, after you register and log in, then start a tax return, the tax refund calculator shows your tax refund estimate at the top of the screen.

The tax refund calculator shows your ATO tax refund estimate. The more details you add to your tax return, the more accurate the tax calculator becomes

It is accurate to the cent, based on the information you add to your return and it updates as you go.

Etax includes the all tax cuts and tax rebates in your refund estimate, for 2021.

Each time you add a new detail to your return, the tax refund calculator re-calculates your tax estimate. You can see how each number and each tax deduction affects your overall tax refund.

This happens automatically, helping you see how different items in your return can affect your refund. Thats not possible with most tax calculators!

Recommended Reading: How To Request Tax Extension

When You’ll Receive Your Payment

MCTR direct deposit payments for Californians who received GSS I or II are expected to be issued to bank accounts between October 7, 2022 and October 25, 2022. The remaining direct deposits will occur between October 28, 2022 and November 14, 2022.

MCTR direct deposit recipients who have changed their banking information since filing their 2020 tax return will receive a debit card. Debit cards for this group will be mailed between December 17, 2022 and January 14, 2023.

MCTR debit card payments for Californians who received GSS I and II are expected to be mailed between October 24, 2022 and December 10, 2022. The remaining debit cards will be mailed by January 14, 2023.

Refer to the tables below for the latest updates to the payment schedules.

| Direct deposit recipients who have changed their banking information since filing their 2020 tax return | 12/17/2022 through 01/14/2023 |

Direct deposits typically occur within 3-5 business days from the issue date, but may vary by financial institution.

Allow up to 2 weeks from the issued date to receive your debit card by mail.

We expect about 90% of direct deposits to be issued in October 2022.

We expect about 95% of all MCTR payments direct deposit and debit cards combined to be issued by the end of this year.

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Don’t Miss: How Does Sales Tax Work

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterdays audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldnt have asked for more. I cannot thank you enough for your help.

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 2 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks

The Wheres my Refund application shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.

Recommended Reading: What State Has The Lowest Sales Tax

Where Is My Refund

Check your State or Federal refund status with our tax refund trackers.

With the IRS tax refund tracker, you can learn about your federal income tax return and check the status of your federal refund instantly. The IRS’ Wheres My Tax Refund tool provides a safe, fast and easy-to-use portal to track your 2021 refund just 24 hours after it has been received. If youre seeking the status of an amended return, call the IRS directly at 1-800-829-1040. Found your federal return, but looking to get your refund even faster? When you file with Liberty Tax®, you may pre-qualify for an advance loan on your IRS tax refund. Learn more today.

Wheres My State Tax Refund Vermont

Visit Vermonts Refund Status page and click on Check the Status of Your Return. You will find it toward the bottom left. That link will take you to a form that requires your ID number, last name, zip code and the exact amount of your refund. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers.

You May Like: Property Tax In Frisco Tx

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAssets tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Read Also: Wheres My Income Tax Return