Review Your Bank Statements For Deductions

One year is a long time to remember all of the deductions that youre entitled to at tax time. Get copies of all of your bank statements and go through them line by line to make sure that you dont overlook any valuable deductions. When reviewing your bank statements, dont forget to include your credit card statements, as its likely that youve made some deductible transactions there as well.

Read: Do I Have to File Taxes? 3 Times You Can Skip It

You May Be Able To Avail Of Certain Credits And Deductions

You may have to reveal your total income but you dont have to pay taxes on every dollar you earn. The amount of income tax you owe is based on your total income, minus any allowable deductions. Deductions are specific expenses that the IRS allows taxpayers to subtract from their total income for the year. Once all deductions are taken, the remaining incomealso known as taxable incomeis taxed at a determined rate. Almost all taxpayers are eligible to take a standard deduction. If you are filing as single, your standard deduction is $12,550.

If this is your first time filing taxes as independent, you must take the time to understand which credits and deductions you may be eligible for. This will ensure that you get back the maximum amount allowable as a tax refund.

For example, you can deduct up to $2,500 in interest payments on your student loan interest. This is subject to your modified adjusted gross income, which is income minus certain tax deductions

Are you self-employed or have a freelancing side-hustle? You may be able to claim deductions for work-related expenses such as software subscriptions and other supplies.

You can also deduct qualified charitable donations if you donate any money to charity. This is subject to certain conditions, such as itemizing your taxes.

Gather All Of Your Tax Documents

If you’re expecting a refund, you might be eager to file your tax return as soon as you can. Throughout January, February and even March, you can still receive important tax documents in your mailbox, email or online.

Collect all the tax documents needed for your taxes before you begin, such as your

- tax forms that report other types of income,

- tax deductions, and

If you file without one of these forms, you might need to amend your tax return later.

Take a minute and think about anything you did in the past year that might impact your taxes, such as:

- Opening a new savings account

- Selling stocks or mutual funds

- Paying college tuition or student loan interest

Recommended Reading: How To Pay My Tax Online

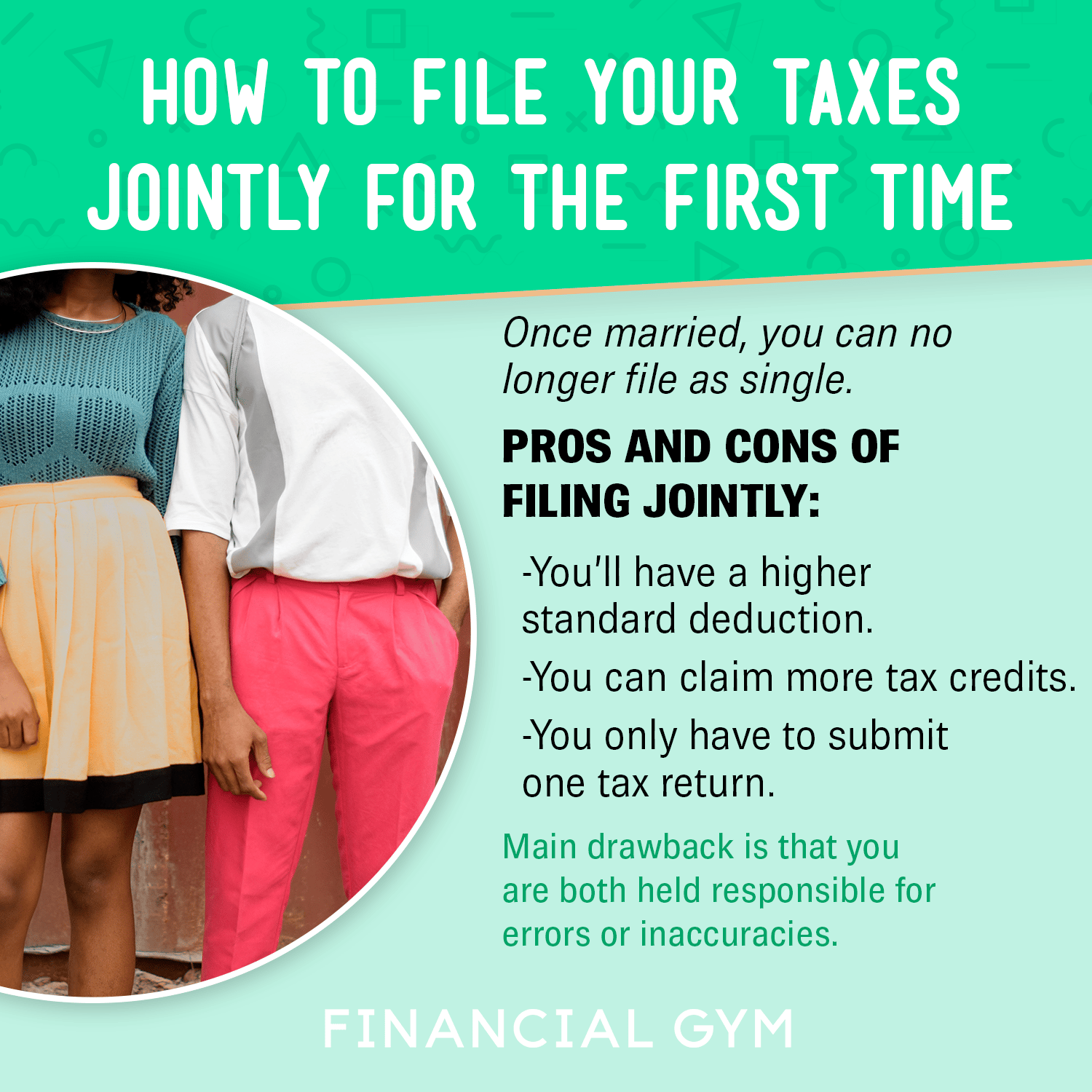

Decide If You Want To Take The Standard Deduction Or Itemize

The standard deduction is a specific dollar amount that lowers the income youre taxed on. Like weve touched on already, for single filers, that dollar amount is $12,550. For qualifying widows or people who are married filing jointly, that dollar amount is $25,100.

So, for example, if your filing status is single, you made $30,000 in 2021, and you decided to take the standard deduction, you would only pay taxes on $17,450.

If you take the standard deduction, you dont have to add up receipts or fill out any extra forms to see which individual deductions you qualify for. Just use Form 1040 to add up your income, subtract the standard deduction, and boom! The bottom line will show if youre getting a refund or if you owe more.

The standard deduction is pretty cool because it lowers your taxable income even if you dont qualify for any itemized deductions.

Your other option is to itemize all your deductions. People who choose this option keep receipts of qualifying expenses throughout the tax year and record them in Schedule A .

Some examples of these types of expenses would be:

- Out-of-pocket medical or dental expenses

- Charitable donations

- Large work-related expenses that werent reimbursed

- Paid mortgage interest or real estate taxes

Depending on which tax bracket youre in, your itemized deductions will reduce your taxable income by a certain amountso it only makes sense to itemize if those deductions add up to more than the standard deduction.

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

Also Check: State Of California Sales Tax

Paying For Free Software To File Your Taxes

If youre not confident about doing something on your own for the first time, you may think you need to pay a tax preparer to do the work for you. But tax-preparation software and online services have made it easier than ever to self-prepare and e-file your federal and state income tax returns.

Be aware that not all free tax software options are truly free. Some may allow you to start your taxes for free and charge you a fee to e-file your return. Others may allow you to do simple returns for free, or your federal return for free, but charge for more-complex tax situations or if you also want to file a state return. Be sure to read the fine print before committing to a provider.

First Time Filing Taxes For Small Business

When you file taxes for the first time, carefully follow the instructions on the tax form. Make sure you fill out all the information correctly. Mistakes on tax forms could lead to an IRS penalty, fine, or audit.

Send the form to the appropriate government agency. Instructions on where and how to send the document will be located on the form. Send the form before its deadline.

Remember, this article focuses on federal business tax liabilities. You will also need to file taxes for your state, and possibly your locality. Check with your state and local business agencies to see which tax forms to file.

Tracking income and expenses is a critical part of filing business taxes. For a simple solution to your small business books, try Patriots online accounting software. Try it for free today!

This article has been updated from its original publication date of September 8, 2016.

This is not intended as legal advice for more information, please

Also Check: How Much Tax Is Deducted From Paycheck In Florida

Don’t Forget Your Ira Contributions

If you make a contribution to a traditional IRA, you might be entitled to a tax deduction. Although youre supposed to receive a tax document from your IRA provider reflecting your contribution, this may be easy to overlook at tax time. In some cases, that document may only be sent to you electronically, so if you dont keep close tabs on your email account and/or your online investment account, you may not even notice it. However, its important to get credit for this deduction if youre entitled to it.

Whats The Earliest Date To File Taxes In 2023 How To Get The Quickest Tax Return

SOPA Images/LightRocket via Getty Images

Key Takeaways

- The earliest the IRS accepts tax filings is the end of January. Expect an official date from the IRS sometime in mid-January.

- Filing your taxes as early as possible allows you to get a faster refund. It can also help protect you against identity theft.

- There are several different tax deductions and credits that can help you get the largest refund. See details below.

Gone are the days of large, pandemic-related tax credits. Your 2022 tax return is likely to look more like your 2019 tax return, but this doesnt mean there arent ways to strategize and ensure maximum tax savings.

To get the biggest refund, youll want to file early, take advantage of eFile and direct deposit options, and review all the tax deductions or credits you might be eligible for.

Read Also: Mercedes G Wagon Tax Write Off

Requirements To File Taxes As Independent

When you file a tax return, youll need to provide certain personal information. Some of it you probably already know, like your Social Security number. Other information will have to come from your employer, your school, or your bank. We said it before and will say it again getting all the documents together takes time. Make sure to start early.

The IRS website has the full list of forms and instructions. Go through it to determine whats applicable to you so can make sure you have the necessary forms by the deadline.

Claim Your Renewable Energy Credits

You might not be able to deduct your mortgage interest payments in any meaningful way, but you can still claim renewable energy credits. You should file Form 5695 if you have qualified costs for residential energy across any of these areas:

Youll also use this form to deduct any energy-efficient home improvements youve made to your property.

These nonrefundable credits can help lower your tax bill to $0, but they wont put any money back in your pocket.

Don’t Miss: How To Avoid Capital Gains Tax On Stock

Why Do I Have To Do My Taxes

Because its mandatory. In Canada, taxes pay for services we all benefit from, everything from schools and roads to social programs like employment insurance and family allowance payments.

If your annual income is below a certain level, you may not have to pay taxes. But its still a smart idea to file a return, because you could receive money or qualify for tax benefits from different levels of government.

If you have a job, chances are your employer deducts a certain amount from your cheque for tax purposes. If too much is deducted during the year, the only way for you to get it back is by filing a return. Learn to make a budget to manage a potential tax refund.

Good to know: In addition to paying income tax to the federal government, you also need to calculate and pay tax to the government of your province or territory. The Canada Revenue Agency receives your return and payments and administers the tax system at both the federal and provincial levels, except for the province of Quebec.

If you live in Quebec, you have to file two tax returns, because Revenu Québec handles the provincial portion.

Don’t Wait Until The Last Minute

This year’s tax-filing deadline might seem far away right now. That’s a good thing: At this point, you have time to review all your forms for accuracy.

“If something is incorrect on your W-2 or 1099, or you didn’t receive all your documents, it will be impossible to get it fixed in time if you wait until the end of tax season,” Hammer said.

Additionally, if you want to open an individual retirement account and make a tax-deductible contribution for 2017, waiting too close to the filing deadline could result in your contribution landing in the account after the deadline.

“You’d be lucky to get an account set up in five or six days,” Hammer said. “Then you have to have the contribution credited to your account in time.”

If something is incorrect on your W-2 or 1099, or you didn’t receive all your documents, it will be impossible to get it fixed in time if you wait until the end of tax season.Greg HammerCEO and president of Hammer Financial Group

Don’t Miss: Federal Tax Return Due Dates Chart 2022

Figure Out If You Have To File

This one can be tricky, so you might want to consult a tax professional or get free tax help before you decide not to file a return. In general, the IRS requires a tax return if one of the following is true:

- Your gross income is over $12,550, or $25,100 for joint filers.

- Youre self-employed and earned at least $400.

- You sold your home.

- You owe taxes on retirement distributions.

- You owe Social Security, Medicare or income taxes that were not withheld.

This is not a comprehensive list, and penalties for non-filing can be severe, so verify you are exempt before not filing.

Figuring Out Your Dependency Status In College

Your parent, foster parent, or another relative likely claimed you as a dependent on their taxes in the past. As long as you’re in school, a relative can claim you as a dependent until you’re 24 if they provide more than half of your financial support.

Your dependency status matters for a couple of reasons. First, as mentioned above, it affects whether or not you must file taxes as a student. Second, the person who claims you as a dependent may qualify for deductions and education-related tax credits.

You May Like: Calculate Capital Gains Tax On Real Estate

How To Collect And Organize The Necessary Tax Documents

One of the most confusing parts of filing your taxes, especially the first time around, is knowing which tax forms you need to collect, when you should expect to receive them and how to keep everything organized so that youre ready when its time to put it all together.

The first step is to simply have a basic system for keeping everything organized so that whenever you do receive a document, youll have somewhere to keep it.

I definitely recommend to clients, especially if theyre getting a lot of documents in the mail, that they keep a folder where they can keep them all, said Panek. Every time you receive something, put it in that folder and just let it accumulate so that when start your return, you have all of it ready to go.

According to Panek, most tax documents have to be sent out by Jan. 31. That includes W-2s that report your earned income from your employers, 1099-INTs that report interest earned on your bank accounts and 1099-DIVs that report dividend income earned from your investments.

Other forms you might need to collect, depending on your situation, include:

While you dont want to wait until the last minute to file your taxes, Panek recommends that you do give it some time so that you can be sure you have everything you need before starting the process.

There Is A Deadline For Filing Taxes For The Year

Yes, there is deadline for filing federal individual income tax. The due date is usually April 15 of each year. If you dont file your taxes by the due date, youll have to pay a fine. And the fines can be pretty high.

To make sure you have everything ready to submit before the deadline, its a good idea to start early. It can take time to put together all the documents you need to submit. Then it takes even more time to calculate total income, qualified deductions, and taxable income. If you start only a few days before the deadline, youre sure to make mistakes that could cost you.

As a general rule, its better to file your tax returns earlier rather than later. The earlier you file, the earlier youll get any refund thats due to you. Start working on your taxes by early March. This gives you sufficient time to get everything done properly without getting stressed.

Recommended Reading: When Can I File My 2020 Taxes In 2021

Failing To Report All Your Income

Say you held down a side job most of the year cutting yards in a few neighborhoods near your home. You made $4,500 during yard-cutting season, and your customers paid you in cash. Youre tempted to omit that self-employed income from your tax return, thinking that if you dont report it you wont have to pay taxes on it. But this is a mistake for several reasons.

Not only are you risking penalties and interest on any unpaid tax and the potential for other serious consequences, youre also cheating yourself out of some expenses that could help lower your tax burden. Filing a Schedule C will allow you to report qualifying business expenses like fuel for the lawnmower, gas to drive to and from customers houses, and the flyers or business cards you printed up to get customers. You might even be able to deduct depreciation on your lawn equipment!

You Can Deduct Mortgage Interest And Pmi

Under the Tax Cuts and Jobs Act of 2017 , you can deduct any interest you paid on your mortgage, as long as you borrowed $750,000 or less. This includes mortgage interest you paid as part of closing costs. If you bought your home on or before December 15, 2017, youre grandfathered in under the old limit of $1 million, so you can deduct loan interest on mortgages up to that amount. You can snag this homeowners tax credit every year youre paying on your mortgage and for subsequent home purchases as long as your loan amount is below the threshold. You can also deduct the interest you paid on a home equity loan up to $100,000, if you use that money to improve your home.

If you borrowed for your home with a down payment of less than 20 percent, you probably have private mortgage insurance, or PMI. You can deduct PMI payments if your adjusted gross income is less than $100,000 if youre married or $50,000 if youre single.

Recommended Reading: Are Medical Insurance Premiums Tax Deductible

Here’s How Free File Works:

What Else Do I Need To Know

The IRS reminds you: file only one federal income tax return for the year no matter how many jobs you had, how many W-2 forms you’ve received, or how many states you lived in during the year.

Also, file only one return per calendar year even if you haven’t gotten your refund or haven’t heard from the IRS since you filed.

Just because your parents aren’t doing your taxes doesn’t mean they are out of the picture. You need to talk to them to find out if they are claiming you as a dependent.

“You don’t want to claim yourself as a dependent without talking to your parents first,” says Kohler, “because it could trigger a domino effect resulting in an audit because you’ve been claimed twice.”

Don’t Miss: What Is My Tax Identification Number