What If I Can’t Afford To Pay My Taxes

The only way to avoid penalties for sure is by paying your taxes on time. If you can’t afford to pay all of your taxes, pay as much as you can by the filing deadline and request a payment plan for the rest.

Whether you qualify for a payment plan depends on your tax situation. The IRS offers long-term and short-term payment plans to qualifying taxpayers.

More Time To File Not More Time To Pay

Its important to remember that the Form 4868 extension gives you more time to file, not more time to pay. You will still have to pay your taxes by that year’s original due date, even if the IRS grants an extension to file later.

If you think you may owe taxes when it comes time to file your return, you should estimate how much you will owe and subtract any taxes that you have already paid . If your estimate is on the high side and you end up overpaying, you will get a refund when you eventually file your return. You’ll also avoid potential penalties and interest accumulating, which is what can happen if you underestimate your taxes due.

When you file Form 4868, youll need to pay the estimated income tax you owe. Sometimes it’s better to err on the high sideyoull get a refund anyway, while underestimates increase the risk of paying interest on the money owed.

You can pay some or all of your estimated income tax online using a debit or credit card, or through an electronic funds transfer using Direct Pay. It’s also possible to mail a check or money order to make your tax payment, even if you file electronically. Make the check or money order payable to the United States Treasury and include a completed Form 4868 as a voucher.

You do not need to file a paper Form 4868 if you submitted one electronically and are not mailing a payment.

File A Tax Extension Request By Mail

It’s also possible to file Form 4868 in paper form. You can download the form from the IRS website or request to have a paper form mailed to you by filling out an order form on the IRS website. Alternatively, you can call the IRS at 800-829-3676 to order a form. Your local library or post office may also have copies.

Notably, if you are a fiscal year taxpayer, you can only file a paper Form 4868.

If you recognize ahead of time that youll need an extension, dont wait until the last minute to submit Form 4868. The earlier you get it in, the more time youll have to fix any potential errors that may come up before the deadline passes and the extension door closes.

Read Also: When Is An Estate Tax Return Required

An Extension To File Is Not An Extension To Pay

This is one of the most important aspects to understand about expat tax extensions. Even if you are granted an extension, it only extends the deadline for filing. It doesnt extend the deadline for paying any taxes you owe. If you owe taxes, you must pay them by the original filing deadline . Failing to do so may result in penalties and interest.

Of course, since you havent filed yet, this will require you to estimate what you owe. If you arent sure what your tax liability will be, consult an expat tax professional to help you make a reasonable estimate. Its always better to be safe than sorryespecially when the IRS is involved.

What If The Irs Owes Me A Refund

If it turns out the IRS owes you money, youll have to wait until after the IRS processes your tax return for the refund. So if you hold off until October 17 to file, you wont get the refund until about three weeks after that date based on the IRS assessment that most taxpayers receive their refund within 21 days of filing.

This years average refund is more than $3,200, according to the latest IRS data.

If you believe the IRS owes you money, you dont have to send in a check by April 18 to the IRS, of course. However, you should be confident that you are correct in your assessment, otherwise youll face penalties for failing to pay your debt to the IRS.

You May Like: How Much In Taxes Do I Owe

How To Get An Automatic 6 Month Tax Extension

If you are a U.S. Citizen who owes taxes you can file the IRS Form 4868 to ask for a six-month tax extension. This is an automatic approval process. You will need to download the IRS Form 4868 from the government, but you dont need to use any paid services. Well show you how to file a tax extension from your computer, iPhone, iPad or Android device.

If you want to skip the manual process of downloading and filling out the IRS Form 4868 you can use an app to e-File your tax extension. Youll need to pay for this option when it is available. At this stage, the app isnt updated for 2017.

You may want to e-file IRS Form 4868 if you miss the deadline to mail your taxes to the IRS. The app allows users to e-File a tax extension up until midnight on April 18, 2016.

If you are comfortable filling out the form and mailing it to the IRS, you can save yourself a dollar and get started with the directions below. Make sure you fill out the IRS Form 4868 for 2016 taxes and include the estimated amount to pay if you own taxes. Jump down below to figure out how much you need to pay.

1. Download the IRS Form 4868 for 2016 taxes

2. Fill it out on a computer and print it out.

Fill out the short and easy IRS Form 4868 to get an automatic tax extension

3. To file an IRS Tax Form 4868 on iPad, iPhone or Android you need the Adobe Reader App.

4. Print the IRS Form 4868 and mail it to the IRS. Make sure it is postmarked by April 18, 2017.

https://www.youtube.com/watch?v=TYYeWcS5OI4

Ca Tax And Accounting Firm Serving Sacramento And Roseville

Cook CPA Group is a California tax and accounting firm serving businesses and individual taxpayers throughout the Sacramento and Roseville regions. Featuring skilled tax accountants and consultants, our accomplished team of financial professionals brings more than 20 years of combined experience to the clients we serve. If you or your business owes taxes to the state of California, has unfiled returns to catch up on, needs help resolving a tax controversy, or simply has questions about effective tax planning or FTB procedures, Cook CPA Group can provide detailed, step-by-step guidance for all your California and federal tax needs. To arrange a free consultation about our tax services in California, contact Cook CPA Group online, or call us today at 269-9282.

Consulting Services

Recommended Reading: Iowa State Tax Refund Status

How To File A Claim For Refund

California Department of Tax and Fee Administration publication 117, Filing a Claim for Refund, details the general requirements for filing a claim for refund and includes form CDTFA-101, Claim for Refund or Credit, and instructions. Mail claims to:

The Fuel Tax programs also have some special requirements not included in publication 117. Be sure to review the Program Specific Guidelines and Procedures for the individual Fuel Tax programs to ensure you include all required information with your claim for refund.

Tax Extension For Multi

Multi-member LLC that files for tax treatment as a partnership LLC can file an automatic extension of time through the IRS. This automatic six-month extension is until March 15th of the following tax year.

If you need more time, you may request up to another three-month tax extension by filing Form 7004 before October 15th.

In general, LLC members participating in partnership returns are required to pay self-employment taxes in order to document their share of any profits generated by the firm.

They must also indicate their pro-rata part of business income, credits, and deductions on Schedule K-1 of Form 1065.

Also Check: How To File Free Taxes

Recommended Reading: How Do The Rich Avoid Taxes

Individuals Living Abroad Or Traveling Outside The United States

If youre living or traveling outside the U.S. or Puerto Rico on May 1, you have until to file your return. You must still pay any tax you expect to owe by the May 1 due date.

Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

I Filed An Extension But The Irs Sent Me A Notice Saying I Didn’t

If the IRS sends you a notice assessing the failure to file penalty, youll need to respond with the information you have and ask it to remove the penalty. Depending on how you requested the extension, you should have documentation, such as the confirmation receipt for an electronically filed extension, or proof of mailing .

If you didnt file an extension in time, but something happened that you believe amounts to reasonable cause for not filing, you can ask the IRS to abate the penalty. Youll need to write a statement describing what kept you from filing on time.

Recommended Reading: State Of Ct Income Tax

Compare Online Tax Filing Services

1 – 6 of 6

Can I mail my tax extension?

If you prefer to go the snail mail route, print and fill out your tax extension form, and drop it in the mail. Make sure you have proof that you mailed it. This way the IRS cant come back and claim they never received it.

Page four of Form 4868 lists several addresses to mail out your extension. The exact address depends on the state you live in and whether youre including a payment with your form.

The Tax Preparation Process

If you are filing your federal income tax return or filing an extension for the first time, you will need to gather various documents to ensure that your return is accurate. Having all of your tax information in one place can help you avoid making rookie mistakes and can lead to lower tax preparation fees. Heres a list of things you need to know and do during your tax preparation process:

The IRS also encourages you to file your taxes as early as possible to avoid penalties. Most people must file their taxes by May 1. You can also file early for an extension if youve already made a payment.

Read Also: Irs Tax Extension 2021 Form

Can’t Pay Still File For A Tax Extension

Even if you can’t pay the tax, file for an extension. The combined penalty for failure to file taxes and failure to pay taxes is 5 percent of the amount you owe. The penalty for late payment is just 0.5 percent of the amount you owe per month, plus interest on the amount you owe.

If you’re unable to pay taxes because of financial hardship, you can ask the IRS for an installment payment plan. In most cases, you can arrange one online with the Online Payment Application tool.

John Waggoner covers all things financial for AARP, from budgeting and taxes to retirement planning and Social Security. Previously he was a reporter forKiplinger’s Personal FinanceandUSA Todayand has written books on investing and the 2008 financial crisis. Waggoner’sUSA Todayinvesting column ran in dozens of newspapers for 25 years.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Secure An Irs Tax Extension Before The Deadline

As the April 15th tax season deadline quickly approaches, its imperative to be proactive and ensure that you have all the necessary documentation and paperwork to file your income tax return on time. But what if youre not ready to file by the deadline? Thats where an IRS tax extension can be beneficial. When securing a tax deadline extension, you can defer the due date for filing your taxes and give yourself more time to complete it. In this blog, well discuss how to request an IRS tax extension and the benefits of doing so.

Don’t Miss: How Much Will I Get Paid After Taxes

When To File And Pay

You must file your return and pay any tax due:

Note: The due date may change if the IRS changes the due date of the federal return.

You must pay all Utah income taxes for the tax year by the due date. You may be subject to penalties and interest if you do not file your return on time or do not pay all income tax due by the due date. See

Utah does not require quarterly estimated tax payments. You can prepay at any time at tap.utah.gov, or by mailing your payment with form TC-546, Individual Income Tax Prepayment Coupon.

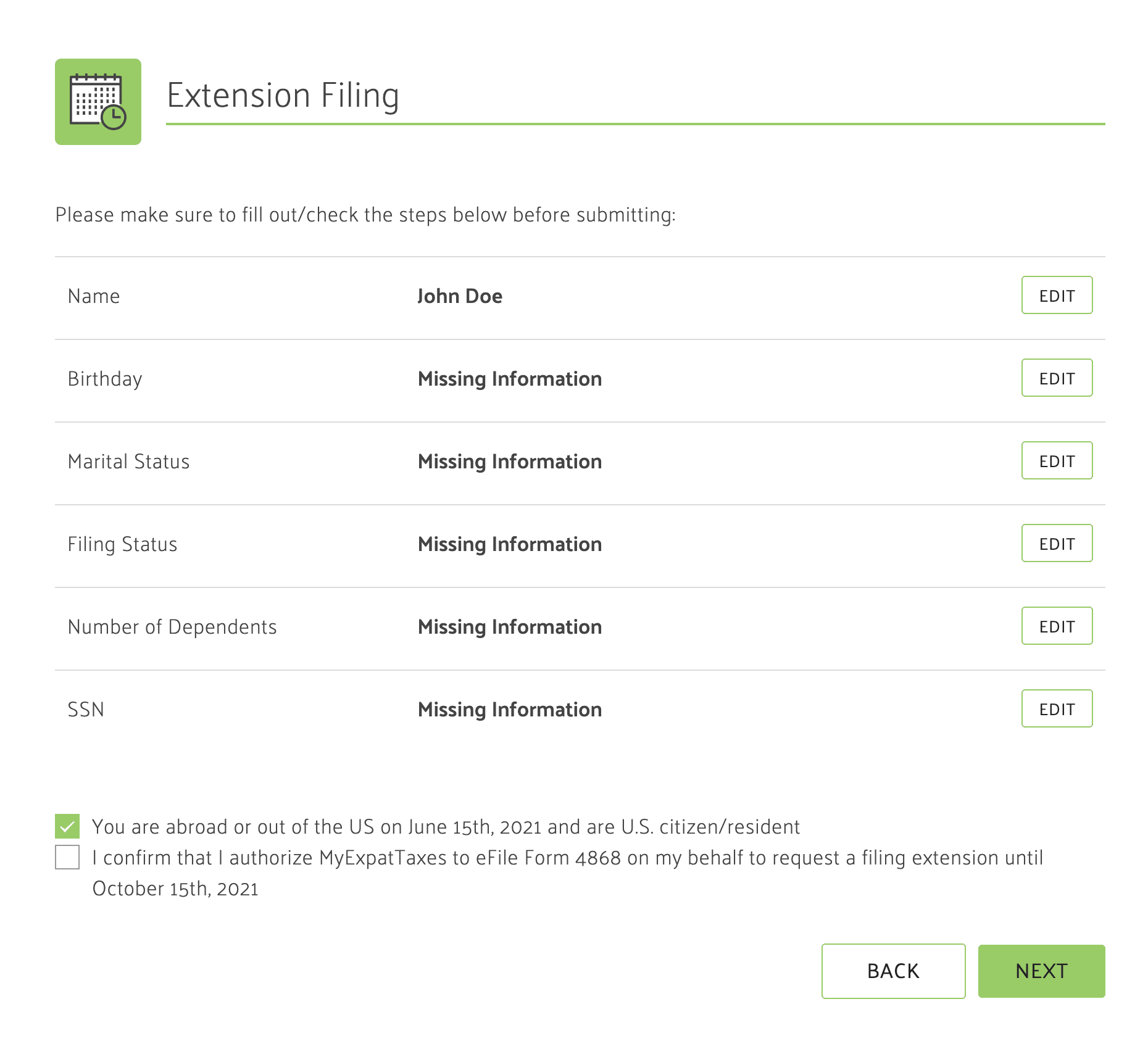

How To File For Tax Extension

The best way to get an IRS tax extension is to file Form 4868. This form is available online and can be submitted electronically or by mail. When you file IRS form 4868, you will need to provide personal information such as your name, address, social security number, and an estimate of your tax liability for the tax year. You will also need to include the payment for any taxes due. Additionally, you can specify a future date when the IRS should expect your income tax return instead of the usual April 15 deadline.

Also Check: How Do I File Back Taxes

What Are My Payment Extension Options

If you cant pay your taxes in full by the regular deadline, either set up a payment plan or look into tax relief options.

- Monthly payment plan. The IRS offers an installment agreement for those who wish to pay their taxes back over time. You may be eligible for a short-term payment plan if you up to $100,000 or a long-term plan if you owe less than $50,000. You can set up a plan through the IRS website.

- Tax relief options. The IRS may waive your penalties if its your first time missing the deadline, you have a financial hardship that prevents you from paying or you believe the IRS gave you incorrect written advice. In all of these situations, you need to fill out Form 843. If your request is denied, you may be eligible for an appeal.

Can I File A Tax Extension Electronically Free Of Charge

Yes, you can. If your adjusted gross income falls below the annual threshold, you can use the IRS Free File program to electronically request an automatic tax-filing extension. Higher earners can use the IRS Free Fillable forms, assuming they are comfortable handling their taxes. If that’s not the case, there are several tax-software companies that offer free filing under certain conditions.

Read Also: How To File Unemployment Taxes

Chat With Charlie Unread Messages

The Educator School Supply Tax Credit and the Return of Fuel Charge Proceeds to Farmers Tax Credit have received Parliamentary approval. This means that the CRA can now process your 2021 income tax and benefit return if you claimed these credits. Contact Us if you have questions.

Find out whats new for the 2021 tax season and your filing and payment due dates. Begin by gathering your documents to report income and claim deductions, and choose how you want to file and send your completed tax return to the CRA.

When You Need More Time To Finish Your Tax Return

Filing a tax extension request using IRS Form 4868 asks the Internal Revenue Service to give you additional time to file your personal tax return.

An extension moves the filing deadline from April 15 to October 15, but it doesnt give you extra time to pay taxes you might owe on that return.

Is taking one always a wise move?

Residents and business owners in Louisiana and parts of Mississippi, New York, and New Jersey were granted extensions on their deadlines for filings and payments to the IRS due to Hurricane Ida. Due to the tornado in December 2021, taxpayers in parts of Kentucky were also granted extensions. You can consult IRS disaster relief announcements to determine your eligibility.

Also Check: Capital Gains Tax On Primary Residence

California Franchise Tax Board Extends Tax Deadline To Hurricane Ian Victims

By Christian Burgos, National Co-Leader, State & Local Tax

On October 5, 2022, the California Franchise Tax Board announced special state tax relief for individual and business taxpayers affected by Hurricane Ian. ).

Individuals and businesses in presidentially declared disaster areas are granted an extension until , to file California tax returns on 2021 income and make any tax payments that would have been due between September 23, 2022, and February 15, 2023.

Affected taxpayers who would have had an October 17, 2022, tax filing deadline now have until February 15, 2023, to file. However, tax year 2021 tax payments originally due on April 18, 2022, are not eligible for the extension.

On September 29, 2022, the IRS announced that taxpayers affected by Hurricane Ian in Florida have an extension to file various individual and business tax returns, and make tax payments, until February 15, 2023. . The California FTB automatically conforms to IRS postponement periods for presidentially declared disasters.

Taxpayers are instructed to write the name of the disaster in blue or black ink at the top of their tax return to alert FTB. For electronically filed returns, taxpayers should follow the software instructions to enter disaster information: If an affected taxpayer receives a late filing or late payment penalty notice related to the postponement period, the taxpayer should call the number on the notice to have the penalty abated.