Final Franchise Tax Reports

Before getting a Certificate of Account Status to terminate, convert, merge or withdraw registration with the Texas Secretary of State:

- A Texas entity, terminating, converting or merging, must file its final tax report and pay any amount due in the year it plans to terminate, convert or merge.

- An out-of-state entity, ending its nexus in Texas, must file its final report and pay any amount due within 60 days of ceasing to have nexus.

Franchise Tax Treatment Of Texas Series Llcs

By Kevin Vela

As I have written before, the Texas Series LLC is a great tool for real estate investors, and anyone who needs multiple Texas LLCs. But, since they are new, there are still gaps being filled in as they become more commonly used throughout the state.

Ive answered a few questions about Texas Series LLCs in a previous post, but since we are in the middle of tax season, Ive been getting calls from clients and CPAs who work for my clients concerning filing franchise taxes. How are the individual cells within a master series treated by the state? How many returns should the LLC file?

I did not know the answers, so I called the Comptrollers office where one of the Franchise Tax experts was kind enough to answer my questions. Though this is not a comprehensive account of all franchise tax considerations, here are a few conclusions.

File A Single Return

The cells within a series will most likely be treated as a combined group and will be rolled up to the master LLC. Thus, the Series LLC will only file one return. This is irrespective of ownership.

Cells will be totaled

This is no different than a single person owning 5 separate LLCs with similar business purposes, as those would be rolled into a combined group return, so the tax effect is unchanged.

File Your Franchise Tax Reports

Read Also: Maryland Tax Changes For 2021

Due Dates Extensions And Filing Methods

Franchise tax reports are due on May 15 each year. If May 15 falls on a Saturday, Sunday or legal holiday, the next business day becomes the due date.

The Comptrollers office will tentatively grant an extension of time to file a franchise tax report upon timely receipt of the appropriate form. Timely means the request is received or postmarked on or before the due date of the original report. See Franchise Tax Extensions of Time to File for more information.

You can file your franchise tax report, or request an extension of time to file, online.

There is a $50 penalty for a franchise tax report filed after the due date, even if no tax is due with that report and even if the taxpayer subsequently files the report.

Established Llcs Fall Into This 2nd Category:

Their annualized total revenue is greater than $1,230,000. In this case, they have to file the reports below :

- Public Information Report

- EZ Computation Report or a Long Form

- Additionally, supporting documentation may be required

For more information on how to file the forms listed above, please see the Long Form or EZ Computation section below.

Read Also: Are Taxes Due At Midnight

Im As Confused As A Goat On Astroturfwhere Can I Find More Information

Understanding the Texas Franchise Tax is as easy as putting socks on a rooster, so we understand if you have a few more questions. To find out more about the who, what, where, when, and why, here are some places you can get a littler more know-how:

Or you can call the Texas Taxpayer Services Line at 1-800-252-1381. This line is specifically dedicated to franchise tax questions and is available for your assistance Monday through Friday, from 8 AM until 5 PM.

What Is A Texas Passive Entity

You may see notes about Texas passive entities not having to file any No Tax Due returns.

While most LLCs are pass through entities for federal taxation, the term passive entity has a different meaning in Texas.

The term passive entity doesnt apply to LLCs in Texas.

It only applies to Sole Proprietorships and Partnerships .

Don’t Miss: Deadline For Filing 2020 Taxes

What Is The Income Threshold For Texas Franchise Tax

1. Franchise Tax

The franchise tax is imposed upon each corporation doing business in Texas at the rate of $25 per year for each $100,000 or fraction thereof of its total capital employed in this state. A corporation shall pay the franchise tax on January 1st of each calendar year.

2. Capital Employed

Capital employed means the sum of the following items: the value of tangible property owned and used directly in connection with the activity for which the corporation was organized the amount paid out for interest-bearing debt secured by mortgage or deed of trust on real estate held primarily for sale to customers in the ordinary course of trade or business the market value of shares of stock issued by the corporation the book value of any indebtedness owed by the corporation to persons who have furnished goods or services to the corporation and the book value of intangible assets used in the activity for which the company was organized.

3. Income Threshold

The income threshold is defined as the lesser of the average annual gross receipts over the preceding three years or $250,000.00.

Which Entities Are Excluded

The IRS publishes a list of entities that are excluded from taxation. These include sole proprietorships, general partnerships, certain unincorporated passives, grantor trusts, estates, escrow accounts, real estate mortgage investment conduits, qualified real estate investment trusts, non profit self insurance trusts, and trusts exempt except under IRS Code Section 501, among others.

Recommended Reading: Capital Gains Tax On Primary Residence

How To File A Public Information Report

You can file your LLC Public Information Report online via WebFile or by mail.

Filing via WebFile is quicker and easier. To do so:

- login to WebFile

- please see the Public Information Report instructions listed above

To file by mail, visit the Texas Franchise Tax Forms page, click on the report year, click EZ Computation or Long Form, then click 05-102, Public Information Report to download the form. Once complete, mail it to:

Comptroller of Public Accounts PO Box 13528 Austin, TX 78711-3528

Note: The mailing address is subject to change. Please double-check this mailing address with the address listed on the Public Information Report.

What Is The Accounting Year For Texas Franchise Tax 2020

The 2020 annual report is due May 15, 2020. Accounting Period Accounting Year Begin Date: Enter the day after the end date on the previous franchise tax report. For example, if the 2019 annual franchise tax report had an end date of 12-31-18, then the begin date on the 2020 annual report should be 01-01-19.

Also Check: Sales Tax In Denver Colorado

Small Business Taxes In Texas: The Basics

Texas has the second-largest economy in the U.S., with a gross state product of $1.76 trillion in 2020. Much of that money is made in the oil and gas industry, though farming, steel, banking, and tourism were also big contributors. Part of the reason may be that Texas, in the 21st century, has a very pleasant business climate.

How To File For Texas Franchise Tax Step

Filing Texas franchise tax isnt difficult, but it is a bit of a process, so well walk you through it.

Getting a Texas Franchise Tax Account Set Up

First, go to www.comptroller.texas.gov.

This is where youll register for both a sales tax permit and a franchise tax account. Actually, most people go ahead and sign up for both at the same time.

You should have received your webfile number in a letter when you registered for your sales tax permit. The letter would look like this:

At the bottom of the letter, itll have your sales tax webfile number. You can extrapolate your franchise tax webfile number from your sales tax webfile number. You do that by changing the last digit of your sales tax number to one more and changing the R to an X.

Ex: Sales tax webfile number: RT590914 -> Franchise tax webfile number: XT590915

After you login, youll come to a screen that looks like this:

If you dont see both options, click on the blue button in the upper right corner to be assigned an account.

Youll enter your taxpayer number and be directed to another screen.

If you scroll down a little, youll see where to enter that webfile number for franchise tax. After you do, both will be highlighted in green and you know its been assigned to you.

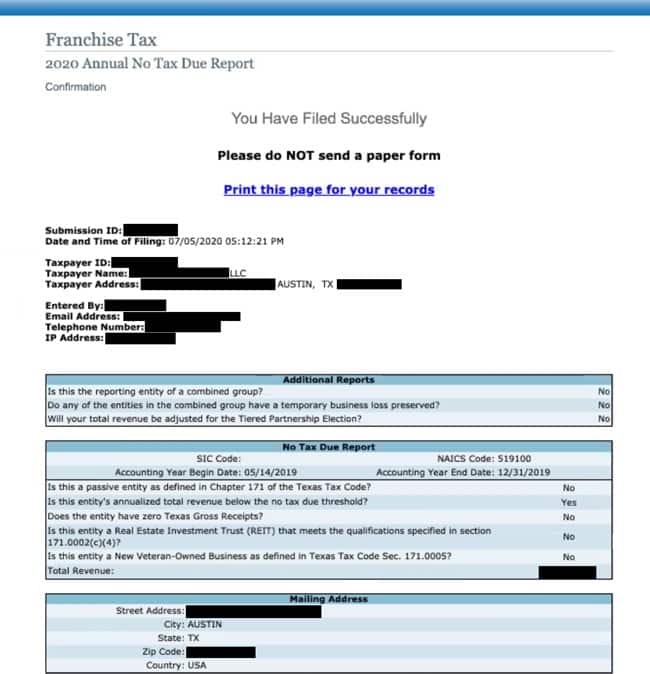

How to Fill Out the No Tax Due Report

After you click on File and Pay for your franchise tax account, youll come to a page that looks like this:

This page is where youll access all three types of forms, make a payment, and file extensions.

Read Also: Do I Have To Pay Taxes On Inherited Money

Who Do I Contact If I Have Issues Filing My Texas Annual Franchise Tax Report

Texas tries to make the reporting process smooth, but problems can still happen. If youre having an issue with your report, first check the comptroller websites franchise tax FAQ.

Or, if you need to speak with someone, comptroller locations are open 8 a.m. to 5 p.m., Monday through Friday, except for holidays.

How To Close Out Your Texas Franchise Tax Account

Learning how to close out your Texas Franchise Tax Account will save you on unnecessary late fees. Closing out your Texas franchise tax account is an important and separate step after you close your sales tax account.

You will need both your Texas Taxpayer Number and your Texas Webfile Number:

Texas Taxpayer Number An 11-digit number issued by the state and also known as your permit number

Texas Webfile Number A WebFile number is attached to the returns being mailed from the state. It is located in the top left corner of the letter/return and begins with either RTxxxxxx or XTxxxxxx. If you did not receive a tax report/letter yet, you could call the Texas Comptrollers electronic reporting system at 1-800-442-3453 to get your webfile number.

Here is the Process to Close Out Your Texas Franchise Tax Account:

Recent Posts

Also Check: How To Check Status Of Amended Tax Return

Franchise Tax Responsibility Letter From The Comptroller

Within about 2-3 weeks, youll receive a Welcome Letter from the Texas Comptroller. This is what it will look like:

It will be mailed to your Registered Agents address. If you hired Northwest Registered Agent, they will scan this letter into your online account and youll receive an email notification. If you hired a different Registered Agent company, youll need to check whether this will be mailed or emailed to you.

The Welcome Letter is technically called the Franchise Tax Responsibility Letter .

Within this letter, youll find a bunch of different numbers. At first, it can be a little overwhelming and hard to figure out what each of them mean. Weve explained them below.

Taxes On Larger Businesses

The state taxes businesses that do not file the E-Z Computation form at a rate of 0.75% on their taxable margins . It defines this as the lowest of the following three figures: 70% of total revenue, 100% of revenue minus cost of goods sold , or 100% of revenue minus total compensation.

Nearly all business types in the state are subject to the franchise tax. The only exceptions are sole proprietorships and certain types of general partnerships.

Small businesses with gross receipts below $1,180,000 pay zero franchise tax for tax year 2020.

For many businesses, the actual tax rates are much lower than the stated rates. For example, the franchise tax for retail and wholesale companies, regardless of the size of the business, is 0.375%. Businesses that earn less than $20 million in annual revenues and file taxes using the state’s E-Z Computation form pay 0.331% in franchise tax.

However, the E-Z Computation form does not allow a business to deduct COGS or compensation, or to take any economic development or temporary credits.

You May Like: How To Get Old Tax Returns

Tiered Partnerships: Comptrollers Rule 3587

A tiered partnership arrangement is an ownership structure in which any of the interests in one taxable entity treated as a partnership or an S corporation for federal income tax purposes are owned by one or more other taxable entities . This ownership scenario is typically seen in law and medical practices but can also be encountered in real estate ownership structures.

A lower-tier entity may exclude from its total revenue any amount of total revenue reported to an upper-tier entity, as long as the upper-tier entity is subject to the franchise tax ). The lower-tier and upper-tier entities must submit a report to the comptroller showing the amount of total revenue that each upper-tier entity should include with the upper-tier entitys own taxable margin calculation, according to the ownership interest of the upper-tier entity.

There are some limits to the tiered partnership election. First, the tiered partnership provision is not available if the lower-tier entity is included in a combined group. Second, the no-tax-due thresholds, discounts, and the E-Z computation method do not apply to an upper-tier entity if, before the attribution of any total revenue by a lower-tier entity to an upper-tier entity, the lower-tier entity does not meet the criteria.

May I File Now And Make My Filing Effective At A Later Date And/or Time

Certain filings may be made effective on a date and/or time after the date of receipt. The delayed effective date may be no more than days from the date the instrument is signed. A time also may be provided along with the delayed effective date however, the time may not be specified as midnight, noon, 12:00 a.m. or 12:00 p.m. The time provided will always be entered into our computer system using Central Time even if the document specifies time from another time zone.

Where permitted, the secretary of state forms explain delayed effectiveness in greater detail. A delayed effectiveness provision must be stated within a document instructions relating to the effectiveness in a cover letter are insufficient.

Delayed effectiveness is not permitted for:

In addition, there is no provision in Chapter 71 of the Business & Commerce Code for delayed effectiveness for an assumed name certificates or an abandonment of assumed name certificate.

Don’t Miss: What Is The Sales Tax

Where Do I File My Texas Annual Franchise Tax Report

Texas maintains different report filing and payment requirements, based on how much tax is due, based on the following four categories:

Online payments are also subject to a $1 service fee.

If your tax due is less than $10,000, you also have the option of paying by check, payable to the Texas Comptroller. Checks are not accepted for tax payments over $10,000.

If your tax due is over $500,000, the only payment option is TEXNET.

What Is The Difference Between Income Tax And Franchise Tax

Income taxes apply to profit. Franchise taxes do not apply to profit. Another difference between income tax and franchise tax is the entity that does the taxing. Corporate franchise taxes, on the other hand, are essentially fees that companies must pay for the privilege of doing business in a particular city or state.

Read Also: Does Arizona Have State Income Tax

Annual Franchise Tax Report Service Benefits

At Northwest Registered Agent, were committed to protecting our clients privacy. So, weve designed our franchise tax report service to protect your privacy. Heres how:

In order to preserve your privacy, well list OUR contact information instead of yours.

Only the minimum required information will be included.

We will list our IP address limiting the connection between your cell phone, personal computer, and work computers this makes it harder for advertisers to follow you.

We will list our bank and credit card information not yours.

We believe everyone has the right to keep their information private. Thats why privacy is our guiding principle when we create every service and product.

Limited Liability Company Taxes

LLC is the other common designation for small businesses. In most states, LLCs are entities that protect business owners from certain legal liabilities but pass their incomes to those owners, who pay personal income tax rather than business income tax on their proceeds.

As with S corporations, Texas bucks the national trend and charges the franchise tax to LLCs, with the same rules that apply to all business types. However, the income that passes to the owners as personal income is not subject to state income tax in Texas.

You May Like: How Much Do I Have To Make To File Taxes