How To Pay Estimated Taxes

You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. You can also make your estimated tax payments through your online account, where you can see your payment history and other tax records. Go to IRS.gov/Account. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

Using the Electronic Federal Tax Payment System is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits , installment agreement and estimated tax payments using EFTPS. If its easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as youve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations.

Check The Irs Website To See Your Payment Reflected

Did you know the IRS has a website where you can view information about prior year taxes, balances due, and payments on your account? Head over to the IRS website to view your tax account.

While this step is optional, it’s not a bad idea to log in the following day to make sure your payment is reflected properly.

Congrats, you’re all done! But before you put your quarterly estimated taxes completely behind you, take a moment to write down the next due date so you stay on track. Keep in mind that you may also need to make estimated tax payments to your state, so be sure to look up your state’s guidelines for calculating and making your estimated payments, as well as the due dates, as these may differ from the IRS’s.

As long as you meet the minimums and don’t miss the quarterly due dates, you should be all clear of penalties. And, if you do accidentally pay a little extra, you’ll always get it back when you file your tax return.

Quick tip: As important as quarterly taxes are, the most important thing is to file your yearly return on time. “The worst thing in tax, just from my standpoint, is failure to file and owing taxes,” Mathis says. Filing your annual return late can get you in a world of trouble.

Make Your Quarterly Tax Payments And Check The Irs Website To See If It’s Reflected

There are two ways you can pay your estimated taxes. The easiest method is EFTPS, which allows you to make a payment online or over the phone .

If you want more flexibility in when and how much you pay quarterly taxes, then it’s best if you send a check with your tax return. The post office can be a little unpredictable, so you should let the IRS know if it’s sent or when it was sent.

Filing estimated taxes is no biggie when you think about all of the benefits that come with it. If you’re not required to make quarterly payments, then why would you?

Even though technically, the IRS doesn’t take into account the money you’ve already paid in taxes, we’re all about being on the safe side.

Related Articles:

Don’t Miss: Tax Credit For Electric Vehicle

Estimated Tax And Filing Quarterly

When you file taxes on a quarterly basis, it means that you are filing estimated taxes instead of having an employer do it for you.

Each quarter you make an estimation of your income, and then you pay the appropriate amount of money into that quarter’s return.

Because most individuals’ incomes do not reflect the profits and losses from running a business, it is best to file your taxes under the entity that most closely matches your business’s needs.

How To Calculate Quarterly Tax Payments Step

The IRS has free resources to help you calculate your quarterly estimated tax payments. And if you use an accounting tool like QuickBooks Self-Employed, your tax payments are estimated automatically. But if you plan to take a DIY approach, or just want to understand how these payments are calculated, these are the steps you should take:

1. Start with your total expected income for the year. Apply any tax deductions to get your adjusted gross income.

2. Use Tax Rate Schedules provided by the IRS to determine your tax amount. Multiply your adjusted gross income by the applicable tax rate to find your estimated income tax owed.

3. Factor in any self-employment taxes to get your total estimated tax for the year.

4. Divide your total estimated tax by four to get your quarterly estimated tax payments.

Don’t Miss: Tax Short Term Capital Gains

What Is The Qualified Business Income Deduction

You may have a chance to reduce your self-employment income further by claiming the qualified business income deduction. This allows you to reduce your pass-through income from self-employment or owning a small business by up to 20% on your tax return.

You can reduce the net amount of qualified items of income, gains, deductions, and losses tied to your trade or business. This means items like capital gains and losses, dividends, interest income, and other nonbusiness gains and losses don’t figure into this calculation.

In general, to claim the QBI deduction, your taxable income must fall below $170,050 for single filers or $340,100 for joint filers in 2022. Tax year 2021 has limits of $164,900 and $329,800, respectively.

You first determine your self-employment or business income and report your adjusted gross income on Form 1040. From there, you can calculate this pass-through deduction.

Extra Time For Quarterly Payers

If you pay your property taxes quarterly, you are entitled to pay interest-free if you pay by the 15th . This is called a “grace period. If the last day of the grace period falls on a weekend or a federal holiday, the payment is due the next business day.

If payment is made after the grace period, interest will be charged from the original due date .

If your payment is mailed, we consider your payment date to be the postmark date on your envelope.

Also Check: Is Spousal Support Tax Deductible

What Happens If I Underpay Or Don’t Make An Estimated Tax Payment

If you fail to make any estimated payments, you could be assessed penalties and interest on the unpaid portion. Using a safe harbor method of calculating your quarterly tax payments, might generally prevent the IRS from charging a penalty for underpaying your estimated taxes.

If your payment to the IRS is returned for insufficient funds, it is considered nonpayment and you could be penalized. Finally, if you make your estimated payment late, you could incur a penalty even if you are due a refund.

How Much Is The Penalty For Not Paying Quarterly Taxes

Itâs important to pay by the deadlines posted above. Otherwise, you might be on the hook for penalties.

Quarterly tax penalties include both a cumulative monthly percentage and a monthly interest rate. As a rule of thumb, itâs about 7% of the taxes youâll owe at the end of the year.

There’s one important detail to note: Every month you delay paying adds to the penalty. That means you should pay as soon as possible.

If you missed the estimated tax payment deadline in April, for example, you should double your payment in June to avoid six months of penalties.

You May Like: Capital Gains Tax On Cryptocurrency

How To Figure Estimated Tax

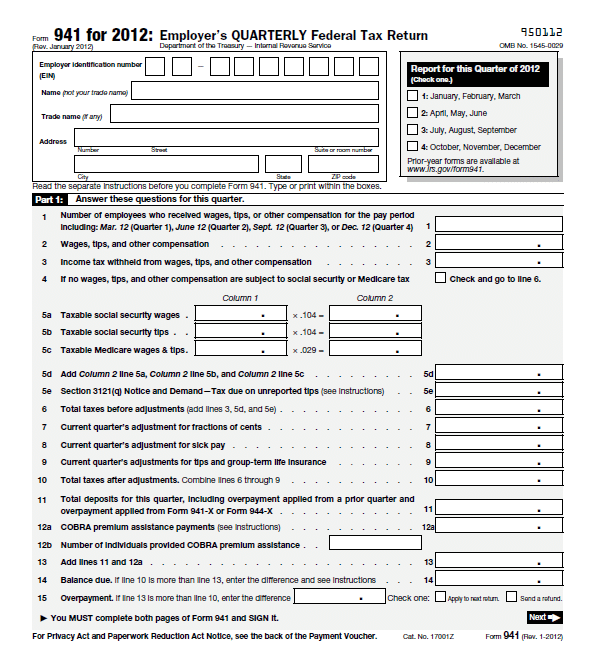

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax. Nonresident aliens use Form 1040-ES to figure estimated tax.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Use your prior year’s federal tax return as a guide. You can use the worksheet in Form 1040-ES to figure your estimated tax. You need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as accurately as you can to avoid penalties.

You must make adjustments both for changes in your own situation and for recent changes in the tax law.

Corporations generally use Form 1120-W, to figure estimated tax.

Who Has To Pay Quarterly Taxes

In most cases, freelancers are required to pay quarterly taxes. If you are the owner of a small business or owe a minimum amount of $1,000 in income tax, then you are expected to pay quarterly taxes.

In case you owe less than $1,000, then you will not be required to pay quarterly taxes. Instead, all you have to do is pay your due taxes as you are filing for a tax return.

Making less money does not make you exempt from taxes. It just changes the way you would normally make the payment.

Moreover, if you had no tax liability during the previous year, then you may also be exempt from paying quarterly taxes. This may be because you did not have to file for an income tax return, or because the “total tax” box on your Form 1040-ES stated $0.

To put it simply, as long as you are self-employed or you have your own business, you need to file for quarterly taxes, lest you’ll receive a penalty. You are considered self-employed if you work in the following circumstances:

- You have a job as an independent contractor

- You are part of a partnership that runs a small business, such as an LLC

- You are the sole proprietor in a particular field or trade

- You run a business by yourself, whether it’s full-time or part-time

Side hustles might also be exempt from paying quarterly self-employment tax. All you need to do is ask the potential employee to withhold the necessary extra and file for you.

The same thing also applies in case you file jointly with your spouse and they have a W-2 job.

You May Like: Which State Has Low Property Taxes

When Are Quarterly Tax Payments Due

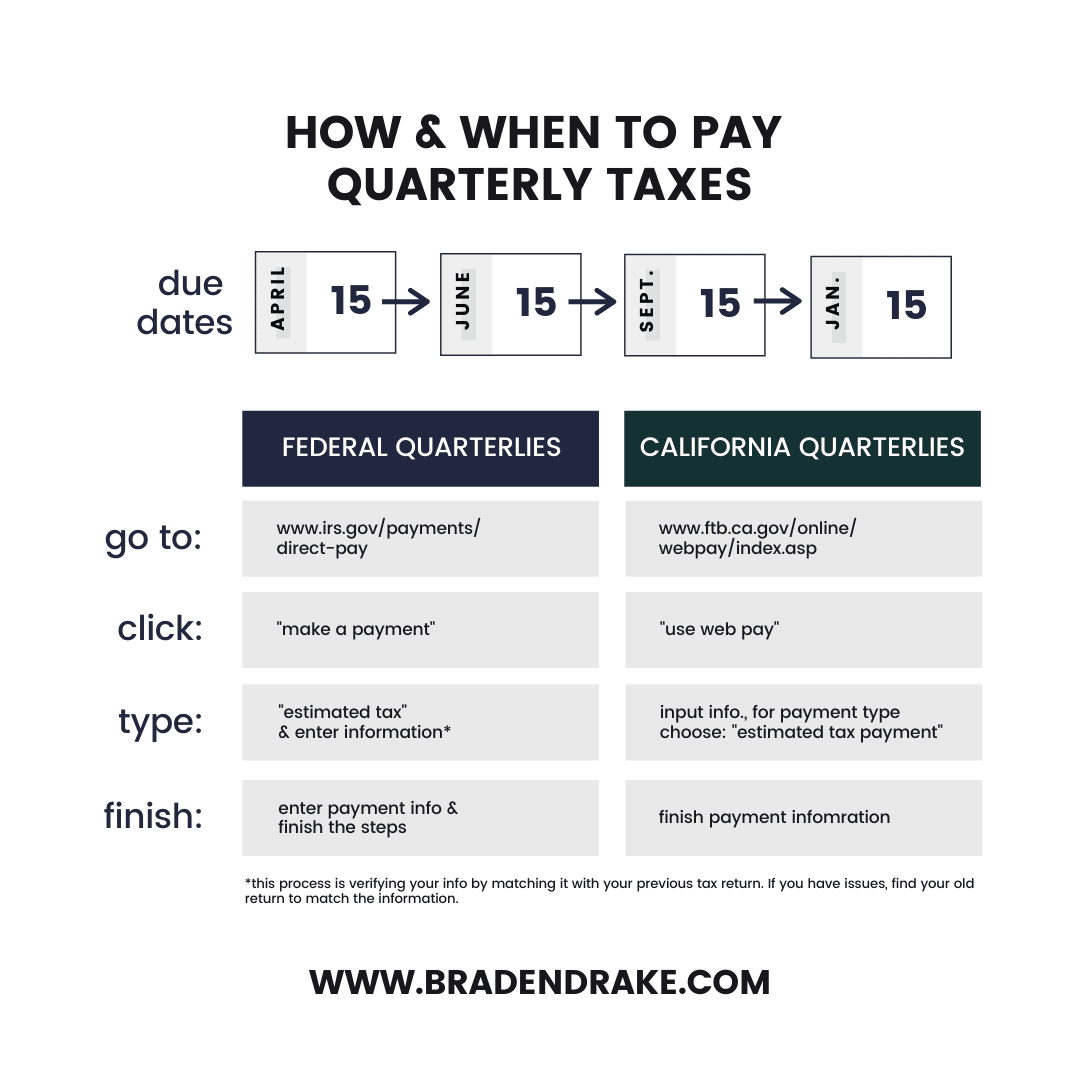

Quarterly tax dates generally fall 15 days after the end of a quarter.

- First quarter: From January 1 March 31Estimated tax payment is due by April 15

- Second quarter: From April 1 May 31Estimated tax payment is due by June 15

- Third quarter: From June 1 August 31Estimated tax payment is due by September 15

- Fourth quarter: From September 1 December 31Estimated tax payment is due by January 15 of the following year.

Always refer to the IRS website when scheduling your payments. There may be changes to the tax deadlines during national emergencies or IRS technical difficulties.

Why Do You Need To Make Quarterly Payments

We know what you might be thinking. Why not just pay your taxes once a year, when you file your return? However, the IRS doesnt look too kindly on those who dont make enough tax payments throughout the year. It may be tempting to simply save all your tax payments for the year and throw them into a high-yield savings account. After all, Uncle Sam will still get paid in the end. In the meantime, maybe youll be able to make a few extra bucks in interest payments.

Unfortunately for you, the IRS frowns upon this practice. You can be charged interest and other penalties if you dont make at least quarterly payments. Do not wait until tax season to pay what you owe.

Recommended Reading: Pto Cash Out Tax Calculator

Gather Taxable Miles Traveled

Drivers must calculate the miles driven in each state using odometer readings. This is required for all IFTA trucks and jurisdictions. Owner-operators can use software to track the mileage for a fleet and get the required data to file IFTA tax properly.

If you track this manually, it can take a lot of time because there isnt a proper system for keeping track of mileage reports. Fleets need to be well organized, or they may have trouble calculating the mileage for each state and end up being subject to an IFTA audit.

What Is An Ifta Report

The International Fuel Tax Agreement was developed to make it easier for American states and Canadian provinces to tax trucking fleets. It helps to eliminate paperwork for trucks crossing state or provincial lines. To stay compliant, trucks need to file an IFTA quarterly report, which covers the fleet fuel purchases and kilometers traveled in each jurisdiction during the quarter. IFTA fuel reports are due four times a year on the last day of the month following each quarters close.

The IFTA fuel tax report is necessary even if fleets used no taxable fuel or operations were carried out during the reporting period. You can submit your IFTA reports online. The online system will automatically determine the amount of tax owed in each jurisdiction entered. Late filing of IFTA reports will result in a penalty amount based on the jurisdiction rules and the number of months of late filing.

Read Also: When Do I Have To File Taxes 2021

What Happens If I Dont Pay Quarterly Taxes And Wait Until April

If you owe more than $1,000 in taxes and dont pay taxes quarterly, youll get an underpayment penalty from the IRS.

However, you may be able to avoid the penalty if either of the following apply to you:

You didnt pay due to a disaster or an unusual circumstance.

You retired or became disabled during the tax year.

Learn how to declare these waivers on page two of the instructions for Form 2210.

American Rescue Plan Act Of 2021

The American Rescue Plan Act of 2021 was passed in March of 2021 in response to the COVID-19 pandemic. The act provides businesses with tax relief in the form of payroll tax credits, enhanced deductions for business expenses, and extended deadlines for filing and paying taxes.

As we have moved into the 2022 tax year, some ARPA benefits and credits for businesses have changed. Some notable changes include:

- Unemployment benefits are taxable in 2022.

- Businesses with more than $600 of income transferred through a mobile service payment app will be issued Form 1099-K from the service provider.

Also Check: Sales Tax Calculator For Tennessee

Do You Need To File Quarterly Tax Payments

Whenever you get a new job, youre required to fill out a W4 form. Your answers will help your new employer figure out how much tax to withhold from your paycheck. They will send that money to the IRS on your behalf. In most cases, these withholdings will cover your tax liabilities. Especially once you start tacking on tax credits or deductions you might be eligible for. In the end, most traditional 9-to-5 workers dont need to worry about making regular tax payments to the IRS. . However, there are some other workers who need to make quarterly tax payments to the IRS.

Even if you have regular tax withholding, quarterly tax payments could still apply to you. If you earn extra income from the gig economy, for example, those earnings will also be taxed. You can also factor in income from a solid investment portfolio or renting out your extra space on AirBNB.

Finally, there are the people who dont work a regular job. Whether you run your own small business, work in subcontracting, or spend your days freelancing for different clients, you may not have an employer withholding your estimated taxes. As a business owner, you are in charge of making your own tax payments. Think of yourself as both the employer and the employee. Tax payments are part of the employers job, after all. You need to make sure that you pay your income tax, as well as your payroll taxes .

Quarterly Tax Payments Throughout The Year

The IRS expects tax payments to be made quarterly to cover income thats been made in the previous three months. In normal years, these are the due dates.

- The first quarter is due on April 15.

- Second quarter payments are due on June 15.

- The third quarter is due on September 15.

- Fourth quarter payments are due January 15 of the following year.

If those dates fall on a weekend or a Federal holiday, then the payment is due on the next open business day.

Some of my self-employed friends employ a useful strategy for these quarterly payments. They make an estimated monthly tax payment into their own high yield savings accounts. Those payments earn a little bit of money, before they are sent to the IRS every three months. It also helps them avoid coming up with a large payment every three months something that many self-employed people end up struggling with if they dont budget properly.

They just take the amount that they owed the previous year and divide it by 12. Then, they transfer that amount into a high-yield bank account every month. When its time to make their quarterly tax payment, they transfer the payment via EFTPS.gov .

You May Like: Are Campaign Contributions Tax Deductible

Guide To Managing And Paying Quarterly Taxes

Once you figure out how much your quarterly taxes are, meet with your local business banker to see how you can pay directly from your business account or credit card. Presented by Chase for Business.

As a business owner, paying quarterly estimated taxes provides you with reassurance that there wont be a large tax bill waiting for you in April.

You have to pay taxes but fortunately, the Internal Revenue Service has a chart for quarterly tax dates so you don’t have to worry about missing a payment date.

In this guide, youll learn when quarterly taxes are due, how to calculate and pay quarterly taxes and what happens if you miss a payment. Please consult your own tax advisor for more information.