Pay Your Income And Self

Once youve determined whether you need to pay quarterly or annually and used Form 1040-ES to calculate your income and self-employment taxes, its time to pay.

If youre paying quarterly, your taxes are due on the following dates:

If youre paying annually, your filing deadline depends on the type of business you own:

- Partnerships, S corporations, and multi-member LLCs must file by .

- Anyone who files taxes as an individualwhich usually includes sole proprietors and single-member LLCsmust file by .

If youre still not sure when your taxes are due, we recommend consulting with an accountant who can give tax-filing advice specific to your business.

You have a few options for sending your taxes to the IRS. The most straightforward option is to use the IRSs online payment system. An accountant or tax professional can file for you. Alternatively, you can use small-business tax software to file your self-employment and income taxes.

When You Cannot File Online

You cannot file a Self Assessment tax return online:

- for a partnership

- to report multiple chargeable gains, for example from life insurance

- if you get income from a trust, youre a Lloyds underwriter or a religious minister

If youre sending a tax return for the 2017 to 2018 tax year or earlier, get forms from the National Archives.

How Much Is Self

Letâs take a moment to make sure we understand self-employment tax. If you work for yourself, itâs how you pay FICA taxes, which comprise Social Security and Medicare taxes. These are automatically withheld from W-2 employeesâ paychecks.

Since freelancers and self-employed individuals donât have employers, they get the special privilege of paying this themselves, for a whopping tax rate of 15.3%. Regrettably, this is added on top of your federal and state income taxes.

To learn more â including why this rate is so high â check out our guide to self-employment tax. In the meantime, howâs that smile holding up?

Recommended Reading: How Can I Get My Tax Transcript Online Immediately

Captains Of Fishing Boats

As the captain of a fishing boat, you can deduct expenses for which the owner did not pay or reimburse you. These expenses include the cost of personal navigation aids and rubber gear. You can also deduct motor vehicle expenses you paid to transport crew members and to get supplies and parts to use on the boat. You may be able to deduct business-use-of-home expenses and the cost of travel between your home and the fishing boat if you meet certain conditions. For more information, see Line 9281 Motor vehicle expenses and Line 9945 Business-use-of-home expenses.

Line 9790 Or 9270 Other Expenses

For business and professional expenses, use line 9270 on Form T2125.

For farming expenses, use line 9790 on Form T2042.

For fishing expenses, use line 9270 on Form T2121.

There are expenses you can incur to earn income other than those listed on Form T2125, Form T2042 or Form T2121. We cover some of them in the following sections. Enter on this line the total of other expenses you incurred to earn income, as long as you did not include them on a previous line. You have to list these expenses on the form.

Note for farmers

You can pay some of your expenses by having them deducted from your cash grain tickets or grain stabilization payments. These expenses include seed, feed, sprays or fertilizers. You can deduct these expenses if you include in your income the gross amount of the grain sale or stabilization payment.

Recommended Reading: Arizona Charitable Tax Credit List 2021

How To File Your Taxes As A Freelancer

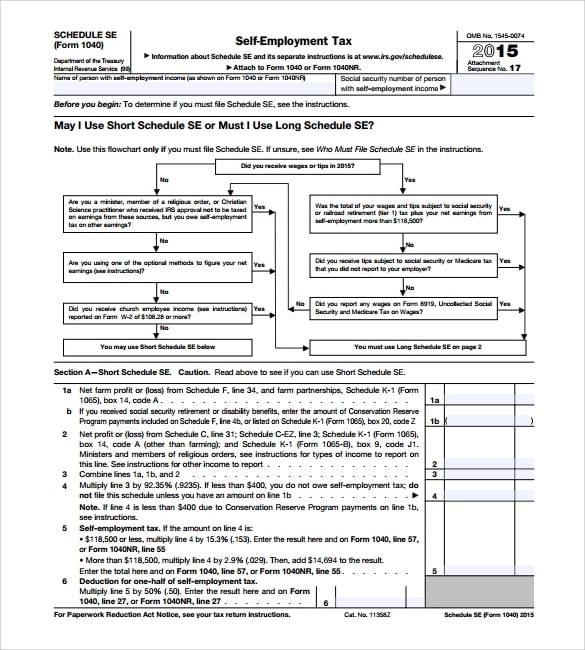

If you are filing your taxes as a sole proprietor, you will file your standard 1040 tax return, but will include Schedule C for your business income.

If you’re filing as a corporation, you’ll need to fill out a separate business tax return utilizing the 1120 form .

If you choose to do it yourself, there are several popular tax software options available. And you’ll probably benefit from paying for small business accounting software, such as Quickbooks, to help you organize your income and expenses.

It can be helpful to work with a licensed professional, such as a Certified Public Accountant or Enrolled Agent . Both are required to pass rigorous testing and are recognized by the IRS to represent you. While licensed tax professionals may cost more, they can help you set up and protect your freelance business. They may also save you from making costly tax mistakes.

Figure Out Your Pay Schedule

Many people arenât aware of this, but taxes arenât technically due April 15th. Theyâre due at the time the income is earned. This is why employers remit payroll taxes throughout the year. Freelancers and independent contractors, of course, donât have employers to do this for them. Consequently, many of them are required to pay their taxes quarterly, in the form of âestimated tax payments.â These payments are due by the 15th business day in the month following the end of a quarter:

- ð· Quarter 1 is due April 15th

- ðï¸ Quarter 2 is due July 15th

- ð Quarter 3 is due October 15th

- ð² Quarter 4 is due January 15th

Anyone who expects to owe more than $1,000 to the IRS is required to make quarterly payments or face underpayment penalties.

Think that might be you? Use our quarterly tax calculator to figure out exactly how much you should pay by the next estimated due date .

Your quarterly payments can be made directly to the IRS through their free payment portal.

Read Also: Do I Have To Charge Sales Tax On Handmade Items

Line 9974 Gst/hst Rebate For Partners Received In The Year

If you received a GST/HST rebate for partners, report the amount of the rebate that relates to eligible expenses other than CCA on line 9974 of your form in the year you receive the rebate.

For business and professional income, enter the total of amount 5A, amount 5B and line 9974 at amount 5C.

For farming income, enter the total of amount 5A, amount 5B and line 9974 at amount 5C.

For fishing income, enter the total of amount 5A and line 9974 at amount 5B.

You Can Minimise The Risk Of Mistakes

HMRC says that 630,000 people filed their tax return on deadline day on 31 January 2022, with 20,947 filing between 11pm and 11:59pm.

While leaving it late might be unavoidable for some, it does carry the risk of making more errors than necessary.

And mistakes can lead to fines. While HMRC wont issue penalties for people whove taken reasonable care when filling in returns, they charge 0 to 30 per cent of the tax due if people have been careless.

You May Like: Free H& r Block Tax

Line 9797 Crop Insurance Revenue Protection Program And Stabilization Premiums

Enter the amount of deductible premiums to the Crop Insurance Program. Do not include any premiums for private, business-related or motor vehicle insurance. For information on other types of insurance, see Line 9760 Repairs, licences and insurance, Line 9804 Insurance and Line 9819 Motor vehicle expenses.

What Is The Self Employment Tax Deduction

The self-employment health insurance deduction allows eligible self-employed individuals to deduct the cost of monthly health insurance premiums from their taxable income. This applies to premiums paid for medical, dental, and qualified long-term care insurance coverage for the self-employed individual, their spouse, dependents, and non-dependent children under the age of 27.

A tax deduction reduces your taxable income, which in turn lowers your overall tax bill. This particular deduction is an above-the-line deduction, meaning that you do not need to itemize your deductions to receive the benefit. Since 2003, the self-employed insurance deduction has allowed for a deduction of up to 100% of eligible premiums paid. For example, if you spent $7,600 on health insurance premiums during the tax year, you may be able to reduce your taxable income by $7,600.

Don’t Miss: How Much Is Capital Gains Tax On Crypto

Filing Your Taxes Can Be Tricky When You’re Self

Theres no avoiding giving Uncle Sam his due, and if you want to avoid an audit, its important to do it right the first time. Unlike W-2 employees, self-employed individuals do not have taxes automatically deducted from their paychecks. Its up to them to keep track of what they owe and pay it on time.

Because taxes arent automatically deducted, take-home pay for the self-employed tends to be higher than it is for wage earners. However, unless you want the IRS to come knocking, its wise to set aside a chunk of those funds to cover your tax obligations.

Business owners, whether they are self-employed freelancers or corporation owners, are responsible for complying with tax law with respect to their business, said Shoshana Deutschkron, vice president of communications and brand at Upwork. Financial literacy is a critical skill, that literacy includes an understanding of taxation.

You need to hold on to some of your money, added Lise Greene-Lewis, CPA and tax expert for TurboTax. You should pretend you dont have that much money because your income varies so often. You have to think about paying your taxes.

Not only are government forms daunting, but learning the ropes of taxation can be truly complicated. If youre filing as self-employed with the IRS, here are the basics of filing, paying and saving for taxes.

Line 9137 Nets And Traps

Nets and traps include lines, hooks, buoys, anchors and radar reflectors. Generally, you cannot deduct the entire cost of nets and traps you bought in the year. Instead, there are two methods you can use to deduct these costs.

Method 1 Capital cost allowance method

Capitalize the cost of nets and traps and claim CCA. See Chapter 4for details on CCA.

Method 2 Inventory method

Include in inventory the cost of nets and traps and deduct the loss in value, as shown in the following example:

Example

If you just started your fishing business, choose one of the two methods. If you have been running your fishing business for several years and each year you claim the cost of replacing nets and traps, you can keep on doing so. However, you can choose to change to either the CCA or the inventory method. If you choose to do this in 2021, the value of nets and traps on hand at the end of 2020 will be zero since you have deducted their value in previous years.

You can change from the inventory method to the CCA method. However, you cannot change from the CCA method to the inventory method.

You May Like: Do You Have To Pay Taxes On Inheritance

How Can I Best Prepare For My Tax Bill

For most people, setting aside a rough percentage of their net income each time they are paid , will help make sure that their tax bill, along with the payments on account, can be met. Our table may help you work out your rough % using 2022/23 rates assuming you are using the cash basis or if using the accruals basis you get paid promptly. Please note this does not include Class 2 NIC and that these are based on UK income tax rates see our webpages for information on Scottish rates of income tax and the Welsh rates of income tax:

|

Net income |

Example: Hugh

Hugh began trading as an electrician in April 2022. He estimates that in the 2022/23 tax year he will invoice approximately £22,000 and expects his expenses to be around £2,500, resulting in profits of £19,500. Hugh looks at the table above and decides to put aside 19% of his net income each time his invoices were paid, meaning at the end of the tax year, he had saved £3,705 towards his tax bill.

On competition of his accounts and tax return Hugh calculates his actual profits to be £19,000 instead of £19,500 and his 2022/23 tax bill looks like this:

Total due by 31 January 2024 £3,183.19.

|

Net profit from self-employment |

The Takeaway: There Are Ways To Make Freelance Taxes Less Taxing

Freelancing is a great way to help you build up a business with the flexibility and freedom you desire. One drawback? The taxes can be a little complicated. However, there are ways to set yourself up on the right foot and avoid rushing on your taxes. Choosing the right business structure, and organizing your finances in a tax-friendly way can help you avoid stress at tax time.

More guides for freelancers and the self-employed > > >

Read Also: Your Tax Return Is Still Being Processed 2022

Are Se Earnings Also Subject To Income Tax

Yes, though the amount of taxable income is figured slightly differently than for employees, because of the much greater range of allowed deductions. One of the deductions is for half of your self-employment tax. So even though you have to pay the entire self-employment tax, you get half of it back when you prepare your return.

It Gives You More Time To Research Professional Advice

You can include the costs of hiring a professional accountant or adviser as a tax-deductible expense.

If you start your tax return early and arent sure about the details, in the first instance you should be able to speak to someone at HMRC quicker .

But if you need more advice, it gives you more time to find the right professional to help you out.

Its important to do your research and make sure you find someone with a great reputation, as bad advice can cost you time and money.

Their advice can help you set up a proper record-keeping system, plus their knowledge of tax and expenses could go towards reducing your overall tax liability.

Read more about hiring an accountant and bookkeeping tips.

Also Check: Long Term Capital Gain Tax Calculation

How To File Your Self Employment Taxes

As an independent contractor/self employment individual, you have to keep good records to aid in tax preparation.

Even more importantly for the ease in completing your tax return, you have to know where they are.

Before you start your federal income tax return, gather all the supporting documentation you need to support business expenses and gross income. Youll need those items to calculate your net earnings from self employment. Youll also need the documentation from your quarterly estimated taxes that you paid, based on your predictions for gross income and expenses on your estimated income tax payments.

Net Income Before Adjustments

If you are self-employed, you can deduct certain amounts you spent to earn business, professional, commission, farming and fishing income. For the definition of self-employed fisher, see Find out if this guide is for you. If you use the cash method of reporting income and expenses, you can only deduct expenses you paid in the year. If you are using the accrual method, you can deduct expenses you had during the year, whether you paid them or not. There are special rules for deducting prepaid expenses. For more information, see Prepaid Expenses.

Read Also: Calculator For Taxes On Paycheck

How Much Can You Make Without Filing Taxes

You need to claim all the income you earn from any job. If you are an employee for someone during the year, they must issue you a W-2 reporting your wages, and the amounts withheld for Social Security, Medicare, federal and state taxes. If you are working as an independent contractor, have a side gig, or are starting your own business, keep track of your income and expenses.

Do I Need To Include Coronavirus Business Support Grants On My Tax Return

You may have received financial support for your business during the Coronavirus pandemic. These grants may have come from your local authority , government departments or from HMRC grants).

Many of these grants are taxable and will need to be included on your tax return. See our page on Coronavirus payments for more information.

For each grant you have received you should check the conditions to see if it is taxable income and then if so, you need to work out which tax year it is taxable in, so that you know which tax return it needs to be included on. If the grants are taxable income, with the exception of the SEISS grants , factors such as when you received the support grant, your basis period and whether you prepare your accounts using the cash basis or the accruals basis will affect in which tax year they are taxable, and so which tax return they should be included on.

The 2021/22 tax return has a box on page 1 of the self-employment pages for Coronavirus business support income. For the SEISS grants, we have separate detailed guidance on our page: SEISS: where do I include the grants on my tax return?

You May Like: Check The Status Of Tax Refund

Line 9937 Mandatory Inventory Adjustment Included In The Previous Year

If you included an amount for the mandatory inventory adjustment on line 9942 in your 2020 fiscal period, deduct the amount as an expense in your 2021 fiscal period. Do not include the valuation of inventories if you are using the accrual method of accounting. For more information about the accrual method, see Reporting methods.

For more information on MIA, see Line 9942 Mandatory inventory adjustment included in the current year.

Self Employment Tax: What To Know And How To Calculate It

Self-employment taxes require quarterly payments calculated at a higher rate than employees who have their payments deducted from each of their paychecks.

Self-employed tax rates are a bit higher than rates employees pay, because self-employed workers’ payments combine both employee and employer contributions. Self-employed workers also pay a rate that combines Medicare and Social Security taxes. This is because employees have Medicare taxes and Social Security taxes withheld from their paycheck by their employer, while self-employed workers need to be responsible for these taxes themselves.

Self-employed individuals may also owe the Additional Medicare Tax if their total wages and net earnings from self-employment exceed $200,000 for single filers or $250,000 for those married filing jointly.

Also Check: How Much Percent Is Tax