Irs Reminds Taxpayers Irs Free File Remains Open Until Nov 17

IR-2022-199, November 15, 2022

WASHINGTON The Internal Revenue Service today reminded those who still need to file their 2021 tax returns that IRS Free File remains open until November 17 and can help those who qualify claim the Child Tax Credit, Recovery Rebate Credit or Earned Income Tax Credit.

These and other tax benefits were expanded under last year’s American Rescue Plan Act and other recent legislation. The only way to get these valuable benefits, however, is to file a 2021 tax return.

Last month, the Internal Revenue Service sent letters to more than 9 million individuals and families who appeared to qualify for a variety of key tax benefits but had not yet claimed them by filing a 2021 federal income tax return.

Many in this group may be eligible to claim some or all of the 2021 Recovery Rebate Credit, the Child Tax Credit, the Earned Income Tax Credit and other tax credits, depending on their personal and family situation. The letter, printed in both English and Spanish, provided a brief overview of each of these credits.

Often, individuals and families can get these expanded tax benefits, even if they have little or no income from a job, business or other source. This means that many people who don’t normally need to file a tax return should do so this year, even if they haven’t been required to file in recent years.

Irs Free File Available Until October 17 Midnight Eastern Time

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.8 million electronically filed returns in 2021. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Also Check: How Can I Get My Tax Transcript Online Immediately

What Is A 501

Organizations with tax-exempt status, such as public charities and private foundations, are commonly known as 501 organizations. The term 501 refers to section 501 of the IRS code, which outlines the rules controlling tax-exempt organizations.

A 501 organization enjoys various tax benefits. You wont pay federal income tax and may be eligible for state tax exemption. This tax advantage allows for diverting more resources to help accomplish the organizations mission.

However, the 501 status comes with responsibilities. You must keep detailed records and file tax returns annually with the IRS to prove the organization complies with tax rules.

Here’s What Flood Victims Need To Know When Filing Tax Returns This Year Experts Say

Travel trailer in home’s driveway on Baringer Road near Profit Ave., Friday, Dec. 30, 2016 in Old Jefferson subdivision near Most Blessed Sacrament Catholic Church, over four months after the August flooding.

Filing tax returns is confusing enough but will be much more complicated this year for tens of thousands of flood-stricken south Louisiana homeowners trying to account for their damaged homes and belongings, expenses and plummeting property values.

Were in uncharted territory, said Gerard Jerry Schreiber Jr., of Schreiber & Schreiber CPAs in Metairie. Theres never been an incident like this before where there were so many uninsured people who were affected by such massive flooding.”

The complications are true even for insured homeowners, who have to weigh their losses against insurance payments they receive.

“As people start to work on their tax returns, there will probably be more questions coming up,” said Schreiber, who was honored recently by the American Institute of CPAs tax division for his devotion to tax work related to disaster relief.

The place to go is the Internal Revenue Service’s form for itemized deductions, where casualty losses are claimed.

The biggest issue for people who suffered property losses in the flood is determining how much the value of their home declined and how much property damage they sustained.

With repairs still underway for most homeowners, the overall cost may not be known yet.

You May Like: Amended Tax Return Deadline 2020

Which States Dont Have Income Tax

If you live or work in one of the states below that dont have income tax, you wont need to worry about filing a state tax return for that state.

Note: New Hampshire and Tennessee are two additional states with the lowest taxes at 0% for income taxes on earned income, but they do tax dividend and interest income. That said, you may still need to file a state return for those two states.

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS once electronic filing season opens. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

You May Like: Va State Tax Refund Status

Free Tax Help Is Available

The IRS Volunteer Income Tax Assistance Program generally offers free tax help to people who make $57,000 or less. The IRS also offers tax help for seniors through its Tax Counseling for the Elderly program . There are VITA and TCE sites across the state where trained volunteers can answer your questions, file your taxes and help you take advantage of any tax credits for which you are eligible.

Ner With A Registered Agent

Think of a registered agent as the link between your organization and the state. The agent can be an individual or an agency that receives tax and legal communication on your nonprofits behalf.

The requirements for registered agents vary by state. But most require agents to hold a physical address in the state or residency in the state .

Read Also: Tax Id Numbers For Businesses

Millions In State Tax Refunds Heading To Unclaimed Property If Taxpayers Dont Claim Themcontinue Reading

BATON ROUGE Louisiana taxpayers have until Oct. 6, 2022, to claim millions of dollars in state income tax refunds before they become unclaimed property.

The Louisiana Department of Revenue sent letters to 20,400 individual and business taxpayers advising them to claim their refunds before they are transferred by law to the Unclaimed Property Division of the state treasurers office. More than $36 million in unclaimed refunds is due for transfer if not claimed from LDR.

To claim a refund, complete and return to LDR the voucher in the Notice of Unclaimed Property letter dated Aug. 18, 2022. The department will issue paper checks to all taxpayers submitting completed vouchers by the Oct. 6 deadline.

Any refund not claimed by the deadline remains the property of the taxpayer, and can be retrieved from the Unclaimed Property Division.

Spouses Who Work In Different States

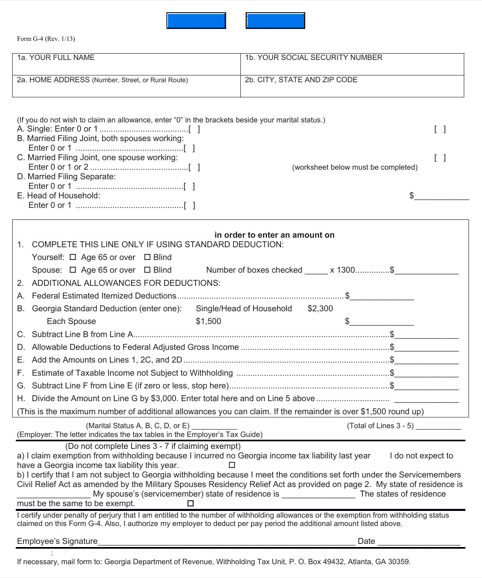

A big problem for military families in the past was having residency in more than one state. Members of the military are exempt from state residency and taxes in states where they’re stationed, but their spouses weren’t always exempt prior to 2009. This meant that each spouse would have their own state of residency. They would owe taxes to both states.

Don’t Miss: 2021 Dependent Care Tax Credit

Nebraska Driver’s License Or State Id For E

This filing season, the Nebraska Department of Revenue, along with many other state revenue agencies, is requesting additional information for electronically filed individual income tax returns. This is an effort to combat stolen-identity tax fraud, and to protect you and your tax refund.

We ask that you provide the requested Nebraska drivers license or state-issued ID card information when completing your tax return. Providing this information is voluntary. We will not reject your return if you do not provide the requested drivers license or state-issued ID information. However, providing this information will help us process your tax return more quickly.

How Onboard Powers Effective 501 Organizations

Nonprofits today often use board management software to automate processes, enhance communication, improve security, among other benefits.

With OnBoard meeting software, youll never worry about how to prepare for a board meeting. Our platform improves collaboration before and during your board meetings to help take your nonprofit to the next level. Put simply, OnBoard acts as a central platform for all board activities.

You can use OnBoard to create, store, and distribute board materials. Virtual offerings allow board members to meet from anywhere, while leaders can use tools like the Agenda Builder to create customized templates.

Need some assistance planning a nonprofit board meeting? Download our free Board Meeting Agenda Template today.

Read Also: Capital Gains Tax Calculator New York

Are You Required To File State Taxes If You Dont Live There

If you lived in a state for an entire year, theres no question about your residency status. But what if you moved during the year? Or, what if you were not a resident at all and you just have wage or other income from the state? Lets go over a few scenarios when you have to file state taxes, possibly in more than one state.

- Moving from state to state If you moved from one state to another during a tax year, you may have to file state taxes in both states. Some states base the filing requirement on a minimum number of days or months you spend in the state. In other states, moving there with the intent to stay permanently is enough to require that you file a state return, even if only for a few days. For example, you might wonder if you have to file state taxes in California if you only moved there permanently in late December. In this case, youd be considered a resident and youd need to file a return.

Note: These types of income are also sourced to your resident state regardless of where its earned. However, your resident state will generally allow a credit against state income tax for the income taxes paid to another state on the same income.

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies who provide their online tax preparation and filing for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications if needed. It provides a free option to taxpayers whose income is greater than $73,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

IRS Free File Program offers the most commonly filed forms and schedules for taxpayers.

Other income

You May Like: Your Tax Return Is Still Being Processed 2021

If You Lived In Two States

You’ll have to file two part-year state tax returns if you moved across state lines during the tax year. One return will go to your former state. One will go to your new state. You’d divide your income and deductions between the two returns in this case. But some states require that you report your entire income on their returns, even if you resided there for less than the full year.

Free File: About The Free File Alliance

The Free File Alliance is a group of industry-leading private-sector tax preparation companies that provide free online tax preparation and electronic filing only through the IRS.gov website. IRS Free File is a Public-Private Partnership between the IRS and the Free File Alliance. This PPP requires joint responsibility and collaboration between the federal government and private industry to be successful.

You May Like: Are Gofundme Donations Tax Deductable

What Taxes Can I Pay With Webfile

- Boat and Motor Boat Sales and Use

- Cement Production

- Compressed Natural Gas/Liquefied Natural Gas Dealer

- CNG/LNG Interstate Trucker

- Direct Pay Sales and Use

- International Fuel Tax Agreement

- Loan Administration Fee

- Manufactured Housing Sales and Use

- Maquiladora Export

- Mixed Beverage Sales and Gross Receipts

- Motor Vehicle Sales and Use

- Motor Vehicle Seller-Financed

- Oil and Gas Well Servicing

Taxpayers who paid $500,000 or more for a specific tax in the preceding state fiscal year are required to pay using TEXNET.

Paying by credit card will incur a non-refundable processing fee:

| Amount Paid |

|---|

| 2.25% of the amount plus a $0.25 processing fee |

Payment Deadlines

- TEXNET ACH Debit payment of $1,000,000 or less, must be scheduled by 10:00 a.m. on the due date. Payments above $1,000,000 must be initiated in the TEXNET system by 8:00 p.m. the business day before the due date.

- and loss of timely filing and/or prepayment discounts.

- If you are required to pay electronically, there is an additional 5% penalty for failure to do so.

Richmond Hill Georgia Sales Tax Rate

richmond hill Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Richmond Hill, Georgia?

The minimum combined 2022 sales tax rate for Richmond Hill, Georgia is . This is the total of state, county and city sales tax rates. The Georgia sales tax rate is currently %. The County sales tax rate is %. The Richmond Hill sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Georgia?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Georgia, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Richmond Hill?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Richmond Hill. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Recommended Reading: Where’s My Tax Refund Pa

Irs Free File Online Options

Do your taxes online for free with an IRS Free File provider.

If your adjusted gross income was $73,000 or less, review each providerâs offer to make sure you qualify. Some offers include a free state tax return.

Use the IRS Free File Lookup Tool to narrow your list of providers or the Browse All Offers page to see a full list of providers. After selecting one of the IRS Free File offers, you will leave the IRS.gov website.

Irs Keeping Free File Open Through Thursday

WASHINGTON The Internal Revenue Service said Tuesday it was keeping its Free File service open until Thursday for those needing to file their 2021 tax returns.

The IRS said in a press release it sent letters to more than 9 million who may qualify for tax benefits but had not yet claimed them by filing their tax return.

According to the IRS release, many in the group may be eligible to claim some or all of the 2021 Recovery Rebate Credit, the Child Tax Credit, the Earned Income Tax Credit and other tax credits.

And the IRS said you could get these expanded tax benefits, even if they have little or no income from a job, business or other source. This means if you dont normally need to file a tax return, you should do so this year even if you havent been required to file in recent years.

The IRS said it will not issue a penalty for a refund claimed on a tax return filed after the regular April 2022 tax deadline. The fastest and easiest way to get a refund is to file an accurate return electronically and choose direct deposit.

IRS Free File lets people whose incomes are $73,000 or less to file a return online for free using brand-name software.

IRS Free File provides two ways for taxpayers to prepare and file their 2021 federal income tax return online for free:

Always start at IRS.gov:

Don’t Miss: Ny State Tax Payment Online