When Do I Get My W

Normally, every employer submits the W-2 form for their employees by the end of January. However, you should expect to get the form from your employer before that the end of January is the deadline. Also, its possible youll get it a couple of days after January if the employer used the last day of the deadline to mail the form.

Of course, that’s only the case if your employer actually mails these kinds of documents through physical mail. On the other hand, your employer might make them available to you electronically or perhaps they use both methods. That’s why it’s always smart to keep your employer up to date with any changes to your email and physical addresses that prevents important stuff from getting lost in the mail.

Generally, if mid-February arrives and you still dont have your W-2, its probably best to contact your employer and see if theres anything wrong. In most cases, this is enough to resolve your issue.

What Happens If Your Employer Does Not Pay Payroll Taxes

When employees are paid cash, employers often do not pay the appropriate payroll taxes. This is called payroll tax fraud. Employers may try to justify this fraud by claiming that:

- You will receive more money in cash.

- Every small business, or everyone in this industry, is doing the same.

- You will not be hurt in any way.

However, your employers tax fraud does harm you, by creating the following difficulties:

- You cannot document your income because you do not receive W-2s and paycheck stubs. Without proper documentation of your income, it also may be difficult to file an accurate income tax return, which may prompt an audit by the government.

- You may owe the government unreported taxes that will have to be paid all at once,

- You may be ineligible to receive unemployment, disability, Social Security, or Medicare benefits when you need them.

Also Check: How To Correct State Tax Return

How Do I File My Taxes Without A W

FilewithoutaW2: If you do not expect to receive aW2 from your previous employer â if, for instance, they are no longer in business â you can submit Form 4852, Substitute for Form W2, Wage and Tax Statement, with your tax return in place of aW2.

HowdoIfilemytaxeswithouta W2 orPaystub? Use Form 4852 and your last paystub to file income taxes Download Form 4852 from the IRS website and complete it using a copy of your last paystub. Once complete, attach Form 4852 to your 1040 or other tax form and send it to the IRS.

Download Form 4852 from the IRS website and complete it using a copy of your last paystub. Once complete, attach Form 4852 to your 1040 or other tax form and send it to the IRS.7. File your income taxes on time Even if you have not yet received aW2, you should still file your tax return on or before April 15, 2021.

Although, technically, you should do everything you can to get a copy of your W2 before you complete your tax return, it is possible to file your taxeswithouta W2. Some employers make W2s available electronically and some tax preparation software companies allow you to automatically import your W2 without having the specific form.

Read Also: Penalty For Filing Taxes Late If I Owe Nothing

How To File Taxes Without W2 Or 1099

You can enter it as Cash under self employment income.

You can enter Self Employment Income into Online Deluxe or Premier but if you have any expenses you will have to upgrade to the Self Employed version.

Or There is also The Turbo Tax Free File program which is free for federal and state. And has more forms than the Federal Free Edition, like Schedules A, B, C , D, E, F, EIC, H, K-1, SE, etc.

To qualify for the Free File website you just need to meet one of these 3 things.

AGI $36,000 or less.

Active duty military with AGI of $69,000 or less

OR qualify for EIC

In order to use the Free File program, you have to start it at a special website. Try signing in at the top right.

Is It Legal To File Without W

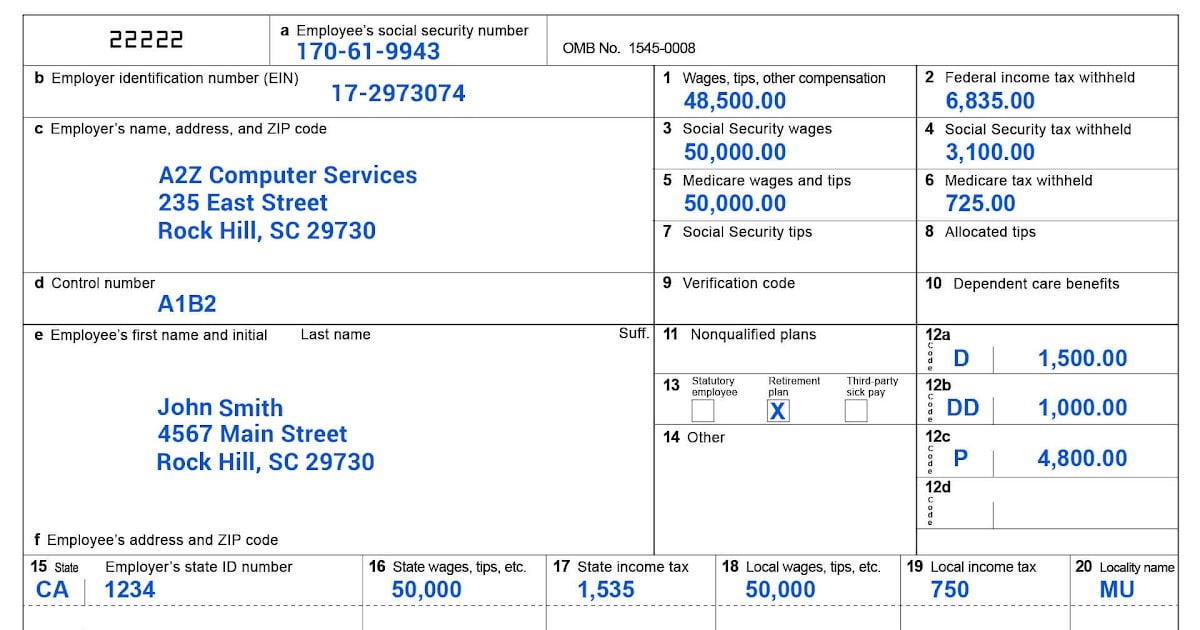

Technically, you could still file your taxes legally without the W-2 form as long as you’re filing electronically. However, if you’re going to do so correctly, there’s a bunch of information from your W-2 you’ll need nonetheless, such as:

- Any separate local income taxes withheld

- Medicare tax withheld

- Your complete wages, including other compensation like tips

- Social security tax withheld

- Social security tips and wages

- Identification number of your employer

- Federal income tax withheld from your income

- State income tax withheld

- Name and address of your employer

So, if youre filing your taxes electronically, you wont need an actual copy of your W-2 form. However, its where youd find all of the information weve listed above. And even if you have that info, we advise you to keep your W-2 somewhere secure you never know if youre going to have to produce it for the authorities in the future due to an audit or a background check.

Bear in mind that your employer is supposed to file your W-2 with the SSA by the end of every January, and then the SSA is supposed to share this with the Internal Revenue Service . Therefore, if the data you enter differs from the numbers that your employer reported, it’s perfectly possible you might get audited.

Still, these are just contingencies in case you really can’t find your W-2. The safest way to ensure you’re filing consistent and accurate info is to directly take the numbers off your W-2 sheet.

Recommended Reading: Are Funeral Expenses Tax Deductable

How To Report Foreign Income Without A W

As an American living overseas, filing your U.S. taxes can seem like a complicated, overwhelming taskand reporting foreign income without a W-2 only adds to the complexity.

If youre one of the thousands of U.S. expats wondering how taxes work when you dont receive a W-2, were here to brighten your day. The good news is that yes, you can still file your U.S. taxes without a W-2. The bad news is that, depending on the country you live in and whether youre claiming any exclusions of credits, it may take some detective work and a lot of math. The silver lining? H& R Block is here to help.

Filing without a W-2 may mean more work, but youre in good hands. Whether you file expat taxes by yourself or file with an advisor, H& R Block is here to help. Ready to file? Head on over to our Ways to File page to check out your options.

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

You May Like: Sales Tax And Use Texas

Take A Look At Other Deductions

There are many people who may have pretax deductions which lower the amount of taxes they have to pay.

Some of these include employer benefits and health insurance.

Life insurance, transportation packages, and others.

Subtract this amount from the number youve had in the previous step.

This is then the foundation of your W2 which is your total taxable income for the year.

Change Your Address If You Moved

If your address has changed since you stopped working for your former employer, make sure you filled out a change-of-address form at your local United States Post Office. After submitting this form, you must typically wait seven to 10 days before the USPS processes your request and mail arrives at your new address. If you forgot to fill this form out when moving, mail sent to your previous address will not get forwarded to your new home, and the Postal Service might have returned your W-2 to your former employer.

Read Also: Michigan Gov Collectionseservice

You May Like: Can I Still File My 2017 Taxes Electronically In 2021

Can Turbotax Find My W2

TurboTax does not have your W-2. They would only have a local form for data that you either entered from your W-2 or downloaded from your employer. You would need to get a copy from your employer. You can get a wage and income transcript from the IRS which shows data from Forms W-2 and other information returns.

Who Receives A W

The IRS requires that all employees who were paid at least $600 the previous year receive a W-2 form. And if you had more than one job in a year, you will likely receive multiple W-2 forms.

Its important to note that contractors dont receive this tax form. If you worked as an independent contractor, then any business that paid you at least $600 will send you Form-1099. Whereas income on a W-2 form reports any federal income tax withheld, income recorded on a 1099 form usually does not include this information. However, there are situations where a company may have to withhold taxes from 1099 contractors, such as when they dont provide a tax identification number .

Don’t Miss: When Are Tax Payments Due 2022

Havent Received Your W

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Youre ready to file your taxes except for one thing: Youre still awaiting an IRS Form W-2 from an employer.

Each January, companies issue W-2s to inform workers, and Uncle Sam, of the amount of money the worker made during the previous year and how much in income, Social Security and Medicare tax was withheld. If you file without all of your W-2s, it could delay processing of your return and the arrival of any refund.

Federal law requires employers to send W-2s to workers by Jan. 31 each year, or a few days later if the end of the month falls on a weekend. If you’re still waiting on your earnings statement, here are six steps you can take.

How Do I File Form 4852

Even though you can find the form online, you cant submit it to the IRS electronically so youll have to print out the form, fill it out, and mail it to the IRS along with everything else. And to fill it out, youll need to have:

- A detailed explanation of how you attempted to obtain the proper W-2 form from your employer

- Your employers address and name

- A statement that explains how you came up with the data you entered

- The estimated wages and withheld taxes that you would otherwise have listed on the W-2

Remember this: the information you enter on form 4852 is supposed to be a good faith estimate. However, if you obtain information that suggests this data wasnt correct later, youre still supposed to file your amended tax return with the newly acquired information.

Recommended Reading: When Is Tax Returns Due

How To Get Your W

A W-2 form is an important document to have when filing your annual taxes. At the beginning of each year, companies send all their employees W-2s that include information about the previous years earnings and taxes. If you have changed jobs in the past year, you must still get a W-2 from your former employer to file your taxes properly. In this article, we describe how to get your W-2 from a previous employer and tips if you have not received it yet.

Is Filing Taxes Without Your W

Technically, it is possible to legally file taxes without your W-2 if you file electronically, but in order to do your taxes correctly you will need the information contained in your W-2. This includes the following:

- Your employers identification number

- Your employers name and address

- Your total wages, including tips and any other compensation

- Amount of federal income tax withheld

- Your social security wages and tips

- Social security tax withheld

- State income tax withheld

- Any local income taxes withheld

When you file electronically, you are not required to submit a copy of your W-2 itself, but will only need to enter the information from it. However, it is recommended to keep your W-2 in a safe place in case you need to produce it in the future, such as in the event of an audit, or for other purposes such as background checks.

Keep in mind that your employer should have filed a W-2 form with the Social Security Administration by the end of January and the SSA will have shared this information with the Internal Revenue Service . So if the numbers you enter differ from what your employer reported, you could end up with an audit on your hands.

In the event of an audit, you will need to produce documents, to prove your income and withholding. In such an event, you could end up with legal difficulties if you cant show that the numbers you entered were in good faith.

Also Check: Morgan Stanley Tax Documents 2021

Reporting Foreign Income Without A W

If the above makes your stomach churn, you can relax with H& R Block, you can easily file your U.S. taxes and report foreign income without a W-2. With multiple ways to file, you can be as hands-off or hands-on as you like in the drivers seat with our DIY expat tax service or let one of our tax advisors guide you each step of the way.

Dont know what tax forms you need to file? No problem! After we collect some basic information, well give you a checklist. Heres how to file your U.S. expat taxes online:

Ready to get started on your U.S. taxes? No matter where in the world you are, weve got a tax solution for you. Get started with our made-for-expats online expat tax services today!

Can I File My Taxes Without My W2

ikkie_2005_rox

Hello- You might beable to file your return using information from your last pay stub orpaycheck of the year but that doesnt mean you should.

We knowthat you count on getting your refund as quickly as possible.However, many tax experts advise against filing without your W-2.

Why? Becausein your hurry, you could cause your refund to be delayed for weeks.

Important: Filing your return using only your last paystub or paycheck could create headaches for you later:

- The IRS or your state might send you notices, if whats on your pay stub doesnt match whats on your W-2. The W-2 contains specific data that isnt always on your paycheck.

- If the numbers you enter on your return dont match your W-2, the IRS could hold up your refund for weeks until the differences are resolved.

- You might have to amend your return, If you do file with your pay stub only and some figures differ from your W-2. That can be time-consuming.

As soonas you receive your W-2 ,you can use our TurboTaxImport feature.

Hope this helps and thank you for using TurboTax!

If youremployer participates, import your data automatically tosave time and ensure your return is accurate.

You May Like: Corporate Tax Rate In India

How To File Your Income Tax Return Without Your W

Your employer is responsible for providing a vital piece to your tax-return puzzle by issuing you Form W-2, Wage and Tax Statement. Without this form, you wont have the information you need to file your tax return, and your anticipated refund may seem unreachable. Remember that if you dont file your return because your W-2 is missing, you will likely be facing a stiff penalty. This seemingly complex dilemma is easily resolved by filing a substitute form as a replacement W-2.

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

Read Also: How To File Free Taxes