How To Get A Copy Of Your Tax Return

If you do need a copy of your tax return, you have a few options.

- You can ask your tax preparer to send it to you.

- If you used an online tax preparation and filing service to e-file your return, you may also be able to access a copy of your tax return directly through the program for the years you filed through the software. For example, if you e-filed with Credit Karma Tax® in prior years, you can get your prior-year returns for free after accessing this years free tax product. Other online filing services may also allow you to access past returns you filed with them. But be aware they may limit the number of years you can access or charge a fee to allow you to access and download past years returns.

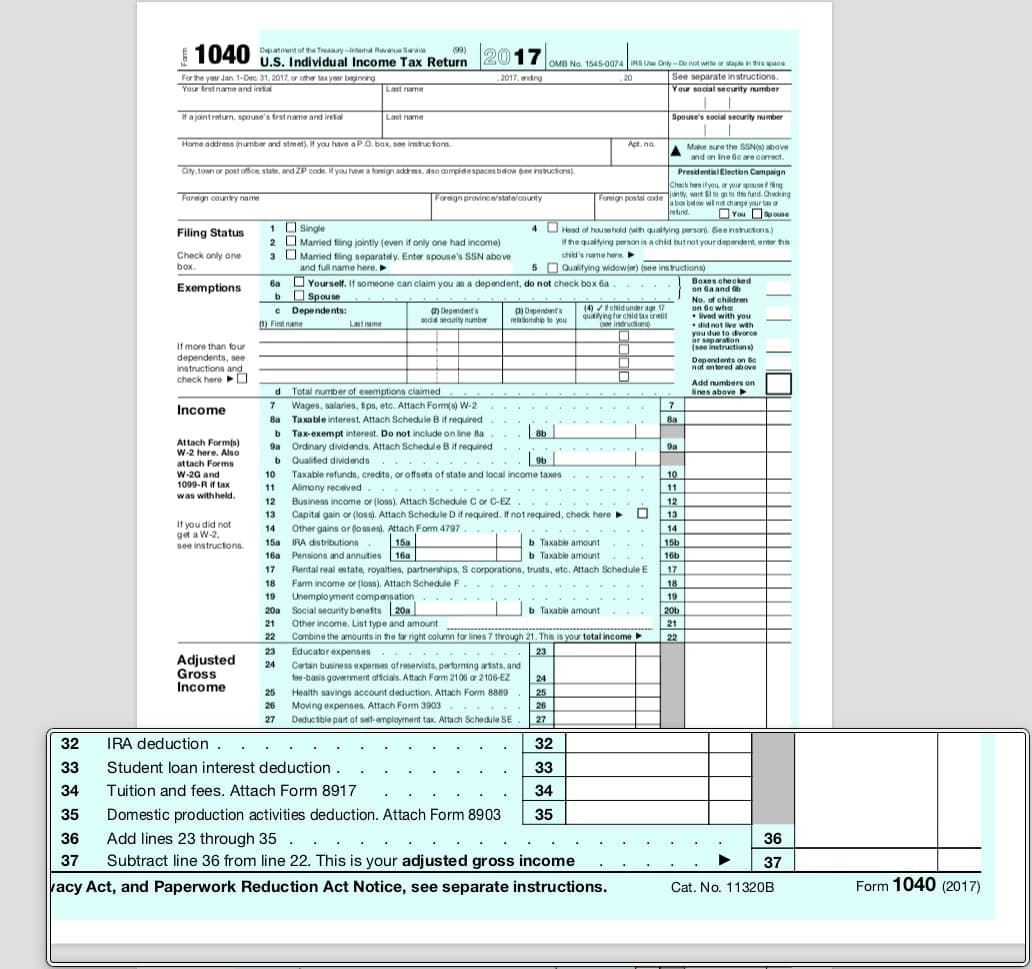

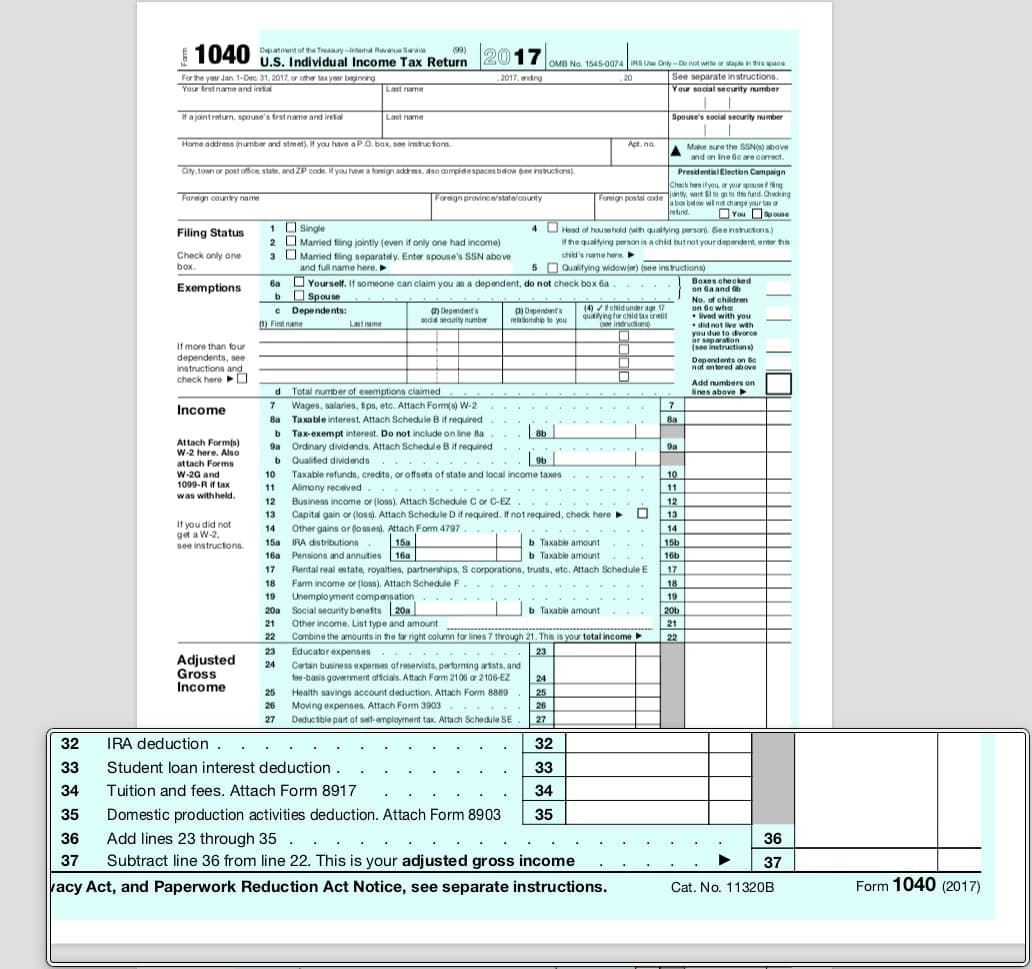

- Finally, you can always request a copy directly from the IRS. You cant request a past years return over the phone or online, so youll need to fill out Form 4506 and mail it in. Itll also cost you $50 per copy, per tax year for which youre requesting a return copy, and it could take 75 days for the IRS to process your request.

Dont Miss: How To File Federal Taxes For Free

Q1 How Do I Get A Transcript Online

Upon successful registration, we give you the option to “continue” and use Get Transcript Online. We’ll ask you the reason you need a transcript to help you determine which type may be best for you. Get Transcript Online provides access to all transcript types and available years for you to view, print, or download from your browser.

You may log in with your username and password any time after you’ve registered by clicking on the Get Transcript Online button.

Consider Irs Transcript Vs Return

If you cant access your H& R Block tax records for some reason, you can fill out IRS Form 4506, Request for Copy of Tax Return, and pay a fee to have the IRS send you a photocopy of your federal tax return. This method will let you get a past return as far back as six years ago. The downside is that you may have wait as long as 75 days to have the IRS mail you the documents, and this can be a problem if you need them quickly for an application youre filling out.

If you only need to know specific information from your last tax return and dont need the actual document, then requesting an IRS tax transcript can be a free and quick alternative. The IRS makes transcripts available for the last three tax years, and you can get yours as soon as five to 10 days from when you order.

You have a few transcript options that may work for you. If you need your adjusted gross income, taxable income and other basic items from your tax return, you can request a tax account transcript. You can also request a tax return transcript that has much of the information from your tax return and related forms but doesnt account for any changes made after the original filing date. Credit Karma notes that banks and other organizations will often accept tax transcripts as part of their verification process, so check to find out which they prefer.

You May Like: How Can I Make Payments For My Taxes

Also Check: Federal Tax Return By Mail

Filing Back Tax Returns

You may be able to fill out past-due tax returns through online software or with an accountant, but youll need to print the forms and mail them to the IRS.

Mail your back tax returns to the IRS in separate envelopes and send them by certified mail so that you have proof that the IRS received each individual tax return. Mailing them in separate envelopes will also help prevent the IRS from making any clerical errors in processing them. It takes about six weeks for the IRS to process accurately completed back tax returns.

Remember, you can file back taxes with the IRS at any time, but if you want to claim a refund for one of those years, you should file within three years. If you want to stay in good standing with the IRS, you should file back taxes within six years.

You May Like: Is Plasma Donation Money Taxable

How Can I Get My Agi From Last Year

If you do not have a copy of your tax return, you can get your AGI from one of the IRS self-service tools:

Also Check: When Is Tax Returns Due

Tax Refund Delay: The Latest On The Irs Backlog And How To Track Your Money

How long will it take the tax agency to get through its massive backlog? Heres what we know.

If you see IRS TREAS 310 on your bank statement, it could be your income tax refund.

At the beginning of the month, the IRS announced it had 8.5 million unprocessed individual returns, including 2020 returns with errors and amended returns that require corrections or special handling. And refunds that usually take around 21 days to process are taking at least 120 days. Refund checks were expected to come this summer, but its nearly fall and the IRS hasnt given an update to let taxpayers know when the money is coming.

To add to that, the IRS has also been busy with stimulus checks, child tax credit payments and refunds for tax overpayment on unemployment benefits. The plus-up stimulus adjustments and the third advance monthly check of the child tax credit payment that went out today could give families some financial relief, but an overdue tax refund would be an even bigger help.

In most cases, taxpayers can only continue to practice patience the tax agency isnt easy to reach. The best solution is to track your refund online using the Wheres My Refund tool or check your IRS account. Well show you how. We can also tell you what to do if you received a math-error notice from the IRS. This story is updated frequently.

If You Preparedyour Taxes Online

Youll have to use your TurboTax login if you used the online version of the product. Make sure you sign in to the same account you used to prepare your return. From there, its a simple matter of clicking on the Documents tab, then on the tax year you want, then finally on Download PDF.

TurboTax suggests using the Account Recovery tool if you cant find the return youre looking for. Its possible that youre not signed in under the same account you used to prepare it.

Also Check: How Long Does Your Tax Return Take

Security Changes For 2018

The IRS is trying to reassure taxpayers that theyre taking steps to secure their information and that its safe to e-file. They notify you if they receive duplicate filings under your Social Security number. Theyve also published Form 14039 for you to use if your e-filing is rejected because someone already filed a return with your Social Security number on it. A fillable version of this form is available on their website. After youve filled it out, you have to print it and attach it to your paper return. When the IRS receives the paper return, theyll do an investigation to identify which return is fraudulent and they will process the legitimate one. Yes, this takes a long time.

Irs Transcripts Are Free

Your other option is to order a tax transcript from the IRS rather than an actual copy of your return. The IRS makes two types of transcripts available: a tax return transcript and a tax account transcript, and both are free. A transcript is more or less a summary of the information included in your return and your payment and refund histories.

Mail in Form 4506T-EZ if you want a tax return transcript, or Form 4506T if you want a tax account transcript. You can also request a transcript online from the Get Transcript Online page of the IRS website, or even call the agency, although the IRS isnt taking phone calls in spring 2020 due to the coronavirus pandemic.

It will take from five to 30 days to get the transcript, depending on whether you make the request online or via USPS mail, and theyre only available for four years the current year and the previous three.

Don’t Miss: How Much Do You Have To Make To Claim Taxes

How To Filean Amended Tax Return With The Irs

turbotax.intuit.comtaxreturn

Beginning with the 2019 tax year, you can e-file amended tax returns. If you used TurboTax to prepare Form 1040-X, follow the softwares instructions to e-file the

www.PastYearTax.com/_Tax2019Ad

Do Your 2019, 2018, 2017, 2016 Taxes in Mins, Past Tax Free to Try! Easy Fast & Secure

Tax Situations Requiring A Specific Return Or Form

There are exceptions, such as if you had residential ties in another place, where you would need a specific tax return.

Use the income tax package for the province or territory with your most important residential ties.

For example, if you usually live in Ontario, but were going to school in Quebec, use the income tax package for Ontario.

Factual resident

This may also apply to your spouse or common-law partner, dependant children, and other family members.

do not

You may be considered a deemed resident of Canada if you:

- do not have significant residential ties with Canada

- are not considered a resident of another country under a tax treaty between Canada and that country

Use the tax package for non-residents and deemed residents of Canada.

If you are not a factual resident of Canada, or a deemed resident of Canada, you may be considered a non-resident of Canada for tax purposes. Use the tax package for non-residents and deemed residents of Canada.

If you earned employment income or business income with a permanent establishment in a certain province or territory, complete the following instead:

Also Check: Small Business Income Tax Calculator

Tax Refund Frequently Asked Questions

Direct Deposit is a safe, reliable, and convenient way to receive Federal payments. The Department of the Treasury’s Bureau of the Fiscal Service and the Internal Revenue Service both encourage direct deposit of IRS tax refunds. Direct Deposit combined with IRS e-file provides taxpayers with the fastest and safest way to receive refunds.

This resource page of frequently asked questions about IRS tax refunds provides financial institutions with useful information for reference while assisting customers during the tax filing season.

For other FAQs about Direct Deposit, .

How Can I Get A Copy Of My Income Tax Return Online

It is summed up in the following steps.

Recommended Reading: How Long To Get Tax Refund 2022

Can I Deduct $300 Of Charitable Contributions In 2021 Without Itemizing Like Last Year

Yes. If you are single, you can deduct up to $300 of cash contributions to qualified charities and still take the standard deduction. If you are married and filing a joint return for 2021, you can claim the standard deduction and also deduct up to $600 of cash contributions to qualified charities. Remember that gifts to some charitable organizationsfor example, those to private, non-operating foundations and donor-advised fundsare deductible only as itemized deductions. In addition, if you made substantial cash contributions in 2021, you may claim itemized deductions for cash contributions in an amount equal to 100% of your adjusted gross income.

How Do I Know If The Amount Listed On My 1099

If you have access to your HIRE account, you may want to look at your Claim Summary page to see the benefits you have been paid out throughout the weeks you have filed. Both your weekly benefit amount and your additional Loss Wage Assistance, , and Federal Pandemic Unemployment Compensation, , are counted as benefits paid to you.

However, this option may not be helpful if you have received benefits under several unemployment programs in 2020. This is because Claimants often have their claim summary page refreshed, for example, when filing a new claim for an extension of benefits or consideration of another benefit program.

Also Check: Irs Track My Tax Return

When Are State Tax Returns Due

Of the 41 states that collect income tax, most are adhering to the April 18 deadline, though there are some exceptions.The deadline to file 2021 state income taxes in Delaware and Iowa, for example, is April 30, 2022. In Virginia, the due date is May 1 and in Louisiana, its May 15.Check with your state department of revenue for the most current information and deadlines.

Your state may have a different tax deadline than the IRS does.

Dont Miss: Does Doordash Give You A 1099

I Still Haven’t Got My Tax Return From Last Year

Did you e-file your tax return and was it accepted?Only the IRS and your State control when and if a Federal or State tax refund is Approved and Issued.

You complete your tax return by finishing all 3 Steps in the File section. In Step 3, to e-file your tax return, you must click on the large Orange button labeled “Transmit my returns now“.

After completing the File section and e-filing your tax return you will receive two emails from TurboTax. The first email when your tax return was transmitted and the second email when the tax return has either been accepted or rejected.

Note – Once a tax return has been Accepted by the IRS or a State, TurboTax receives no further information concerning the tax return or the status of any tax refund. Only the taxpayer listed on the tax return can obtain the status of a tax refund or a tax return.

To check the status of an e-filed return, open up your desktop product or log into your TurboTax Online Account. You can find your status within the TurboTax product.If accepted by the IRS use the federal tax refund website to check the refund status – If accepted by the state use this TurboTax support FAQ to check the state tax refund status –

Don’t Miss: Can I Use Bank Statements As Receipts For Taxes

Why Do I See Irs Treas 310 In My Bank Statement

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed in the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of electronic payment. You may also see TAX REF in the description field for a refund.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Q2 Can I Request A Transcript If I Filed Jointly With My Spouse And My Name And Ssn Was Listed Second On Our Tax Return

Yes, a secondary taxpayer may request any transcript type that is available.

Please note, only the account and the tax return transcript types are available using Get Transcript by Mail. Use Form 4506-T, Request for Transcript of Tax Return, if you need a different transcript type and can’t use Get Transcript Online.

Recommended Reading: When Is The Last Day To Turn In Taxes

What’s On A Tax Transcript

A transcript displays your tax information specific to the type of tax transcript you request.

The IRS is responsible for protecting and securing taxpayer information. Because of data thefts outside the tax system, cybercriminals often attempt to impersonate taxpayers and tax professionals. Thieves attempt to gain access to transcript data which can help them file fraudulent tax returns or steal additional data of other individuals and businesses listed on transcripts.

The IRS better protects your information from identity theft by partially masking the personally identifiable information of everyone listed on transcripts. All financial entries remain fully visible to assist with tax preparation, tax representation and income verification. Anyone with a need to know will be able to identify the taxpayer associated with the transcript based on the data that still displays.

Some Taxpayers Will Receive The Rebate By Direct Deposit And Some Will Receive A Paper Check

If you received a refund by direct deposit this year, youll likely receive your rebate by direct deposit in the same bank account, with the description VA DEPT TAXATION VATXREBATE. All other eligible taxpayers will receive their rebate by paper check in the mail.

- If you’ve moved in the last year and have a current forwarding order with the USPS, then your check will be forwarded to your new address.

- Were not able to update your bank account information. If the bank account where you received your Virginia refund by direct deposit is closed, call us at , and we can mark it as an invalid account. Youll receive your rebate by paper check in the mail.

Read Also: California Used Car Sales Tax

I Received A Validation Key Letter Will That Delay My Refund

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification web page for more information.