Understand How Education Savings Plans Work

Parents and students can save for school using education savings plans. These plans can help pay for elementary, secondary, and higher education expenses. The money you save or withdraw from your savings plan for qualified education expenses is tax-free. There are two types of savings plans:

- 529 plans are qualified tuition programs sponsored by states and colleges. Theyre authorized under Section 529 of the Internal Revenue Code. With these plans, you can:

- Prepay or contribute funds to an account to help cover qualified higher education expenses

- Transfer or rollover funds from the 529 plan to an Achieving a Better Life Experience account. These funds can benefit the savings account holder or a family member. Learn how an ABLE account can help a person with a disability pay for education, housing, health, and other qualified expenses.

- Pay off up to $10,000 in student loan debts.

- Pay for fees, books, supplies, and equipment required under qualified apprenticeship programs.

Take Advantage Of Your Registered Retirement Savings Plan

Maximizing your RRSP contributions for the year is one sure way to reduce your taxes regardless of whether you work for an employer or are self-employed. Your RRSP contributions qualify for tax deductions. RRSP tax deductions reduce your tax payable in the year that you claim them, and allow you to pay lower taxes.

Your contributions in your RRSP grow tax-free until when you withdraw your money in retirement. The great part about this is that your income tax rate in retirement is expected to be lower. Why is that good? That means that your income tax bill should be lower too.

Want To Lower Your Tax Bill Then Dont Miss These Frequently Overlooked Tax Breaks

You need to claim all the tax breaks youre entitled to if you really want to cut your tax bill to the bone. Unfortunately, though, people often overlook great tax-saving opportunities because they simply dont know about them. The tax laws are changing all the time, which makes it even harder to keep up on the latest tax deductions, credits and exemptions. And youre completely out of luck if you dont discover the write-offs you qualify for before the applicable amended return deadline has passed.

Dont let that happen to you! Check out our list of 20 frequently missed tax breaks. You may uncover a hidden gem that turns your 2021 tax return into a money-saving masterpiece.

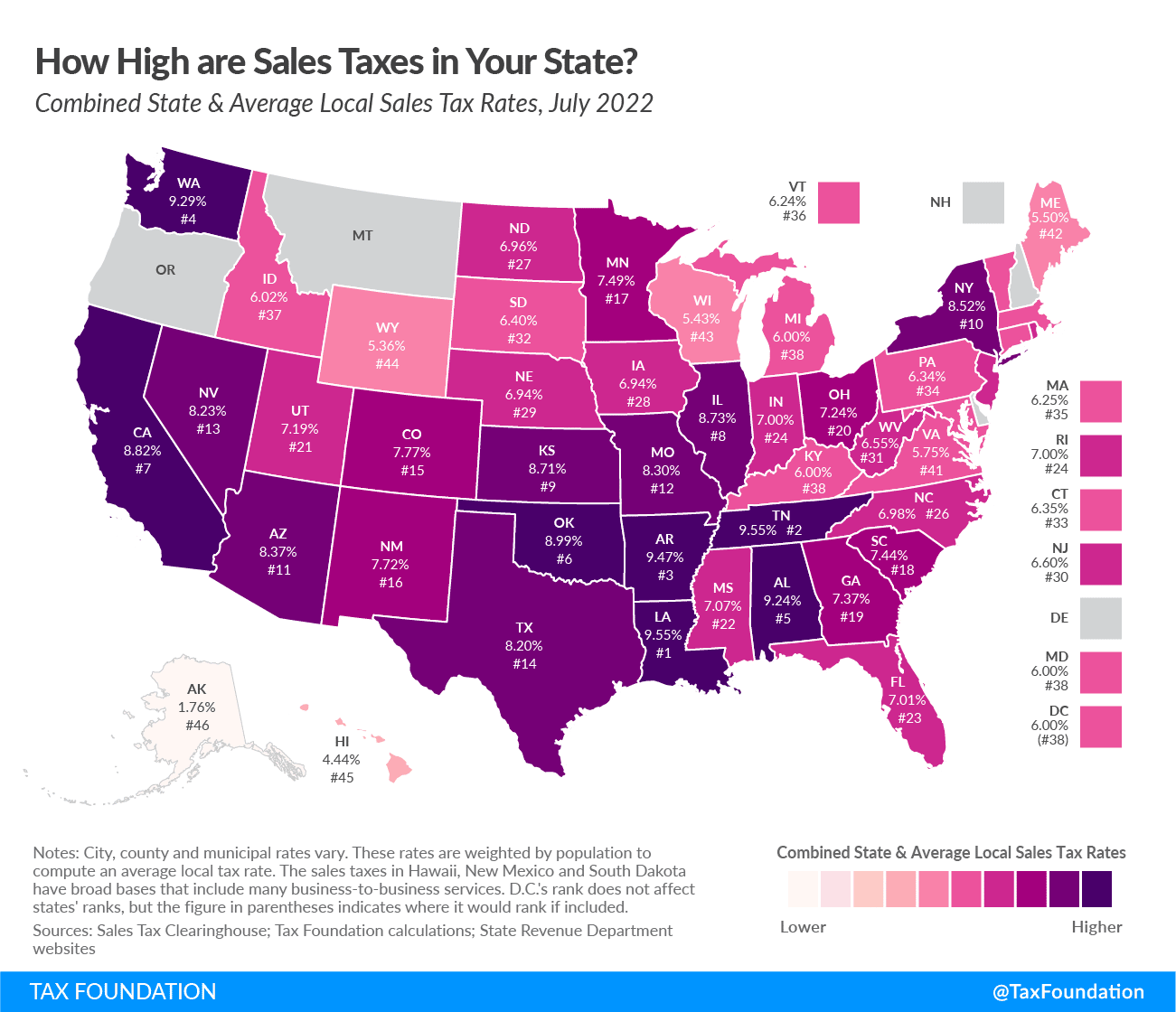

Don’t Miss: Income Tax By State Ranked

Refigure Your Paycheck Withholding

If youre simply having too little withheld from your paycheck, you can create a new Form W-4 by going through the Form W-4 section under the Next Year main tab in TaxAct.

If you have simple changes to your return, such as fewer dependents, you can enter the changes in this section and TaxAct will determine how you should file.

Take the new Form W-4 to your employers payroll department. Do not send it to the IRS.

How Not To Owe Your Federal Tax Return

This is a calm thought: you have nothing owed on your federal tax return. If you deal with withholding tax strategically, you can achieve this goal. The W-4 form you fill out for your employer when you start your new job determines how much income tax will be withheld from your salary, and how much tax you will ultimately owe or refund at the end of that year.

What you may not know is: this is not a one-off. You can submit a revised W-4 form to your employer at any time. Managing the amount withheld by your employer through your W-4 form will give you a better chance of tax exemption in April. Of course, you should also avoid too much concealment. That would be an interest-free loan to Uncle Sam for a whole year.

This is a way to get your tax bill close to zero before the time comes.

Recommended Reading: File Income Tax Return India

Setup A College Savings Fund For Your Kids

Originally created to help families save for college tuition, 529 plans were expanded by the Tax Cuts and Jobs Act of 2017 to cover savings for K-12 public, private, and religious school tuition. You can use up to $10,000 of 529 plan funds per year, per student, to pay qualified educational expenses.

- The contributions you make to a 529 plan are not tax-deductible at the federal level, but part or all of them may be tax-deductible at the state level .

- The earnings from a 529 account are not subject to federal tax, and the distributions are not taxed as long as they are used to pay for qualified educational expenses for the student named as the beneficiary of the plan.

- Another option under the 529 program is use a pre-paid college tuition plan for a qualified in-state public institution. This allows you to lock in current tuition rates no matter how old your child is.

Use Online Tax Software

These days, you can DIY your tax return and save a bundle on tax filing fees. Online tax software, like TurboTax, makes it easy: you can instantly import tax information from the Canada Revenue Agency with Auto-Fill my return. The software includes a complete list of tax deductions to make it easy for customers to find the deductions that apply to them.

Once your information is entered, a review section offers suggestions on credits and deductions that may apply to your situation, as well as ones that definitely apply. The software then asks simple questions to determine if you qualify and applies credits and deductions automatically based on your responses.

The bottom line? TurboTax offers a cheap and easy way to file your taxes and get the most out of your tax return. Whether youve got a straightforward tax return or a complicated one involving business income and expenses, TurboTax has software suited to your needs at an affordable price. In particular, TurboTax Self-Employed is the only software in Canada designed specifically for people with self-employed income and provides expert guidance specific to these individuals.

Read Also: Department Of Tax Debt And Financial Settlement Services

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Will I Owe Income Taxes Because Of Cerb

For the 2021 income tax year, many Canadians may find themselves owing personal income taxes due to the Canadian Emergency Response Benefit and other government income support benefits.

If you received the CERB, you may or may not have been aware that the benefit was taxable income and that the Canada Revenue Agency and Service Canada did not deduct income tax when they paid you the money. Since the government did not tax these benefits at source, you have not yet contributed to your 2021 income taxes for that source of income and must pay what is owed.

You May Like: I Only Got Half Of My Tax Refund 2021

Cats Can Be Worth Big Money

The cost of caring for the cats began to mount for Van Dusen, so when she filed her 2004 tax return, she tried to write off $12,068 for cat-rescue items like food, vet bills, paper towels and more. After the IRS informed her that those expenses counted as personal ones and she couldnt deduct them, she sued the IRS. Following a long battle, Van Dusen proved her cat care was charity, resulting in the IRS finally granting deductions for most of her claims.

Delaware Resident Working Out Of State

Q. Im considering taking a job in Maryland. I know the states do not have a reciprocal agreement. How does the credit work for taxes paid to another state? Will I owe County taxes in MD?

A. If you are a resident of Delaware who works in Maryland, you may take credit on line 10 of the Delaware return for taxes imposed by other states. You must attach a signed copy of your Maryland return in order to take this credit.

Even though you may not be liable for Maryland County Taxes, Maryland imposes a Special Non-resident tax on their non-resident income tax return.

Recommended Reading: How Is Property Tax Paid

If Not Enough Is Being Withheld

The W-4 form has a place to indicate the amount of additional tax that you would like to have withheld each pay period.

If youve underpaid so far, subtract the amount that youre on track to pay by the end of the year, at your current level of withholding, from the amount that you will owe in total. Then divide the result by the number of pay periods that remain in the year.

That will tell you how much extra you want to have withheld from each paycheck.

You could also decrease the number of withholding allowances that you claim, but the results wont be as accurate.

Also Check: Appeal Taxes Cook County

Tax Withholding From Other Income

If you have non-wage income, you may be able to have income tax withheld from it voluntarily.

For example, you can have 10% of your unemployment benefits withheld for taxes. That may hurt a little now, but its a whole lot less painful than a big tax bill next spring.

To have income tax withheld on government payments, including social security benefits or unemployment benefits, complete Form W-4V from the IRS website and send it to the payer.

Do not send it to the IRS. You can have 7%, 10%, 15%, or 25% withheld from most government payments.

You can only have 10% withheld from unemployment payments.

If you receive pension or annuity payments, adjust your income tax withholding on Form W-4P, available on the IRS website.

If you do not tell an annuity payer how to withhold income tax, the IRS generally requires them to withhold as if you are married and have three dependency exemptions.

Read Also: What Is Fica Ee Tax

Plan For Tax On Your Small Business

Self-employed individuals have special challenges paying enough income tax through the year.

Their income may be sporadic, and it can be difficult to know how much they will owe in taxes after business deductions.

And no one deducts tax from their pay. Naturally, its harder to find money for taxes than it is to have it deducted from a persons pay in the first place.

The only way self-employed taxpayers can be sure they are setting aside enough money for taxes is to maintain good records throughout the year.

Once a quarter, calculate your net income and estimate the amount you owe in taxes. Dont forget self-employment tax.

If you have trouble making your estimated tax payments, consider opening another bank account just for taxes.

Every time you deposit money into your business checking account, transfer the appropriate amount to the tax account.

Then, consider that money untouchable for anything but your federal taxes.

What Are Estimated Taxes

Estimated taxes are quarterly payments that cover your income tax, self-employment tax, and alternative minimum tax. Self-employed individuals, sole proprietors, partners, and S-corporation business owners pay these each quarter to prevent being charged a penalty by the IRS.

Non-self-employed individuals may also pay estimates if they’ve under-withheld or have significant other income.

Read Also: Capital Gains Tax On Primary Residence

Record All Business Deductions

The more you track tax deductions and the more organized you are, the better youâll be during tax season. Remember, you are responsible for paying “both sides” of the self-employment tax. When you know your expenses and accurately track them, you will understand what tax deductions you can get and can maximize them. Simply follow the Schedule C instructions to claim your tax deductions.

Note: Itâs critical to separate business expenses from personal ones, as you donât want to merge the two accidentally. If you want to do all of that automatically, try Bonsai’s freelancer 1099 expense tracking software. Our tax software can help you organize all of your expenses and save you money on your tax bill at the push of a button.

Paying Quarterly Estimated Taxes

You May Like: Boat Loan Calculator With Tax

How We Calculate The Penalty

We calculate the Failure to File Penalty based on how late you file your tax return and the amount of unpaid tax as of the original payment due date . Unpaid tax is the total tax required to be shown on your return minus amounts paid through withholding, estimated tax payments and allowed refundable credits.

We calculate the Failure to File Penalty in this way:

- The Failure to File Penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won’t exceed 25% of your unpaid taxes.

- If both a Failure to File and a Failure to Pay Penalty are applied in the same month, the Failure to File Penalty is reduced by the amount of the Failure to Pay Penalty for that month, for a combined penalty of 5% for each month or part of a month that your return was late.

- If after 5 months you still haven’t paid, the Failure to File Penalty will max out, but the Failure to Pay Penalty continues until the tax is paid, up to its maximum of 25% of the unpaid tax as of the due date.

- If your return was over 60 days late, the minimum Failure to File Penalty is $435 or 100% of the tax required to be shown on the return, whichever is less.

How Strong Is A Verbal Agreement In Court

Most business professionals are wary of entering into contracts orally because they can difficult to enforce in the face of the law.

If an oral contract is brought in front of a court of law, there is increased risk of one party lying about the initial terms of the agreement. This is problematic for the court, as there’s no unbiased way to conclude the case often, this will result in the case being disregarded. Moreover, it can be difficult to outline contract defects if it’s not in writing.

That being said, there are plenty of situations where enforceable contracts do not need to be written or spoken, they’re simply implied. For instance, when you buy milk from a store, you give something in exchange for something else and enter into an implied contract, in this case – money is exchanged for goods.

Recommended Reading: Sales Tax Rate For Chicago Il

Is It Possible To Pay Nothing In Taxes

A tax deduction works by lowering your taxable income, so you pay less in taxes. If you want to avoid paying taxes, youll need to make your tax deductions equal to or greater than your income. For example, using the case where the IRS interactive tax assistant calculated a standard tax deduction of $24,800 if you and your spouse earned $24,000 that tax year, you will pay nothing in taxes. Remember this refers to federal taxes you may be subject to local and state taxes.

If the deductions you qualify for arent enough to completely eliminate your tax bill, youll need to plan on making less money the following year. Dont think that moving outside of the U.S. will help you avoid paying taxes according to the IRS, if you are a U.S. citizen or a resident alien living outside the United States, your worldwide income is subject to U.S. income tax, regardless of where you live.

Its always best to consult with a tax professional who can help you reduce or eliminate your tax bill without getting in trouble for tax fraud.

Why Do I Owe

Let us help resolve your compliance or collections problem. Learn about reasons why we think you owe us taxes, how we discover the information, what types of notices we send, and what to do about it.

Below you will find links for the most common reasons you may have a Maryland Individual tax liability. You may have received a notice in the mail from us and want more information about it.

If you have not paid your taxes due in full, or have not filed a Maryland return that we believe you should have, you will receive an income tax notice from the Comptroller of Maryland. If you do not respond to the first notice, an assessment notice will be issued.

Once you receive an assessment notice you will be billed for the amount of the assessment in addition to a substantial penalty and interest charge on the tax owed.

Use the links below if youd like to learn more about the notice you received, how we determined that there was a problem, and what you need to do about it.

In all cases, if you have questions about the notice you received, or you cant find your notice defined here, call the phone number on the notice promptly. By calling the number on your notice, you can find out how to resolve the dispute or file an appeal and Dispute It! Failure to respond to the notice may cause us to assess additional penalty and interest charges and result in further collections efforts.

This notice is to advise that a Notice of Lien of Judgment has been satisfied.

Don’t Miss: Is It Better To File Taxes Jointly