Guide To 1099 Tax Forms For Doordash Dashers And Merchants

DoorDash partners with Stripe to file 1099 tax forms that summarize your earnings or sales activities. Weve put together some FAQs to help you learn more about 1099s, and how to use Stripe Express to review your tax information and download your tax forms.

If you have already created a Stripe Express account, you can log in to manage your tax information at connect.stripe.com/app/express.

What is a 1099 tax form?

A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. Its provided to you and the IRS, as well as some US states, if you earn $600 or more in 2022. If youre a Dasher, youll need this form to file your taxes.

A 1099-K form summarizes your sales activity as a Merchant. Its provided to you and the IRS, as well as some US states, if you have more than $600 in sales activity in 2022. If youre a Merchant, youll need this form to file your taxes.

What is Stripe Express, and how do I access it?

Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. If youre a Dasher and earned $600 or more in 2022 through DoorDash in the US, Stripe will send an email inviting you to create an account and log in to Stripe Express.

If youre a Merchant, Stripe will send an email inviting you to create an account and log in to Stripe Express if you meet the following criteria in 2022:

-

You have more than $600 in sales activity and

-

You are based in the US or are a US taxpayer

Is my tax information secure?

Requirements For A 1099

If you receive deposits from a partner platform like PayPal, you may receive a tax form 1099-K.

A Dasher would need to have conducted 200 transactions and have a gross volume of $20,000 to meet the 1099-K requirements.

Gross Volume, which in DoorDash’s case is the subtotal of payments and tax on processed orders.

However, there is one exception to this rule. If you made more than $600 in total earnings from deliveries in Vermont or Massachusetts, you will receive a 1099-K regardless.

Importance Of Mileage Tracking

Keeping track of your mileage used to mean tediously writing down the miles driven.

You can track mileage a variety of different ways, but we would suggest using the best mileage tracking apps to do so.

Now gig drivers can use apps such as MileIQ and Everlance to keep tabs on miles driven.

This is important since DoorDash does not track your mileage for you.

Youll need your mileage total for deducting mileage as a business expense and for keeping track of actual driving expenses.

Some mileage trackers are free, while others have a price tag.

Make sure to include the cost of mileage tracking, if any, as a tax-deductible business expense.

You May Like: Where’s My Tax Credit

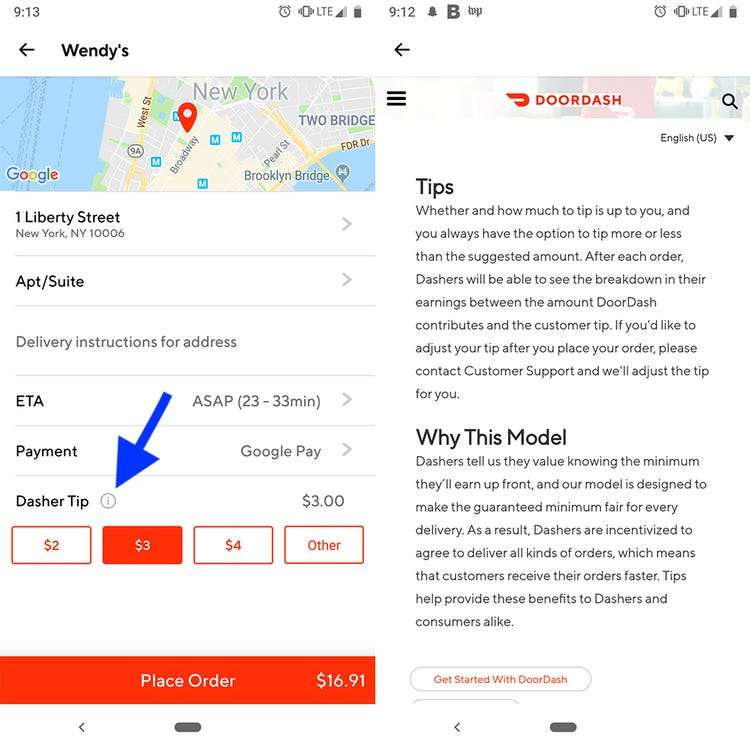

Do You Pay Taxes On Doordash Tips

Yes – Cash and non-cash tips are both taxed by the IRS. Federal income taxes apply to Doordash tips unless their total amounts are below $20.

Your cash tips are not included in the information on the 1099-NEC you receive from Doordash. However, you still need to report them.

If you receive a tip as an employee, you are obligated to pay taxes on this additional income.

What To Do If You Do Not Get A Doordash 1099

If you meet any of these requirements and you didn’t receive a tax form, there are a few reasons why.

- There is an error in the business details on your account

- You made less than $600 from delivery payments. The IRS requires companies to deliver a 1099 tax form if a business paid out a contractor $600 or more. So, Dashers who earned $600 or more within a calendar year will be given a 1099 form

Note that just because you do not get a 1099, you will still need to report your income when filing taxes.

All you need to do is contact DoorDash and file a support case.

Also Check: How Much Taxes Deducted From Paycheck Pa

Will Doordash Send Me A W

Because youre an independent contractor and not a Doordash employee, youll receive a 1099 NEC instead of a W-2.

The 1099 and the W-2 show how much a person has earned from a company in any given year. The difference is that regular payroll employees receive a W-2 while freelancers and contractors receive a 1099.

This will serve as your employment verification to prove your income

Like any other employee, you may receive your income as a direct deposit in your bank account. But thats about where the similarities end. Unsurprisingly then, the IRS treats you differently.

A W-2 breaks down how much money youve earned and how much money youve paid in taxes throughout the entire year.

A 1099 only shows how much money youve earned the taxes are up to you.

How To File Doordash Taxes

DoorDash is the largest food delivery service in the United States. Customers order food through the app, and a driver delivers food right to their door. It can be a solid gig for those looking to make a little extra income. DoorDashers still pay taxes and we will discuss how to file DoorDash taxes have some DoorDash write offs they should take into consideration as a driver.

Also Check: Sales Tax Exempt Form Ny

Doordash Driver Canada: Everything You Need To Know To Get Started

Your complete guide to becoming a DoorDash Driver in Canada. DoorDash is an international food delivery business that competes with UberEats, Skip The Dishes and Foodora. If you are interested in becoming a courier, we are here to give you everything you need to know about how to sign-up and work as a DoorDash Driver in Canada.

In addition to learning about the requirements to become a DoorDash driver, we also cover how the rating system works, some essential gear you should have for work, how the pay structure is set up and how much you will make as a DoorDash driver.

As an independent contractor, we also break down the basics for running your own business like insurance, expenses and taxes. To wrap everything up, we have all the ways you can get in touch with customer support as a DoorDash driver and answer some frequently asked questions.

- Complete an Orientation

Why Is The Third Quarter Tax Payment Due In September Instead Of October

The fiscal year for the US government ends on September 30. The quarterly payments were once due in three-month intervals . Somewhere along the line, the government was running out of money before the end of the fiscal year. They figured they could fix that by moving the third quarter due date to September. It was a form of borrowing 25% of the year’s revenue from the next fiscal year.

Also Check: Texas Property Tax Increase 2021

Hot Bags Blankets & Courier Backpacks

Another great tax deduction for Doordash drivers includes any hot bags, blankets or other gear you use for your deliveries. You know those insulated bags and blankets that you use to keep food orders nice and warm? Yep! They are deductible as a business expense.

Again, just be sure these are items you use for work purposes only if youâre going to deduct them from your taxes.

How Much Should I Set Aside For Taxes

This is an important point to understand because you need to set aside money to pay your taxes 1099 throughoutthe year.

Unfortunately you cannot find a Doordash tax calculator in the Dasher app. Basically the taxable income is theamount of money you earned minus any deductions and varies depending on your tax rate and filing status ).

The general rule is that the total amount you should set aside to cover both federal and state taxes should be30-40% of what you earn.

Don’t Miss: Travel Trailer Tax Deduction 2021

What Do Doordash Drivers Get Paid

For each delivery made, dashers receive a base rate that ranges from $2 to $10+, based on the projected time, distance, and demand for the order. They receive the whole delivery cost as well as any client tips.

The average hourly wage for DoorDash delivery drivers in Ontario is $24.70, although their exact earnings are based on the orders they accept, client tips, and other variables.

Everything You Need To Know About Doordash Taxes

How do taxes work with Doordash?…Read more

How much do you make working for Doordash?…Read more

Can you choose when Doordash pays you?…Read more

Does Doordash withhold taxes?…Read more

How much do Doordash drivers pay in taxes?…Read more

Does Doordash report to the IRS?…Read more

Doordash tax forms…Read more

How to get a Form 1099 from Doordash?…Read more

Deductions for delivery drivers…Read more

Read Also: Is Gross Before Taxes Or After

How Do I Sign Up As A Doordash Driver

Signing up to be a DoorDash driver is pretty easy and mostly done online. We have divided the process into five steps:

How To Choose A Mileage Expense Deduction Method

For deliveries done by personal car, you need to choose a mileage expense tax deduction method. The IRS offers two ways to deduct mileage expenses.

You must stick to one method for the entire tax year. What this means is you cant use the Actual Car Expense Method for half the year and the Standard Mileage Rate for the other half of the year.

Dont Miss: When Is The Deadline To File Your Income Tax

You May Like: How Late Can I File My Taxes

How Do I Pay Taxes For Doordash

It all really depends. Believe it or not, you have a choice.

You can file as you normally would. If you do this, you will pay your taxes owed before the April 15 tax filing deadline. But you may want to think long and hard before choosing this option. With zero withheld, your taxes will pile up and you will have a big tax bill due Tax Day. If you cannot pay the full amount, you will face penalties and owe interest.

Another option is to pay quarterly estimated payments direct to the IRS. This could help you avoid a surprise tax bill and possibly keep you from paying any penalties. The IRS doesnt want you to wind up with a large bill you cannot afford. If you expect to owe more than $1,000 in taxes for the year, the IRS may suggest quarterly payments. Quarterly taxes are sometimes required for self-employed people whose income exceeds a certain amount.

Should you pay quarterly taxes, you will calculate your estimated taxes owed. Then you will pay that money directly to the IRS every three months. Instead of having one traditional tax day, you will have four. Those dates are April 15, June 15, Sept. 15, and Jan. 15.But be careful: should you underpay, you may face a penalty. Its a little complex, and the IRS has more information for how this works .

There Are Actually Two Different Taxes That Come Into Play

We don’t only have to worry about our Federal income taxes. We also have self-employment taxes.

Calculating the self-employment tax impact is actually pretty simple once you’ve figured out your profits. It’s a straight 15.3% on every dollar you earn. There are no tax deductions or any of that to make it complicated. No tiers or tax brackets. The only real exception is that the Social Security part of your taxes stops once you earn more than $142,800 .

Related: Understanding Top Dasher and its Requirements.

Income tax is, of course, a completely different story for delivery. Your tax impact here is dependent on a lot of outside things. What kind of deductions do you have? Do you or your partner have other income? And then, as you earn more, you go from 12% taxes to 22% to 24% to 32%.

The two taxes are figured individually from one another. Self Employment taxes are based only on your business profits. For income tax, your business profits are added to any other income like W2, interest and investment income, etc., and then deductions and adjustments are applied to figure out the income tax.

Don’t Miss: Sales Tax Vs Use Tax

Doordash Driver Checklist Of Tax Deductions

The following items are also generally allowed tax write-offs. See this post for more in-depth info on tax deductions for delivery drivers.

- Fees to apply for a platform or for a background check.

- Transaction fees .

- Signs or lighting to identify you as a delivery driver.

- Business software you use to help you find the best times to drive.

The following items are generally not deductible because they are also for your own personal use.

- Cellphone bills.

- Floor mats and other improvements to your car.

Some of the above items could be partially deductible if you can prove to the IRS what portion of the expense was for business use. This is hard to do because so many people try to deduct personal expenses, and the IRS auditor will be very skeptical.

Do I Need To Tell My Insurance If I Drive For Doordash

DoorDash drivers should check with their insurance carriers to see if they are insured while dashing, though, according to the New Jersey news website NJ.com.

Some companies will not cover accidents or damage that happens when dashing.

DoorDash offers commercial insurance coverage of up to $1 million for its drivers.

Still, it pays only after a DoorDash drivers personal auto insurance has been exhausted after an accident in which the driver was at fault, Forbes reports.

It only covers the damage caused by the DoorDash driver and not damage to the drivers car, making a personal car insurance policy a must.

Recommended Reading: Nj State Income Tax Rate

Doordash Tax Guide: What Deductions Can Drivers Take

A side hustle like DoorDash can be a terrific way to make some extra cash. If self-employment is for you, you can also plunge headfirst into the gig economy and become a full-time delivery driver. Either way, its important to understand that although working as an independent contractor for DoorDash and other companies offers some tremendous benefits, it also comes with tax consequences. Its important to understand these tax issues so you dont accidentally run afoul of the IRS.

A side hustle like DoorDash can be a terrific way to make some extra cash. If self-employment is for you, you can also plunge headfirst into the gig economy and become a full-time delivery driver. Either way, its important to understand that although working as an independent contractor for DoorDash and other companies offers some tremendous benefits, it also comes with tax consequences. Its important to understand these tax issues so you dont accidentally run afoul of the IRS.

Doordash Taxes Are Based On Profits

Your taxable income as a Dasher is not the money you received for deliveries. Instead, it’s your profit: what’s left over after expenses.

This is the big difference between being taxed as a business and as an employee. An employee’s taxable income is simply the wages reported on their W-2. When you’re self-employed, there’s more to it.

The money you make from Doordash and the tips from customers are your business’s income. While it’s reported on your Doordash 1099-NEC form, it’s NOT the same as personal income.

A business subtracts the cost of doing business from gross revenue. That sum is the profit and is added to your tax form as income.

Your business operates at a loss when expenses are higher than income. If you brought in more than your business expenses, only the difference is taxable income.

Also Check: Sc State Tax Refund Status

Tracking And Claiming Car Expenses Is The Best Way To Slash Your Tax Bill

Dashers can put a lot of miles on while dashing. The cost of doing so can be higher than you realize. All those additional miles create wear and tear, greater maintenance and repair costs, and lower vehicle value .

Because driving IS such a significant expense, writing off your Doordash car expenses can make a huge difference.

The IRS lets you choose from claiming a standard mileage rate or the actual cost of driving. You can claim the business percentage of the actual cost of driving for Doordash or a flat rate per mile.

For the 2022 tax year, the standard mileage allowance is 58.5 cents per mile for the first six months and 62.5 cents for the second half. While 62.5 cents may not seem like much, 20,000 miles adds up to a $12,500 tax deduction.

To claim those expenses, you must track the miles you drove. You can do this with a GPS tracking app like Hurdlr or keep a written log. You can read more about how to track Doordash miles,what miles you can track while Dashing, and what to do if you forgot to track your miles.

Can You Deduct Mileage

You can generally take a deduction for all non-commuting business mileage while you are doing DoorDash deliveries or working through multiple apps. This includes when you have an order in your car and when youre picking up the next order.

DoorDash doesnt track mileage for you. You can either or keep a manual mileage log from your cars odometer.

Read Also: Department Of Tax Debt And Financial Settlement Services

Keeping Track Of Your Expenses

Keep an accurate and detailed paper trail of your expenses to help you fill out Schedule A or Schedule C at tax time. Receipts and logs are your best friends and come in handy if you should be audited.

- If you have an expense that is both personal and business, then you need to allocate it between the two.

- If an expense is only business related, then no allocation is required.

For example, suppose you use your phone 30% for delivery food and 70% for personal use.

- You would multiply your phone bill by 30% to determine how much might be a deduction from your earnings or as an unreimbursed employee expense for itemizing your deductions.

If you are using your vehicle for delivering items, you might be able to deduct the costs of its use. There are two ways to deduct vehicle costsusing the mileage method or actual expenses method. Either way you need to track your personal miles and your business miles.

To understand more about tax deductions, visit our Self-Employed Tax Deduction Calculator for Delivery Drivers.

When using the mileage method:

When using the actual method:

If you use the actual expenses method, you will need to track your business and total miles as well as the actual expense of operating your vehicle. These expenses can include:

- Interest on a car loan

- Registration fees

- Your total auto expenses are $5,000

- Your total miles are 20,000

- Your total business miles are 10,000

- 10,000 / 20,000 = .5 or 50%

- $5000 x .5 = $2,500, which is the amount you can claim