I Expect My Tax Bill To Be Less This Year Than Last Year What Can I Do

Note: References to income tax include Class 4 NIC.

You can apply to reduce your payments on account. You can do this at any time using form SA303 either online or in paper form up to when the balancing payment is due. You can also make the claim on the previous years tax return giving details of the circumstances in the additional information box at the end of the form.

Please bear in mind that if you reduce your payments on account below what they should in fact have been you will have to pay interest on the shortfall from the date each payment on account was due. In some cases, HMRC may charge a penalty if the reduction is excessive. Any taxable coronavirus support payments such as grants received under the Self-Employment Income Support Scheme are treated as taxable income and should be included when calculating any reduction in payments on account.

Example: Robert continued

Roberts income for 2022/23 is likely to be much lower than that for 2021/22, so he can claim to reduce his payments on account. Robert works out that he will have an income tax bill for 2022/23 of around £2,200. The reduction will be £600. He therefore claims to reduce each of his 2022/23 payments on account by £300 each.

On 8 February 2023, Robert realises that he has reduced his payments on account by too much. He thinks he will have an income tax bill for the year 2022/23 of nearer £2,500 and not £2,200.

You May Like: Can I Pay My Estimated Taxes Online

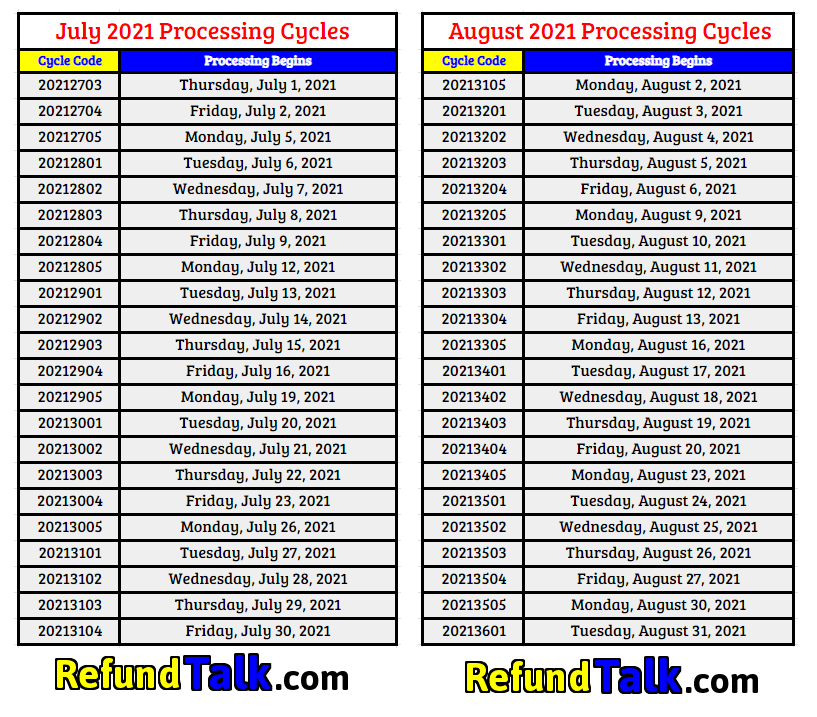

Be Aware Of Processing Delays

Again, this year some tax returns with errors or items on the return that need an IRS correction due to a tax law change will take longer than the normal timeframes to process, so expect delays. It may take the IRS more than the normal 21 days to issue refunds for some 2021 tax returns that require review, including but not limited to, ones that claim the Recovery Rebate Credit, the Earned Income Tax Credit and Child Tax Credit . Note: For all tax returns that claim EITC and/or CTC, those refunds must be held, by law, until after mid-February and cannot be released before then.

How To Pay Mcd Property Tax

MCD Property Tax can be paid online or at the MCD office. To pay online, property owners must register on the MCD website and submit their property tax details. They can then make the payment using a debit or credit card. To pay at the MCD office, property owners must fill out a form and submit it along with the payment.

Common Mistakes to Avoid in MCD Property Tax 2023

Not paying the tax on time: Property owners must pay the MCD Property Tax by April 1, 2023, or face a penalty.

Not calculating the tax correctly: Property owners must calculate the tax accurately to ensure they are paying the correct amount.

Not registering on the MCD website: Property owners must register on the MCD website to pay the tax online.

Benefits of Paying MCD Property Tax on Time

Paying the MCD Property Tax on time has several benefits, including:

It helps to fund public services such as health, education, and infrastructure.

It helps to improve the quality of life in Delhi.

It helps to reduce the tax burden on other taxpayers.

Recommended Reading: How To File Back Taxes Without Records

Did You File Your Tax Return Or Pay Your Taxes Late

If you filed your tax return or paid your taxes late, the IRS may have assessed one or more penalties on your account. In some cases, the IRS will waive the penalties for filing and paying late. However, youll need to ask the IRS to do this. The IRS will usually consider the following:

- Reasonable Cause You have a reason for not filing or paying on time such as:

- You exercised ordinary business care and prudence to determine your taxes.

- You had matters beyond your control that left you unable to file or to determine the amount of deposit or tax due.

- You didnt receive necessary financial information.

- You didnt know you needed to file a tax return even though you made efforts to find out.

- You had a death in your immediate family.

- You or a member of your immediate family suffered a serious illness that kept you from handling your financial matters.

- You lost your tax documents in a fire or some other disaster.

Payments By Electronic Check Or Credit/debit Card

Several options are available for paying your Ohio and/or school district income tax. For general payment questions call us toll-free at 1-800-282-1780 or adaptive telephone equipment).

If you are remitting for both Ohio and school district income taxes, you must remit each payment as a separate transaction.

Payments made online may not immediately reflect on your Online Services dashboard. Please allow 2-3 business days for the payment made to be applied to your outstanding liability.

The Department is not authorized to set up payment plans. However, you may submit partial payments toward any outstanding liability including interest and penalties. Such payments will not stop the Department’s billing process, or collection attempts by the Ohio Attorney General’s Office.

Note: This page is only for making payments toward individual state and school district income taxes. To make a payment for a business tax, visit our online services for business page.

Whether you file your returns electronically or by paper, you can pay by electronic check or credit/debit card via the Department’s Online Services or Guest Payment Service .

See the FAQs under the “Income – Online Services ” for more information on using Online Services.

Payment can be made by credit or debit card using the department’s Online Services, Guest Payment Service, directly visiting ACI Payments, Inc.or by calling 1-800-272-9829.

You May Like: How To Pay My Tax Online

Pay Taxes Online 2021

The Internal Revenue Service allows taxpayers to pay taxes online in two different ways in 2021. A taxpayer can either pay taxes online using a bank account or a debit or credit card. If paid with a debit or credit card, the payments will be processed within hours. If paid using a bank account, it will take up to two business days.

While you can pay the IRS directly using your bank account on Direct Pay, you must pick a payment processor to pay taxes with debit or credit card. On Direct Pay, you wont be subject to any fees but since you will use a payment processor, you will have to pay processing fees. These fees range from $2 to about 2% of the amount paid depending on what you use to pay taxes.

Irs Free File Is Now Closed

Check back January 2023 to prepare and file your federal taxes for free.

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

You May Like: Self Employed Tax Deductions Worksheet

Who Must Pay Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax.

Pay By Check Or Money Order

Before submitting a payment through the mail, please consider alternative methods.

One of our safe, quick and easy electronic payment options might be right for you.

If you choose to mail your tax payment:

- Make your check, money order or cashier’s check payable to U.S. Treasury.

- Please note: Do not send cash through the mail. If you prefer cash payment, see “More Information” below.

| What is your payment situation? |

|---|

| Paying and filing |

| Follow the instructions on your notice, or find where to send balance due payments |

Don’t Miss: Penalty For Filing Late Taxes

Facts You Need To Know:

- The EFW transaction authorizes the U.S. Department of the Treasury to transfer the specified payment amount from the specified bank account to the Treasury’s account,

- “IRS USA Tax Payment,” “IRS USA Tax Pymt” or something similar will be shown on your bank statement as proof of payment.

- If the payment date requested is a weekend or bank holiday, the payment will be withdrawn on the next business day. In that case, your bank may put a hold on those funds, and treat it as a pending transaction.

- The payment amount will be debited in a single transaction. No recurring or partial withdrawals will be made.

- Federal Tax Deposits cannot be made via the EFW payment option. For payment options for making Federal Tax Deposits, please refer to the Tax Form Instructions for that form.

Credit And Debit Cards

You can use your debit or credit card to pay your tax bill online or over the phone. The IRS doesn’t charge a fee for this service, but the service providers charge a fee for processing the payment. The three providers PayUSAtax, Pay1040, and ACI Payments, Inc. charge a fee. Debit card transactions are often between $2 and $4. For credit transactions, the fee is based upon a percentage of the payment amount. For instance, for a credit transaction of $1,000, the taxpayer may be charged a fee of $19.90 while a credit transaction of $10,000 would cost the taxpayer a fee of $199. The IRS accepts Visa, Discover, American Express, Mastercard, STAR, Pulse, NYCE, Accel, PayPal, and PayNearMe

Also Check: 2021 Short-term Capital Gains Tax

Scheduling Or Rescheduling A Payment

For taxpayers looking to reschedule or schedule their federal tax payments, the IRS offers two payment options where payments can be scheduled up to 365 days in advance. These two options are optimal for those who cancelled their payments that were due April 15 and want to reschedule their payment to the July 15 due date. They are:

- Electronic Federal Tax Payments System is free and taxpayers can schedule their estimated and other federal tax payments up to 365 days in advance. New enrollments for EFTPS can take up to five business days to process.

- Debit, credit card or digital wallet is through a payment processor up to 365 days in advance. The payment processors charge a fee, no fees go to the IRS.

Taxes Taken From Your Payroll Check

You can make changes to the amount your employer withholds from each of your paychecks by filling out an Form W-4, Employees Withholding Allowance Certificate, and giving it to the person who takes care of your payroll. The reason you complete an IRS Form W-4 is so your employer can withhold the correct federal income tax from your pay. You should consider completing a new IRS Form W-4 when your personal or financial situation changes.

New Tax Reform implementation changed the way the IRS calculates your federal tax. The IRS encourages everyone to perform a quick paycheck checkup to ensure you have the right amount withheld.

You may use the IRS withholding calculator to figure your federal income tax and withholding. The withholding calculator is a tool on IRS.gov designed to help you determine how to have the right amount of tax withheld from your paychecks.

When you use the withholding calculator, it will help you determine if you need to adjust your withholding and submit a new Form W-4, Employees Withholding Allowance Certificate, to your employer.

Don’t Miss: C Corp Tax Rates 2021

Pay Taxes Online With Bank Account

Those who opt to pay taxes with their bank account must use the IRSs own payment platform Direct Pay. Paying taxes online on Direct Pay is completely free of charge and you wont be subject to fees. However, it will take a little bit longer for your payment to reach the IRS.

Having that said, if your tax payment isnt urgent, paying using a bank account might be a better option since you wont pay any fees whatsoever. On Direct Pay, just like using the above payment processors, you can pay all kinds of taxes.

On Direct Pay, select the type of tax you want to pay and proceed to select the tax year and forms that apply to your payment. Fill out the identity verification form to prove who you are and proceed to pay. Once you place your payment, you will be given a confirmation number. Use this number to track the status of your payment.

Note: If you pay taxes after 8 PM, your payment will begin processing the next business day.

Did You File A Tax Return With Your Spouse And All Or Part Of Your Refund Was Applied To A Debt Only Your Spouse Owes

Youre an injured spouse if you filed a joint income tax return and all or part of your share of the joint refund was applied against a legally enforceable past due debt. The IRS applied all or part of taxpayers refund to pay another tax debt. that belongs just to your spouse. The past due amount can be a federal debt, state income tax debt, state unemployment compensation debt, or child or spousal support payments.

As an injured spouse, you can request your part of the tax refund by filing Form 8379, Injured Spouse Allocation, using the instructions for this form.

Do you owe tax because your spouse didnt report deductions or didnt include income on your joint tax return?

When you file a joint tax return, you and your spouse are each individually responsible for the tax, penalties, and interest that arise even if you later divorce. Under certain circumstances, you may not have to pay the amount owed to the IRS.

If you and your spouse or former spouse owe a balance because he or she improperly reported deductions or didnt report income, then you may request relief from all or part of the liability.

Don’t Miss: How Long Receive Tax Refund

How To Pay Your Taxes

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments:

- Electronic Funds Withdrawal. Pay using your bank account when you e-file your return.

- Direct Pay. Pay directly from a checking or savings account for free.

- . Pay your taxes by debit or credit card online, by phone, or with a mobile device.

- Pay with cash. You can make a cash payment at a participating retail partner. Visit IRS.gov/paywithcash for instructions.

- Installment agreement. You may be able to make monthly payments, but you must file all required tax returns first. Apply for an installment agreement through the Online Payment Agreement tool.

Notice To Taxpayers Presenting Checks:

When you provide a check as payment, you authorize us either to use information from your check to make a one-time electronic fund transfer from your account or to process the payment as a check transaction. When we use information from your check to make an electronic fund transfer, funds may be withdrawn from your account as soon as the same day we receive your payment, and you will not receive your check back from your financial institution.

You May Like: Mail Tax Return To Irs Address

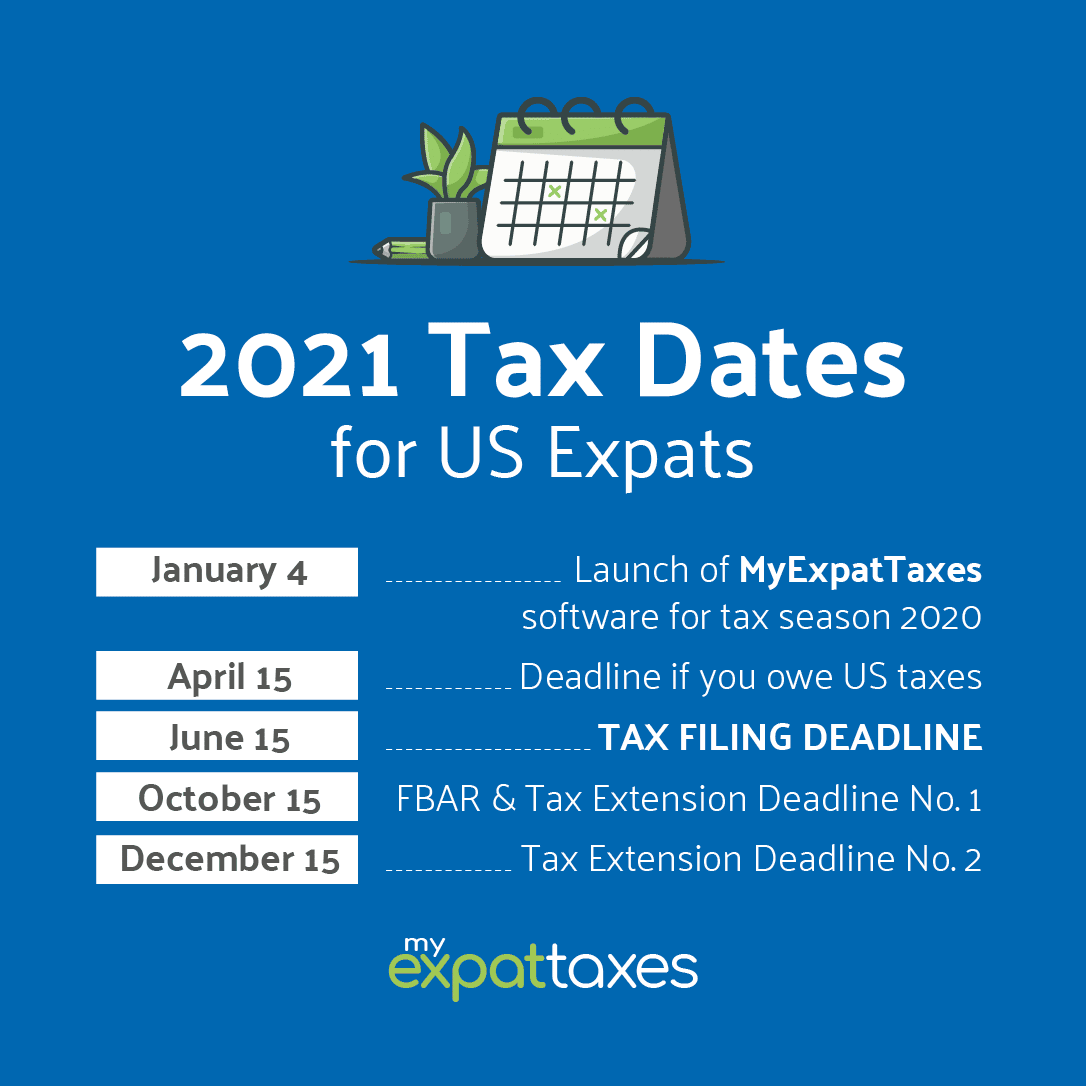

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.