Who Should Make Estimated Quarterly Tax Payments

People who aren’t having enough withheld. The IRS says you need to pay estimated quarterly taxes if you expect:

-

You’ll owe at least $1,000 in federal income taxes this year, even after accounting for your withholding and refundable credits , and

-

Your withholding and refundable credits will cover less than 90% of your tax liability for this year or 100% of your liability last year, whichever is smaller.

» MORE: Learn how FICA and withholding taxes work on your paycheck

The self-employed. Independent contractors, freelancers and people with side gigs are prime candidates for estimated quarterly taxes, says Bess Kane, a CPA in San Mateo, California. Thats because theres no tax automatically withheld on their income, she explains.

Landlords and investors . People with rental income and investments might need to pay estimated quarterly taxes, too even if their employers withhold taxes from their paychecks.

Those might not always be calculated into their withholding amount, and then they come up short and end up having to pay an estimated tax penalty and don’t even know what estimated taxes are, says Thomas Mangold, a CPA in Austin, Texas.

What If I Didn’t Earn That Much

Even if you only earned a little, you may still need to pay quarterly taxes. If you expect to owe $1,000 or more in taxes for the year , the IRS expects you to make quarterly tax payments on your business profit for that tax year.

As a reminder, youre making a profit if your self-employment income is higher than your business deductions.

Put simply: You should consider paying quarterly taxes if you have income that didn’t have taxes withheld and you expect to owe $1,000 or more in taxes on your combined income for the year.

Do I Need To Pay Estimated Quarterly Taxes

You need to pay estimated quarterly taxes if you meet both of the following two conditions:

- You expect to owe more than $1,000 at year-end , even after accounting for any withholding and refundable credits

- Your withholding and refundable credits are less than the smaller of 90% of your current year tax liability, or 100% of your previous year tax liability

This means if you expect to owe less than $1,000 after withholding and credits, you can stop right here. If you expect to owe more, but your withholding and refundable credits were equal to 90% of your current tax liability or 100% of your previous year’s tax liability, you’re also exempt.

If you owe more than $1,000 and your withholding and credits do not equal the necessary amounts, you need to pay estimated quarterly taxes.

You also don’t need to pay quarterly taxes if you had no tax liability for the previous year, you were a U.S. citizen for the whole year, and your prior tax period covered twelve months.

Recommended Reading: Tax Credits For Electric Vehicles

Add Quarterly Tax Payment Reminders To Your Calendar

Never miss a quarterly payment with lightweight calendar reminders.

Find write-offs.

Paying your quarterly estimated duty and tracking your business expenses is vital to staying on top of your taxes. Heres a quick breakdown of what you need to know about paying your quarterly tax payments.

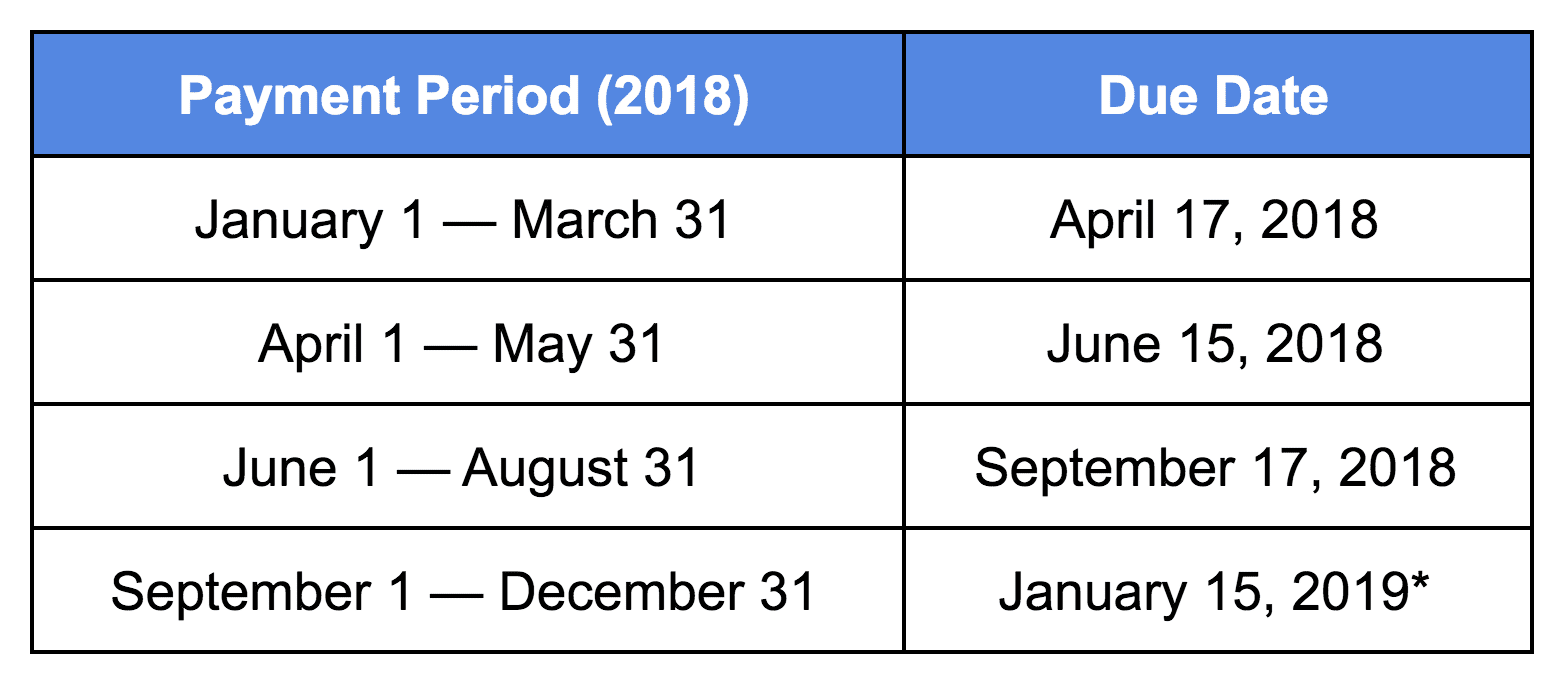

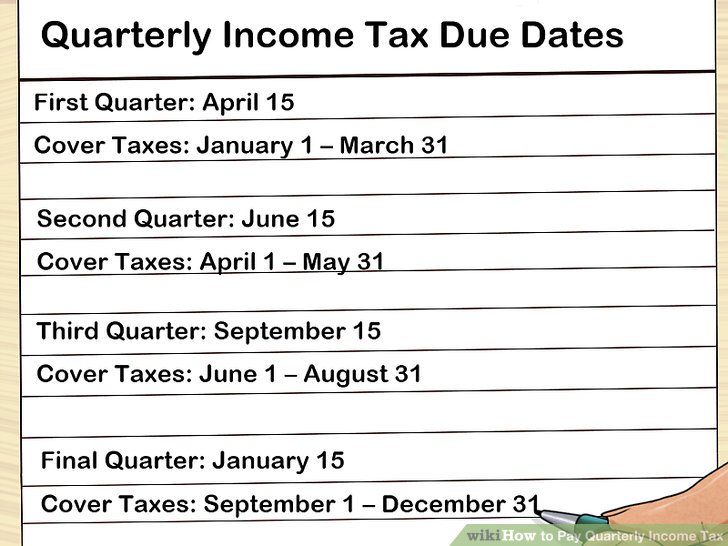

Quarterly tax payments are due April 15, June 15 and September 15 of the tax year, and January 15 of the next year. Your income tax liability accrues on income as it is earned, rather than being due on April 15 of the next year.

If you receive income unevenly during the year you may annualize your income. Complete the MI-2210 Annualized Income Worksheet to determine what quarter your payments are due.

You may make estimated tax payments using Michigan Department of Treasurys e-Payments system or mail your estimated payment with a Michigan Estimated Tax voucher .

To ensure your estimated tax payment is received timely, allow 3 to 5 days for an electronic payment to be received and 2 weeks to post to your account. Allow 2 weeks for a mailed payment to be received and 8 weeks to post to your account.

Note: Payments that are not received by the due date will be applied to the following estimated tax quarter.

Penalty is 25% for failing to file estimated payments or 10% of underpaid tax per quarter. Interest is 1% above the prime rate.

What Are Qualified Business Income Deductions

You must pay a self-employment tax on your net earnings. This means that you can subtract qualified business income deductions from the mix to lower the amount youre taxed. The IRS allows self-employed individuals and small business owners to deduct up to 20% on their pass-through income.

For example, you can deduct 50% of your self-employment tax on your income taxes. This means that if your Schedule SE states you owe $4,000 of self-employment tax, you can deduct $2,000 on your Form 1040.

You May Like: When Is Tax Returns Due

How To Calculate Quarterly Estimated Taxes For 2021

You may have heard us mention before that the federal income tax is a pay-as-you-go tax. As the name implies, this means that you pay your taxes as you earn income. This is why your employer withholds federal taxes from your paycheck every week.

Self-employed people, however, dont have an employer to withhold taxes for them. As such, they must calculate how much tax they think theyll owe at tax time and make payments throughout the year. Because these payments are based on how much money the person expects to make, the tax payments are estimated.

Who Should Pay Estimated Taxes

The IRS uses a pay-as-you-go income tax system, meaning you must pay your taxes as you earn income. It enforces this by charging penalties for underpayment if you haven’t paid enough income taxes through withholding or making quarterly estimated payments. It also charges penalties on late payments even if you end up getting a refund.

The IRS uses a couple of rules to determine if you need to make quarterly estimated tax payments:

- You expect to owe more than $1,000 after subtracting withholding and tax credits when filing your return, or

- You expect your withholding and tax credits to be less than:

- 90% of your estimated tax liability for the current tax year

- 100% of the previous year’s tax liability, assuming it covers all 12 months of the calendar year

These are commonly referred to as safe harbor rules. The 100% requirement increases to 110% if your adjusted gross income exceeds $150,000 .

One exception applies to individuals who earn at least two-thirds of their income from farming or fishing. The requirement is to pay in two-thirds of your current year tax or 100% of your prior year tax. Also, there is only one estimated tax payment date – January 15 of the following year. Additionally, if you file and pay in full by March 1, then estimated tax payments are not required.

Don’t Miss: When Are Tax Payments Due 2022

How To Make An Estimated Payment

We offer multiple options to pay estimated taxes.

- Individual online services account. If you don’t have an account, enroll here. You’ll need a copy of your most recently filed Virginia tax return to enroll.

- 760ES eForm. No login or password is required. Make sure you choose the correct voucher number.

- ACH credit. Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

See all options to file and pay estimated taxes.

Electronic filing requirement

You must submit all of your income tax payments electronically if:

- Any installment payment of estimated tax exceeds $1,500 or

- Any payment made for an extension of time to file exceeds $1,500 or

- The total income tax liability for the year exceeds $6,000

If any of the thresholds above apply to you, all future income tax payments must be made electronically.This includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed.

How Much Is The Underpayment Penalty From The Irs

The underpayment penalty varies based on a variety of factors, including:

- How much you owe in taxes

- How long the amount has been overdue

Generally, the underpayment penalty starts at 0.5% of the unpaid tax bill, and increases monthly for however long the amount remains unpaid. This is capped at 25%. Interest is also calculated on any underpayment amounts, at a variable rate set by the IRS.

For Q3 of 2022 , the IRS interest rates for underpaid taxes are:

- 5% for underpayments

- 7% for large corporate underpayments

Don’t Miss: Tax Short Term Capital Gains

Make An Estimated Income Tax Payment Through Our Website

You can pay directly from your preferred account or by credit card through your Online Services account.

Note: There is no online option at this time for Forms IT-2658, Report of Estimated Tax for Nonresident Individual Partners and Shareholders, or CT-2658, Report of Estimated Tax for Corporate Partners. See Pay estimated tax by check or money order for instructions.

Changes In Income Or Exemptions

If your expected Virginia adjusted gross income changes during the year, re-compute your estimated tax to determine how much your remaining payments should increase or decrease.

A change in income, deductions or exemptions may require you to file an estimated payment later in the year. If you file your state income tax return and pay the balance of tax due in full by March 1, you are not required to make the estimated tax payment that would normally be due on Jan. 15.

If you file your return after March 1 without making the January payment, or if you have not paid the proper amount of estimated tax on any earlier due date, you may be liable for an additional charge for underpayment of estimated tax.

You May Like: Where Is My California Tax Refund

How To Pay Taxes Quarterly: A Simple Tax Guide For The Self Employed

by Gary M. Kaplan, C.P.A., P.A.| Comments Off on How to Pay Taxes Quarterly: A Simple Tax Guide for the Self Employed

The self-employment tax is just above 15.3%. It usually consists of Medicare and social security.

If youre self-employed, you have to stay on top of your taxes. You have to know how much to pay and when to pay. This is why its helpful to have a software to keep track of your business and personal expenses.

Having software or an accountant do your taxes quarterly can help you avoid potential disaster with the IRS. You want to avoid paying more taxes to the IRS than you already do.

If youre unsure of how to pay taxes quarterly, heres a guide on how to pay taxes to the IRS quarterly that will lower your stress.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: California Llc First Year Tax Exemption

When Are Quarterly Taxes Due In 2022

The first deadline in 2022 is for your last quarterly payment for 2021. That date is

The rest of the 2022 quarterly tax deadlines are:

-

Q1 Deadline: April 18, 2022File estimated taxes for January 1 to March 31

-

Q2 Deadline: June 15, 2022File estimated taxes for April 1 to May 31

-

Q3 Deadline: September 15, 2022File estimated taxes for June 1 to August 31

-

Q4 Deadline: January 16, 2023File estimated taxes for September 1 to December 31

Why You Should Change Your Withholding Or Make Estimated Tax Payments

If you want to avoid a large tax bill, you may need to change your withholding. Changes in your life, such as marriage, divorce, working a second job, running a side business or receiving any other income without withholding can affect the amount of tax you owe. And if you work as an employee, you don’t have to make estimated tax payments if you have more tax withheld from your paycheck. This may be a convenient option if you also have a side job or a part-time business.

Some income is not subject to withholding. This includes some income from self-employment, the sharing economy or some rental activities. Be sure to make estimated tax payments on those sources of income throughout the year. You may also make estimated tax payments if the withholding from your salary, pension or other income doesn’t cover your income tax for the year.

You make your estimated payments based on the income you expect to earn and any credits you expect to receive in the year. You can use your prior year tax return as a guide and Form 1040-ES, Estimated Tax for Individuals has a worksheet to help you figure your estimated payments.

You can use estimated tax payments to pay both income tax and self-employment tax .

Read Also: How To Find 2020 Tax Return

The Annualized Income Installment Method

If your income from self-employment fluctuates, such as if you’re the owner of a seasonal business or a freelancer with a varying roster of clients, your quarterly taxes can vary too. The annualized income installment method can help you estimate your taxes with more accuracy than the regular installment method.

Using the annualized income installment method, you’ll estimate your actual income, expenses and deductions each quarter to determine your tax liability, rather than dividing your entire year’s income by four and paying in standard installments. This can help make paying taxes more affordable when your earnings are lower.

Follow the instructions in IRS Form 1040-ES for calculating your quarterly estimated tax payments. The form will walk you through determining your income tax, as well as self-employment tax, which covers Social Security and Medicare.

Alternatively, consider using tax software or working with a tax professional to make paying quarterly taxes easier.

Who Has To Pay Quarterly Taxes

In most cases, freelancers are required to pay quarterly taxes. If you are the owner of a small business or owe a minimum amount of $1,000 in income tax, then you are expected to pay quarterly taxes.

In case you owe less than $1,000, then you will not be required to pay quarterly taxes. Instead, all you have to do is pay your due taxes as you are filing for a tax return.

Making less money does not make you exempt from taxes. It just changes the way you would normally make the payment.

Moreover, if you had no tax liability during the previous year, then you may also be exempt from paying quarterly taxes. This may be because you did not have to file for an income tax return, or because the “total tax” box on your Form 1040-ES stated $0.

To put it simply, as long as you are self-employed or you have your own business, you need to file for quarterly taxes, lest you’ll receive a penalty. You are considered self-employed if you work in the following circumstances:

- You have a job as an independent contractor

- You are part of a partnership that runs a small business, such as an LLC

- You are the sole proprietor in a particular field or trade

- You run a business by yourself, whether it’s full-time or part-time

Side hustles might also be exempt from paying quarterly self-employment tax. All you need to do is ask the potential employee to withhold the necessary extra and file for you.

The same thing also applies in case you file jointly with your spouse and they have a W-2 job.

Also Check: When Are Llc Taxes Due

How Can I Make This Easier

If you’re married and your spouse has a regular job and is having taxes withheld, he or she may have enough taxes withheld to cover the two of you, Kane explains.

You can accomplish this by giving his or her employer a new Form W-4, instructing how much tax to withhold from each paycheck. You can change your W-4 any time. If youre getting a pension or annuity, use Form W-4P.

What Defines A Verbal Contract

A verbal contract refers to an agreement between two parties that’s made âyou guessed itâ verbally.

Formal contracts, like those between an employee and an employer, are typically written down. However, some professional transactions take place based on verbally agreed terms.

Freelancers are a good example of this. Often, freelancers will take on projects having agreed on the terms and payment via the phone, or an email. Unfortunately, sometimes clients don’t pull through on their agreements, and hardworking freelancers can find themselves out of pocket and wondering whether a legal battle is worth all the hassle.

The main differences between written and oral contracts are that the former is signed and documented, whereas the latter is solely attributed to verbal communication.

Verbal contracts are a bit of a gray area for most people unfamiliar with contract law âwhich is most of us, right?â due to the fact that there’s no physical evidence to support the claims made by the implemented parties.

You May Like: Montgomery County Texas Tax Office

Rely On Income Tax Withholding

You may be able to rely on income tax withholding if one or more of these apply:

- You have a working spouse: If you have a spouse with a job, your spouse can increase his or her withholding to cover your anticipated estimated taxes.

- You have a W-2 earning job: Business owners, especially those with side businesses, may have part-time or full-time jobs. Again, figure withholding from your wages to cover the tax on your business income.

- You have an LLC thats elected S corporation status: If you have a limited liability company, you can opt to be taxed as an S corporation. This enables you to take a salary, and have withholding taken to cover the taxes on your salary as well as your share of business profits.