Premium: Best For Investors Landlords Or Those Who Sold Cryptocurrency In 2021

The Premium plan costs $50 for your federal return plus $37 for each state return.

The third tier of H& R Block tax plan options adds several layers of tax services for those with more complicated tax situations. If you earned money from a rental property or have capital gains from the sale of stock, a house or other investments, you’ll need to pay for the H& R Block Premium plan.

Likewise, if you gained or lost money from the sale of cryptocurrency, you’ll need to use the Premium plan.

The cost for virtual professional help, including screen-sharing via Online Assist, goes up to $60 for the Premium plan. The Worry-Free Audit Support and Tax Identity Shield services are still available for $20 a piece.

File Your Taxes For Free

If you use tax software or a tax program online, you have the option to file your taxes for free. There are many programs offered by companies like H& R Block that provide this option alongside their other services.

You should always file electronically because its the only way you can file without paying a fee. Paper filing incurs a fee from the IRS, which rises most years.

Filing electronically also means your tax return is likely to be accepted faster. But before you get to this stage, you need to go through the process of filing your taxes.

Free Online: Best For Students And Most W

The Free Online plan, as the name suggests, costs $0 for filing federal taxes and $0 for one state return. If you made money in multiple states, you’ll need to pay $37 for each additional state return.

H& R Block’s free tax plan works best for W-2 employees with simple tax returns, but it’s also great for students as it allows for both education tax credits and deductions for student loans, tuition and fees.

The free plan includes coverage of 1040 Schedule 1, which allows reporting many more types of income like gambling winnings, alimony and stock options. It also allows for income adjustments such as educator expenses and IRA or student-loan interest deductions.

While the free plan also covers 1040 Schedule 3 — “Additional Credits and Payments” — it doesn’t include most of the supplemental forms needed to claim the many credits, such as the increased child care credit, the retired saver’s credit and the electric vehicle credit, on that schedule.

H& R Block Free Online does include Form 8863 for education credits, including the Lifetime Learning Credit and American Opportunity Credit, which again bolsters its appeal for students.

While the paid versions of H& R Block include access to phone or web chat support, the Free Online version does not. You can buy support: Online Assist , Worry-Free Audit Support or Tax Identity Shield .

Recommended Reading: What Is Tax Filing Deadline

Do You Need To Hire A Tax Professional

Even if your taxes are too complex to use H& R Block’s free software, you may be able to file a return yourself using paid software. But for complicated taxes, it could pay to hire a professional. While you’ll spend more for an accountant or tax preparer, hiring one could help you avoid costly mistakes that cause you to lose out on deductions you were otherwise entitled to. If you own a small business, it especially pays to hire someone, even if you have a solid handle on your company’s finances.

What Happens If I Miss A Class

Classes are held on days, evenings, and weekends. If you miss your regular time for an in-person class, you may be able to take a class at another time or another location that week. For classes in the Virtual Classroom, please reach out to your instructor for a recorded playback of any missed class time.

Read Also: Department Of Tax Debt And Financial Settlement Services

When You Should Hire A Cpa Or Tax Pro

When should you hire a CPA or tax preparer, and when can you do your taxes yourself? A look at the costs, advantages, and disadvantages of hiring a tax pro.

In recent years tax laws have undergone major revisions that could drastically affect the returns of people with complicated tax situations. If your tax needs take you beyond what TurboTax Deluxe can handle, you should seriously consider hiring a tax professional or getting live help from an IRS-certified volunteer rather than upgrading to TurboTax Premier or Self-Employed. A pro can not only capture all of your deductions accurately but also set you up for future tax strategies and savings.

A good tax professional can handle:

- self-employed filers and small-business owners with deductions, inventories, or employees

- investors with complicated portfolios and tax strategies

- income from partnerships or small companies with K-1 forms

- big life events such as getting married or divorced, sending kids to college, buying or selling a home, or receiving inheritance

- advice for future tax planning

With a tax professional, you dont have to do form-by-form price comparisons or hope that you fit inside an income or age captheyll take whatever you have, and most are clear up front about what theyll charge based on your specific situation.

The average cost of professional tax preparation ranges from $220 to $903 depending on the complexity of the returns.

Form 8965 Health Coverage Exemptions

Form 8965 is one of the newest forms around because it only came into usage with the Affordable Care Act . You should check the latest information on Form 8965, due to the quick changes going on within the healthcare industry.

But for the purposes of your 2021 tax return, this is still valid.

Its used primarily to claim coverage exemption or to calculate your 2021 shared responsibility payment. Generally, anyone who files Form 1040 must fill this out. The only exception is if you dont need to file any tax return for this tax year.

Your shared responsibility payment applies if you didnt have health coverage. The annual payment amount is either 5% of your household income thats above the filing threshold or a flat dollar amount. For adults, this is $695 and for children, its $347.50. This is up to a maximum of $2,085.

The greater amount applies. H& R Block can help you to calculate which one will apply to you.

Your shared responsibility payment applies even if you were only uninsured for part of the year.

You May Like: Do You Have To Pay Taxes On Life Insurance

H& r Block Online Prices And Plans

H& R Block has four major pricing tiers including a completely free option. H& R Blocks Premium pricing tier is one of its most competitively priced tiers.

Users can also opt for Worry-Free Audit assistance which costs $19.99 and provides support if you are audited.The Online Assist plans from H& R Block include unlimited help from tax professionals such as CPAs or Enrolled Agents. These individuals can answer tax questions specific to your situation.

Bonus: Get 20% off H& R Block online by signing up through this link > >

|

Plan |

|---|

Note: Prices are subject to change, especially as it get’s closer to the tax deadline. The earlier you start, the higher likelihood you have of locking in better prices.

How Much Does H& r Blocks Tax Service Cost

H& R Block offers a free online tax-filing program that includes simple federal and state tax returns. If you need to upgrade based on your tax situation, youll pay $49.99 to $109.99 to complete a federal return, and $36.99 for each state tax return.

At the time of publishing, the company is offering a temporary discount. Filing a federal return costs just $29.99 to $84.99 during the promotion, which brings the pricing more in line with TaxSlayer, the lowest-cost provider we reviewed.

H& R Block also offers in-person tax filing starting at $69 per federal return plus an additional fee for state returns. Its desktop software, which downloads to your computer, ranges from $29.95 to $89.95 for federal returns, and $19.95 for each state return. The in-person and downloadable software options arent included in our review.

Read Also: What Do You Need To Do Your Taxes

What Are The Course Attendance Policies

Our general attendance requirements state that participants cannot miss or fail to complete more than 8 hours of any of the instructor-led sessions. All self-study online training sessions must be completed to complete the course successfully. The class attendance requirement may vary based on the specific state where the class is held.

What Is An Expat Who Qualifies

What is an expat? An expat is a U.S. citizen or green-card holder living or working outside the United States. Importantly, even though they are no longer in the U.S., they are required to report worldwide income and file taxes even as an expat if they meet specific filing thresholds. However, there are some special issues expats need to consider when filing their return, including potentially reporting financial information through FBAR or FATCA requirements.

Read Also: Are Municipal Bonds Tax Free

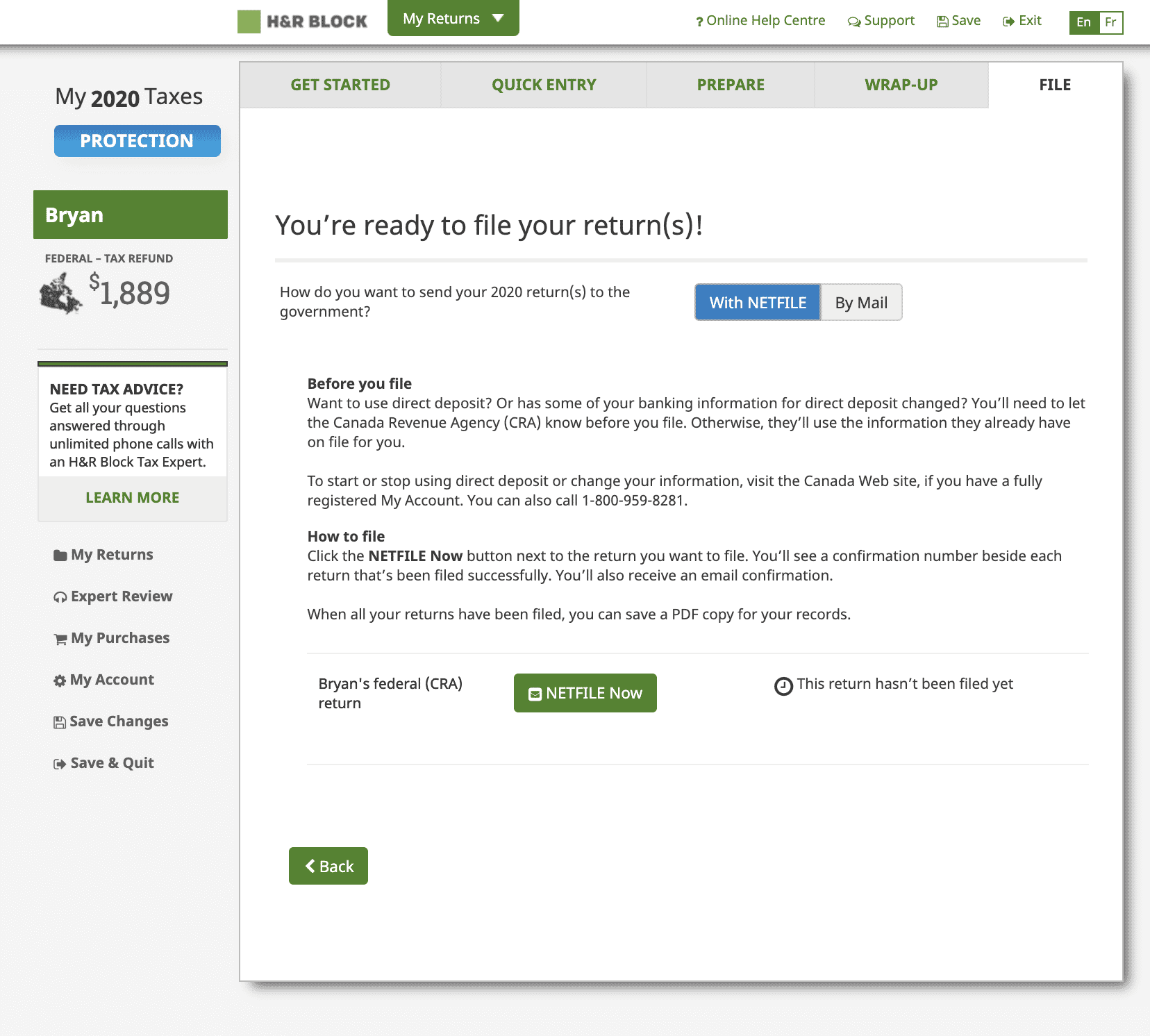

From Rejection To Acceptancein Real Time

With backend monitoring firmly in place, Falkenberg and team next turned to New Relic Insights and New Relic Browser to gain a view of frontend business performance. One of the first items they focused on was acceptance ratethe number of returns filed through H& R Block Canadas DIY software that the government actually accepts.

The first place we started using custom attributes in New Relic was around the NETFILE API, says Falkenberg, referring to the online filing system that allows customers to send their tax return directly to the Canada Revenue Agency . Was the transaction successful? Did we communicate with the government and attempt to transmit? Was that transmission accepted or rejected, and if it was rejected, what was the response and what was the error code coming back?

This year, we got a bunch of rejections within 15 minutes of opening the system for filing, says Falkenberg. But unlike in past years, we were able to resolve the issue immediately. With the data provided by New Relic Insights dashboards, our compliance team spotted the problem, put the DevOps teams on it, and by the end of a 30-minute phone call they had identified and fixed the bug and restarted the servers with no disruption to users.

Premium & Business Edition

H& R Block also offers a Premium & Business online edition to serve the more than 60 million freelancers, independent contractors, and other self-employed taxpayers, including the estimated over three in 10 Americans who rely on gig work for their primary income. Among its features are an import of Uber driver tax information and full support for common tax situations faced by self-employed individuals. This product costs $115 including a state return, plus an additional $45 for each additional state tax return. Like the Premium version, the Premium & Business edition also includes support for rental property owners.

Read Also: Federal Tax Return By Mail

How Long Will It Take

Typically, this can take up to 6 weeks. Some of the time needed might be for our tax advisors to prepare the previous year’s returns. Still, in many cases, additional time is necessary for you to gather the appropriate records from current and prior employers, financial institutions, and other institutions.

Are There Additional Costs For Books And Materials

Students are required to purchase course materials in all states except for New York and Tennessee, where the purchase of some materials is optional. Course materials are offered for $149 in most states and $99 in Minnesota. The printed course materials fee may be non-refundable, depending on your state requirements. See the refund policy below for more details. Note: Sales tax, if applicable, will be applied after the $149-course material fee.

Recommended Reading: When Is Tax Returns Due

Volunteer Income Tax Assistance

In the past five years, The Cooperative Ministry’s VITA program has helped over 21,000 households with free tax preparation in the Midlands and brought nearly $14 million in federal refund dollars to the community. In-person tax preparation assistance is available to individuals and families who earned $55,000 or less.

The Cooperative Ministry will hold free tax preparation during the days and times at the locations here. Click here for a printable version of the chart.

What Are H& r Block’s Different Products

H& R Block offers four different online products: Free Online, Deluxe, Premium and Self-Employed, which range from $0 to $85. The decision on which is best for you depends mostly on the deductions and tax credits you want to claim.

Free in-person audit support is offered with all H& R Block tax plans, and enhanced “Worry-Free Audit Support,” including IRS communication and in-person audit representation, can be added to any plan for $20. H& R Block’s Online Assist feature — additional virtual support with live assistance and screen-sharing — can also be purchased on top of any of the plans for either $40 more for Basic or Deluxe, or $60 for Premium or Self-Employed. Tax Identity Shield — proactive protection against tax identity theft — can be added to any plan for another $20.

Recommended Reading: Where’s My Tax Credit

Upload Tax Documents To Speed Up The Process

H& R Block is one of the easiest online filing software packages. It allows users to upload tons of forms including 1099-NEC, 1099-MISC, 1099-INT, W-2 forms, and much more. If the form is standard, you can upload it in H& R Block. Users can even snap pictures of their forms and upload them using H& R Blocks app. When they are ready to file, the software will glean what it can from the photos and automatically fill in the details.

How Does H& r Block Stack Up To The Competition

H& R Block has an impressive set of functionalities available through its free pricing tier. It frequently makes the list a top choice for people seeking free filing.The Deluxe Tier is H& R Blocks worst value. Low-cost or free software can easily help filers itemize deductions and claim straightforward credits.Compared to H& R Blocks competition, the Premium tier is the best value for a paid tier. It supports rental properties, basic self-employment income and expenses, and all stock and crypto activity.Users who dont need H& R Blocks robust functionality may find that FreeTaxUSA or TaxSlayer offers the necessary functionality at lower costs.

H& R Block typically prices itself near the top end of the market and the current prices are no exception. Filers looking for a deal on H& R Block should lock in prices in early January of 2022 to get the lowest possible rates. Plus, if you use this link, you can get 20% off.

| Header |

|---|

| READ REVIEW |

Also Check: How To Calculate The Sales Tax

Is It Worth It

For those who qualify for free filing, H& R Block Online deserves to be on the shortlist. It is a premium software, but the free offering is expansive. Additionally, the Premium edition of the software could offer a good value for investors and gig workers.However, users considering the Deluxe Tier should think carefully before paying the price. Deluxe users may find a better by considering TaxSlayer Classic or FreeTaxUSA. These tools may also be a good alternative for self-employed people who dont have depreciating assets in their business.Landlords and others with depreciating assets should also carefully consider whether H& R Block is the right tool to get the job done. TurboTax has a superior user experience for rental property owners which is important given the complexity of depreciation.

How Are H& r Block’s Software Downloads Different From Its Online Service

H& R Block also offers downloadable and CD versions of its software, broken down again into four tiers of services with similar limitations. The main differences between the downloaded software and the online service are the cost and the lack of a free state tax filing at the lowest level.

Whereas the online tax preparation software breaks down the levels into Free Online , Deluxe , Premium and Self-Employed , the downloadable versions are slightly different: Basic for $20 Deluxe + State for $45 Premium for $65 and Premium & Business for $80. H& R Block will also include a CD backup of the software for an additional $10.

For the downloads, a Basic plan at $20 is similar to the Free Online plan in terms of income and deductions, but unlike Free Online, it does not allow a free state tax filing.

The downloads for the two middle plans, Deluxe + State and Premium, are virtually equivalent to their counterparts online, Deluxe and Premium, except for the price.

It’s worth noting that alternative online sellers may offer the H& R Block downloads at cheaper prices than the tax provider itself. As of Feb. 4, Amazon was selling H& R Block Basic for $15, the H& R Block Deluxe + State edition for $30, the H& R Block Premium edition for $50, and the H& R Block Premium & Business edition for $55.

You May Like: What Is The Sales Tax

See What H& r Block Free Online Has To Offer

Take a look at the following features of H& R Block Free Online.

1 More forms for free

H& R Block Free Online includes many popular forms for free in fact, we let you file more forms for free than TurboTax Free Edition.

For example, students who want to claim the student loan interest deduction might find H& R Block Free Online the best free tax preparation vs. TurboTax Free Edition, because this deduction isnt covered in TurboTax Free Edition. Read more about how TurboTax Free Edition and H& R Block Free Online tax filing stack up.

2 Easy document uploading, including W-2 photo capture

Uploading important tax documents has never been swifter at Block. Send a picture of your W-2, and well put all your information where it needs to be so you can start your free tax preparation instead of spending time filling out each item, line by line.

3 You could switch in as little as two clicks

Its simple to switch. If you used the other guys before, uploading last years return is no problem. Simply import your return from TurboTax, TaxAct, Credit Karma or any other tax preparation service and youre set.

4 Tax guidance and support

With H& R Block Free Online, well make sure youre well informed and confident every step of the way, with answers to commonly asked questions and tips for hundreds of credits and deductions.

5 Refund results in real time

6 A guaranteed accurate tax return

Simplicity, transparency and a brand that stands behind its work. What else would you want?