Premium: Best For Investors Landlords Or Those Who Sold Cryptocurrency In 2021

The Premium plan costs $50 for your federal return plus $37 for each state return.

The third tier of H& R Block tax plan options adds several layers of tax services for those with more complicated tax situations. If you earned money from a rental property or have capital gains from the sale of stock, a house or other investments, you’ll need to pay for the H& R Block Premium plan.

Likewise, if you gained or lost money from the sale of cryptocurrency, you’ll need to use the Premium plan.

The cost for virtual professional help, including screen-sharing via Online Assist, goes up to $60 for the Premium plan. The Worry-Free Audit Support and Tax Identity Shield services are still available for $20 a piece.

What Is The H& r Block Emerald Card

H& R Blocks Emerald Card is a prepaid debit card to receive the direct deposit of your tax refund. The debit Mastercard can be reloaded throughout the year via direct deposit , using the MyBlock mobile app, transferring money from a linked account, or by adding cash at any participating retail location. You can apply whether you complete your taxes online with H& R Block or in person. Learn more about the H& R Block Emerald Card.

How Does Tax Software Help Small Businesses

Online tax software can help small businesses complete their tax returns quickly. Most of the software is easy to use, provides step-by-step guidance and offers professional tax help. Since you wont need extensive tax knowledge to use tax preparation software, it may be a good option for small business owners who want to complete their tax returns themselves.

Don’t Miss: How To Check On Status Of Tax Refund

Monitoring A Mobile User Base

No DIY app can exist these days without a mobile component, and although H& R Block Canadas mobile tax app is still in its infancy, the company is already using New Relic Mobile to monitor it. Says Falkenberg, Im not a developer, but I wrote most of the code for the mobile app myself, and with a little help from New Relic Support, I was able to plug in New Relic Mobile and see what was going on with the app.

In addition to monitoring internal builds and simulator builds, and accessing back traces for errors that have crept in during the apps development, Falkenberg and team are looking forward to using New Relic Mobile to collect and analyze all kinds of metrics around mobile, including what devices and OS versions its customers are employing, where users are dropping off the application, conversion statistics, and moreand rolling all of these metrics into a single Insights dashboard.

What Do You Get With H& r Block

- Easy tax form import and upload. This is one of H& R Block’s best time-saving features. In a matter of seconds, you can upload a PDF version of your tax form or import it from your employer, bank, or investment company.

- Mobile version. Work on your taxes on the mobile or web versions, or switch back and forth.

- Step-by-step guidance. This is something H& R Block excels at. Any time you’re required to answer a question or provide a number, one click will populate a side-bar with a helpful explainer that breaks down, in layman’s terms, what it means.

- Option to upgrade for live support. Pay extra and you can consult a tax expert, or hand off your documents to a professional to prep everything for you.

- Multiple refund options. You can get your federal refund deposited into your bank account, sent as a check, or loaded onto a prepaid debit card. You can also use your refund to buy an Amazon gift card in increments of $100 and H& R Block will add on a 3.5% bonus. This is probably only worth doing if you have a large refund, otherwise the bonus is negligible.

- Tax return storage. H& R Block will store your finished tax returns in your account for up to six years.

- Accuracy guarantee. H& R Block will pay IRS penalties and fees related to calculation errors up to $10,000. If it’s determined that you entered information improperly, the guarantee does not apply.

Unless you qualify for the free package, you’ll pay at least $49.99 plus an additional $36.99 per state return.

Recommended Reading: What Age Do You Start Paying Tax

Premium & Business Edition

H& R Block also offers a Premium & Business online edition to serve the more than 60 million freelancers, independent contractors, and other self-employed taxpayers, including the estimated over three in 10 Americans who rely on gig work for their primary income. Among its features are an import of Uber driver tax information and full support for common tax situations faced by self-employed individuals. This product costs $115 including a state return, plus an additional $45 for each additional state tax return. Like the Premium version, the Premium & Business edition also includes support for rental property owners.

Is H& r Block Online Assist Worth The Cost

Online Assist is an extra service that can be added on to any of the H& R Block tax preparation plans. It costs $40 for Free and Deluxe plans, and adds $60 to the price of Premium and Self-Employed Plans.

The service provides virtual tax assistance from a professional online. It lets you share your screen so the pro can see exactly what’s going on in order to solve your problem.

Most taxpayers with common tax situations won’t need online assistance. However, whether or not Online Assist is right for you depends on your comfort level with doing your taxes alone and the nature of your own specific tax situation.

You can always add Online Assist at any time during the tax filing process. If you run into questions you can’t answer yourself when running the H& R Block software, you might consider adding Online Assist to your plan.

Read Also: Why Am I Paying Medicare Tax

Diy Tax Options For Expats

Last tax season, H& R Block debuted a package designed specifically for US citizens living abroad.

A federal return covering simple employment income costs $99, and a federal return covering investment and self-employment income runs $149. State returns are an additional $99 each. Reporting of non-US bank and financial accounts is an extra $49.

There’s also an option to file with a tax advisor, starting at $199 per federal return.

H& R Block may be most recognized for its offices scattered throughout the US, but the company offers online filing and downloadable computer software, too. If you choose an online package, you can work on your taxes with the mobile app for Android and iOS devices.

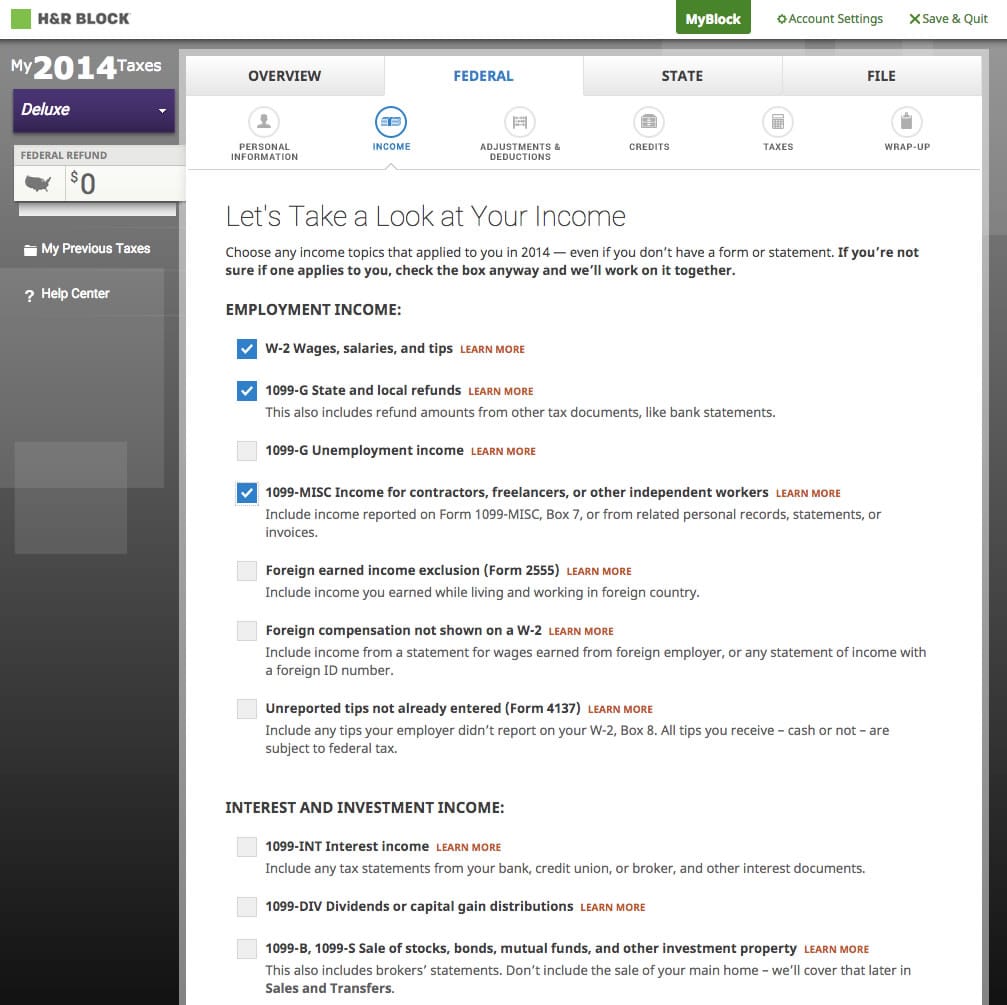

H& R Block caters to the vast majority of tax filers with a modern and easy-to-navigate interface. Like other tax-preparation services, the platform walks users through a series of questions about their household, income, and opportunities for deductions and .

In addition to answering these questions, you’ll need to add information from your employer, other income sources, and 1099, 1098, W-2, and other tax forms that may show up in your mailbox or inbox.

If you’re concerned about making mistakes, missing deductions, or getting lost amidst the tax forms, H& R Block can connect you with a professional in its network for an additional fee.

What Are H& r Block’s Different Products

H& R Block offers four different online products: Free Online, Deluxe, Premium and Self-Employed, which range from $0 to $85. The decision on which is best for you depends mostly on the deductions and tax credits you want to claim.

Free in-person audit support is offered with all H& R Block tax plans, and enhanced “Worry-Free Audit Support,” including IRS communication and in-person audit representation, can be added to any plan for $20. H& R Block’s Online Assist feature — additional virtual support with live assistance and screen-sharing — can also be purchased on top of any of the plans for either $40 more for Basic or Deluxe, or $60 for Premium or Self-Employed. Tax Identity Shield — proactive protection against tax identity theft — can be added to any plan for another $20.

Also Check: How To Check If Your Taxes Were Filed

Free Online: Best For Students And Most W

The Free Online plan, as the name suggests, costs $0 for filing federal taxes and $0 for one state return. If you made money in multiple states, you’ll need to pay $37 for each additional state return.

H& R Block’s free tax plan works best for W-2 employees with simple tax returns, but it’s also great for students as it allows for both education tax credits and deductions for student loans, tuition and fees.

The free plan includes coverage of 1040 Schedule 1, which allows reporting many more types of income like gambling winnings, alimony and stock options. It also allows for income adjustments such as educator expenses and IRA or student-loan interest deductions.

While the free plan also covers 1040 Schedule 3 — “Additional Credits and Payments” — it doesn’t include most of the supplemental forms needed to claim the many credits, such as the increased child care credit, the retired saver’s credit and the electric vehicle credit, on that schedule.

H& R Block Free Online does include Form 8863 for education credits, including the Lifetime Learning Credit and American Opportunity Credit, which again bolsters its appeal for students.

While the paid versions of H& R Block include access to phone or web chat support, the Free Online version does not. You can buy support: Online Assist , Worry-Free Audit Support or Tax Identity Shield .

Good For Self Employed

Pros:

A variety of formats for downloading and saving files for future use. Quick and straightforward to use with updates when they are released. Really like final audit checks and ability to print forms.

Cons:

The price! They are tons of different prices and offers. Also do not like how difficult it is to talk to customer servicethats an extra cost. Also the file extension is difficult to open without software. Make sure you save a pdf!

John

Read Also: Why Is Tax Day April 18

Extra Fees Will Apply If

- You need state filing. If you live in one of the majority of states that require you to do state income taxes as well, you’ll have to pay an additional $36.99 per state. If you lived or worked in more than one state, you may have to pay for multiple state returns.

- You upgrade to Online Assist. Nearly identical to the online filing options mentioned above, but you can chat instantly and share your screen with a tax expert. The all-in cost is between $69.99 and $194.99 for a federal return.

- You upgrade to full-service preparation: Hand off your tax documents to a professional, either in a physical office or virtually, who will prepare and file your return. These services start at $69.99 for a federal return.

- You pay H& R Block from your refund. If you’re expecting a tax refund, H& R Block will ask if you want to use part of it to pay for its tax prep services. It sounds more convenient than pulling out a debit or credit card on the spot, but beware: a $39 processing fee applies.

Why is it so hard to predict my costs? It’s not as simple as choosing a filing package based on the type of income you earn. H& R Block also considers which deductions you might qualify for, and some of these have nothing to do with how you earn money. Assume you’ll pay on the higher end of the cost range so there are no unpleasant surprises when it’s time to check out.

Cost Of Diy Options And What They Cover

- Free Online: $0. Supports W-2 income, unemployment income, interest and dividend income, retirement distributions, the student loan interest deduction, the tuition and fees deduction, the child tax credit, and the earned income tax credit . You can’t itemize deductions, but that’s typical of a free version. Notably, H& R Block’s free version includes student deductions, while TurboTax’s does not.

- Deluxe Online: $49.99. Everything the free version includes, plus the mortgage interest deduction and health savings accounts, and you can itemize.

- Premium Online: $69.99. Supports everything in the Deluxe version, plus rental property income and freelance/contractor income below $5,000. You can also import mileage and other expenses from common tracking apps.

- Self-Employed Online: $109.99. The highest-tier online package offered by H& R Block. It’s ideal for self-employed people, including small business owners, partners, and contractors who earned more than $5,000.

Also Check: What Can I Write Off On My Taxes

Your Return Is Guaranteed

With the 100% Accuracy Guarantee, H& R Block promises that your return will be error-free. If there does happen to be a mistake in the softwares calculations that results in penalties from CRA or RQ, then H& R Block will reimburse you.

Additionally, the Maximum Refund Guarantee will ensure that if another software gives you a bigger refund, H& R Block will refund the price you paid for the competitions software.

Detailed Information For H& r Block

Company name: H& R Block Canada Inc.

Certified for the 2017 to 2021 tax years.

Available services:

- Auto-fill my return 2017 to 2021 tax years

- Express Notice of Assessment 2017 to 2021 tax years

- ReFILE 2018 to 2021 tax years

- T1135 2017 to 2021 tax years

Not supported for the 2017 to 2021 tax years:

- Form T1273 Statement A Harmonized AgriStability and AgriInvest Programs Information and Statement of Farming Activities for Individuals

- Form T1163 Statement A AgriStability and AgriInvest Programs Information and Statement of Farming Activities for Individuals

- Form T2203 Provincial and Territorial Taxes Multiple Jurisdictions

- Electronic transmission of Form T1134

- Amendment of the electronic transmission of Form T1135 2017 to 2019 tax years

Please note that this information was provided by the software developer. If you find discrepancies in the information provided, please contact the software developer directly. The links are provided for your convenience and are to be used at your own discretion

Also Check: How Much Will I Get Back In Taxes From Unemployment

How Much Does H& r Block Cost

Tax prep companies frequently offer discounts on products. The prices listed in this article do not include any discounts. Check the site »

The cost of filing with H& R Block is less than TurboTax, but more than TaxSlayer, TaxAct, or Credit Karma.

H& R Block offers four main ways to prepare and file taxes: do-it-yourself online packages, the option to add Online Assist , full service from a tax preparer, and downloadable computer software.

Each of these categories offers different price points, which are determined by which tax forms you need. With all versions except the computer software, you can prepare your return for free you only pay when it’s time to file.

|

$54.95 – $89.95, plus $19.95 to e-file |

Prices do not include any discounts.

Not sure which package is right for you? Go to H& R Block’s website, navigate to the online filing page , and click the “Help me choose” button. Complete the short questionnaire to see which option is best suited for your needs. If you realize you need to add other income or deductions later, you can upgrade to another product while preparing your return.

H& r Block: Get Your Refund Fast

Get your tax refund the day you file with an H& R Block Refund Advance loan. The IRS says that tax refunds are typically available in 21 days, but H& R Block doesnt think you should have to wait. Heres what you need to know:

- Get up to $3,500

- Money is available the day you file

- Refund Advance ends Feb. 28, 2022

- Have to e-file at an H& R Block office

- No interest, finance charges, or loan fees

- Wont affect your credit score

- Repay the loan when your tax refund comes in

Read Also: Sc State Tax Refund Status

Fantastic Service Quick Efficient Quality And Reassuring

This app is extremely user friendly. It walks you through literally every scenario. If you don’t understand something, you can click on a link below what you’re looking at for more information. If you still have questions there is another section of frequently asked questions. If you Still need assistance there is a chat available with many options, as well as chatting with a live person. Beyond that if you still have questions you’re able to email, message, chat with or speak with a live Professional Tax Return representative. The customer service is amazing, efficient, friendly, professional and prompt service.The price is affordable and fair. I saved a ton of time, money and stress by being able to use this app and self service but with the Peace of Mind knowing that not only the system looked over my work, but that it was double checked by a live human being. And I have the reassurance of knowing H& R Block has my back if any issues arise or if there’s any type of IRS audit. Just an overall exceptional service.

Taxes Haven’t Been Easier Until Now

Pros:

I personally do my taxes myself, it saves me time and money. The software is easy to use and helps me know what important documents I need to file my taxes. It also verifies that all my information I entered is correct. I am also able to check for updates and receive emails and text messages with my status. I am always in the loop of what is happening and I like that. I was able to download my taxes because I needed it for my daughters daycare scholarship.

Cons:

I do not see any issues with the software. It was easy for me to use. The only thing I could recommend is the layout of the software. It can be challenging to find what I need and to navigate to certain sections, but it is not a deal breaker.

Mona

Also Check: Who Does Taxes For Free