Adjust Your Tax Withholding

Once you know the total you’ll owe in federal taxes, the next step is figuring out how much you need to have withheld per pay period to reachbut not exceedthat target by Dec. 31.

Then, fill out a new W-4 form accordingly.

You dont have to wait for your employers human resources department to hand you a new W-4 form. You can .

Why Do I Owe Taxes If I Claim 0

When you start working for an employer, they need to know how much federal income tax to withhold from your paycheck. For this, you need to fill a W4 form, including your exemptions and allowances. In theory, the fewer allowances you claim, the less money you owe the IRS.

Sometimes, though, you may claim 0 allowances on your W4 but still owe taxes. Here, we will talk about why you owe taxes despite claiming 0 on the form.

What Do I Claim On My W

Most people have asked themselves, what do I claim on my W-4? in a moment of confusion. The good news is you no longer have to claim allowances on your W-4. However, you should continue to claim dependents here if you want, and this is especially important if you have children or are a guardian.

One thing to understand about filling out income tax forms and filing taxes in America is that the rules and regulations around everything can change yearly. Its essential to keep yourself up to date with changes by the federal government or within your state regarding W-4s and taxes!

If youve been working the same job for a while with little change in your life, you dont need to worry about filling out a new form. If your marital status has changed, youre working another job, or youve welcomed a new child into your home, these are all things you should revise.

Read Also: How Long Do Taxes Take To Process

How Does Tax Withholding Work

Most employers withhold a small portion of your paycheck and use that money to pay a slice of your tax obligation. This is known as tax withholding. Employers also withhold money to pay for Social Security and Medicare.

- Theyve classified you as an independent contractor

- Youre exempt from federal income taxes

- You have no federal tax obligation

You

Professional Associations Magazine Subscriptions And Trade Union Fees

As a part of your profession, you may be a member of an association the good news is, you can claim your subscriptions. If youre part of a trade union, your fees are also deductible.

Magazines can make a dent in your return, as can subscriptions to mags associated with your line of work. If youre an investor, financial publications and research services are claimable. Think ahead and prepay next years fees before June 30 and claim your deduction now.

Don’t Miss: How To File Unemployment Taxes

Understand Your Tax Situation

Even if you owe taxes this year, use it as a learning opportunity to understand your finances better for the future. Keep track of how much you earn, what methods you use to earn money, and how your life changes over time. Its also smart to stay on top of tax-related news so you know about major changes that might affect you. Of course, anytime youre in doubt about how much you owe or what your payment options may be, talk to a professional. Its the best way to protect yourself and keep the IRS happy.

Recommended Reading: Buying Tax Liens In California

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

If you adjusted your withholding part way through 2021, the IRS recommends that you check your withholding amounts again. Do so in early 2022, before filing your federal tax return, to ensure the right amount is being withheld.

Also Check: How To Pay Taxes Quarterly

The Number Of Allowances Meaning

When you claim an allowance on your taxes, you are telling the government that you are not qualified to pay that amount. If you claim zero allowances, that means you are having the most withheld from your paycheck for federal income tax.

If you didnât claim enough allowances, you overpaid in taxes and will get that amount back through a tax refund.

If you claim too many allowances, the IRS will tell you that you owe them more money. The more allowances you claim, the more money you will take home, but always being honest when making these claims is essential.

Instead of searching the internet for ânumber of allowances meaning,â read on to learn how much you should be claiming on your taxes.

What Is A W

An IRS W-4 tax form is a form an employer uses to determine how much federal income tax they need to withhold from an employee’s paycheck. This form includes the number of allowances and personal exemptions you will receive on your payday. You need to fill this form the day you join a company.

Your employer uses this W4 form until you fill a new one. You often need to fill a new W4 when your financial position changes. This form is important because it tells the accountant of the company how much your paycheck adds up to.

If you claim more allowances, your employer withholds a smaller amount from your paycheck. You then receive more money. However, this also means that you will not get a refund, and you may even owe some money to the IRS. Claiming few or no allowances means you will be eligible for a refund.

You can either hire a CPA to handle your taxes or do them yourself. Either way, knowledge of how a W4 form works is necessary.

Don’t Miss: Federal Taxes On Capital Gains

Will I Owe Money If I Claim 1

While claiming one allowance on your W-4 means your employer will take less money out of your paycheck for federal taxes, it does not impact how much taxes you’ll actually owe. Depending on your income and any deductions or credits that apply to you, you may receive a tax refund or have to pay a difference.

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2022 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $34,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $68,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct qualified charitable donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

Read Also: How To Check If Your Taxes Were Filed

Dont Count On That Tax Refund Yet Why It May Be Smaller This Year

- If youre banking on a tax refund, it may be smaller, or you may owe money this season, according to financial experts.

- The advance child tax credit, paused student loan payments and year-end mutual fund payouts may cause higher taxable income for 2021.

If you’re banking on a tax refund, it may be smaller, or you may owe money this season, according to financial experts.

Typically, you get a federal tax refund when you’ve paid or withheld more than the amount you owe, based on taxable income.

The IRS subtracts the greater of the standard or itemized deductions from adjusted gross income to reach taxable income, and there are a few reasons why it may be higher in 2021.

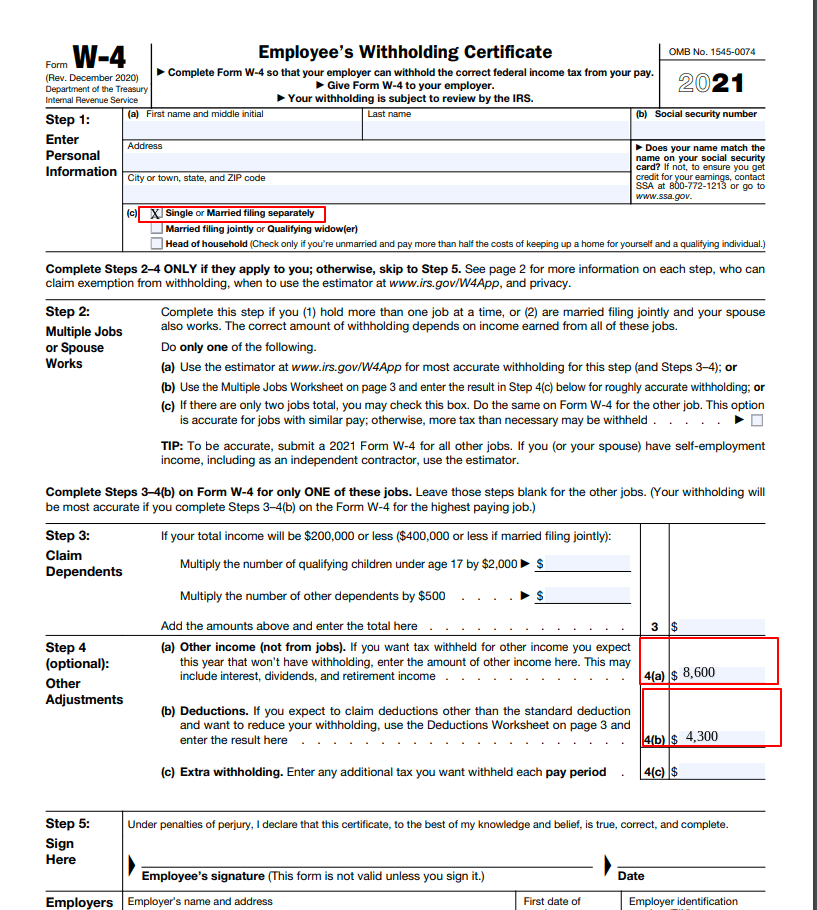

How Do I Fill Out My W4

Filling out a Form W4 is more than a little intimidating sometimes. But dont lose any sleep! Consult your local Liberty Tax® professional and they will be happy to assist you with your W4 and any other tax issues you may have. If youd like to handle it yourself, follow the step-by-step instructions below.

Step 1:

Provide your name, address and social security number. In addition, provide your marital status you expect to use when you file your 2020 federal tax return. This will determine the tax table/bracket used to figure your amount of withholding.

If youve recently gotten married or changed your name and havent updated that info with the Social Security Administration, you will need to update that in the Name Changes section.

If you are single, or if you are married but only one of you works, and you work at only one job at a time, you may skip Step 2.

Step 2:

If you have more than one job at the same time, or you are married filing jointly and you and your spouse both work, you have some extra things to consider. If you skip this Step 2, you will probably be under-withheld and could owe taxes when you file your return.

Step 3:

Multiply the number of qualifying children by $2,000 and enter the total on the W-4 and multiply the number of other dependents by $500

A $2,000 child tax credit is available for each qualifying child determined by the following seven factors:

Step 4:

Also Check: What Is The Property Tax In North Carolina

What If My Ctc Advance Payment Amount Was Wrong

Your CTC advance payments may have been too little or too much. Your advance payment amount could have been wrong because:

- The number of children in your household changed. You may have had a new baby in 2021 or your children were no longer living with you.

- Your income changed. Your income may have been lower or higher in 2021. Since advance payments were based on your 2019 or 2020 tax return, the payments may not have accurately reflected how much you currently made.

- Your marital status changed. If you got divorced in 2021 and you were claiming the children on your 2021 tax return , you may have missing all or some of the advance payments that you were eligible for.

- Garnishment. While your CTC advance payments were protected from tax debts, state and federal debts, and past-due child support, the advance payments were not protected from garnishment by your state, local government, and private creditors.

If you wanted to adjust your advanced payment amounts, you could have:

Why Do I Owe Taxes

If youre like many taxpayers, getting ready to file starts with a quick check with a tax calculator. You plug in your numbers and eagerly anticipate that final number. But when that last screen doesnt show a refund, you have to ask, why do I owe taxes? We get it. When you see you owe taxes, it can be somewhat of a shockespecially if you were planning on a nice refund. Well answer, why do I owe so much in taxes?. Then, well help outline what your next steps should be.

You May Like: Will Property Taxes Go Up In 2022

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

How Can I Maximize My Federal Withholding

Change Your Withholding

Recommended Reading: How To Check If Taxes Were Filed

They Have A Lot Of Influence: Ex

The IRS has started sending letters to around nine million households nationwide reminding Americans who have not yet filed their tax returns this year that they could be eligible for $1,400 stimulus checks or even $2,800 checks for married couples.

Americans who havent yet claimed the third installment of stimulus payments that were sent out by virtue of the $1.9 trillion American Rescue Plan can still do so if they file a 2021 tax return.

The benefit would be applied to those who have yet to file their returns that were due this past April.

The plan, one of the first major pieces of legislation passed by the Democrat-controlled Congress and signed into law by President Joe Biden, included rental assistance, tax rebates, vaccine distribution funds, and direct payments to Americans who were struggling due to the coronavirus pandemic.

The federal government under the Trump administration began sending direct checks to Americans in the early days of the coronavirus pandemic, when state governors began mandating lockdowns and business closures to mitigate the spread of the virus.

Households should check their mailboxes for letters from the IRS, according to The Washington Post.

Americans can claim the third stimulus check even if they didnt have an income last year though there are income caps.

Those with an adjusted gross income which is gross income minus certain adjustments of $75,000 or less are eligible to get the full $1,400.

How To Use A W

If your objective is to engineer your paycheck withholdings so that you end up with a $0 tax bill when you file your annual return, then the accuracy of your W-4 is crucial.

-

Use the correct tax-filing status. If you file as head of household and haven’t updated your W-4 for a few years, for example, you may want to consider filling out a new W-4 if you want the amount of taxes withheld from your pay to more accurately align with your tax liability.

-

Make sure your W-4 reflects your current family situation. If you had a baby or had a teenager turning 18 this year, your tax situation is changing and you may want to update your W-4.

-

Accurately estimate your other sources of income. Capital gains, interest on investments, rental properties and freelancing are just some of the many other sources of non-job income that might be taxable and worth updating on line 4 of your W-4.

-

Accurately estimate your deductions. The W-4 assumes you’re taking the standard deduction when you file your tax return. If you plan to itemize , you’ll want to estimate those extra deductions and change what’s on line 4.

-

Take advantage of the line for extra withholding. If you want to have a specific number of extra dollars withheld from each check for taxes, you can put that on line 4.

Need more help? There are worksheets in the Form W-4 instructions to help you estimate certain tax deductions you might have coming. The IRSs W-4 estimator or NerdWallet’s tax calculator can also help.

Don’t Miss: Short-term Rental Tax Loophole

Note If You Are Exempt From Withholding Taxes

Being exempt means your employer wont withhold federal income tax from your pay. Generally, the only way you can be exempt from withholding is if two things are true:

You got a refund of all your federal income tax withheld last year because you had no tax liability, and

You expect the same thing to happen this year.

If you are exempt from withholding, write exempt in the space below step 4. You still need to complete steps 1 and 5. Also, youll need to submit a new W-4 every year if you plan to keep claiming exemption from withholding.

How Many Allowances Should I Claim On Form W

Youre about to start a new job. But before you can get to work, your new employer hands you a Federal W 4 Withholding Allowance Certificate, filling you with the dread of completing yet another tax form you dont quite understand.

Dont worry were here to help! Below, we explain what W4 allowances are, what to claim on your W4 and how best to fill out that form and get your new career started on the right foot.

Read Also: Look Up State Tax Id Number