How To Use Our Free Us Import Duty Calculator

Its easy to estimate duties on this import duty calculator.

- Importing from field: Select the country of import from the drop-down list.

- Import to field: This import duty calculator only applies to imports into the US, but it will soon be extended to include the UK and other EU countries.

- I am importing field: Type in one or two words that you feel most accurately hones in on your product. If more than one HS code is related to that word, a drop-down list will appear. Simply browse and select the HS code description that best fits your product.

Alternatively, select the Browse HS codes link and navigate down through HS classification system.

The import duty calculator will automatically calculate whether duty is payable for that HS code. It will either return Estimated to be exempt from duties or a customs duty rate . If it returns a customs duty rate, the Estimate Duties button will become active. Input shipment weight and click on the button. The import duty calculator will calculate and return an estimate for the total customs duty payable for the shipment.

Please note, that these are estimates only. The customs authority determines the rate of duty applied to a shipment. For professional advice, consult a qualified customs broker.

How To Pay The Import Tax

When the shipment arrives, the importer needs to be present there with the relevant papers of the shipment as quickly he can. The papers will be handed over to the United States Customs and Border Control team. From there the shipment needs to be moved by the importer within 15days.

If the importer fails to do so, then it will be moved to the storage house of the customs and the importer needs to pay the storage cost as well. If the shipment stays in storage for 6 months, the shipment will be sold at auction.

To clear up the fees and take the shipment, the importer needs the following papers:

How Are Duty Rates Determined

Determining duty rates is not even close to easy. It depends on a number of factors set by the customs authority. The same goes for custom fees from China to the USA.

In the case of determining duty rates, Harmonized Tariff System determines duty rates for every possible item. It is like a reference system, which you can use to determine the duty rates of any particular product. Now lets come to how the rate is determined.

The whole process takes only two steps, though both of them are quite challenging. Firstly, the product needs to be classified according to its type. Classification specialists need to know the details of the product, like its origin, the different parts it includes, and so on.

The country of origin of the material used in that product is also to be kept in mind. That is because while some countries offer a tax-free supply of some specific product, other countries dont. Therefore, the country of origin is to be taken into consideration as well.

You can get an approximate idea of the products duty rate from the US International Trade Commission-Tariff Database. However, the duty rate will be closer to the actual rate, the more accurate information you provide about the details of the product.

And based on the variations and some points that you might miss, the actual import duty rate will vary a little. Nevertheless, CBP makes the final call about the import rate, not the importer.

You May Like: How To Avoid Paying Taxes On Crypto

Whats Hs Code And How To Check It

Now, you are going to learn what H.S. code is and how to check it.

What is H.S. code?

H.S. code stands for Harmonized System Code. It is a multipurpose global product nomenclature created by WCO . It is used to find the category of products that you are importing.

How to check H.S. code?

To check the H.S. code of the product, you have to go to the official website of HTS and write the query in the search box. Then you will get the results.

It consists of the following structure:

- Six digit identification code

- Each chapter has 21 sections

- Arranged in a logical structure

- Well-defined rules for uniform classification

How To Pay The Import Tax When Is A Customs Bond Required

The import tax will be collected by the U.S Customs and Border Protection . Given the complexity of import clearance process, most of the time, you as the importer can buy the service of a local customs broker to help you prepare all the documents needed to declare the goods upon their arrival.

CBP also requires that the importer must post a customs bond if you are importing merchandise into the United States, for commercial purposes that are valued over $2,500, or a commodity subject to other federal agencies requirements .

A customs bond, sometimes also called US surety bond, assures CBP that the importer will fulfill any financial responsibilities for customs duties, penalties, and other obligations.

The easiest way to obtain a customs bond is through a customs broker or an international freight forwarder.

However, if you import goods subject to FDAs requirements and regulations, you need to register your importer information on the FDA website, in such a situation, you must purchase a customs bond to prove that you have the qualification needed to import those goods. If you use a freight forwarder, the U.S customs will not accept the forwarders identity for the imports.

Under DDP terms, your supplier will be responsible for import clearance and pay for all the import duties and tax.

Recommended Reading: Is Auto Insurance Tax Deductible

Customs Clearance Procedures In The United States

US Customs Clearance Process and Required Documents.

A: After receiving the ARRIVAL NOTICE, the customs broker must have the documents required by the customs to be able to arrive at the port or arrive at the inland station within 5 days . Apply to customs for customs clearance. Customs usually will decide whether to release or not within 48 hours. Air cargo will be notified within 24 hours. before the arrival of the goods, but will only show the results after ARRIVAL IT.

There are two ways to declare to the customs.

1. The first one is an online declaration. The customs broker enters the contents that the customs need to know, into the US Customs Network , including what kind of goods and materials, value, number of pieces, bill of lading and container number, and extracts terminal information, and then send to the customs. If the customs release, you will get a notice from ABI. Most brokers are now used to online customs declaration. This method is quickly and usually, you will be notified by the ABI system within 48 hours, whether it is released or needs further inspection.

B: Documents required for customs declaration:

BILL OF LADING .

COMMERCIAL INVOICE.

PACKING LIST.

ARRIVAL NOTICE.

Ams Ic And Vssl Arrival

VSSL ARRIVAL: Notify Customs the day the ship arrives at the port of destination. This is based on an actual port of arrival and does not count the situation at the previous port of arrival.

AMS IC: After customs clearance, the AMS system will automatically display clearance information, indicating customs clearance. Almost all goods destined for the port can be declared before the arrival of the ship and the customs clearance results can be displayed. While many inland goods can be used for PRE-CLEAR, freight companies need to know if they will be released on arrival. After AMS, many NVOCCs forgot about ARRIVALI.T, which resulted in the goods not being released after customs clearance.

Read Also: How To Pay My Tax Online

Chapter : How Much Should I Pay For Customs Duties

Import duty from China to USA depends on several factors. The type of products, number of products, and prices also contribute to the overall price of the import duty from China to USA.Do you want to know how much import duty you need to pay from China to USA? If yes, no problem at all. I can help you figure this challenge quite comfortably.To check the import tax from China to the USA for every item, consider the HS code as a top choice. Every product has a different import duty from China to USA. HS code helps determine it effectively.However, here is the China import tax calculator.

Dropshipping Import Tax From China

Dropshipping is another popular method today. Nowadays, most retailers are drop shippers. Do you know, why? Because of numerous advantages.So, what exactly dropshipping is?It is a method in which retailers directly connect the sales channels with the manufacturers channels. In simple words, it is supply chain management. The retailers might receive orders and inform the manufacturers to fulfill the order. Either by postal services or third-party shipments, the order is fulfilled.Retailers dont have to hire warehouse services. It keeps them away from unnecessary expenses.So, customs duties apply to it?No. You dont have to pay the customs duties. Only income tax or sales tax applies.

Also Check: How To Report Coinbase On Taxes

Purchase Of Medicinal Products By Distance Selling

For medicinal products, there is a prohibition on purchase by distance selling on the basis of the Austrian Medicinal Products Import Act. This means that private individuals in particular are prohibited from ordering medicinal products via the internet or other means of long-distance communication such as telephone, teleshopping, email and the like. This applies both to purchases from non-EU states and to purchases from EU states.

Medicinal products are not only those available in Austrian pharmacies, but in particular also the following:

- herbal medicinal preparations based on one or more active substances produced from a plant or parts of plants, e.g. by drying, grinding, extraction or purification

- homoeopathic medicinal preparations

- vitamin or mineral preparations based on vitamins or minerals, including trace elements, used for the treatment or prevention of specific diseases, conditions or their symptoms. Such preparations often referred to as dietary supplements generally contain at least three times more vitamins or minerals than the normally recommended daily intake

The following are exempted from the prohibition on the purchase of pharmaceutical products at a distance:

- Medicinal products authorised in Austria

- Available not only on prescription , which are obtained

- at a quantity conforming to normal personal needs

- from an EEA-contracting party

- from a pharmacy authorised to dispatch them there.

When For Free Import Duty From China To The Us

suppose Im getting a customized sample from the supplier to the US with a value of $500. Do I need to pay for Duty?

The answer is: NO

Because the declared value is less than $800, the Duty is free. If your commercial invoice value is over $800, you need to pay for the Duty.

To determine your duty rate, you need to know your HTS code which Im gonna show you how to do an HTS code lookup.

Recommended Reading: Irs Estimated Tax Payment Dates

Import Duty As Harbor Maintenance Fee From China To Us

Harbor Maintenance Fee collected if the goods imported by sea. In late 80s the HMF was imposed on the importers. It is the maintenance cost of the terminals and also containers in the USA.

The HMF is currently 0.125% of the imported cargo. However, it does not affect your import duties because it is a minor amount.

What Is Customs Duty

Youll need to pay customs duty on any goods you move across the US border from China, though goods from some countries are exempt due to different international trade agreements. The United States Customs and Border Protection enforces customs rules.

Customs duties vary by country of origin and type of product. You’ll need to know the Harmonised Tariff Schedule or HTS code to calculate the exact rate due. CBP uses extended version of international HS codes Harmonized Tariff Schedule of the United States Annotated .

The minimum threshold for import tax is $800. Goods valued below that are not subject to duty.

You May Like: What Do You Need To Do Your Taxes

The Difference Between The Hts Or Hs

HTS or HS, most people are confused by this.

Once you know the difference between the HTS or HS, you will never ask this question. Why can I not find my suppliers code?

Here is the difference.

HS code stands for harmonized system code.

HTS code stands for harmonized Tariff Schedule code.

here is the specific difference:

When we talk about the harmonized system code, were talking about a six digits code that is used by 200 countries, 98% of the world trade, and this harmonized system code is admitted by the World Customs Organization.

When we talk about the HTS code, this is regulated by the US International Trade Commission ITC. As you can imagine, we are one of the 200 countries that participated in the harmonized system. Our first six digits in the HTS code are the same as the HS code.

However, the last 4 digits are country-specific. This is why your 10 digital HTS code could be different from the ten digits that your Chinese suppliers give it to you.

Lets take a look at an example:

for this beautiful piece of the hand-made leather bag.

The first six digits are 4 2 0 2 2 1. These six digits are harmonized system code, whether you are in China United States, Canada, Australia.

These first six digits are harmonized. They are the same. the last four digits 0 0 1 0 are country-specific.

Altogether, 10 digits we call this HTS code.

What Are The Goods Imports From China To Usa

China exports mainly technology to the US, which alone accounts for 50.3%. Also, in this case, broadcasting equipment, which accounts for 14%, computers , office equipment components , and video displays . The textile sector as a whole accounts for 8.2%, metals 5%, plastics 4.2%. As a single item, toys , seats , and vehicle components can be reported.

Recommended Reading: Travel Trailer Tax Deduction 2021

Chapter : How To Avoid Import Duties From China To Us

It doesnt matter that you are buying from China a large or small number of items, form many people the import duty from China to US will be a great burden. They will try as many ways as possible to prevent or minimize tax during business purchases. Below are some of the most common approaches weve seen.

There are some conditions where there is some relief in paying import duty from China to US, which includes

Import Tax As Harbor Maintenance Fee From China To Us

It implies the products imported by sea. It was introduced first in the late 80s. As the name suggests, it is the fee of maintenance cost for the containers and terminals in the USA. Currently, the HMF is 0.125% of the imported cargo. As the amount is very low, it does not affect your import taxes much.

Also Check: Lee County Tax Collector Fort Myers

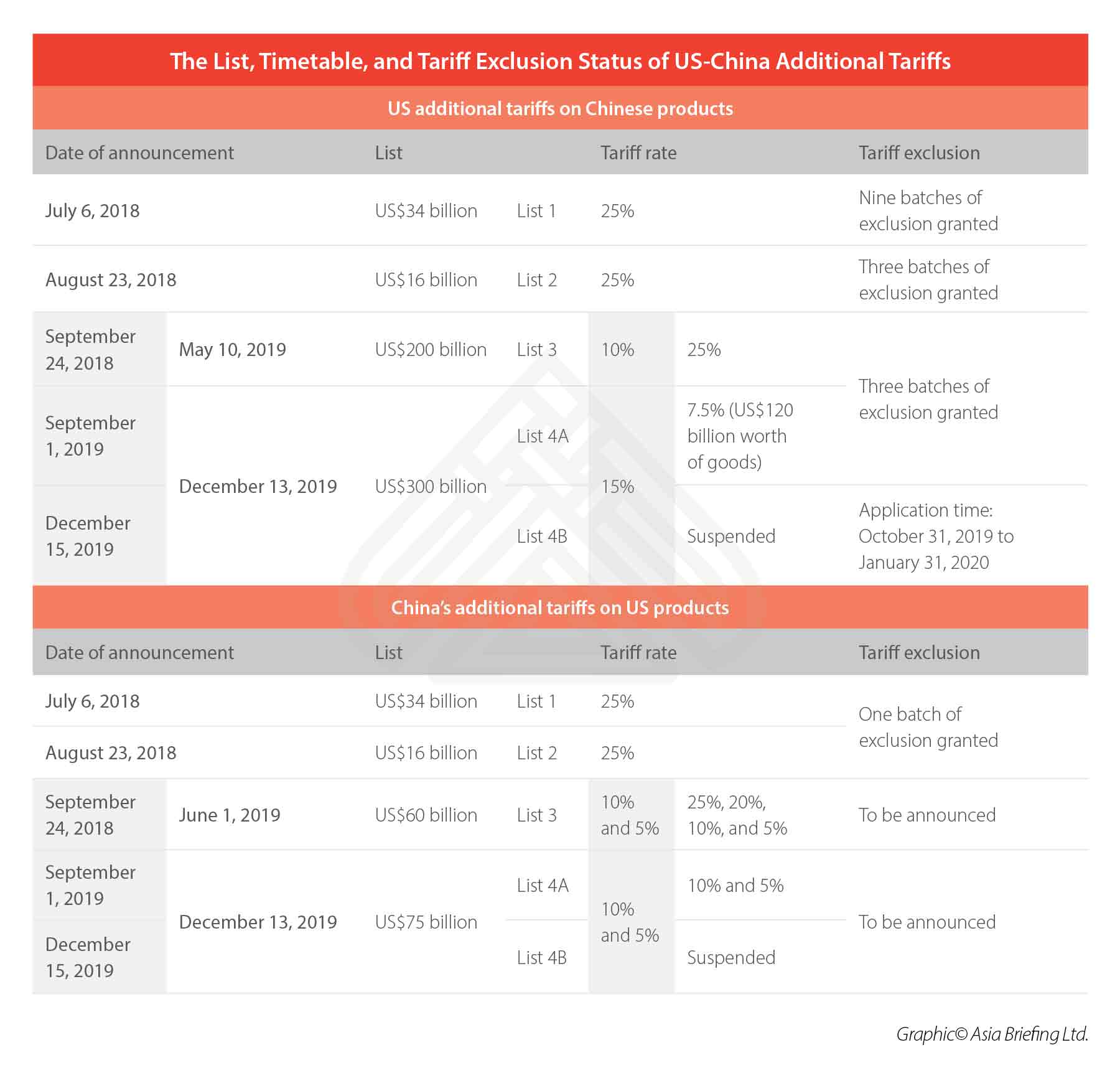

Tariff Calculation Step : Check If Your Product Is Hit With Additional Duty Rate

After the first two steps, youve already known how to check the rate on USITC. Now well show you how to find whether your product is charged with another 25% rate under the trade war.

For example, HS code 8408.10.00 is meant for Marine propulsion engines. Before the trade war, the general duty rate was 2.5%. However, as you can see below, there is a / followed, asking you to refer to sub-heading 9903.88.01. When you search 9903.88.01, youll see plus 25%.

It means that, for products of China, the current rate is the duty rate provided in the applicable subheading plus 25%, which comes to 27.5%, the new tariff rate.

The General Duty Rate

Plus Additional Tariff

In the article description, note 20 and note 20 are mentioned to help you get a better understanding. You can find a detailed explanation under Chapter Notes as shown below:

China Is The Largest Exporter To The Usa

It is with facts proven that China is one of the largest exporters of goods around the globe. It is known as the worlds factory in other countries.

China exports electronic machinery and equipment to the USA including tech machines like smartphones and tablets. It also exports furniture, cars, mineral fuels, bedding, gems, toys, plastics, copper, spices, and foods to the United States of America and thus, is widely recognized as the largest exporter to the USA and the world.

You May Like: Where Cani Get Tax Forms

Courier Shipping From China To The Usa

This method is highly effective for goods weighing between 0.5 and 500 kgs.

- Benefits of Courier Shipping

The courier company has its own customs broker who will get the clearance done. And will allow you to keep track of it in the same period.

So, you dont have to be concerned about clearing the imported goods and rapid delivery on a seasonally adjusted time.

- Choose from the most trusted International Express Companies

Although there is no shortage of international express organizations, you deserve the best. UPS, FedEx, and DHL are the most renowned ones for the concerned task.

DHL is pretty affordable, but it often gets late bringing goods to the US.

This is why UPS and FedEx are your go-to companies for shipping products from China to the USA quickly.

- Working with International Express Organizations

If you have decided to get your exports to China or goods imports shipped by any of the above-mentioned express companies, you need to take care of some things.

For starters, you have to pay the delivery cost to your supplier in China.

The supplier will be responsible for arranging the shipment. Once you successfully receive the ordered items, simply sign on the package.