State Tax Deadlines For Filing 2021 Individual Returns

Most states require individual taxpayers to file their state income taxes by Tax Day. Thats easy to remember because it is the same deadline as the federal tax deadline. However, there are several states that impose different deadlines and nine states that have no income tax. You can see the deadline for each state and the District of Columbia in the table below.

| 2022 State Income Tax Deadlines |

| State |

What Is The Penalty For Missing A Tax Deadline

Generally, if you miss the filing due date or fail to file by the tax extension deadline, the IRS may charge a failure-to-file penalty. The penalty is based on your unpaid taxes, and the IRS charges 5% of your taxes due for every month or partial month your tax return is not filed. However, the maximum amount the IRS can charge you is capped at 25% of any taxes owed.

Letâs say you owe $10,000 in taxes. The IRS will charge you $500 for every month you donât file your taxes. But the most the agency may charge you is $2,500.

Itâs important to know that if you expect a tax refund and have yet to file your tax return, the IRS wonât charge you a penalty for late filing. But if you expect you may owe penalties for filing your tax return late, you should consider speaking with a tax professional before filing. You may be responsible for penalties plus interest.

No Form 8606 To Verify Nondeductible Ira Contributions

Another common oversight is skipping Form 8606 for nondeductible IRA contributions, said Marianela Collado, a CFP and certified public accountant at Tobias Financial Advisors in Plantation, Florida.

Thats an issue because you may need this paperwork to verify contributions for so-called Roth conversions, a move that bypasses the income limits for Roth IRA deposits, allowing future tax-free growth. Without proof of the original deposits, you may get taxed on the same income twice.

You May Like: Property Taxes In Austin Texas

Can I Claim Expenses

Generally, you may claim tax deductions on expenses ‘wholly and exclusively’ incurred in earning your income. Find out more about deductions for the different types of expenses .

To simplify the tax filing for rental expenses, you may opt to claim the rental expenses based on 15% of the gross rental income derived from the tenanted residential property, instead of the actual amount of deductible expenses incurred. In addition to the 15%, you may claim a deduction on interest paid on the loan taken to purchase the property. Please use the Rental Calculator to decide if it is beneficial to claim 15% deemed rental expenses or to claim based on actual rental expenses incurred. Find out more about theSimplification of Claim of Rental Expenses for Individuals .

You may claim personal reliefs and rebates if you are a Singapore tax resident and have met the qualifying conditions for the respective reliefs/rebates in the preceding year .

Find out the reliefs that you may be able to claim:

When Is Irs Free File Available

IRS Free File, a partnership between the IRS and leading tax-software companies, traditionally becomes available in January. The program allows taxpayers under a certain income threshold to file electronically for free, using software provided by participating providers.

Free File typically begins before tax season officially starts, so the partner companies hold the completed returns until they can be filed electronically with the IRS.

Read Also: Sale Of Second Home Tax Treatment

When Can I Expect My Refund

Once the IRS begins accepting returns, the agency says taxpayers who file electronically and are due a refund can expect it within 21 days — if they choose direct deposit and there are no issues with their return. By law, the agency cannot issue refunds involving the Earned Income Tax Credit or Additional Child Tax Credit before mid-February, in order to help prevent fraudulent refunds from being issued.

Winter Storm Disaster Relief For Louisiana Oklahoma And Texas

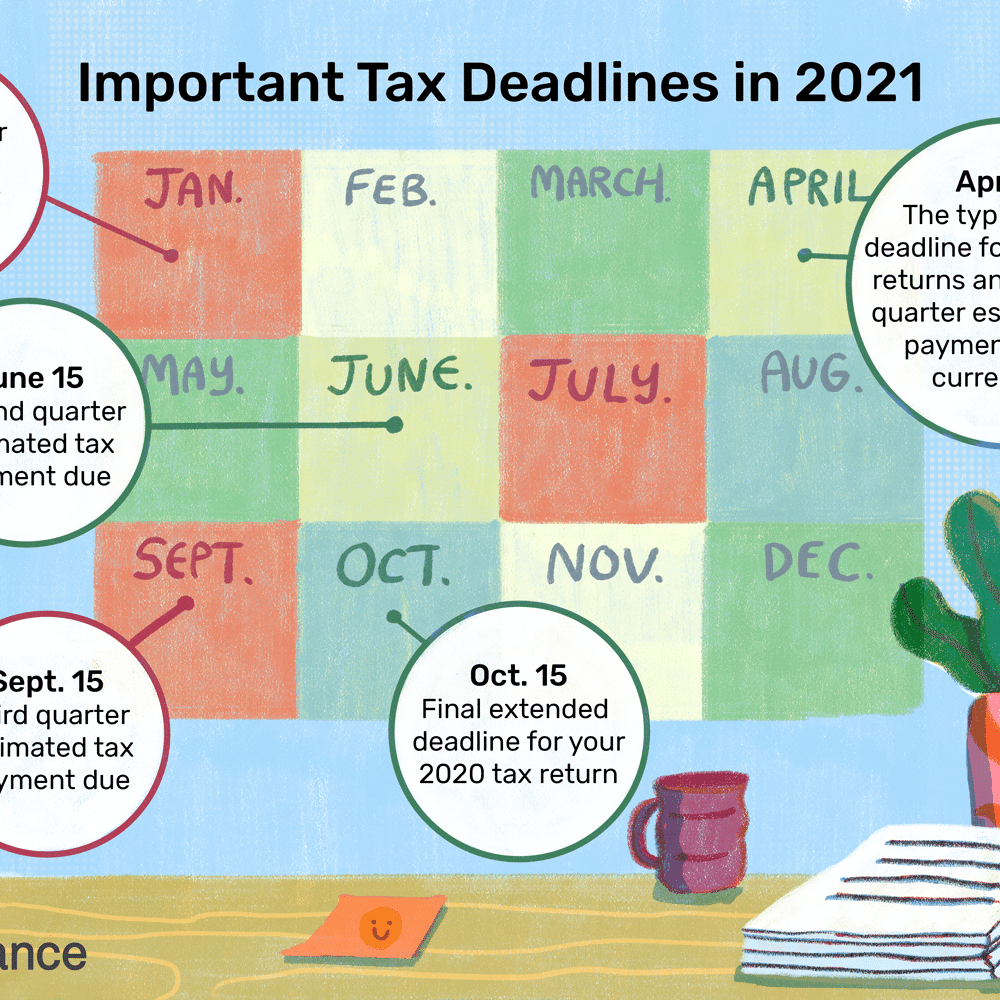

Earlier this year, following the disaster declarations issued by the Federal Emergency Management Agency , the IRS announced relief for victims of the February winter storms in Texas, Oklahoma and Louisiana. These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. This extension to May 17 does not affect the June deadline.

For more information about this disaster relief, visit the disaster relief page on IRS.gov.

You May Like: What’s The Deadline For Filing Taxes

What If You Miss A Deadline

You’ll probably be hit with a financial penalty, such as an extra interest charge, if you don’t submit a tax return and make any payment that is due by its appropriate deadline. There are two main penalties you may face:

- Failure-to-file penalty:This penalty for 1040 returns is 5% of the tax due per month as of tax year 2021, up to a cap of 25% overall, with additional fees piling up after 60 days.

- Failure-to-paypenalty: This penalty is 0.5% for each month, or part of a month, up to a maximum of 25%, of the amount of tax that remains unpaid from the due date of the return until the tax is paid in full.

If both are penalties are applied, the failure-to-file penalty will be reduced by the failure-to-pay penalty amount for that month. If you are on a payment plan, the failure-to-pay penalty is reduced to 0.25% per month during that payment plan schedule. If you don’t pay the taxes you owe within 10 days of receiving a notice from the IRS that says the agency intends to levy, then the failure-to-pay penalty is 1% per month.

Deadlines To Claim A Refund Or Credit

To qualify for a refund or credit, you must file a return within:

- three years from the original return due date , or

- two years from the payment date.

For amended returns, you must file a claim for refund or credit within:

- two years after you had to file an amended Utah return based on changes to your federal return made by the IRS, or

- three years from the original due date of the return of a loss year to report a net operating loss carryback.

This website is provided for general guidance only. It does not contain all tax laws or rules.

For security reasons, TAP and other e-services are not available in most countries outside the United States.Please contact us at 801-297-2200 or for more information.

Don’t Miss: Cheapest Place To Get Taxes Done

Tax Deadlines: January To March

- : Deadline for employees who earned more than $20 in tip income in December to report this income to their employers on Form 4070.

- :Deadline to pay the fourth-quarter estimated tax payment for tax year 2021.

- : Your employer has until Jan. 31 to send you your W-2 form reporting your 2021 earnings. Most 1099 forms must be sent to independent contractors by this date as well.

- :Deadline for employees who earned more than $20 in tip income in January to report this income to their employers. You can use Form 1070 to do so.

- : Deadline for financial institutions to mail out Form 1099-B relating to sales of stock, bonds, or mutual funds through a brokerage account, Form 1099-S relating to real estate transactions and Form 1099-MISC, unless the sender is reporting payments in boxes 8 or 10.

- : Deadline for businesses to mail Forms 1099 and 1096 to the IRS.

- : Deadline for farmers and fishermen to file individual income tax returns unless they paid 2021 estimated tax by Jan. 18, 2022.

- : Deadline for employees who earned more than $20 in tip income in February to report this income to their employers.

- :Deadline for corporate tax returns for tax year 2021, or to request an automatic six-month extension of time to file for corporations that use the calendar year as their tax year, and for filing partnership tax returns or to request an automatic six-month extension of time to file .

- : Deadline for businesses to e-file Forms 1099 and 1098 to the IRS, except Form 1099-NEC.

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterdays audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldnt have asked for more. I cannot thank you enough for your help.

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

IR-2021-59, March 17, 2021

Don’t Miss: How Long Does My Tax Return Take

Schedule Federal Tax Payments Electronically

Taxpayers can file now and schedule their federal tax payments up to the October 17 due date. They can pay online, by phone or with their mobile device and the IRS2Go app. When paying federal taxes electronically, taxpayers should remember:

- Electronic payment options are the optimal way to make a tax payment.

- They can pay when they file electronically using tax software online. If using a tax preparer, taxpayers should ask the preparer to make the tax payment through an electronic funds withdrawal from a bank account.

- Online Account and IRS Direct Pay allow taxpayers to pay online directly from a checking or savings account for free, and to schedule payments up to 365 days in advance. Taxpayers should be aware they will need to create an account to use Online Account services.

- Choices to pay with a credit card, debit card or digital wallet option are available through a payment processor. The payment processor, not the IRS, charges a fee for this service.

- The IRS2Go mobile app provides mobile-friendly payment options, including Direct Pay and debit or credit card payments.

- The Electronic Federal Tax Payment System is convenient, safe and easy. Choose to pay online or by phone, using the EFTPS Voice Response System. EFTPS payments must be scheduled by 8 p.m. ET at least one calendar day before the tax due date.

What Is The Last Day To File Taxes

The last day to file taxes for individual federal income tax returns is April 15, or as late as April 18 in the event Tax Day falls on a Saturday, Sunday or official holiday. Some state-level holidays can extend the tax deadline by one day further. You can request a six-month filing extension through filing Form 4868, making your last day to file individual income taxes October 17, 2022.

If you also file taxes for your small business as a partnership, LLC or S Corp, the last day to file taxes is March 15 unless it falls on a weekend or official holiday. If your business runs on a non-calendar tax year, your federal tax return is generally due by the 15th day of the third month following the end of the tax year.

Remember, with TurboTax, well ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Recommended Reading: Best Places To File Taxes

Irs Reminds Taxpayers Of Upcoming Filing Extension Deadline Free File Remains Open Until Nov 17

IR-2022-179, October 14, 2022

WASHINGTON The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that the deadline is Monday, October 17. IRS Free File remains open until November 17 for those who still need to file their 2021 tax returns. This includes those who qualify for the Child Tax Credit, Recovery Rebate Credit or Earned Income Tax Credit but haven’t yet filed a 2021 tax return to claim them.

IRS Free File is a public-private partnership between the IRS and tax preparation software industry leaders who provide their brand-name products for free. There are eight Free File products available in English and two in Spanish.

IRS Free File provides two ways for taxpayers to prepare and file their 2021 federal income tax return online for free:

- IRS Partner Sites. Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Individual taxpayers whose adjusted gross income is $73,000 or less qualify for any IRS Free File partner offers. Free File lets individuals electronically prepare and file their federal income tax online using guided tax preparation.

Irs Reminds Taxpayers Of May 17 Deadline For Individual Income Tax Returns: Extensions Other Help Available

IR-2021-114, May 17, 2021

WASHINGTON The Internal Revenue Service reminds taxpayers that the deadline for filing most individual income tax returns this year is May 17. The agency also wants taxpayers who have yet to file their tax returns to know that there are a variety of options available to help them.

IRS tax help is available 24 hours a day on IRS.gov. Whether filing a tax return, requesting an extension or making a payment, the IRS website can help last-minute filers on just about everything related to taxes.

The IRS encourages taxpayers to file electronically. Doing so, whether through e-file or IRS Free File, vastly reduces tax return errors as the tax software does the calculations, flags common errors and prompts taxpayers for missing information. Free File Fillable Forms means there is a free option for everyone.

Read Also: Can You Write Off Property Tax

Irs Free File Available January 13

IRS Free File will open January 13 when participating providers will accept completed returns and hold them until they can be filed electronically with the IRS. Many commercial tax preparation software companies and tax professionals will also be accepting and preparing tax returns before January 23 to submit the returns when the IRS systems open.

The IRS’s Free File program, available only at IRS.gov, allows taxpayers who made $73,000 or less in 2022 to file their taxes electronically for free using brand-name software provided by commercial tax filing companies. Free File Fillable forms, a part of this effort, is available to any income level and provides free electronic forms that people fill out and file themselves also at no cost.

Tips To Help People With The 2023 Tax Season

The IRS recommends several things for people to keep in mind for a smooth filing experience this year:

Have the right information before filing. The IRS encourages individuals to have all the information they need before filing a complete and accurate return. Organize and gather 2022 tax records including Social Security numbers, Individual Taxpayer Identification Numbers, Adoption Taxpayer Identification Numbers and this year’s Identity Protection Personal Identification Numbers valid for calendar year 2023.

Filing an accurate tax return can help taxpayers avoid delays or later IRS notices. Sometimes this means waiting to make sure individuals have accounted for all their income and the related documents. This is especially important for people who may receive one of the various Forms 1099 from banks or other payers reporting unemployment compensation, dividends, pension, annuity or retirement plan distributions.

People should also remember that most income is taxable, including unemployment income, interest received or money earned from the gig economy or digital assets. Individuals should make sure they report the correct amount on their tax return to avoid processing delays.

Visit IRS.gov first for questions. The IRS reminds people to visit IRS.gov first for common questions and also to check on the status of their refunds. IRS.gov has much of the same information that IRS phone assistors have.

You May Like: Irs Free Tax Filing 2022

Here Are A Few Resources On Irsgov To Help Last

- IRS Free File Available through October 17, IRS e-file is easy, safe and the most accurate way to file taxes. There are eight Free File products available in English and two in Spanish. Filing electronically can also help taxpayers determine their earned income tax credit, child and dependent care credit, and recovery rebate credit.

- Online Payments Taxpayers can pay online using IRS Direct Pay at no cost or use a debit card, credit card or Digital Wallet, which may be subject to a payment processing fee.

If theyre filing through tax software or a tax preparer, taxpayers can schedule a payment when filing.

Read Also: Free Irs Approved Tax Preparation Courses

Tax Deadlines: April To June

- :Deadline for employees who earned more than $20 in tip income in March to report this income to their employers.

- : Deadline for household employers who paid $2,300 or more in wages in 2021 to file Schedule H for Form 1040.

- : All individuals must file their 2021 personal tax returns, or Form 1040 or Form 1040-SR by this date. This is also the deadline to request an automatic extension for an extra six months to file your return, and for payment of any tax due.

- : Deadline for filing 2021 personal tax returns if you live in Maine or Massachusetts.

- May 10, 2022: Deadline for employees who earned more than $20 in tip income in April to report this income to their employers.

- : Deadline for employees who earned more than $20 in tip income in May to report this income to their employers.

- :Deadline for second-quarter estimated tax payments for the 2021 tax year.

- :Deadline for U.S. citizens living abroad to file individual tax returns or file Form 4868 for an automatic four-month extension.

Also Check: Are Taxes Taken Out Of Social Security