Example For A Return Beginning With An Alpha Character:

To find Form SS-4, Application for Employer Identification Number, choose the alpha S.

Find forms that begin with Alphas:C, S, W

Note: Some addresses may not match a particular instruction booklet or publication. This is due to changes being made after the publication was printed. This site will reflect the most current Where to File Addresses for use during Calendar Year 2022.

Irs Free File Now Accepting 2021 Tax Returns

COVID Tax Tip 2022-16, January 31, 2022

IRS Free File, available only through IRS.gov, is now accepting 2021 tax returns.

IRS Free File is available to any person or family with adjusted gross income of $73,000 or less in 2021. The fastest way to get a refund is by filing and accurate return electronically and selecting direct deposit. This year, there are eight Free File products in English and two in Spanish.

This program gives people an opportunity to file their taxes and claim the 2021 recovery rebate credit, the enhanced child tax credit, the earned income tax credit, and other credits. Taxpayers can also use Free File to claim their remaining child tax credit or any advance payments they did not receive in 2021. By law, the IRS cannot release earned income tax credit and additional child tax credit refunds until mid-February.

Additionally, IRS Free File users can use direct pay or electronic options to submit their tax payment if they owe a balance.

As an alternative, Free File Fillable Forms are electronic federal tax forms available to everyone, regardless of income. Only people who are knowledgeable and comfortable preparing their own tax return should use them.

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Also Check: Is Spousal Support Tax Deductible

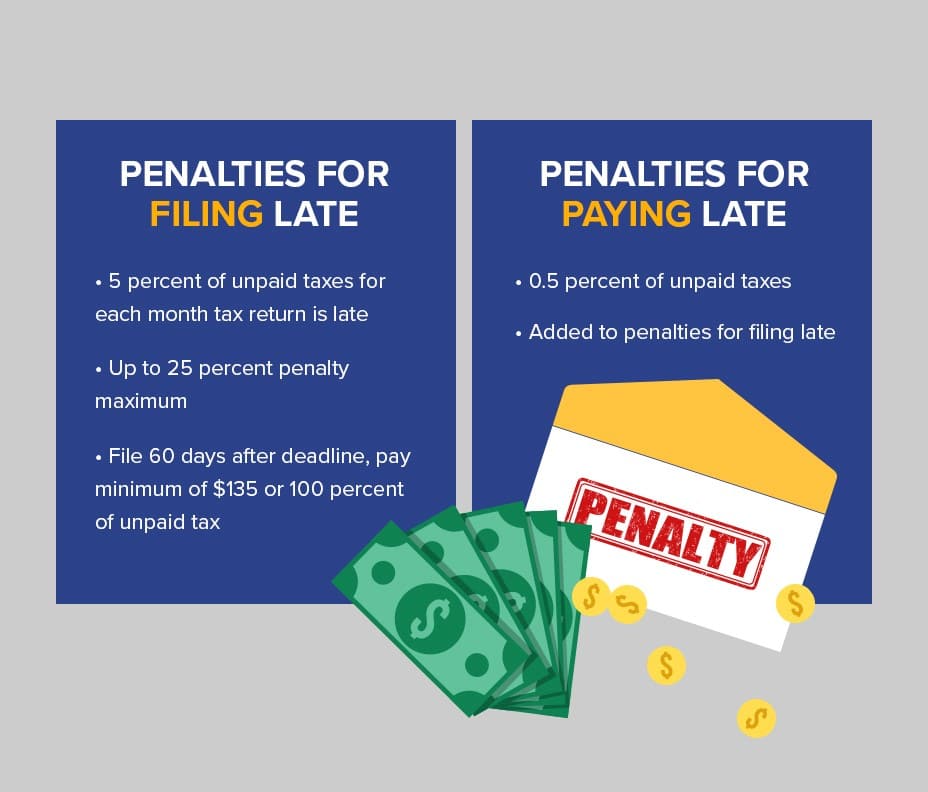

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

Alternatives To The Online Tool

If you want an IP PIN but cant successfully validate your identity through the Get an IP PIN tool, there are alternatives. Please note using an alternative method to the online tool takes longer for an IP PIN to be assigned to you.

Requesting in-person authentication for an IP PIN

If youre unable to verify your identity online or with the Form 15227 process or you are ineligible to file Form 15227, you may make an appointment for an in-person meeting at a local Taxpayer Assistance Center. Please bring one current government-issued picture identification document and another identification document to prove your identity. Once we verify your identity, you will receive your IP PIN via the U.S. Postal Service usually within three weeks. You will then receive your IP PIN annually through the mail.

Read Also: Montgomery County Texas Tax Office

Gathering 2022 Tax Documents

Gathering paperwork can be a hassle but the IRS suggests setting up a records system to keep your tax documents organized.

These 2022 documents include W-2 forms from employers, 1099 forms from banks or other payers, and 1099-K forms from third-party payment entities.

RELATED: Still missing your tax refund? The IRS will soon pay you 7% interest

The IRS says creating an online account on their site lets filers securely access their personal tax information. You can do this by logging in and verifying your name and address. The agency notes that people should notify them if their address has changed and contact the Social Security Administration if they have a legal name change to avoid a delay in processing a return.

How Do You File Taxes If You Own Multiple Businesses

Whether you own one or multiple businesses, the steps for calculating your business income are usually the same. When you own one business, you only need to perform these steps once. When you own multiple businesses, you need to do this for each business, typically resulting in separate business tax returns. That means if you own three businesses taxed as S corporations at the federal level, youll need to file three separate tax returns for them , create three sets of Schedule K-1s, and then report the K-1 information on your personal tax return.

TurboTax Tip: Keeping separate bank accounts, credit cards and accounting records for each business can help you stay organized during tax time. Having these accounts listed under each business name makes it easier to keep track of your business performance.

You May Like: Illinois State Sales Tax Rate 2021

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Do Businesses Pay Payroll Taxes

If you have a business that has employees, you’re responsible for paying various payroll taxes, including half of each employees Social Security and Medicare taxes and withholding taxes from your employees wages. You calculate the amount of payroll taxes due based on taxable wages paid to your employees. The amounts that a business pays and the amount that is withheld from employee paychecks is sent to the IRS on a semi-monthly, monthly, or quarterly schedule. The frequency that you have to send this money in is typically based on the amount of payroll taxes the business generates each payroll cycle.

You can use Publication 15 , Employers Tax Guide, Publication 15-A, Employers Supplemental Tax Guide, and Publication 15-T, Federal Income Tax Withholding Methods to determine the amount of withholding and the directions on depositing the withheld amounts and other employment taxes. Additionally, you will typically use Form 941, Employers Quarterly Federal Tax Return to report your payment of employment taxes. If you have employment tax liabilities of $1,000 or less, you can use the annual version of Form 941, Form 944. You can submit payments through the Electronic Federal Tax Payment System.

Also Check: Sales Tax Exempt Form Ny

Tax Credits Return To Pre

Those who received $3,600 per dependent in 2021 for the Child Tax Credit will, if eligible, get $2,000 for the 2022 tax year. For the EITC, eligible taxpayers with no children who received roughly $1,500 in 2021 will now only get $500 in 2022. The Child and Dependent Care Credit returns to a maximum of $2,100 in 2022 in lieu of $8,000 in 2021.

Get Ready Now To File Your 2022 Federal Income Tax Return

IR-2022-203, November 22, 2022

WASHINGTON The Internal Revenue Service today encouraged taxpayers to take simple steps before the end of the year to make filing their 2022 federal tax return easier. With a little advance preparation, a preview of tax changes and convenient online tools, taxpayers can approach the upcoming tax season with confidence.

Filers can visit the Get Ready webpage to find guidance on whats new and what to consider when filing a 2022 tax return. They can also find helpful information on organizing tax records and a list of online tools and resources.

You May Like: What Is The Federal Tax On Gasoline

This: Filing Taxes On Your Iphone

If a pictures worth a thousand words, a snapshot of your tax return information may be worth much more. The maker of Canadas No. 1-selling tax software, TurboTax, wants you to file your taxes in a snapshot, using just a T4 slip and an iPhone or iPod touch.

SnapTax, the innovative point-and-shoot tax preparation app from Intuit takes only minutes to prepare and file simple tax returns. Users can finish tax chores in record time, bringing that hoped-for refund much closer to their bank account.

Nothing comes close to SnapTax. You take a picture, review the forms and file. Just like TurboTax, the calculations are guaranteed accurate, said Jeff Cates, president of Intuit Canada. We know Canadians love their iPhones and iPod touches, and know theyre using them for just about everything these days. With SnapTax that now includes getting their maximum tax refund!

Point, Tap, File. Done.

Filing taxes with SnapTax is as easy as point, tap and file.

Security First

Just like TurboTax, SnapTax protects privacy by encrypting transactions with the same Secure Sockets Layer technology used by Canadian banks. And because no tax information is stored on your iPhone or iPod touch, your information is safe and sound if you misplace or lose your device.

Pricing and Availability

Canadians can download and try SnapTax for free on iTunes. After entering information, it costs $9.99 to submit their return through NETFILE.

Taxpayers Can Access Irs Free File In Four Easy Steps:

Don’t Miss: California Sales Tax By Zip Code

How To Get An Ip Pin

The fastest way to receive an IP PIN is by using the online Get an IP PIN tool. If you wish to get an IP PIN and you dont already have an account on IRS.gov, you must register to validate your identity. The IP PIN tool is generally available starting in mid-January through mid-November. Select the button to get started

Our Streamlined Procedures Deal

The IRS amnesty program, known officially as the Streamlined Foreign Offshore Procedures was established 2012 to encourage U.S. citizens/green card holders living abroad to come into full compliance on their delinquent or incomplete U.S. tax return and FBARs.

-

Individual must have been physically outside the United States for at least 330 days during any of the most recent three years.

-

The failure to file tax returns and FBARs was not due to willful conduct.

-

The IRS has not initiated an examination of taxpayer’s returns for any taxable year.

-

Complete the Certification by U.S. Person Residing Outside of the U.S in which you certify that your failure to file resulted from non-willful conduct.

-

Complete and submit the most recent 3 years of delinquent U.S. tax returns.

-

Complete and submit the most recent 6 years of delinquent FBARs.

We at CPAs for Expats have helped many citizens to take advantage of the Streamlined Procedures Amnesty Program. We provide personalized support to enable you to gather and prepare the necessary documents and then we do rest!

Our Streamlined Amnesty program package includes filing all the required documents:

-

3 years of tax returns

-

6 years of FBARs and

-

Streamline Certification Form

for a flat fee of $1,249

Also Check: 2022 Tax Brackets Married Filing Jointly

S You Can Take Now To Make Tax Filing Easier In 2023

Use online account to securely access the latest information available about your federal tax account and see information from your most recently filed tax return.

You can:

- View your tax owed, payments, and payment plans

- Make payments and apply for payment plans

- Access your tax records

- Sign Power of Attorney authorizations electronically from your tax professional

- Manage your communication preferences from the IRS

Organized tax records make preparing a complete and accurate tax return easier. It helps you avoid errors that lead to processing delays that slow your refund and may also help you find overlooked deductions or credits.

Wait to file until you have your tax records including:

- Form 1099-INT if you were paid interest

- Other income documents and records of digital asset transactions

- Form 1095-A, Health Insurance Marketplace Statement, to reconcile advance payments or claims Premium Tax Credits for 2022 Marketplace coverage

- IRS or other agency letters

- CP01A Notice with your new Identity Protection PIN

Notify the IRS if your address changes and notify the Social Security Administration of a legal name change.

Remember, most income is taxable. This includes:

Check your Individual Tax Identification Number

If your ITIN wasn’t included on a U.S. federal tax return at least once for tax years 2019, 2020, and 2021, your ITIN will expire on December 31, 2022.

Make sure you’ve withheld enough tax

Log in to your online account to make a payment online or go to IRS.gov/payments.

Popular Prior Year Forms Instructions & Publications

Form 1040

US Individual Income Tax Return for Tax Year 2021. Annual income tax return filed by citizens or residents of the United States.

Publication 17 PDF

Form 1040

US Individual Income Tax Return for Tax Year 2020. Annual income tax return filed by citizens or residents of the United States.

Form 941

Employer’s Quarterly Federal Tax Return for 2021.For Employers who withhold taxes from employee’s paychecks or who must pay the employer’s portion of social security or Medicare tax .

Read Also: How To File Unemployment Taxes

About Free File Fillable Forms

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to:

- Choose the income tax form you need

- Enter your tax information online

- Electronically sign and file your return

- Print your return for recordkeeping

If you choose Free File Fillable Forms as your Free File option, you should be comfortable doing your own taxes. Limitations with Free File Fillable Forms include:

- It won’t give you guidance about which forms to use or help with your tax situation

- It only performs basic calculations and doesn’t provide extensive error checking

- It will only file your federal return for the current tax year

- No state tax return option is available

- You can’t make changes once your return is accepted

Bookmark The Following Tools On Irsgov

Online tools are easy to use and available to taxpayers 24 hours a day. They provide key information about tax accounts and a convenient way to pay taxes. IRS.gov provides information in many languages and enhanced services for people with disabilities, including the Accessibility Helpline. Taxpayers who need accessibility assistance may call 833-690-0598. Taxpayers should use IRS.gov as their first and primary resource for accurate tax information.

Read Also: Amend My 2020 Tax Return

Heres Why You May Need To File A 1099

If you were paid at least $600 through third-party payment apps, like Venmo or Zelle, preparing your taxes next year will be different than usual. Youll now have to report those earnings to the IRS.

Its a significant change to how taxpayers should report their income under a new regulation, as the IRS is cracking down on Americans who evade taxes by not reporting all of their earnings.

The new rule requires third-party payment platforms to issue Americans and the IRS a 1099-K for business transactions if they exceed $600 over the course of the year. A business transaction that is taxable is defined as a payment for a good or service.

A 1099-K is an income report form that deals with payment cards or third-party network transactions. Translation: Credit cards and services that receive money from someone else and give it to you.

Before the 2022 tax year, platforms like PayPal, Cash App, etc. only had to issue a 1099-K if someone engaged in more than 200 business transactions for which they received total payments of more than $20,000. For example, if an Uber driver collected $20,000 over at least 200 rides.

In 2021, Congress reduced that $20,000 over at least 200 transactions threshold to $600 over at least one transaction.

This means if you started a side hustle or are self-employed, the IRS will require you to report income over $600 paid to you through digital payment apps.

Irs Free File Online Options

Do your taxes online for free with an IRS Free File provider.

If your adjusted gross income was $73,000 or less, review each providerâs offer to make sure you qualify. Some offers include a free state tax return.

Use the IRS Free File Lookup Tool to narrow your list of providers or the Browse All Offers page to see a full list of providers. After selecting one of the IRS Free File offers, you will leave the IRS.gov website.

Don’t Miss: Retirement Tax Calculator By State