The Ultimate Guide To The Irs Filing Deadlines For 2022

If youre not prepared, tax filing deadlines can catch you off guard. Missing important tax dates can be frustrating and even lead to late penalties.

The easiest way to avoid this is to take some time and save each relevant tax filing deadline to your calendar.

Weve put this article together to make it easier for you to find and remember the right filing dates for common IRS forms.

It also contains a few helpful tips to ensure a successful tax seasonwhether youre an individual taxpayer or business.

Deadline For Hurricane Ida Victims

Tax filing deadlines for residents of six different states impacted by Hurricane Ida have also been moved back. Victims of Hurricane Ida who live in Connecticut, Louisiana, Mississippi, New Jersey, New York and Pennsylvania now have until Feb. 15, 2022, to file various individual and business tax returns and make tax payments.

The IRS has postponed various tax filing and payment deadlines that occurred starting on dates that vary by state:

Individuals and businesses impacted by the storm will have until Feb. 15, 2022, to file returns and pay any taxes that were originally due during these periods. The extension also applies to quarterly estimated income tax payments that were due on Sept. 15, 2021, and Jan. 18, 2022. As a result, taxpayers in these areas can now skip making their estimated tax payments for the third and fourth quarters of 2021 and simply include them when they file their 2021 return.

Did You Receive A 1099

Read Also: 2022 Tax Deductions And Credits

Most Important Tax Dates For Individuals

For individuals who use a calendar year as their tax year, heres a quick look at important dates for your return.

|

Important 2021 Tax Due Dates for Individuals |

|

|

If you are required to make estimated tax payments, your payment for the fourth quarter of tax year 2021 is due on this date. Submit with Form 1040-ES Voucher 4 or pay online. |

|

|

If you are required to make estimated tax payments but do not make your fourth quarter payment by Jan. 18, you can avoid interest and penalties by filing your return by Jan. 31 and including payment for the full balance. |

|

|

The first quarterly payment is due for individuals who must make estimated tax payments using Form 1040-ES. |

|

|

Deadline for filing for individuals living or working outside the U.S. and Puerto Rico. |

|

|

The second quarterly payment is due for individuals who must make estimated tax payments using Form 1040-ES. |

|

|

The third quarterly payment is due for individuals who must make estimated tax payments using Form 1040-ES. |

|

|

Income tax filing deadline for taxpayers who requested an extension to file their returns. Returns are still filed with form 1040. |

|

|

The fourth quarterly payment is due for individuals who must make estimated tax payments using Form 1040-ES. |

Although you can file for a tax extension, the extension only extends your income tax deadline to file. It doesnt change your payment due date.

Tax Deadlines: January To March

- : Deadline for employees who earned more than $20 in tip income in December to report this income to their employers on Form 4070.

- :Deadline to pay the fourth-quarter estimated tax payment for tax year 2021.

- : Your employer has until Jan. 31 to send you your W-2 form reporting your 2021 earnings. Most 1099 forms must be sent to independent contractors by this date as well.

- :Deadline for employees who earned more than $20 in tip income in January to report this income to their employers. You can use Form 1070 to do so.

- : Deadline for financial institutions to mail out Form 1099-B relating to sales of stock, bonds, or mutual funds through a brokerage account, Form 1099-S relating to real estate transactions and Form 1099-MISC, unless the sender is reporting payments in boxes 8 or 10.

- : Deadline for businesses to mail Forms 1099 and 1096 to the IRS.

- : Deadline for farmers and fishermen to file individual income tax returns unless they paid 2021 estimated tax by Jan. 18, 2022.

- : Deadline for employees who earned more than $20 in tip income in February to report this income to their employers.

- :Deadline for corporate tax returns for tax year 2021, or to request an automatic six-month extension of time to file for corporations that use the calendar year as their tax year, and for filing partnership tax returns or to request an automatic six-month extension of time to file .

- : Deadline for businesses to e-file Forms 1099 and 1098 to the IRS, except Form 1099-NEC.

Read Also: What Is Self Employment Tax

Contribute To Your Health Savings Account

This medical account, available to individuals who have a high-deductible health plan, provides a tax-saving way to pay for out-of-pocket costs. You have until the April 18, 2022, tax deadline to contribute to an HSA for the 2021 tax year. The 2021 limits were $3,650 for an individual HSA owner and $7,200 for a family. For 2022, the individual coverage contribution limit is $3,650 and the family coverage limit is $7,300. If you’re 55 or older, you can put an extra $1,000 in your HSA.

» MORE: Learn more about the tax effects of HSAs and flexible savings accounts

Awaiting Processing Of Previous Tax Returns People Can Still File 2022 Returns

Currently, the IRS has processed all paper and electronic individual tax year 2021 returns received prior to November 2022 that didn’t require error-correction or further review. The IRS continues to work on remaining tax returns in these categories. This work will not impact tax refund timing for people filing in 2023, but the IRS continues to urge people to make sure they submit an error-free tax return this tax season to avoid delays. Check the IRS Operations page for the latest information about the status of tax returns received in 2022.

Also Check: Credit Karma Tax Return 2020

When Are State Taxes Due

Of the 41 states that levy income tax, most are adhering to the April 18 deadline. There are some exceptions.

| State | |

| Louisiana | May 15 |

Nine states — Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming — have no state income taxes.

Check with your state department of revenue for the most current information and deadlines.

Three Arrested On Charges Of Defrauding State Disaster Relief Programcontinue Reading

BATON ROUGE Three Louisiana residents face felony charges after allegedly defrauding a state program that offers sales tax refunds on personal property destroyed in a natural disaster.

Based on a Presidential declaration, citizens can apply for a refund of sales tax they paid on items lost during a declared disaster.

Starr Carbo, Johnnie Mae Ricard and Erica Williams, all of Westwego, are charged in connection with fraudulently preparing and submitting Natural Disaster Claim for Refund of State Sales Taxes Paid forms following Hurricane Ida in 2021.

Investigators with the Louisiana Department of Revenue say the three women, working for Global Tax Service, charged clients as much as $110 to prepare and submit the sales tax refund form using false information and inflating the value of the losses. The companys clients told investigators they had not provided the information that was submitted on their behalf.

Carbo, Ricard and Williams were booked into the East Baton Rouge Parish Prison on charges of Injuring Public Records, which can result in a sentence of up to five years and fines of up to $5,000.

LDR wants the citizens of Louisiana to know that the Natural Disaster Claim form is available for free on its website, revenue.louisiana.gov.

LDR is committed to preserving the funds available to those who qualify for this program and continues its investigation into disaster related fraud, said Secretary of Revenue Kevin Richard.

Don’t Miss: Property Tax Help For Low-income Homeowners

Here’s Who Needs To Make A Payment

Taxpayers who earn or receive income that is not subject to tax withholding such as self-employed people or independent contractors should pay their taxes quarterly to the IRS.

In addition, people who owed tax when they filed their current year tax return often find themselves in the same situation again when they file the next year, so they may want to consider making estimated tax payments. Taxpayers in this situation often include:

- Those who itemized in the past but are now taking the standard deduction

- Two wage-earner households

- Employees with non-wage sources of income such as dividends

- Those with complex tax situations

- Those who didn’t increase their tax withholding

Tax Calendar: Important Tax Due Dates And Deadlines

Know the tax deadlines that apply to you, so you don’t get hit with IRS penalties or miss out on a valuable tax break.

If you miss a tax deadline, the IRS can hit you hard with penalties and interest. For instance, the standard penalty for failing to file your annual tax return on time is 5% of the amount due for each month your return is late. If you pay your taxes late, the monthly penalty is 0.5% of the unpaid amount, up to 25% of what you owe, plus interest on the unpaid taxes. Similar penalties apply for missing other deadlines. And there could also be other negative consequences for being late, like losing out on a valuable tax break.

It’s easy to avoid these headaches, though just don’t miss the deadline! But we realize that it’s not always easy keeping track of all the various IRS due dates. So, for those of you who need a little help remembering when to file a return, submit a report or pay a tax, we pulled together a list of the most important 2022 federal income tax due dates for individuals. There’s at least one deadline in every month of the year, so play close attentionwe don’t want you to get in trouble with the IRS.

You May Like: New York Tax Refund Status

Deadlines For December Tornado Victims

Following the disaster declarations issued by the Federal Emergency Management Agency , the IRS announced relief for victims of the December tornadoes, severe storms and flooding in parts of Kentucky, Illinois and Tennessee.

Affected individuals and businesses in certain areas of these states will have until May 16, 2022, to file returns and pay any taxes that were originally due on or after Dec. 10, 2021. This includes 2021 individual income tax returns due on April 18, as well as various 2021 business returns normally due on March 15 and April 18. As a result, affected taxpayers will also have until May 16 to make 2021 IRA contributions.

The May 16 deadline also applies to the quarterly estimated tax payments normally due on Jan. 18 and April 18, as well as the quarterly payroll and excise tax returns originally due on Jan, 18. As a result, taxpayers can skip making their Jan. 18 payment and simply include it with their 2021 return. Additionally, the quarterly payroll and excise tax returns that were originally due on Jan. 31, 2022 and May 2, 2022 now can be filed by May 16, 2022.

Every Tax Deadline You Need To Know

OVERVIEW

Make sure your calendars up-to-date with these tax deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2023.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

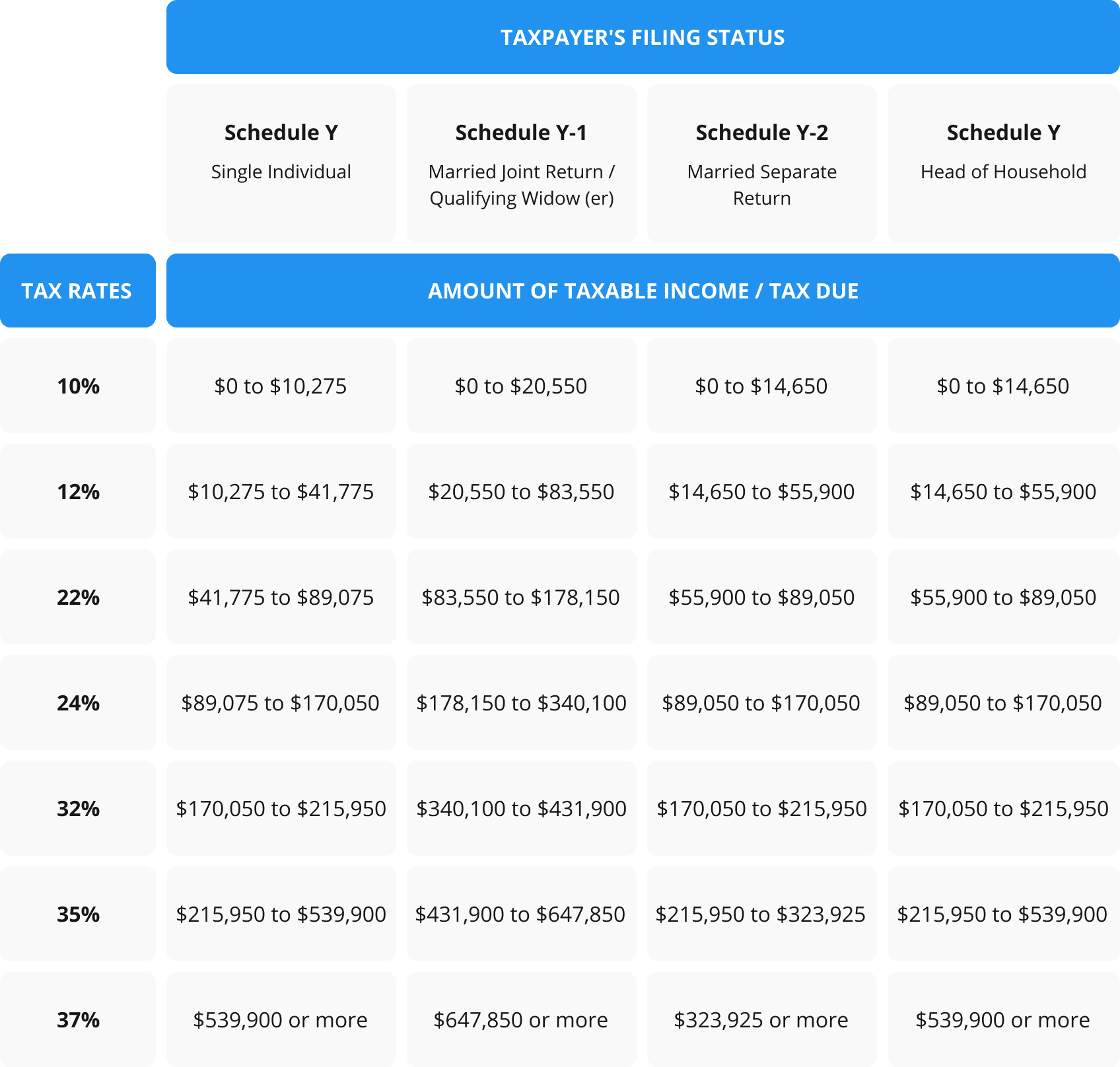

Key Takeaways Individual income tax returns are typically due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people usually have to make quarterly estimated tax payments are pre-set dates throughout the year. Partnerships and S-Corps filing deadlines are typically either March 15 unless they operate on a fiscal year. A six-month extension to September 15 can be requested using Form 7004. |

Read Also: Ssi File Taxes For Stimulus

Two Thirds Of Households Received Income

Tax season is coming and theres some key dates even before filing deadlines.

Its not too early to start thinking about your 2022 income-tax return, if you can bear the thought.

Thats because the tax-filing season is scheduled to start on Monday, Jan. 23, the Internal Revenue Service announced Thursday. Thats less than two weeks away.

The IRS is expecting more than 168 million individual tax returns this year, it said.

Most households come away with a refund, making for a major financial event during the year. Two-thirds of individual taxpayers came away with a refund last year averaging around $3,200, according to IRS data through late October.

This year, refunds will be arriving in a time of high inflation and potential recession worries and experts caution theres a good chance many refunds could be smaller, now that pandemic-era increases to certain tax credits have vanished.

Maximizing an income-tax refund starts by staying organized and knowing when to be on the lookout for the tax forms that pour in from employers, banks, brokers, mortgage lenders and others.

Hurrying too soon, a person might overlook a credit, deduction or piece of paperwork to back a claim. The same goes if theyre rushing at the last minute. An error could snag a refund and hold up a return inside the IRS, as it runs another tax season while cutting a backlog.

While much work remains after several difficult years, we expect people to experience improvements this tax season.

What If I Made A Mistake And Need To Re

Mistakes happen. You file your tax return, then realize you forgot to report some income or claim a certain tax credit. You typically don’t need to redo your whole return. Along with filing an amendment using Form 1040-X, youll also need to include copies of any forms and/or schedules that youre changing or didnt include with your original return.

IRS Form 1040-X is a two-page form used to amend a previously filed tax return. TurboTax can walk you through the amendment process to correct your tax return.

To avoid delays, make sure you only file Form 1040-X after your original Form 1040 has been accepted. If youre filing a Form 1040-X to collect a tax credit or refund from a previous year, youll need to file within three years after the date you timely filed your original return, or within two years after the date you paid the tax, whichever is later.

Read Also: Daycare Expenses Tax Deduction 2021

There’s A ‘safe Harbor’ To Avoid Federal Tax Penalties

One key thing to know: Chichester said there’s a “safe harbor” to avoid underpayment penalties for your yearly federal taxes.

You won’t owe federal penalties if you’ve paid, over the course of 2022 and through the Jan. 17 deadline, the lesser of 90% of your 2022 taxes or 100% of your 2021 bill if your adjusted gross income is $150,000 or less.

However, the safe harbor isn’t a guarantee you won’t owe more federal taxes for 2022, Chichester said. He urges clients to set aside at least 20% of earnings to cover federal taxes, plus a smaller percentage for state taxes, depending on where they live.

Tax Year: Fiscal Year Vs Calendar Year

Not all taxpayers use Jan. 1 through Dec. 31 as their tax year. Some use a fiscal year, which is a 12-month period ending on the last day of any month except December, according to the IRS. In general, companies are the only ones that use a fiscal year for tax purposes, but if you are an individual and you keep your financial records on the basis of an adopted fiscal year, you can apply to use the fiscal year instead. If you want to change your tax year, and thus your tax return due date, you must apply for that with the IRS.

Recommended Reading: Tax On Ira Withdrawal After 59 1/2

Irs Reminds Taxpayers Of Upcoming Filing Extension Deadline Free File Remains Open Until Nov 17

IR-2022-179, October 14, 2022

WASHINGTON The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that the deadline is Monday, October 17. IRS Free File remains open until November 17 for those who still need to file their 2021 tax returns. This includes those who qualify for the Child Tax Credit, Recovery Rebate Credit or Earned Income Tax Credit but haven’t yet filed a 2021 tax return to claim them.

IRS Free File is a public-private partnership between the IRS and tax preparation software industry leaders who provide their brand-name products for free. There are eight Free File products available in English and two in Spanish.

IRS Free File provides two ways for taxpayers to prepare and file their 2021 federal income tax return online for free:

- IRS Partner Sites. Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Individual taxpayers whose adjusted gross income is $73,000 or less qualify for any IRS Free File partner offers. Free File lets individuals electronically prepare and file their federal income tax online using guided tax preparation.

Are Inheritance Taxes Due On The Date Of Death Or When The Inheritance Is Received

While some states do impose an inheritance tax, the federal government only imposes an estate tax. Estate taxes are imposed on the estate itself rather than on the individuals inheriting assets from the estate. Estate taxes aren’t necessarily imposed on the date of death, but they will have been assessed by the time an heir officially receives assets.

Don’t Miss: How Much Can You Inherit Without Paying Taxes